OEM Metal Fabrication Partnerships: 8 Costly Mistakes Draining Your Budget

Understanding OEM Metal Fabrication and Why It Matters

When you need custom metal components for your products but lack the manufacturing infrastructure to produce them yourself, what's your best option? This is where OEM metal fabrication enters the picture, offering a strategic pathway that thousands of companies rely on daily.

At its core, OEM metal fabrication refers to partnering with an external manufacturer who produces metal components based on your designs and specifications. The manufacturer handles the production, while you retain ownership of the product IP and brand the finished components as your own. Think of it as having a skilled production team without the overhead of building and managing your own factory.

What Sets OEM Metal Fabrication Apart from Standard Manufacturing

Here's where many buyers get confused. Standard metal fabrication typically involves producing generic or catalog parts that any customer can purchase. In contrast, OEM fabricators work exclusively from your proprietary designs, creating components that won't appear in anyone else's product line.

The difference from in-house manufacturing is equally significant. Building your own production facilities requires substantial capital investment in machinery, infrastructure, and skilled labor. According to manufacturing industry analysis, OEM adoption is largely driven by its capital-light nature, allowing companies to scale quickly without heavy upfront investment.

Three primary distinctions define the OEM fabrication model:

- Design Ownership: You maintain complete control over your product IP while the OEM fabricator executes production based on your specifications. Your designs, your intellectual property, their manufacturing expertise.

- Branding Rights: Unlike purchasing off-the-shelf components, OEM-fabricated parts carry your brand identity. The end customer sees your product, not the manufacturer's.

- Production Scalability: OEM fabricators bring established supply chains, trained workforces, and economies of scale. This allows for rapid mobilization, making them ideal for everything from pilot batches to sudden market surges.

The OEM Partnership Model Explained

Why do companies across automotive, aerospace, electronics, and healthcare sectors rely on specialized OEM fabricators rather than building in-house capabilities? The answer lies in focus and efficiency.

OEM fabricators possess the proficiency to work with a wide range of metals, including steel, aluminum, titanium, and various alloys, catering to diverse industry requirements. Their expertise extends beyond mere production to encompass innovation and problem-solving. As noted by industry specialists, these fabricators collaborate closely with clients to refine designs, optimize manufacturing processes, and overcome technical challenges.

Contract metal fabrication differs fundamentally from working with a basic job shop. While job shops handle short-run or one-off production on a per-quote basis, contract manufacturers are structured around long-term relationships and volume-based work. They offer robust systems for scheduling, quality assurance, material handling, and documentation that production environments require.

The bottom line? Choosing OEM fabricators allows your company to concentrate on core competencies, whether that's product design, marketing, or customer relationships, while experienced manufacturing partners handle the complex production process. This collaborative model has become indispensable for businesses seeking to bring products to market efficiently without sacrificing quality or control.

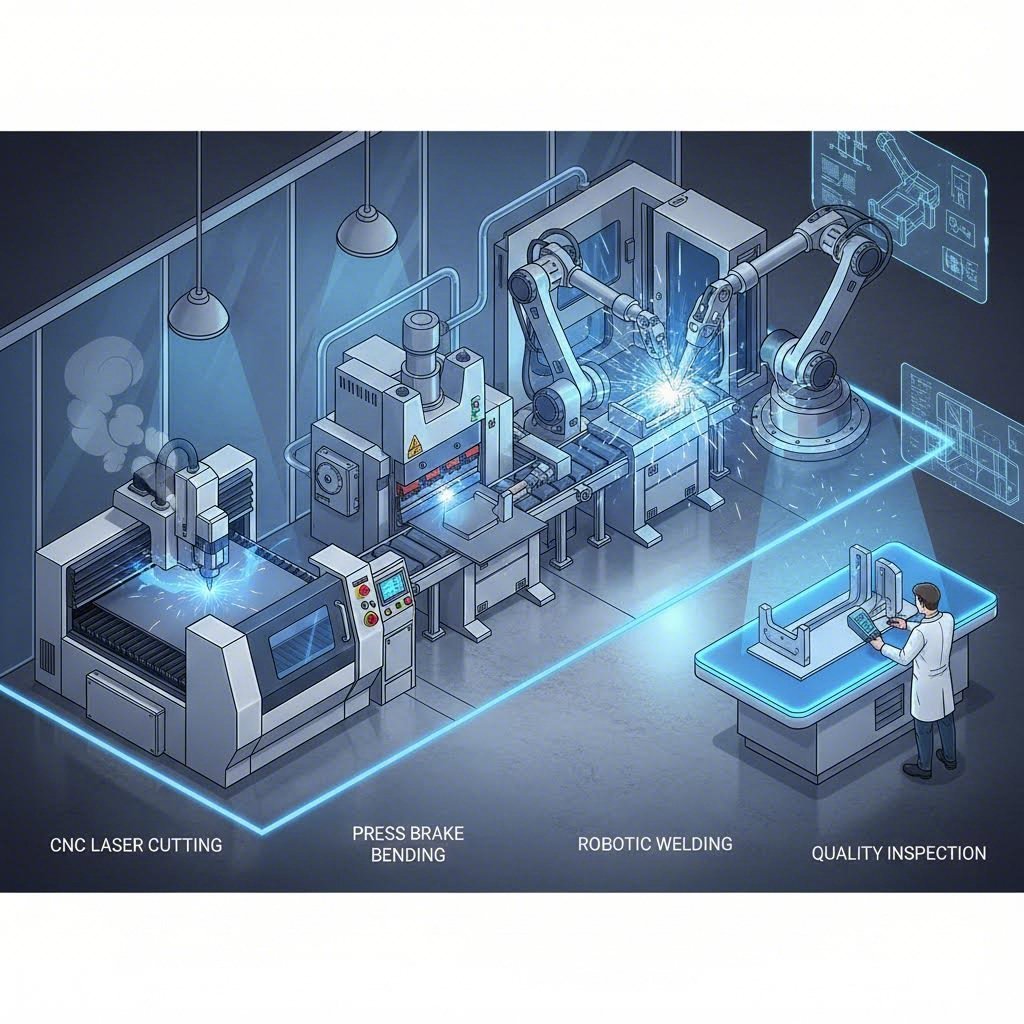

The Complete OEM Metal Fabrication Process Workflow

So you've decided to partner with an OEM fabricator. What happens next? Understanding the complete workflow from initial concept to delivered components helps you plan realistic timelines, anticipate decision points, and avoid costly surprises along the way.

Precision contract manufacturing follows a structured sequence that balances speed with quality. Each stage builds upon the previous one, creating checkpoints where you can verify progress before committing additional resources. Let's walk through this process step by step.

From Concept to Component in Eight Stages

The metal fabrication contract manufacturing process typically unfolds across eight interconnected stages. While the duration of each phase varies based on project complexity and volume requirements, the sequence remains consistent across most metal fabrication partnerships.

- Design Review and Consultation: The journey begins when you share your product specifications with the fabricator. During this phase, engineers examine your CAD files, drawings, and technical requirements. According to manufacturing process experts, this involves defining exact measurements, material types, strength requirements, tolerances, and cost considerations. Expect detailed discussions about your application, performance expectations, and production volumes.

- Material Selection: Based on your design requirements, the fabricator recommends appropriate metals and alloys. Different materials offer unique properties like strength, corrosion resistance, and thermal performance. An experienced contract metal manufacturing partner will help you balance performance requirements against budget constraints, often suggesting alternatives you might not have considered.

- Prototyping: Before committing to full production, physical models are created for testing and evaluation. CNC machining is the most common prototyping method, offering precision, versatility, and quick turnaround times. For enclosures, panels, and components requiring bending and forming, sheet metal prototyping may be more appropriate. This stage allows you to identify design flaws early, when changes cost the least.

- Tooling Development: Once prototypes are approved, the fabricator creates specialized tooling, fixtures, and dies needed for production. This investment enables consistent, repeatable manufacturing at scale. The complexity of your components directly impacts tooling requirements and associated costs.

- Production Runs: The actual fabrication begins. Cutting and shaping operations may include laser cutting, waterjet cutting, plasma cutting, shearing, or sawing. Components requiring tight tolerances receive CNC machining to achieve smooth surfaces. Welding and joining operations assemble multiple pieces into finished components.

- Quality Inspection: Throughout production, your partner verifies that components meet required specifications and quality standards. Inspection techniques range from visual examinations to advanced non-destructive testing methods, depending on your industry requirements and component criticality.

- Surface Finishing: After joining, metal components often have rough edges, weld marks, or oxidation requiring removal. Finishing processes improve appearance, functionality, and durability through grinding, polishing, blasting, or powder coating.

- Logistics and Delivery: The final stage encompasses packaging, warehousing, and shipping to ensure timely delivery. A reliable fabrication partner coordinates these logistics to align with your production schedules and inventory requirements.

Critical Checkpoints in the Fabrication Workflow

Sounds complex? It doesn't have to be overwhelming when you understand where to focus your attention. Several critical checkpoints determine project success, and missing any of them can lead to the costly mistakes this article addresses.

Design for Manufacturability (DFM) represents perhaps the most important checkpoint in the entire process. DFM principles should integrate during the earliest design review stage, not after prototyping reveals problems. This proactive approach analyzes your design to identify features that may cause production difficulties, increase costs, or reduce component reliability.

Imagine designing a bracket with an internal corner radius too tight for standard tooling. Without DFM analysis, you might not discover this issue until production, requiring expensive custom tooling or complete redesign. With DFM integrated early, the fabricator flags this concern during design review, suggesting a slightly larger radius that achieves the same function at a fraction of the cost.

Effective DFM optimization addresses several key areas:

- Feature Accessibility: Ensuring machining tools and welding equipment can reach all required surfaces

- Tolerance Stack-up: Analyzing how individual tolerances combine across assembled components

- Material Utilization: Optimizing designs to minimize scrap and reduce material costs

- Process Consolidation: Combining multiple operations where possible to reduce handling and setup time

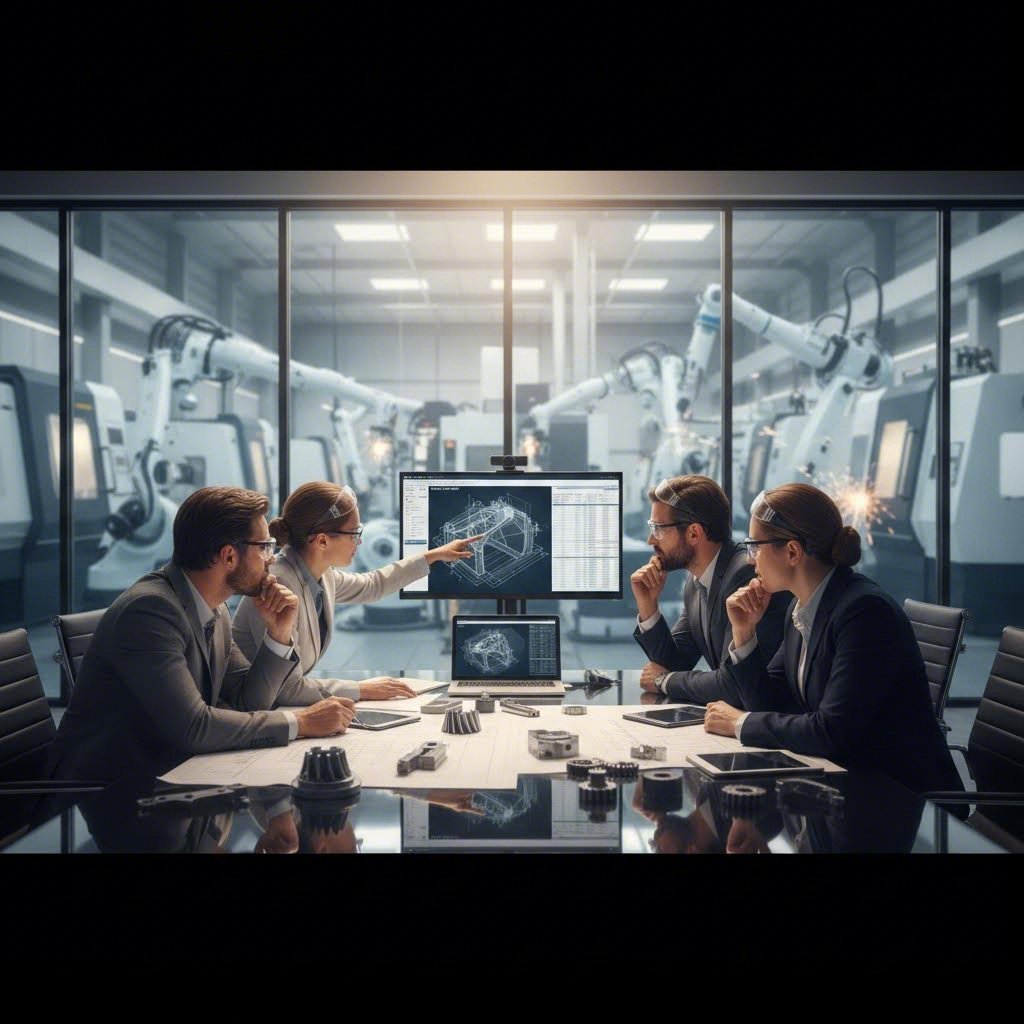

The contract metal manufacturing relationship works best when you treat your fabricator as a collaborative partner rather than simply a vendor executing orders. Their production expertise, combined with your product knowledge, creates components that perform better and cost less than either party could achieve independently.

With the workflow established, the next critical decision involves selecting the right materials for your specific application requirements.

Material Selection Strategies for OEM Metal Components

Choosing the wrong material for your OEM parts fabrication project is one of the fastest ways to blow your budget. Yet surprisingly, many buyers rush through this decision, focusing solely on upfront costs while ignoring how material choice ripples through every downstream process.

Here's the reality: the metal you select impacts not just the component's performance but also welding complexity, finishing options, tooling wear, and even shipping costs. A thoughtful material selection strategy balances six key factors that manufacturers weigh differently depending on their priorities.

According to metallurgy specialists at Ulbrich, the main factors in alloy selection include physical properties, mechanical properties, cost, service life, fabrication requirements, and surface properties. How each ranks varies from project to project, but all should factor into your decision.

Matching Materials to Application Requirements

Before diving into specific metals, ask yourself a few critical questions. Will your component face exposure to moisture, chemicals, or extreme temperatures? Does weight matter for your application? What tolerances and surface finishes do you need? The answers guide you toward the right material family.

Physical properties often drive initial selection. If corrosion resistance matters, you're likely looking at stainless steel or certain aluminum alloys. Applications involving high or low temperature extremes might point toward nickel alloys. Consumer-facing products where aesthetics count may prioritize materials with superior finishing options.

Mechanical properties narrow the field further. Strength requirements, whether tensile or yield, ductility needs for forming operations, and hardness specifications all influence which specific grade within a material family makes sense. Remember that these properties can often be adjusted through processing, as rolling and annealing operations fine-tune characteristics to match your needs.

Steel, Aluminum, and Specialty Metal Selection Guide

Let's break down the most common material categories you'll encounter in metal part manufacturing and when each makes sense.

Carbon Steel remains the workhorse of industrial fabrication. It offers excellent strength at relatively low cost, making it ideal for structural applications where corrosion isn't a primary concern. Low carbon steel like 1018 machines well and accepts welding readily. However, it requires protective coatings or finishes in environments with moisture exposure.

Stainless Steel steps in when corrosion resistance becomes critical. The 300-series grades, particularly 304 and 316, dominate OEM applications. For environments exceeding 2,000°F, Ryerson recommends 310 stainless steel due to its oxidation resistance and high-temperature strength. When welding is involved, 316L offers resistance to intergranular corrosion following the welding process.

OEM Aluminum delivers the best strength-to-weight ratio in the common metals category. Among aluminum alloys, 6061 stands out for structural applications requiring excellent strength, corrosion resistance, and machinability. In contrast, 6063 aluminum offers superior surface finish quality, making it the preferred choice for architectural applications and components where aesthetics matter. As the experts at Ryerson note: if you need strength, go with 6061; for aesthetics and formability, choose 6063.

Specialty Metals enter the picture for demanding applications. Titanium offers exceptional strength-to-weight performance and corrosion resistance for aerospace and medical devices. Inconel and other nickel superalloys handle extreme temperatures and corrosive environments that would destroy conventional steels.

| Material | Tensile Strength | Relative Weight | Corrosion Resistance | Relative Cost | Typical Applications |

|---|---|---|---|---|---|

| Carbon Steel (1018) | High | Heavy | Low | $ | Structural frames, brackets, machine bases |

| Stainless Steel (304) | High | Heavy | Excellent | $$ | Food processing, chemical equipment, medical |

| Stainless Steel (316) | High | Heavy | Superior | $$$ | Marine, pharmaceutical, high-corrosion environments |

| Aluminum (6061-T6) | Medium | Light | Good | $$ | Automotive, aerospace structures, machinery |

| Aluminum (5052-H32) | Medium-Low | Light | Excellent | $$ | Sheet metal enclosures, marine components |

| Titanium (Ti 6Al-4V) | Very High | Light | Excellent | $$$$ | Aerospace, medical implants, racing |

How Material Choice Impacts Downstream Processes

Your material decision doesn't exist in isolation. It cascades through every subsequent manufacturing operation, affecting both quality and cost in ways that surprise many buyers.

Welding Compatibility: Not all metals weld the same way. Directly welding aluminum to steel isn't possible due to their differing metallurgical properties. Industries like shipbuilding and aerospace use bimetallic transition inserts to join these dissimilar metals. Even within the same material family, some grades weld more easily than others, and this impacts labor time and defect rates.

Surface Finishing Options: Different materials accept different finishes. Aluminum can receive mill finish, brushed finish, or anodized treatments that improve both appearance and corrosion resistance. Steel often requires painting or powder coating for protection. Understanding your finish requirements upfront helps narrow material choices.

Machining and Tooling Wear: Harder materials wear tools faster, increasing production costs over time. Some alloys machine more easily than others, affecting cycle times and surface quality. When specifying tolerances, remember that tighter tolerances on difficult-to-machine materials compound costs significantly.

The bottom line? Material selection isn't just about the metal itself. It's about understanding how that choice influences every step of your OEM parts fabrication process. Partner with a fabricator who can evaluate these downstream impacts during the design phase, before material commitments lock in avoidable costs.

With materials selected, the next consideration becomes equally critical: ensuring your fabrication partner maintains the quality certifications and inspection standards your industry demands.

Quality Certifications and Inspection Standards Explained

You've selected the perfect material and finalized your design. But how do you know your fabricated OEM components will actually meet the quality standards your application demands? This is where certifications and inspection protocols separate reliable partners from risky ones.

Here's something many buyers overlook: a certification isn't just a plaque on the wall. It represents a verified quality management system with documented procedures, trained personnel, and third-party audits confirming the fabricator consistently delivers what they promise. Understanding what each certification actually means helps you evaluate potential partners more effectively.

Decoding Industry Certifications for Metal Fabrication

Walk into any metal fabrication facility and you'll likely see logos for various certifications displayed prominently. But what do these acronyms actually guarantee? Let's break down the most common ones you'll encounter when evaluating contract metal products suppliers.

ISO 9001:2015 serves as the foundation for most quality management systems. According to industry certification experts, this internationally recognized standard requires organizations to define and follow a quality management system that is both appropriate and effective while also requiring them to identify areas for improvement. Think of it as the baseline certification that demonstrates a fabricator has systematic quality controls in place.

AWS Certification (American Welding Society) focuses specifically on welding quality. This certification is evidence of a fabricator's ability to produce quality steel welds by industry standards. The certification process includes passing both written exams and practical welding tests administered by AWS-certified educators. Many companies will only work with AWS-certified fabricators, making this credential essential for metal fabrication contracts involving welded assemblies.

AISC Certification (American Institute of Steel Construction) provides third-party verification that a steel fabricator has the personnel, organization, experience, capability, and commitment to meet rigorous quality standards for structural steel products. As noted by certification specialists, AISC Certification is recognized throughout the United States as the mark of a competent and trustworthy steel fabricator.

AS9100D takes quality requirements to aerospace-level stringency. This certification builds upon ISO 9001 but adds specific requirements for the aerospace industry, including enhanced traceability, configuration management, and risk-based thinking. If your components end up in aircraft or space applications, this certification isn't optional.

IATF 16949 represents the automotive industry's quality standard. Beyond basic quality management, it emphasizes defect prevention, reduction of variation, and waste elimination in the supply chain. Automotive OEMs typically require this certification from their tier suppliers.

ISO 13485:2016 governs medical device manufacturing. According to regulatory experts at NSF, this standard emphasizes regulatory compliance and risk management to ensure the safety and effectiveness of medical devices. It serves as the foundation for compliance with medical device regulations across the EU, Canada, Japan, Australia, and increasingly the United States.

Certification Requirements by Industry Sector

Which certifications matter for your specific application? Industry requirements vary significantly, and selecting a partner without the right credentials can derail projects entirely.

- Automotive Sector: IATF 16949 certification is typically mandatory for direct suppliers. ISO 9001 may suffice for lower-tier suppliers, but automotive OEMs increasingly push certification requirements down the supply chain. AWS certification becomes critical for chassis and structural components involving welded assemblies.

- Aerospace Sector: AS9100D certification is the minimum expectation. Depending on the specific application, additional certifications like Nadcap (for special processes) may be required. Traceability requirements extend to raw material certifications and heat lot tracking.

- Medical Device Sector: ISO 13485:2016 is essential for manufacturers, suppliers, and service providers. As NSF notes, this standard establishes quality and safety processes from design through production, installation, and servicing. The FDA has aligned its requirements with ISO 13485, with full enforcement of the new Quality Management System Regulation beginning February 2026.

- Marine Sector: Classification society certifications from organizations like ABS (American Bureau of Shipping) or Lloyd's Register verify that fabricated components meet maritime safety standards. These certifications involve regular audits and material traceability requirements specific to marine applications.

- General Industrial: ISO 9001:2015 provides a solid foundation. CRSI (Concrete Reinforcing Steel Institute) certification matters for reinforcing steel applications, ensuring rigorous standards for quality control, production, and inspection.

Quality Control Checkpoints That Protect Your Products

Certifications establish the framework, but what happens on the shop floor determines whether your fabricated OEM components actually meet specifications. Effective quality control involves multiple inspection methods applied at strategic points throughout production.

Dimensional Verification confirms that finished parts match your design specifications. This ranges from manual measurements with calipers and micrometers to advanced coordinate measuring machines (CMMs) for complex geometries. Critical dimensions receive 100% inspection, while less critical features may follow statistical sampling plans.

Material Testing verifies that the metal you specified is actually what you received. This includes chemical analysis to confirm alloy composition, mechanical testing for tensile strength and hardness, and certifications tracing material back to the mill. For critical applications, independent third-party testing provides additional assurance.

Weld Inspection employs multiple techniques depending on criticality. Visual inspection catches surface defects, while non-destructive testing methods like ultrasonic testing, radiographic inspection, or magnetic particle inspection reveal internal flaws invisible to the eye. AWS-certified inspectors bring standardized evaluation criteria to this process.

Surface Finish Analysis ensures components meet aesthetic and functional requirements. Profilometers measure surface roughness quantitatively, while visual standards verify coating thickness, color consistency, and appearance. For anodized or plated parts, adhesion testing confirms finish durability.

Understanding Tolerance Standards

Tolerance specifications directly impact both component performance and manufacturing cost. Tighter tolerances require more precise equipment, slower processing speeds, and increased inspection, all adding expense. Understanding industry-standard tolerances helps you specify appropriately without over-engineering.

General machining tolerances typically fall within +/- 0.005 inches for most commercial applications. Precision applications may require +/- 0.001 inches or tighter. Sheet metal fabrication generally holds +/- 0.015 inches on formed dimensions, though this varies with material thickness and bend complexity.

The key is matching tolerances to functional requirements. Ask yourself: what tolerance does this feature actually need to perform its function? Specifying unnecessarily tight tolerances on non-critical features wastes money without improving product performance.

Quality-focused fabricators help you optimize tolerance specifications during the Design for Manufacturability review. They identify which dimensions truly require tight control and which can accept standard manufacturing tolerances, balancing performance requirements against production economics.

With quality frameworks understood, the next consideration becomes how these standards apply differently across specific industry sectors, each with unique fabrication demands and compliance requirements.

Industry-Specific OEM Fabrication Requirements

Here's a question that trips up many procurement teams: why does the same type of bracket cost dramatically different amounts depending on whether it goes into a car, an airplane, or a hospital machine? The answer lies in industry-specific requirements that fundamentally reshape how contract manufacturing metal fabrication partners approach each project.

Every sector brings unique demands to the table. These differences extend far beyond simply meeting tighter tolerances or obtaining additional certifications. They influence material selection, documentation requirements, testing protocols, and even how your fabricator organizes their production floor. Understanding these distinctions helps you select the right sheet metal contract manufacturer for your specific application and avoid costly mismatches.

Automotive Sector Demands and Compliance Requirements

When you're fabricating chassis components, suspension brackets, or structural assemblies for automotive applications, you're entering a world where volume, consistency, and cost efficiency reign supreme. Automotive OEMs demand IATF 16949 certification as table stakes, but that's just the beginning.

The automotive sector operates on razor-thin margins with production volumes that dwarf most other industries. Your OEM sheet metal fabrication partner must demonstrate capacity for high-volume runs while maintaining statistical process control across thousands of identical parts. According to contract manufacturing specialists, industry-specific expertise enables faster project start-up, reduced development time, and compliance with sector regulations, all critical factors when automotive launch timelines compress continually.

Typical automotive components include:

- Chassis and Frame Components: Structural brackets, cross members, and mounting plates requiring high strength-to-weight ratios

- Suspension Parts: Control arms, strut mounts, and spring seats demanding precise dimensional control

- Body Structural Elements: Reinforcements, pillars, and crash structures where material consistency impacts safety ratings

- Powertrain Brackets: Engine mounts and transmission supports requiring vibration resistance and thermal stability

Lead times in automotive often follow just-in-time delivery models, meaning your fabricator needs robust logistics capabilities and the flexibility to adjust production schedules rapidly. Miss a delivery window, and you might shut down an assembly line, a scenario that destroys supplier relationships instantly.

Aerospace: Where Precision Meets Traceability

Step into aerospace fabrication and the rules change dramatically. Here, every gram matters, documentation requirements multiply exponentially, and quality isn't just important; it's literally a matter of life and death.

Aerospace structural assemblies face extreme operating conditions: temperature swings from -65°F at altitude to 300°F near engines, constant vibration, and stress cycles measured in millions. Materials like titanium alloys, high-strength aluminum, and specialty steels dominate, each requiring specific processing expertise that general fabricators often lack.

AS9100D certification becomes mandatory, but aerospace primes also conduct their own supplier audits and may require Nadcap accreditation for special processes like welding, heat treatment, or non-destructive testing. The traceability requirements alone differentiate aerospace from other sectors. Every piece of raw material must trace back to its original mill certification, and that documentation follows the part throughout its entire service life.

Production volumes tend toward lower quantities but with significantly higher per-part value. A fabricator comfortable running 50,000 automotive brackets monthly might struggle with an aerospace order for 200 complex assemblies requiring extensive documentation packages for each unit.

Medical Device Fabrication: Sterility Meets Precision

Medical device manufacturing introduces requirements that surprise fabricators without healthcare experience. As noted by medical fabrication specialists, when even the smallest error can have severe consequences for patient health and safety, precision fabrication becomes non-negotiable.

Biocompatibility stands as the primary concern for components contacting patients. This requirement drives material selection toward specific grades of stainless steel, titanium, and other alloys proven safe for human tissue contact. Surface finishes matter tremendously, as rough surfaces can harbor bacteria or cause tissue irritation.

Key medical fabrication requirements include:

- Corrosion Resistance: Devices undergo frequent sterilization using harsh chemicals and high temperatures

- Surface Finish Standards: Ra values often specified below 32 microinches for fluid-contact surfaces

- Complete Material Traceability: Full documentation from raw material through finished device

- Clean Manufacturing Environments: Some components require fabrication in controlled environments

ISO 13485:2016 certification governs medical device manufacturing quality systems. According to medical fabrication experts, manufacturers must blend experience, expertise, and the latest technology when manufacturing precision sheet metal parts to ensure quality, safety, and performance for every component produced.

Electronics Enclosures: EMI Shielding and Thermal Management

Electronics fabrication brings its own specialized requirements centered on electromagnetic compatibility and thermal performance. Precision enclosures must protect sensitive components while managing heat dissipation, a challenging balance that impacts material selection and design complexity.

Tolerances tighten considerably for electronics applications. Panel gaps must remain consistent for EMI shielding effectiveness, while mounting features require precision to ensure proper component alignment. Aluminum dominates this sector due to its excellent thermal conductivity, light weight, and natural EMI shielding properties.

Surface finishing requirements often include conductive coatings or treatments that maintain electrical continuity across joined surfaces. Unlike decorative finishes in consumer products, electronics finishes serve functional purposes that impact product performance.

How Industry Dictates Fabrication Specifications

Imagine sending the same drawing to four different fabricators, each specializing in a different industry. You'd receive four dramatically different quotes, lead times, and capability assessments. The table below illustrates why these variations occur.

| Requirement | Automotive | Aerospace | Medical | Electronics |

|---|---|---|---|---|

| Typical Tolerances | +/- 0.010" standard | +/- 0.005" or tighter | +/- 0.005" typical | +/- 0.005" for critical fits |

| Required Certifications | IATF 16949, ISO 9001 | AS9100D, Nadcap | ISO 13485, FDA registration | ISO 9001, UL compliance |

| Common Materials | High-strength steel, aluminum | Titanium, aluminum alloys, Inconel | 316L stainless, titanium | Aluminum, copper, galvanized steel |

| Production Volumes | High (10,000+ units) | Low to medium (50-500 units) | Low to medium (100-5,000 units) | Medium to high (1,000-50,000 units) |

| Lead Time Expectations | 4-8 weeks production | 12-20 weeks with documentation | 8-16 weeks with validation | 6-10 weeks typical |

| Documentation Level | PPAP packages required | Extensive, part-level traceability | Device master records, validation | Standard inspection reports |

Contract manufacturers adapt their processes to meet each sector's unique demands through specialized training, equipment investments, and quality system modifications. A fabricator with deep automotive experience has likely invested in statistical process control software, automated inspection systems, and lean manufacturing methodologies that drive the consistency high-volume production demands.

Conversely, an aerospace-focused shop emphasizes documentation systems, special process certifications, and inspection capabilities that would be overkill for general industrial work but essential for flight-critical components.

The takeaway? Matching your project to a fabricator with relevant industry experience isn't just about certifications on paper. It's about working with a partner whose entire operation aligns with your sector's specific demands. This alignment reduces learning curves, prevents compliance surprises, and ultimately delivers components that meet your requirements without costly rework or delays.

Understanding these industry-specific requirements helps you ask better questions during partner evaluation. But even with the right industry match, partnership pitfalls can still derail your fabrication projects if you're not prepared to address them proactively.

Avoiding Common OEM Fabrication Partnership Pitfalls

You've identified the right industry-specialized fabricator with impressive certifications. The initial conversations went smoothly, and the quote looked competitive. So why did the project still go sideways? The answer often lies in partnership dynamics that certifications and capabilities alone can't predict.

Here's a reality check: even well-matched contract metal manufacturer relationships fail when buyers and suppliers overlook the human and procedural elements that determine day-to-day success. According to contract manufacturing experts, success in these partnerships involves following best practices such as clear communication, thorough research of manufacturers, and establishing strong partnerships. Let's examine the five most damaging pitfalls and how to prevent each one before it drains your budget.

Five Partnership Pitfalls That Derail Fabrication Projects

Think of these challenges as hidden rocks beneath calm water. They don't announce themselves until your project runs aground. Recognizing them early gives you the opportunity to navigate around them entirely.

- Unclear Specifications Leading to Rework: Vague drawings, incomplete tolerance callouts, or ambiguous material requirements create interpretation gaps that your fabricator fills with assumptions. When those assumptions don't match your expectations, expensive rework follows. Prevention starts with thorough design documentation and a formal design review process. As industry specialists note, clearly defining requirements involves outlining the specifications of the product being manufactured, including materials, design, and performance standards. Request that your fabricator document their interpretation of critical features and obtain your written approval before production begins.

- Communication Breakdowns During Production: Projects rarely proceed exactly as planned. Material delays, equipment issues, and design clarifications arise throughout production. When communication channels fail, small issues escalate into major problems. The fix? Establish a strong communication channel that includes regular status meetings, designated points of contact, clear escalation procedures, and defined response timeframes. Don't assume weekly email updates suffice when daily coordination might be necessary during critical phases.

- Quality Inconsistencies Across Batches: Your first production run met specifications perfectly. The third batch had dimensional drift. The fifth batch showed surface finish variations. Batch-to-batch inconsistency erodes confidence and creates downstream assembly problems. Prevent this by establishing clear quality standards upfront and ensuring all suppliers understand and adhere to them. Request quality certifications, consider on-site visits to evaluate processes, and conduct regular quality audits to catch issues early.

- Intellectual Property Concerns: Your proprietary designs represent significant investment. Sharing them with a contract manufacturer creates inherent risk, particularly with OEM manufacturers in USA facilities that might serve your competitors or with overseas partners operating under different legal frameworks. Protection requires confidentiality clauses in your contract, regular monitoring of how your proprietary information is used, and careful evaluation of a fabricator's customer base before commitment. Some buyers segment their manufacturing, keeping the most sensitive components with trusted partners while outsourcing less critical items more broadly.

- Capacity Constraints During Demand Spikes: Your product launch exceeded expectations, or a major customer increased orders unexpectedly. Suddenly your fabricator can't keep pace. This capacity crunch happens more often than buyers anticipate, particularly with smaller metal fabrication USA shops that lack production flexibility. Address this proactively by discussing capacity planning during partner selection. Understand their current utilization, ability to add shifts, and relationships with overflow partners. Building volume commitments with flexibility clauses protects both parties when demand fluctuates.

Proactive Strategies for Smoother OEM Relationships

Avoiding pitfalls requires more than awareness; it demands systematic prevention. The most successful partnerships establish clear frameworks before problems arise, not in reaction to them.

Documentation That Prevents Disputes: Every assumption, every verbal agreement, every design clarification should find its way into writing. Create a project documentation package that includes approved drawings with revision control, material specifications with acceptable alternatives noted, inspection criteria and sampling plans, packaging and shipping requirements, and escalation procedures with named contacts. This documentation serves as your reference point when questions arise, eliminating the "I thought you meant" conversations that delay projects and damage relationships.

Approval Workflows That Catch Issues Early: Establish formal approval gates at critical project milestones. Before tooling starts, sign off on final designs. Before production runs begin, approve first-article samples. Before shipment, verify inspection reports meet acceptance criteria. Each gate represents an opportunity to catch problems when correction costs the least.

Performance Metrics That Drive Accountability: As contract manufacturing best practices indicate, establishing performance metrics helps measure the success of the agreement. Consider tracking on-time delivery rates, first-pass quality percentages, response times to inquiries, and cost variance against quotes. Review these metrics regularly with your fabricator, using the data to identify improvement opportunities rather than simply assigning blame.

Evaluating Partners Before Commitment

The best way to avoid partnership pitfalls? Select partners who demonstrate low-risk characteristics from the start. According to supplier evaluation specialists, qualifying suppliers is an incredibly important step that helps measure and analyze each supplier's potential risk, monitor their capabilities, and look for ways to improve your supply chain.

Before finalizing any partnership, investigate these critical areas:

- Customer References: Who are their current customers? How long have they worked together? Have they encountered problems, and how were those problems resolved?

- Capacity and Growth Potential: How much can they produce for you? Can they scale with your growth? What types of resources are they looking to add?

- Communication Systems: How well do they communicate during your evaluation? What systems and processes facilitate timely, accurate information sharing?

- Quality Infrastructure: What quality systems, standards, or certifications are in place? Do they conduct internal audits? How do they handle non-conformances?

Remember that existing suppliers should be re-qualified on a regular basis. Make this a standard practice, with frequency depending on the criticality of the parts they produce and overall relationship performance.

Addressing these partnership fundamentals positions your fabrication projects for success. But even with the right partner and solid processes in place, understanding the true cost drivers in OEM fabrication remains essential for realistic budget planning and avoiding the financial surprises that derail otherwise successful projects.

Cost Factors and Budget Planning for OEM Projects

Why does one fabricator quote $15 per part while another quotes $45 for the same component? Understanding OEM fabrication pricing requires looking beyond the bottom-line number to see what actually drives those costs. Without this knowledge, you're essentially flying blind during negotiations and budget planning.

Here's what most buyers don't realize: the sticker price on a quote represents just one piece of a complex cost puzzle. Material expenses, tooling investments, production volumes, finishing requirements, quality testing, and logistics all contribute to your total project cost. Let's break down each factor so you can plan realistically and identify genuine savings opportunities.

Understanding the True Cost Drivers in OEM Fabrication

Think of metal fabrication cost factors as layers in an onion. Each layer adds to your final price, and understanding them helps you make informed decisions about where to optimize.

Material Costs: Raw material typically represents 30-50% of your total component cost. According to sheet metal fabrication specialists, selecting the right material is essential as it directly affects both cost and performance. Aluminum commands higher per-kilogram prices than mild steel but may reduce downstream processing costs. Stainless steel offers corrosion resistance that eliminates coating expenses. The key is evaluating total lifecycle cost, not just raw material price.

Tooling Investments: This is where many projects experience sticker shock. Custom dies, fixtures, and molds require significant upfront investment that must be amortized across your production run. As manufacturing analysts note, the biggest cost factor in sheet metal manufacturing is tooling amortization. Mass production requires expensive dies, so real savings appear only when those costs spread across large quantities.

Production Volume Impacts: Volume fundamentally reshapes your per-unit economics. Setup time, programming, and quality documentation represent fixed costs regardless of whether you order 100 or 10,000 parts. Higher volumes distribute these fixed costs across more units, dramatically reducing per-piece pricing. The crossover point where production tooling becomes economical typically occurs between a few dozen to a few hundred parts, depending on material and complexity.

Finishing Requirements: Surface treatments add both cost and time. Powder coating, anodizing, plating, and specialized finishes each carry different price points and processing durations. Specifying tighter surface finish requirements increases machining time and inspection complexity.

Quality Testing: Inspection depth directly impacts cost. Statistical sampling costs less than 100% inspection. Standard dimensional checks cost less than non-destructive testing. Your industry requirements and component criticality determine minimum testing levels, but over-specifying quality checks on non-critical features wastes budget without improving outcomes.

Logistics: Packaging, warehousing, and shipping round out your total landed cost. Rush shipping to recover from production delays can easily add 15-25% to component costs. Planning realistic lead times avoids these premium charges.

Budget Planning for Prototype Through Production

Imagine quoting a project based on prototype pricing, then discovering production costs per unit are actually 60% lower. Or worse, assuming production economics apply to a pilot run and watching your budget evaporate. Understanding how costs evolve from prototype through full production prevents both scenarios.

Rapid prototyping and mass production operate under fundamentally different economic models. Prototyping is more cost-effective for low volumes because it avoids tooling expenses. CNC machining, laser cutting, and manual forming produce functional parts without custom die investment. However, per-piece costs remain relatively high because you're paying for flexibility rather than efficiency.

Mass production flips this equation. Tooling investments that seemed prohibitive for 50 parts become negligible when spread across 50,000 units. Automated processes reduce labor content per piece. Material purchasing at volume unlocks price breaks unavailable for prototype quantities.

Many companies follow a hybrid approach: start with rapid prototyping for design validation, move to soft tooling or bridge tooling for mid-volume runs, then invest in hardened production tooling as demand and design stability increase. This staged approach manages risk while optimizing costs at each phase.

Cost Optimization Strategies That Actually Work

You don't need to accept quotes at face value. Strategic buyers actively reduce fabrication costs through several proven approaches:

- DFM Optimization: Design for Manufacturability analysis identifies cost drivers hiding in your design. According to fabrication cost specialists, simplifying your design can reduce costs significantly. Avoiding overly complex cuts, unnecessary welds, and intricate detailing that require extensive labor and time directly impacts your bottom line. Using standard material sizes further reduces waste and cost.

- Material Substitution Analysis: Evaluate whether specified materials truly match application requirements. While stainless steel offers superior corrosion resistance, aluminum may prove more cost-effective for lightweight applications where environmental exposure is limited. Your fabricator should help identify alternatives that meet performance requirements at lower cost.

- Volume Commitments: Committing to annual volumes, even with scheduled releases, enables better pricing than spot-buying production runs. Your fabricator can optimize material purchasing, schedule production efficiently, and reduce per-unit overhead when they have visibility into future demand.

- Process Consolidation: Reducing handling between operations saves time and cost. Can welded assemblies become single formed pieces? Can multiple machining setups consolidate into fewer operations? Each time a part moves between workstations, cost accumulates.

- Batch Production: Producing components in batches rather than one-off custom pieces significantly cuts costs through reduced setup time and improved labor efficiency while maintaining quality consistency.

Lead Time Considerations and Rush Order Pricing

Time is money in fabrication, quite literally. Rush orders that compress standard lead times typically carry premium charges ranging from 15% to 50% depending on urgency and capacity constraints.

Standard lead times exist because fabricators must sequence your job alongside other customer work, source materials, and schedule equipment efficiently. Jumping the queue requires overtime labor, expedited material shipping, and displacement of other scheduled work. All of these carry real costs that get passed to you.

The smarter approach? Plan fabrication needs with realistic timelines built into your product development schedule. According to fabrication cost experts, last-minute projects often come with premium pricing due to expedited labor and material sourcing. Planning ahead avoids rush fees and ensures smoother, more cost-effective production.

When rush requirements are unavoidable, communicate early with your fabricator. Often, partial acceleration is possible, getting critical components fast while allowing less urgent items to follow standard timing. This selective approach costs less than blanket expediting while still meeting your essential deadlines.

Understanding these cost dynamics positions you to negotiate effectively and plan budgets that reflect reality rather than optimistic assumptions. But knowing what drives costs is only half the equation. Selecting a fabrication partner who aligns with your requirements, and can deliver on their promises, determines whether your budget planning translates into actual project success.

Selecting the Right OEM Metal Fabrication Partner

You've done your homework on costs, quality standards, and industry requirements. Now comes the decision that determines whether all that preparation pays off: choosing the right OEM metal fabrication partner. This choice represents more than a vendor selection; it's an OEM manufacturing partnership that will influence your product quality, delivery reliability, and bottom line for years to come.

So how do you transform everything covered in this article into a practical metal fabrication vendor selection process? The key lies in systematic evaluation across multiple dimensions, asking the right questions, and recognizing the characteristics that separate exceptional partners from adequate ones.

Evaluating OEM Fabrication Partners Against Your Requirements

When choosing a metal fabrication supplier, resist the temptation to focus solely on price. According to contract manufacturing specialists at GMI Solutions, evaluating contract manufacturers raises practical questions beyond quoted costs: Is a quoted job cost all-inclusive, or will fees and other add-ons be assessed? What processes ensure efficiency, quality, and consistency? Is there a dedicated point of contact, and what level of communication can you expect?

Your evaluation should systematically assess six critical dimensions:

Technical Capabilities: Gaining an understanding of the services and types of work a contract manufacturer offers is a fundamental first step in determining partnership potential. Does the fabricator have the specific equipment, processes, and expertise your components require? This includes not just current capabilities but also their commitment to technology investments that signal future readiness.

Certification Alignment: Match certifications to your industry requirements. An automotive supplier without IATF 16949 certification creates compliance risk regardless of their technical abilities. A medical device fabricator lacking ISO 13485 simply cannot serve that market effectively.

Prototyping Speed: How quickly can they move from your design files to physical samples in your hands? Rapid prototyping capabilities, such as 5-day turnarounds, dramatically accelerate product development cycles and allow for faster design iteration.

Production Capacity: Even if the contract manufacturer aligns with your project needs, the point is moot if they can't accommodate production. Understand their current utilization, ability to scale, and track record of meeting volume requirements during demand spikes.

Quality Systems: Look beyond certification logos to understand how quality actually functions on their shop floor. What inspection methods do they employ? How do they handle non-conformances? What does their defect rate look like historically?

Communication Responsiveness: According to fabrication partnership experts, manufacturers must take choosing the right fabrication partner seriously because it's crucial to success. How quickly do they respond during your evaluation phase? That responsiveness typically reflects what you'll experience as a customer.

| Evaluation Criteria | Questions to Ask | Green Flags | Red Flags |

|---|---|---|---|

| Technical Capabilities | What services are in-house vs. outsourced? What equipment investments have you made recently? | Comprehensive in-house capabilities; ongoing technology investment | Heavy reliance on subcontractors; outdated equipment |

| Certification Alignment | Which certifications do you hold? When was your last audit? | Current certifications matching your industry; clean audit history | Expired certifications; audit findings not addressed |

| Prototyping Speed | What is your typical prototype lead time? Can you expedite when needed? | 5-7 day rapid prototyping; flexible expediting options | Multi-week prototype timelines; no expedite capability |

| Production Capacity | What is your current utilization? How would you scale for increased demand? | Capacity headroom; clear scaling plans; multiple shift capability | Near-capacity operation; vague answers about growth |

| Quality Systems | What is your first-pass yield rate? How do you handle non-conformances? | Documented quality metrics; systematic corrective action process | No quality data available; reactive quality approach |

| Communication | Who will be my primary contact? What is your typical quote turnaround? | Dedicated project manager; 12-24 hour quote turnaround | Rotating contacts; multi-day quote response times |

| DFM Support | Do you offer design for manufacturability analysis? Is it included in quoting? | Comprehensive DFM review as standard practice | DFM as extra-cost service or not offered |

| Industry Experience | What similar projects have you completed? Can you provide references? | Proven track record in your sector; willing references | Limited relevant experience; reluctance to share references |

Key Questions to Ask Before Committing to a Manufacturer

Beyond the evaluation checklist, certain questions reveal whether a potential OEM metal fabrication partner truly fits your needs. These questions dig deeper than surface capabilities to expose how the partnership will actually function.

Experience and Track Record: A contract manufacturer may be well-established, but years in business may not equate to being a good fit for you. Familiarity with your industry and a track record of producing products similar to yours is pivotal. Ask for case studies or references to understand their expertise and verify their ability to meet expectations.

Process Flexibility: While robust, well-tested processes benefit everyone, a contract manufacturer should also offer flexibility where and when needed. Can they add your suppliers to their approved vendor list? Will they work with your internal requirements or accommodate product-specific testing processes? Rigidity in a partner often creates friction as your needs evolve.

Design Engineering Support: Fabrication partners should optimize designs for improved cost-effectiveness, efficiency, and quality. Ask if their engineers can refine specifications, determine what file formats they accept for CAD, and discover how they handle design changes mid-production. Partners offering comprehensive DFM support help you avoid the costly design-related mistakes covered earlier in this article.

Scalability and Growth: Your fabrication partner should scale with you as your business grows. Find out their flexibility in production volumes, capacity for future growth, and ability to support increased demand without sacrificing quality. A partner that can't grow with you becomes a bottleneck as your business succeeds.

Financial Stability: Disruption in a supply chain caused by a contract manufacturer's insolvency has far-reaching and risky ramifications for OEMs, including production delays, quality issues, and inventory mismanagement. Don't hesitate to inquire about financial health, particularly with smaller fabricators.

Secondary Operations: An all-in-one partner should help streamline production and improve turnaround time. Ask if they offer in-house powder coating, hardware insertion, welding, or other secondary services. Consolidating operations with a single partner reduces coordination complexity and often cuts costs.

Putting It All Together: Finding Your Ideal Partner

The characteristics discussed throughout this article converge in partners who demonstrate operational excellence across multiple dimensions. For automotive applications specifically, this means finding manufacturers with IATF 16949 certification, rapid prototyping capabilities, comprehensive DFM support, and responsive communication systems.

Consider what an ideal automotive fabrication partnership looks like in practice: Shaoyi (Ningbo) Metal Technology exemplifies these principles, offering 5-day rapid prototyping, IATF 16949-certified quality systems, and 12-hour quote turnaround for chassis, suspension, and structural components. This combination of speed, certification, and DFM expertise represents exactly the partner attributes this evaluation framework helps you identify.

Whether you're sourcing metal stamping parts for automotive applications or precision assemblies for other industries, the evaluation process remains consistent. Use this framework systematically, document your findings, and make decisions based on evidence rather than sales presentations.

The right OEM metal fabrication partner doesn't just execute your orders; they become an extension of your manufacturing capability, bringing expertise that strengthens your products and supply chain resilience.

Remember: the costs of choosing poorly extend far beyond wasted evaluation time. Rework, delays, quality escapes, and relationship management overhead compound over time, draining budgets in ways that initial quotes never reveal. Invest the effort upfront to find a partner aligned with your requirements, and the partnership will return that investment many times over through reliable, quality-focused production that supports your business growth.

Frequently Asked Questions About OEM Metal Fabrication

1. What are the three types of metal fabrication?

The three basic metal fabrication techniques are cutting, bending, and assembling. Cutting involves shaping metal sheets using laser, waterjet, or plasma methods. Bending uses press brakes or forming equipment to create angles and curves. Assembling joins multiple components through welding, fastening, or adhesive bonding. OEM fabricators combine these techniques based on your specific component requirements, optimizing each process through Design for Manufacturability analysis to reduce costs and improve quality.

2. How much does metal fabrication cost per hour?

Metal fabrication labor rates typically range from $70 to $130 per hour for welding and custom fabrication work. However, total project costs depend on multiple factors beyond labor: material costs (30-50% of component price), tooling investments, production volumes, finishing requirements, and quality testing. High-volume production significantly reduces per-unit costs as tooling and setup expenses spread across more parts. Request detailed quotes that itemize each cost component to understand true pricing.

3. What is the difference between OEM fabrication and standard metal fabrication?

OEM fabrication produces custom components from your proprietary designs that you brand and sell as your own products. Standard fabrication typically creates generic or catalog parts available to any customer. Three key distinctions define OEM partnerships: you retain design ownership and intellectual property, you hold branding rights for finished components, and the fabricator provides production scalability through established supply chains and economies of scale without requiring your capital investment in facilities.

4. What certifications should an OEM metal fabricator have?

Required certifications depend on your industry. Automotive suppliers need IATF 16949 certification. Aerospace applications require AS9100D and potentially Nadcap accreditation. Medical device fabrication demands ISO 13485:2016 compliance. AWS certification validates welding quality, while AISC certification verifies structural steel competence. ISO 9001:2015 serves as the baseline quality management standard. Always verify certification currency and audit history before committing to a fabrication partner.

5. How do I choose the right OEM metal fabrication partner?

Evaluate partners across six dimensions: technical capabilities matching your component requirements, certification alignment with your industry, prototyping speed for design iteration, production capacity for volume needs, quality systems with documented metrics, and communication responsiveness. Request references from similar projects, assess their DFM support capabilities, and verify financial stability. Partners offering rapid prototyping, comprehensive design support, and certified quality systems like IATF 16949 demonstrate operational excellence.

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —