Sheet Metal Forming Companies: 9 Insider Secrets Before You Sign

What Sheet Metal Forming Companies Actually Do

Ever wondered how a flat piece of metal transforms into the curved fender of your car or the precisely angled bracket inside your laptop? That's the work of sheet metal forming companies—specialists who reshape flat metal sheets into complex three-dimensional components without cutting away material or welding pieces together.

These aren't your average metal shops. While general fabrication involves cutting, joining, and assembling metal parts, forming specialists focus exclusively on reshaping metal through mechanical force. It's a critical distinction that affects everything from part strength to production efficiency.

With the global metal forming market valued at $484.15 billion in 2024 and projected to reach $719.11 billion by 2035, understanding what these companies do—and why they matter—could save you significant time and money on your next manufacturing project.

Defining Sheet Metal Forming

Sheet metal forming is the process of transforming flat metal sheets into finished parts through bending, stretching, or compressing—without removing any material. Think of it like origami, but with steel, aluminum, or copper instead of paper.

Here's where it differs from general metal fabrication: fabrication typically involves cutting, drilling, welding, or assembling multiple pieces. Forming, on the other hand, reshapes a single sheet into its final geometry. This matters because formed parts maintain material continuity, often resulting in stronger components with fewer weak points.

A precision sheet metal forming company brings specialized expertise in controlling material behavior during deformation. They understand how different metals stretch, spring back, and maintain tolerances—knowledge that general manufacturers simply don't need for their typical projects.

The core value these specialists deliver? They create uniform, repeatable parts at scale while minimizing waste. Since forming reshapes rather than removes material, you're not paying for metal that ends up on the shop floor.

Industries That Rely on Forming Specialists

Why do so many sectors turn to dedicated forming specialists instead of general manufacturers? The answer lies in the precision, consistency, and volume these companies deliver.

Automotive manufacturers need thousands of identical body panels and structural components. Aerospace engineers require lightweight parts that meet exacting safety standards. Electronics companies demand precise enclosures measured in fractions of a millimeter. General fabricators rarely have the specialized equipment or expertise to meet these demands efficiently.

The primary industries served by sheet metal forming companies include:

- Automotive – Vehicle frames, body panels, chassis components, and safety reinforcements

- Aerospace & Defense – Aircraft skins, structural supports, engine housings, and military vehicle armor

- Electronics & Consumer Goods – Device enclosures, heat sinks, and appliance housings

- Construction – Roofing panels, HVAC ductwork, architectural cladding, and structural brackets

- Medical Equipment – Diagnostic device housings, surgical instrument components, and hospital bed frames

- Energy – Solar panel mounts, turbine components, and power generation enclosures

Each industry brings unique requirements—from the corrosion resistance needed in medical applications to the impact durability demanded by defense contractors. That's precisely why businesses seek out forming specialists with proven experience in their specific sector rather than relying on generalist shops.

Core Forming Processes Explained

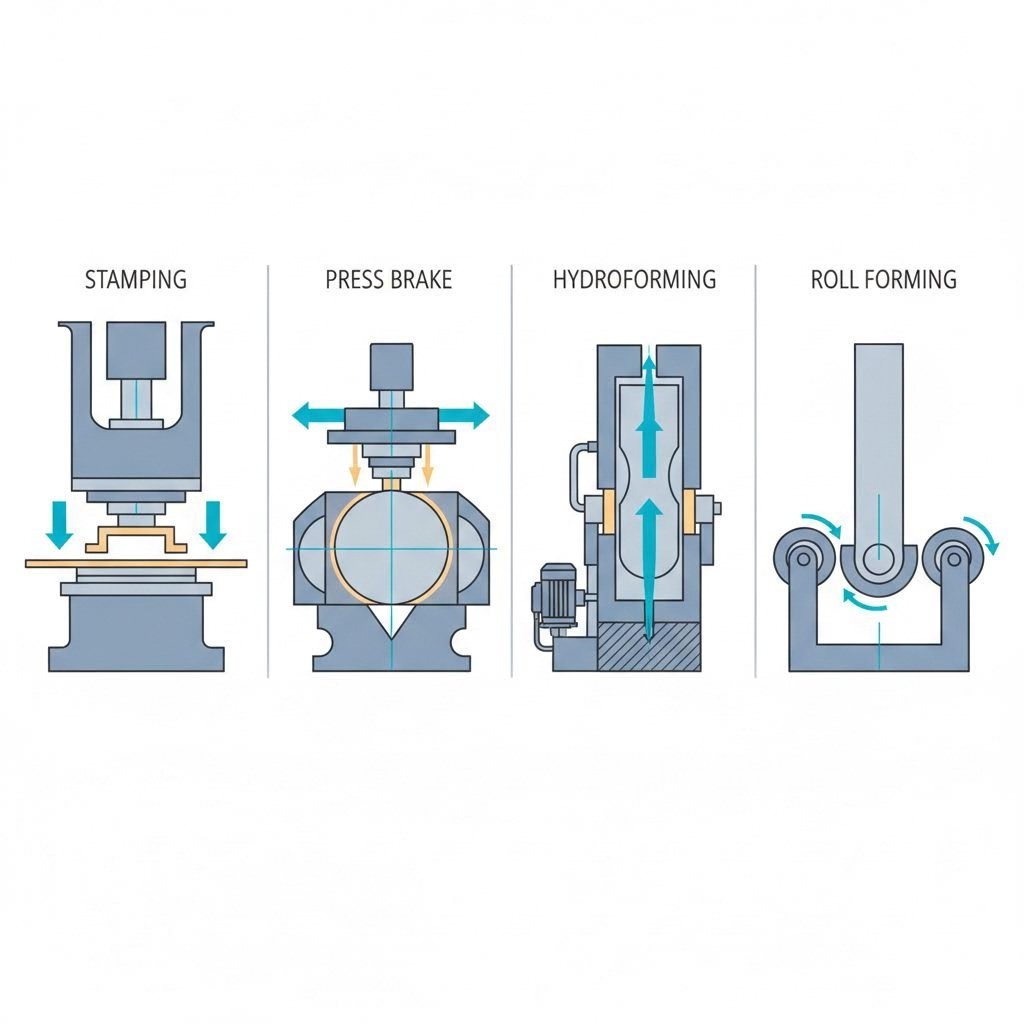

So you understand what forming companies do—but how exactly do they reshape flat metal into three-dimensional parts? The answer lies in five core processes, each suited for different geometries, volumes, and materials. Choosing the wrong one can mean budget overruns, quality issues, or missed deadlines. Choosing correctly? That's where your project succeeds.

Whether you're working with CNC sheet metal forming companies on precision brackets or consulting sheet metal roll forming companies about long architectural profiles, understanding these processes helps you communicate your needs clearly and evaluate supplier capabilities accurately.

Stamping and Bending Fundamentals

These two processes form the backbone of most sheet metal forming operations. They're the workhorses you'll encounter most frequently—and the ones most often confused.

Bending is exactly what it sounds like: creating angles in sheet metal along straight lines. A machine called a press brake positions metal between an upper tool (the punch) and a lower tool (the V-die). The punch descends with tremendous force, pressing the metal into the V-die to create precise bends. According to Worthy Hardware, bending is ideal for prototypes and low-volume runs because setup is fast and no custom tooling costs apply.

What makes bending attractive for smaller projects?

- Standard V-dies and punches work for multiple part designs

- Setup takes minutes, not weeks

- Design changes are simple—just reprogram the press brake

- No expensive custom tooling investment required

The tradeoff? It's slower per part and more labor-intensive, so costs don't decrease dramatically at higher volumes.

Stamping operates on a different principle entirely. Custom-made dies specific to your part perform multiple operations—punching, blanking, embossing, bending—in rapid succession. The initial die investment is significant and can take weeks to produce. But once ready, CNC sheet metal forming and bending companies can stamp thousands of identical parts quickly, driving per-unit costs dramatically lower.

Stamping encompasses several specialized techniques:

- Progressive Die Stamping – A coil feeds through a die with multiple stations, each performing a different operation. The part stays attached to the strip until final cutoff. Perfect for complex parts at high volumes.

- Transfer Die Stamping – The part separates early, with mechanical fingers transferring it between stations. Ideal for larger components that can't remain on a carrier strip.

- Single-Station Stamping – One press stroke performs one operation. Suitable for simpler jobs or moderate volumes.

Here's a practical way to think about it: need 50 brackets? Bending is your only logical choice. Need 50,000? Stamping delivers far lower total project cost despite the upfront die investment.

Advanced Forming Techniques

When part geometry gets complex—deep draws, unusual curves, long continuous profiles—you move beyond basic bending and stamping into specialized territory.

Deep Drawing creates hollow, cup-like shapes from flat blanks. A punch forces the sheet into a die cavity, stretching and forming it into containers, housings, or shells. Think beverage cans, kitchen sinks, or automotive fuel tanks. The challenge? Material can thin unevenly at corners, potentially creating weak points in critical applications.

Hydroforming solves deep drawing's limitations using an ingenious approach. Instead of a solid metal punch, high-pressure hydraulic fluid forces the sheet against a single die. This uniform pressure allows metal to flow more evenly into complex shapes without tearing or excessive thinning. The result is stronger parts with consistent wall thickness—even in asymmetrical or very deep geometries.

According to manufacturing specialists, hydroforming offers several distinct advantages:

- Complex, irregular shapes formed in a single piece

- Superior material distribution for uniform wall thickness

- Excellent surface finish quality

- Part consolidation—combining multiple stamped pieces into one hydroformed component

The downsides? Slower cycle times than stamping, expensive equipment, and complex setup. It's powerful but not always the right choice.

Roll Forming takes an entirely different approach for long, continuous profiles. Sheet metal or coils pass through a series of roller stations, each gradually bending the material into its final cross-section. According to industry specifications, roll forming machines handle material thicknesses from 0.010 inches to 0.250 inches or more, with variable widths depending on machine design.

Sheet metal roll forming companies excel at producing:

- Roofing and siding panels

- Gutters and downspouts

- Structural framing members

- Automotive trim and weatherstripping channels

The process is highly efficient for long runs of consistent profiles, though tooling changeover for different shapes requires significant time.

| Process Type | Best Applications | Material Thickness Range | Production Volume Suitability | Typical Industries |

|---|---|---|---|---|

| Bending | Brackets, enclosures, chassis, simple angles | 0.020" – 0.250" | Prototypes, low to medium volume | Electronics, HVAC, general manufacturing |

| Stamping | Complex parts with punched features, consistent geometry | 0.010" – 0.250" | Medium to very high volume | Automotive, appliances, electronics |

| Deep Drawing | Hollow shapes, containers, housings, cups | 0.020" – 0.125" | Medium to high volume | Food packaging, automotive, cookware |

| Hydroforming | Complex curves, asymmetrical parts, deep irregular shapes | 0.030" – 0.188" | Low to medium volume | Aerospace, automotive, medical devices |

| Roll Forming | Long continuous profiles, channels, panels | 0.010" – 0.250"+ | High volume, long runs | Construction, roofing, automotive trim |

Matching the right process to your project requires understanding your part geometry, target volume, and budget constraints. A complex aerospace bracket might justify hydroforming's higher costs for superior strength. A simple electronics enclosure at moderate volumes points toward bending. And high-volume automotive brackets almost always lead to stamping.

With process fundamentals clear, the next critical decision involves material selection—because even the best forming process fails if paired with the wrong metal for your application.

Material Selection for Sheet Metal Forming Projects

You've identified the right forming process for your part geometry. Now comes a decision that affects everything from tooling costs to final part performance: which metal should you use?

Here's what many buyers discover too late—material selection isn't just about strength or corrosion resistance. Each metal behaves differently during forming. Aluminum springs back more aggressively than steel. Stainless steel work-hardens rapidly, demanding different tooling strategies. Choose incorrectly, and you'll face dimensional issues, cracked parts, or budgets blown on rework.

Whether you're working with sheet metal forming machine companies on automotive brackets or consulting roll forming specialists about architectural panels, understanding material behavior gives you a significant advantage in supplier discussions.

Common Forming Materials

The materials you'll encounter most frequently fall into five categories. Each brings distinct advantages—and limitations—to your forming project.

Steel (Carbon and Low-Alloy)

Steel remains the workhorse of sheet metal forming. Its combination of strength, formability, and cost-effectiveness makes it the default choice for countless applications. According to Xometry's material specifications, common forming grades include:

- DC01 (S235JR) – Non-alloy structural steel with excellent weldability and strength properties. Available in wide-ranging surface finishes for internal and external applications.

- DC04/DC05 – Low carbon cold-rolled steel with high ductility, making it ideal for deep drawing operations requiring significant material flow.

- S355J2 – Higher-strength structural steel for components subject to elevated stress levels.

Steel's higher Young's modulus means less springback compared to aluminum—a major advantage for tight-tolerance parts. However, it's heavier and requires protective coatings in corrosive environments.

Aluminum Alloys

When weight matters, aluminum delivers. At roughly one-third the density of steel, it's the material of choice for aerospace, automotive lightweighting, and portable electronics. But aluminum behaves very differently during forming.

Research from FormingWorld highlights critical differences: aluminum exhibits significantly higher springback due to its lower Young's modulus. Its strain hardening exponent (n-value) drops dramatically as deformation increases, meaning localized necking and splits occur more readily than with steel.

Common forming grades include:

- 5052/5754 – Magnesium-alloyed grades with excellent corrosion resistance and the highest strength among non-heat-treatable alloys. Ideal for marine and chemical environments.

- 6061 – Precipitation-hardened alloy with good mechanical properties and weldability. Commonly used for structural components.

- 7075 – Zinc and magnesium alloyed for high strength and fatigue resistance. Popular in aerospace applications despite forming challenges.

Stainless Steel

Where corrosion resistance is non-negotiable—food processing, medical devices, marine applications—stainless steel dominates. The chromium content (minimum 10.5%) creates a self-healing oxide layer that protects against rust and contamination.

- 304 (18/8) – The most common austenitic grade, offering excellent corrosion resistance and formability. Widely used in food and beverage equipment.

- 316 – Molybdenum addition improves resistance to chlorides and acids. Essential for marine and chemical processing applications.

The tradeoff? Stainless work-hardens rapidly during forming, requiring more powerful equipment and careful process control. Tooling wears faster, and springback exceeds carbon steel.

Copper and Brass

Excellent electrical and thermal conductivity make copper alloys essential for electrical components, heat exchangers, and decorative applications. They form easily but require careful handling to prevent surface damage.

Specialty Alloys

Titanium, nickel alloys, and high-temperature superalloys serve demanding aerospace and medical applications. Their exceptional performance comes with forming challenges: higher tooling costs, specialized equipment requirements, and extended lead times.

Material Selection Criteria for Your Project

Matching material to application requires balancing multiple factors. Ask yourself these questions before finalizing your choice:

What environment will the part face? Outdoor exposure, chemical contact, or high humidity all influence material selection. Carbon steel fails quickly in marine environments where 316 stainless thrives.

What strength-to-weight ratio matters? Aerospace and automotive lightweighting projects often justify aluminum's higher per-pound cost through fuel efficiency gains.

What tolerances must you hold? Materials with higher springback—especially aluminum—require compensation in tooling design. This adds engineering time and cost.

What's your production volume? High-volume projects can absorb more expensive tooling designed for work-hardening materials. Low-volume runs favor easily formed grades.

Thickness Considerations

Material thickness directly impacts formability, and gauge numbers don't mean the same thing across materials. According to Approved Sheet Metal's 2024 specifications, 16 gauge aluminum measures 0.062" thick while 16 gauge steel is 0.059"—a 0.003" difference that creates fit problems in nested assemblies.

Thinner materials form more easily with tighter bend radii but offer less structural strength. Thicker gauges resist deformation better but require more forming force, larger equipment, and may crack at tight bends.

Here's a practical guideline: always specify material thickness in decimal inches or millimeters rather than gauge numbers. This eliminates ambiguity and prevents costly errors when sheet metal forming machine companies quote your project.

Standard in-stock thicknesses vary by supplier. Requesting unusual gauges extends lead times and increases costs. When possible, design to common thicknesses—0.062", 0.080", 0.125" for aluminum; 0.059", 0.074", 0.104" for steel and stainless.

With material and process decisions aligned, you'll need to verify that potential suppliers meet the quality standards your industry demands—which brings us to certifications and what they actually mean for your project.

Industry Certifications and Quality Standards

You've shortlisted potential forming partners based on process capabilities and material expertise. Now comes a question many buyers struggle to answer: what do all those certification acronyms actually mean for your project?

Here's the reality—whether you're sourcing from sheet metal forming companies in the UK, sheet metal forming companies in India, or China sheet metal forming companies, certifications serve as your first line of defense against quality failures. They're not just wall plaques. Each certification represents audited processes, documented controls, and industry-specific requirements that directly impact whether your parts arrive on time, in spec, and ready for use.

Understanding these standards helps you ask better questions during supplier evaluation—and avoid costly surprises downstream.

Understanding Industry Certifications

Certifications fall into two categories: universal quality management standards and industry-specific requirements. Mixing them up—or assuming one substitutes for another—leads to rejected parts and failed audits.

ISO 9001:2015 – The Foundation

Think of ISO 9001 as the baseline. It establishes a quality management system (QMS) framework that applies across all manufacturing sectors. Companies with ISO 9001 certification have demonstrated they document what they do, do what they document, and continuously improve their processes.

What does this mean practically? When you work with an ISO 9001-certified supplier, you can expect:

- Documented procedures for every production step

- Calibrated inspection equipment with traceable records

- Formal processes for handling nonconforming materials

- Regular internal audits and management reviews

According to Giering Metal Finishing, their ISO 9001:2015 certification "reinforces our commitment to doing what we say—and documenting what we do." That transparency and accountability builds trust, especially in precision manufacturing relationships.

AS9100 Rev D – Aerospace Requirements

Flying 35,000 feet in the air leaves zero room for quality failures. AS9100 builds on ISO 9001 with aerospace-specific additions developed by the International Aerospace Quality Group.

According to Advisera's certification analysis, AS9100 adds critical requirements around:

- Product safety – Formal processes to identify and control safety-critical characteristics

- Configuration management – Tracking the exact configuration of each product throughout its lifecycle

- Counterfeit parts prevention – Controls to prevent unauthorized or non-genuine components entering the supply chain

- On-time delivery management – Requirements appearing throughout the standard, not just as a metric

- Human factors – Recognition that operator variability affects process outcomes

If your parts enter aircraft, spacecraft, or defense systems, your forming supplier almost certainly needs AS9100 certification. Major aerospace OEMs won't consider uncertified suppliers for production contracts.

IATF 16949:2016 – Automotive Requirements

The automotive industry developed its own extension through the International Automotive Task Force. While also built on ISO 9001:2015, IATF 16949 takes a different approach than AS9100—focusing heavily on process control and statistical methods.

Key additions include:

- Advanced Product Quality Planning (APQP) – Structured product development with defined phases and gates

- Production Part Approval Process (PPAP) – Formal evidence that production processes can consistently manufacture parts meeting specifications

- Measurement System Analysis (MSA) – Statistical validation that inspection equipment produces reliable data

- Statistical Process Control (SPC) – Real-time monitoring of production processes to detect drift before defects occur

- Total Productive Maintenance (TPM) – Preventive maintenance programs to maximize equipment availability

- Error-proofing – Designed-in mistake prevention rather than inspection-based detection

Automotive supply chains demand IATF 16949 certification at every tier. If your formed components eventually reach vehicle assembly plants, verify your supplier holds current certification.

ITAR – Defense Export Controls

ITAR (International Traffic in Arms Regulations) differs fundamentally from quality certifications—it's a U.S. government regulatory requirement controlling defense-related exports and information access.

As explained by industry experts, ITAR compliance confirms a supplier can "handle military and defense-related components, protect classified or controlled information, ensure secure handling of sensitive customer data, and prevent unauthorized access by foreign entities or individuals."

This has significant implications when sourcing internationally. China sheet metal forming companies cannot work on ITAR-controlled projects—period. Even domestic suppliers without proper ITAR registration create compliance violations for defense contractors.

Mil-Spec – Military Specifications

While not a certification, Mil-Spec refers to detailed technical specifications for materials, processes, and components used in military applications. A supplier claiming Mil-Spec capability should demonstrate experience meeting specific MIL standards relevant to your application—such as MIL-DTL-5541 for chemical conversion coatings or MIL-STD-1916 for sampling procedures.

| Certification Name | Industry Focus | Key Requirements | Why It Matters to Buyers |

|---|---|---|---|

| ISO 9001:2015 | All industries | Documented QMS, process control, continuous improvement, customer focus | Baseline assurance of quality systems; minimum expectation for professional suppliers |

| AS9100 Rev D | Aerospace, space, defense | Product safety, configuration management, counterfeit prevention, on-time delivery | Required for aerospace supply chains; ensures safety-critical process controls |

| IATF 16949:2016 | Automotive | APQP, PPAP, SPC, MSA, error-proofing, production scheduling controls | Mandatory for automotive suppliers; validates statistical process capability |

| ITAR Compliance | U.S. defense/military | Secure handling, personnel restrictions, documentation controls, export compliance | Legally required for defense work; violations carry severe penalties |

| Mil-Spec Capability | Military applications | Compliance with specific MIL standards relevant to materials, processes, or testing | Demonstrates experience meeting stringent military technical requirements |

Quality Control Standards to Expect

Certifications establish systems—but what happens on the shop floor determines whether your parts meet specifications. Understanding standard quality control practices helps you evaluate supplier capabilities and set appropriate expectations.

Inspection Methods

Professional forming companies employ multiple inspection techniques throughout production:

- First Article Inspection (FAI) – Comprehensive measurement of initial production samples against all drawing dimensions before full production begins

- In-process inspection – Operator checks at defined intervals during production runs

- Statistical sampling – Random sample measurement according to AQL (Acceptable Quality Level) standards

- Final inspection – Verification before shipment that parts meet all specifications

For critical dimensions, expect Coordinate Measuring Machine (CMM) reports with measurement uncertainty data. Visual inspection standards should reference specific criteria—workmanship standards, surface finish requirements, or cosmetic acceptance limits.

Tolerance Verification

How does your supplier verify that bent angles fall within ±0.5° or hole positions hold ±0.005"? Certified companies maintain calibration records for all measurement equipment, traceable to national standards (NIST in the United States).

Ask about Gage R&R studies—these validate that measurement systems produce repeatable, reproducible results. A forming company running SPC on critical dimensions can demonstrate process capability indices (Cpk) that quantify their ability to hold your tolerances consistently.

Documentation and Traceability

In regulated industries, knowing exactly which material lot went into which parts—and who inspected them, when—isn't optional. It's a legal requirement.

Proper traceability includes:

- Material certifications (mill test reports) linked to specific production lots

- Process records identifying equipment, operators, and parameters used

- Inspection records with serialized or lot-traceable data

- Nonconformance reports documenting any deviations and dispositions

For aerospace and medical applications, this documentation must be retained for extended periods—sometimes decades. Suppliers without robust document control systems create compliance risks for your organization.

When evaluating certifications, verify currency—not just existence. Request copies of actual certificates and check expiration dates. A lapsed certification signals potential quality system problems.

Certifications and quality systems establish supplier credibility—but even the best-qualified forming company can't fix a flawed design. That's why your next consideration should be Design for Manufacturability: the practices that prevent quality issues before production begins.

Design for Manufacturability Best Practices

You've selected your forming process, material, and a certified supplier with impressive quality systems. Everything should run smoothly now, right? Not quite. Here's where many projects stumble: a design that looks perfect in CAD becomes a manufacturing nightmare on the shop floor.

Design for Manufacturability—DFM—bridges this gap. It's the practice of designing parts so they're not just functional, but actually producible at your target cost and quality level. When you work with sheet metal roll forming machine companies or precision stamping specialists, DFM determines whether your project sails through production or gets bogged down in expensive tooling revisions and quality issues.

According to industry experts, design changes become exponentially more expensive as a project progresses. Catching a problem during design costs almost nothing. Discovering it after tooling is built? That's a budget-breaking scenario.

Critical DFM Principles

Metal doesn't behave like the lines in your CAD software. It stretches, springs back, and resists certain geometries. Understanding these physical realities—and designing around them—separates successful projects from costly failures.

Bend Radius: The Foundation of Every Formed Part

Think of bending sheet metal like folding a piece of cardboard. Fold too sharply, and the outer surface cracks. The same principle applies to metal, just with tighter tolerances.

The simple rule? Your inside bend radius should equal or exceed the material thickness. A 0.060" thick steel sheet needs at least a 0.060" inside radius. Go tighter, and you risk cracking—especially with harder materials like stainless steel or aluminum alloys.

Here's the business impact: when you design all bends with the same radius, your forming partner can use a single tool for every fold. As Norck's DFM guide explains, this "saves time on setup and saves you money on labor." Different radii throughout your part means tool changes, longer cycle times, and higher costs.

Hole Placement: Distance Matters

Ever noticed a round hole become an oval after bending? That's what happens when holes sit too close to bend lines. The metal stretches during forming, distorting nearby features.

The rule is straightforward: keep holes at least twice the material thickness from any bend location. For 0.060" material, that means 0.120" minimum clearance. This ensures your holes remain round, your screws fit properly, and your assemblies come together on the first attempt.

Minimum Flange Width: Give the Machine Something to Grab

A flange is the portion of metal that gets bent up from the flat sheet. Press brakes need enough material to grip during the bending operation. Design a flange too short, and it's like trying to fold a tiny sliver of paper with thick fingers—the machine simply can't do it cleanly.

The guideline: flanges should be at least four times the material thickness. For 0.060" stock, that's a minimum 0.240" flange. Shorter flanges require special tooling that can double your production costs.

Grain Direction: The Hidden Factor

Sheet metal has a "grain" created during the rolling process at the mill—similar to wood grain. Bend with the grain, and the metal may crack along the outer surface. Bend across the grain, and forming proceeds smoothly.

This is what experts call a "hidden" rule that prevents parts from failing months after delivery. When specifying critical bends, note the required grain orientation on your drawings.

Bend Relief: Preventing Tears at Corners

When a bend line meets a flat edge, the metal wants to tear at that intersection. Bend reliefs—small notches cut at the ends of bend lines—prevent this damage.

Add rectangular or circular cutouts at bend line terminations, sized at 1 to 1.5 times the material thickness. This simple feature guarantees clean, professional corners without stress fractures.

Key DFM guidelines for sheet metal parts include:

- Inside bend radius – Equal to or greater than material thickness

- Hole-to-bend distance – Minimum 2x material thickness from bend lines

- Minimum flange width – At least 4x material thickness

- Bend relief – 1 to 1.5x material thickness at bend line ends

- Grain direction – Orient bends perpendicular to rolling direction

- Uniform bend radii – Use consistent radii to minimize tooling changes

- Standard hole sizes – Specify common diameters (5mm, 6mm, 1/4") to use existing tooling

- Narrow feature width – Keep slots and tabs at least 1.5x material thickness to prevent warping

Common Design Mistakes to Avoid

Even experienced engineers make these errors. Recognizing them early saves weeks of delays and thousands in rework costs.

Insufficient Bend Relief

Skipping bend reliefs seems harmless until parts tear during forming. According to Consac's manufacturing guide, "without proper relief cuts, material tears at bends and corners deform." Always add reliefs proportional to material thickness.

Holes Too Close to Bends

This is the single most common DFM violation. Designers place mounting holes exactly where assembly drawings require them—without checking proximity to fold lines. The metal stretches during bending, pulling holes out of round or completely out of specification.

Overly Tight Tolerances

Not every dimension needs five decimal places. Specifying unnecessarily tight tolerances—below ±0.005"—drives costs up dramatically. Standard sheet metal processes economically achieve ±0.010" to ±0.030". Reserve tight tolerances for features that genuinely require them, like mating surfaces or critical alignment holes.

Ignoring Springback

Metal is slightly elastic. Bend it to 90 degrees, release the press brake, and it springs back slightly—maybe to 88 or 89 degrees. Experienced sheet metal roll forming machines companies compensate for this in their tooling setup. But if your design demands exactly 90.00 degrees with zero tolerance, you're asking for expensive inspection time and rejected parts.

The solution? Allow reasonable angular tolerances where function permits. If a bracket doesn't require perfect 90-degree angles to work, specify ±1° and keep your project on budget.

Non-Standard Hole Sizes

Designing a hole at exactly 5.123mm may require your supplier to purchase a custom drill bit just for your job. Standard sizes—5mm, 6mm, 1/4"—let forming companies use existing punch tooling for nearly instant processing.

Narrow Slots and Fingers

Laser cutters generate intense heat. Very thin features—narrow slots, long skinny tabs—can warp or twist from thermal distortion. Keep narrow cutouts at least 1.5 times wider than material thickness to maintain flatness and accuracy.

Working with experienced manufacturers early in your design process helps identify these issues before they become expensive problems. Prevention costs far less than correction.

The most successful projects involve collaboration between design engineers and forming specialists before drawings are finalized. Many sheet metal forming companies offer DFM reviews as part of their quoting process—take advantage of this expertise. A 30-minute conversation about bend radii and hole placement can eliminate weeks of tooling revisions and production delays.

With DFM principles guiding your design, you're ready to evaluate potential forming partners on criteria that actually matter—which is exactly what we'll cover next.

How to Evaluate and Select the Right Partner

You've nailed your design, selected the right material, and understand which forming process fits your project. Now comes the decision that determines whether everything comes together smoothly—or falls apart: choosing your forming partner.

Here's the challenge most buyers face. A Google search for sheet metal forming companies returns hundreds of options. Some specialize in FMS sheet metal forming for flexible manufacturing systems. Others focus exclusively as a sheet metal roll forming company for architectural applications. Many advertise similar capabilities, certifications, and promises. So how do you separate the right fit from the expensive mistake?

The answer lies in systematic evaluation—not just checking boxes, but understanding what each criterion means for your specific project.

Key Selection Criteria

Think of supplier selection like building a puzzle. Each piece matters, but certain pieces are non-negotiable for your particular picture.

Technical Capabilities and Equipment Inventory

A supplier's equipment directly affects what they can produce—and how well. According to CustomMetalPro's supplier evaluation guide, "Limited capabilities often lead to outsourcing, longer lead times, and quality variation."

What should you verify?

- Press brake capacity – Tonnage determines maximum material thickness and bend length

- Stamping press range – Progressive die capability versus single-station limitations

- CNC programming expertise – Modern equipment means nothing without skilled programmers

- Secondary operations – Welding, finishing, and assembly capabilities in-house versus outsourced

- Inspection equipment – CMMs, optical comparators, and calibrated hand tools

When a supplier handles everything under one roof, you maintain control. When they outsource critical steps, quality becomes harder to track—and accountability gets murky.

Industry Experience and Specialization

A company that's manufactured thousands of automotive brackets understands automotive tolerances, testing requirements, and PPAP documentation. But that same company might struggle with medical device housings that demand different surface finishes and traceability protocols.

Ask for examples of similar projects. Request references from customers in your industry. A supplier's honest answer about their experience—or lack of it—tells you more than any sales pitch.

Quality Certifications

You've already learned what each certification means. Now apply that knowledge. If your parts feed an automotive supply chain, IATF 16949 isn't optional—it's mandatory. Aerospace components require AS9100. Defense work demands ITAR compliance.

But here's what York Sheet Metal emphasizes: "Quality should be at the top of your list. If you can't count on quality parts coming in from your sheet metal supplier, it's time to find a new one." Certifications prove systems exist—but part quality proves those systems work.

Communication and Responsiveness

When problems arise—and they will—how quickly does your supplier respond? Can you reach a decision-maker, or do you navigate endless voicemail loops?

Test this before signing contracts. Send a technical question. Time the response. Evaluate the quality of the answer. As industry experts note, "When you call or email your supplier, how long does it take for them to get back to you? What is the quality of that communication?" Fast quotes and responsive engineers signal a supplier who prioritizes customer relationships.

Prototyping Capabilities and Production Scalability

Your project probably starts small—maybe a few prototypes to validate the design. But what happens when you need 10,000 units? Can your supplier scale without sacrificing quality or extending lead times?

Look for partners who support the entire product lifecycle:

- Rapid prototyping for design validation

- Low-volume production for initial market testing

- High-volume capability for full-scale launch

- Long-term repeat order management

Switching suppliers mid-project creates risk. Finding one partner who handles everything from first article to mass production eliminates transition headaches.

Follow this step-by-step evaluation checklist when assessing potential forming partners:

- Define your requirements – Document part geometry, material, tolerances, volume projections, and certification requirements before contacting suppliers

- Request capability statements – Ask for equipment lists, process certifications, and industry experience summaries

- Submit RFQ with complete documentation – Provide drawings, specifications, and volume forecasts for accurate quotes

- Evaluate quote responsiveness – Note turnaround time; slow quotes often predict slow production communication

- Assess DFM feedback quality – Did they identify potential issues? Offer cost-saving suggestions? Experienced partners add value during quoting

- Verify certifications independently – Request certificate copies and confirm they're current, not expired

- Request customer references – Contact references in your industry; ask about quality, delivery, and problem resolution

- Evaluate financial stability – Check for signs of healthy operations; distressed suppliers create supply chain risk

- Conduct facility visit when possible – See equipment condition, housekeeping standards, and workforce engagement firsthand

- Start with a pilot order – Test the relationship with a smaller project before committing to large volumes

Domestic vs International Sourcing Considerations

Should you work with local sheet metal forming machine price companies or explore overseas options? This decision involves tradeoffs that go far beyond unit cost.

The Case for Domestic Sourcing

According to Mead Metals' sourcing analysis, domestic suppliers offer significant advantages:

- Faster lead times – "Because your supplier is just a truck ride away, lead times are shorter, and shipping is quicker." No ocean freight delays, no customs clearance bottlenecks.

- Easier communication – Same time zone, no language barriers. "Clear and timely communication helps build strong relationships, allowing you to work collaboratively to meet your needs."

- Quality consistency – U.S. suppliers adhere to strict industry standards. Issues can be addressed swiftly with local oversight.

- Intellectual property protection – Stronger legal frameworks protect your designs and proprietary processes.

- Supply chain resilience – Global shipping disruptions, port congestion, and international crises don't strand your parts overseas.

The Case for International Sourcing

Overseas suppliers—whether sheet metal forming companies in India, the UK, or China—can offer:

- Lower unit costs – Reduced labor and production expenses translate to competitive pricing, especially for high-volume orders

- Access to specialized materials – Certain alloys or grades may be more readily available in specific regions

- Greater production capacity – Some overseas facilities handle volumes that exceed domestic capabilities

Hidden Costs of Overseas Sourcing

That attractive per-piece price rarely tells the complete story. As Mead Metals warns, "What may seem like a good deal on paper can quickly add up. Shipping fees, tariffs, duties, and even currency exchange rates can turn that low-cost metal order into a much pricier endeavor."

Consider these often-overlooked factors:

- Shipping and logistics – Ocean freight costs fluctuate dramatically; container shortages create delays

- Import duties and tariffs – Trade policies change; today's pricing may not hold tomorrow

- Quality inspection costs – Third-party inspectors, travel for quality audits, and rework expenses

- Inventory carrying costs – Longer lead times require larger safety stock

- Communication overhead – Time zone differences add days to simple decisions

Making the Right Choice for Your Project

Neither option is universally better. The right decision depends on your specific circumstances:

- Choose domestic when lead times are critical, volumes are moderate, designs are proprietary, or you need responsive collaboration

- Consider overseas when unit cost dominates the decision, volumes are very high, designs are stable and proven, and you have resources to manage international logistics

"The certainty that a stronger supplier provides to your supply chain beats aggressive promises and missed deliveries."

Many successful companies use a hybrid approach—domestic partners for prototypes, urgent orders, and proprietary components; overseas suppliers for high-volume commodity parts where cost savings justify the complexity.

With evaluation criteria defined and sourcing strategy clarified, you're ready to understand the final piece of the puzzle: what drives project costs and how to optimize your investment without sacrificing quality.

Understanding Pricing and Cost Factors

You've evaluated potential partners and understand how to select the right one. But here's the question that often catches buyers off guard: why do two seemingly similar quotes differ by 40%? And more importantly, how do you know which one actually represents better value?

The reality is that sheet metal forming project costs aren't straightforward. A comprehensive industry analysis reveals that "cost control in sheet metal fabrication is a crucial factor in any project. From the choice of materials to the time taken to produce the product, from the actual manufacturing process to the cost of transportation of the final product, all these factors are determinants of the total cost."

Understanding these cost drivers doesn't just help you compare quotes—it empowers you to make design decisions that reduce expenses without compromising quality. Whether you're evaluating a sheet metal forming machine price company or comparing sheet metal roll forming machines for sale companies, this knowledge gives you negotiating power and prevents budget surprises.

Primary Cost Drivers

Every forming project has cost components that stack up to determine your final price. Some you control directly through design decisions. Others depend on market conditions or supplier capabilities. Knowing which is which helps you focus optimization efforts where they'll have the greatest impact.

Material Costs

Raw material often represents the largest single cost component—and it's subject to market fluctuations beyond your control. According to JLCCNC's cost analysis, "The material you choose has the biggest impact on cost."

What drives material expenses?

- Material type – Carbon steel costs significantly less than stainless steel or aluminum alloys. Specialty materials like titanium or nickel alloys command premium prices.

- Thickness – Thicker sheets cost more per unit area and require more powerful equipment to process. "1.2 mm stainless steel can cost 40–60% more to process than 0.8 mm mild steel due to machine load and cutting speed."

- Quantity purchased – Volume purchasing yields discounts; small orders pay retail pricing.

- Market conditions – Global supply dynamics, tariffs, and currency fluctuations all affect raw material pricing.

Tooling Investments

Custom tooling—dies, fixtures, and specialized punches—represents a significant upfront investment that gets amortized across your production run. For stamping operations, die costs can range from thousands to tens of thousands of dollars depending on complexity.

Here's the critical insight: tooling costs are fixed regardless of volume. Order 100 parts, and each one carries a heavy tooling burden. Order 10,000, and that same investment spreads thinly across each unit, dramatically reducing per-piece costs.

Standard operations like bending typically avoid custom tooling costs entirely. As industry experts explain, "Standard V-dies and punches work for multiple part designs"—meaning your parts can be produced using existing equipment without dedicated tooling investments.

Production Volume

Economies of scale significantly impact sheet metal forming economics. Setup costs—programming, tool configuration, first-article inspection—remain constant whether you're making 10 parts or 10,000.

Consider this breakdown:

- Prototype quantities (1-10 pieces) – Setup costs dominate; per-unit prices are highest

- Low volume (10-100 pieces) – Setup costs begin spreading; per-unit savings emerge

- Medium volume (100-1,000 pieces) – Significant per-unit reductions; material discounts become available

- High volume (1,000+ pieces) – Maximum efficiency; tooling investments become justified; lowest per-unit costs

According to manufacturing specialists, "A batch of 500 parts will have a much lower unit price than a batch of 5 because setup costs are spread across more items."

Part Complexity

This is where design decisions directly translate to dollars. As industry analysis confirms, "increased complexity equals increased cost. Parts with intricate geometries, numerous bends, tight tolerances, complex cutouts, or extensive welding require more programming time, longer machine cycles, potentially more specialized tooling, higher skilled labor, and increased inspection efforts."

Complexity factors include:

- Number of bends – Each bend adds setup time and machine cycles

- Cut complexity – Intricate cutouts require slower cutting speeds and longer programming

- Welding requirements – Joints, seams, and structural welds add significant labor costs

- Assembly operations – Fasteners, inserts, and multi-component assembly increase handling time

Tolerance Requirements

Precision costs money. Standard sheet metal tolerances (±0.010" to ±0.030") are economical because they allow normal production speeds and standard inspection methods. Tighten requirements to ±0.005" or below, and costs escalate rapidly.

Why? Tight tolerances demand slower cutting speeds, more frequent measurement, specialized inspection equipment, and higher rejection rates. According to JLCCNC, "The tighter the tolerance (for example, ±0.05 mm instead of ±0.2 mm), the more expensive the process, as it requires slower cutting speeds and additional quality checks."

Secondary Operations and Finishing

Your formed part often needs additional processing before it's truly finished. These secondary operations add cost layers that can surprise buyers who focus only on forming prices:

- Powder coating – Approximately $2 to $5 per square foot of surface area

- Specialized plating – $5 to $15+ per square foot for chrome, zinc, or nickel

- Machining – CNC machining services range from $60 to $200+ per hour depending on complexity

- Welding – Simple welds cost $20 to $50; extensive structural welding runs $200 to $1,000+

- Assembly – Shop labor at $50 to $100+ per hour for multi-component assembly

Strategies for Cost Optimization

Now that you understand what drives costs, how do you reduce them without sacrificing the quality your application demands? The answer lies in smart design decisions and strategic supplier relationships.

Simplify Your Design

Question every feature. Is that decorative curve necessary? Can tolerances be relaxed on non-critical dimensions? According to manufacturing experts, "By making these choices early in the design stage, you can achieve up to 30% cost savings without sacrificing part quality."

Practical simplification strategies:

- Reduce bend count where function permits

- Use uniform bend radii to minimize tooling changes

- Specify standard hole sizes that match existing punch tooling

- Combine multiple simple parts into one multi-featured component

Optimize Material Usage

Design with nesting efficiency in mind. Can part dimensions adjust slightly to fit better on standard sheet sizes? Reducing scrap directly reduces material costs—and helps your supplier offer more competitive pricing.

Additionally, avoid over-specifying materials. If carbon steel meets your functional requirements, upgrading to stainless "just in case" wastes money on every single part.

Engage DFM Expertise Early

This may be the most impactful optimization strategy available. As industry analysis emphasizes, "Engaging a knowledgeable fabricator during the design phase allows their Design for Manufacturability (DFM) expertise to identify potential cost drivers and suggest modifications before designs are finalized."

Early collaboration prevents expensive redesigns. A 30-minute conversation about bend sequences or hole placement can eliminate weeks of tooling revisions and production delays.

Plan for Volume Scaling

If you anticipate production volumes increasing, discuss this upfront. Initial decisions about tooling durability and process selection can save money long-term compared to scaling up inefficiently later.

Evaluate Quotes Beyond Price

Here's where many buyers make costly mistakes. As Swanton Welding advises, "If a company isn't going to provide high-quality work, they can afford not to offer a high-quality price."

A lower quote could indicate:

- Cutting corners on material quality

- Inexperienced fabricators

- Subcontracting to third parties you haven't vetted

- Outdated equipment that produces inconsistent results

- Hidden fees that appear after contract signing

When comparing quotes, ensure you're comparing equivalent specifications. Ask what's included and what's extra. Request itemized breakdowns when possible. The goal isn't finding the cheapest option—it's finding the best value for your specific requirements.

"Rather than finding the cheapest metal fabrication partner, focus on finding a company with a good reputation for producing quality products. Custom metal fabrication requires in-depth knowledge, experience, and attention to detail. It is well worth investing in a partner who can do it right."

Understanding cost drivers and optimization strategies positions you to make informed decisions. But different industries bring different requirements—and those requirements significantly impact both supplier selection and project execution. Let's examine what specific sectors demand from their forming partners.

Industry-Specific Requirements and Applications

Every industry that relies on formed metal components operates under its own set of rules. What works perfectly for a construction bracket will fail miserably for an aerospace structural component. The tolerances, certifications, documentation, and testing requirements differ so dramatically between sectors that choosing a forming partner without understanding these distinctions is like hiring a general contractor to perform heart surgery.

Whether you're sourcing from metal roof sheet forming machine companies for construction applications or evaluating precision specialists for medical devices, understanding industry-specific demands helps you ask the right questions—and recognize when a supplier truly fits your needs versus when they're simply telling you what you want to hear.

Automotive and Aerospace Requirements

Automotive Sector Standards

The automotive industry demands a unique combination of high volume, tight tolerances, and relentless cost pressure. According to EABEL's automotive fabrication analysis, "Automotive fabrication demands tight tolerances and high repeatability to support large-scale production. Consistent fabrication quality is essential to meet OEM performance standards, safety regulations, and long-term durability expectations."

What does this mean practically for forming supplier selection?

- IATF 16949 certification – Non-negotiable for production suppliers; validates statistical process control, PPAP documentation, and continuous improvement systems

- Advanced High-Strength Steel (AHSS) capability – Modern vehicles increasingly use AHSS to balance crash safety with weight reduction

- Progressive and transfer die expertise – High-volume body panels and structural parts require sophisticated stamping capabilities

- Error-proofing systems – Designed-in mistake prevention rather than inspection-based detection

- Complete traceability – Material certifications linked to specific production lots throughout the supply chain

The automotive sector also demands rapid response times throughout the development cycle. When an OEM needs prototype parts for crash testing, weeks of lead time aren't acceptable. This is where suppliers like Shaoyi (Ningbo) Metal Technology differentiate themselves—offering 5-day rapid prototyping alongside IATF 16949-certified production capabilities for chassis, suspension, and structural components. Their 12-hour quote turnaround demonstrates the responsiveness automotive supply chains require.

Materials in automotive forming span a wide range. As industry analysis shows, "Mild steel is widely used for its good formability and low cost, making it suitable for brackets and non-critical parts. Galvanized steel adds corrosion resistance, improving component life in harsh environments." Meanwhile, AHSS and aluminum alloys address lightweighting priorities for fuel efficiency and EV range.

Aerospace Sector Standards

Aerospace operates under entirely different pressures. Where automotive prioritizes volume and cost efficiency, aerospace demands absolute reliability and complete documentation—often at the expense of speed and economy.

Key aerospace requirements include:

- AS9100 Rev D certification – Mandatory for production suppliers; adds product safety, configuration management, and counterfeit parts prevention to ISO 9001 foundations

- First Article Inspection (FAI) per AS9102 – Comprehensive documentation proving the production process produces conforming parts

- Material traceability to heat lot – Every sheet traced back to specific mill production runs

- Special process certifications – Heat treating, plating, and other processes require individual Nadcap accreditations

- Configuration management – Tracking exact part configuration throughout its multi-decade lifecycle

Aerospace components often use aluminum alloys and titanium for weight reduction, along with specialty superalloys for high-temperature applications near engines. These materials present unique forming challenges—higher springback, work-hardening characteristics, and tighter process windows than standard steel applications.

Volume considerations differ dramatically too. Where automotive runs measure in hundreds of thousands, aerospace production quantities might be measured in dozens or hundreds. This shifts the economics toward processes with lower tooling investments and higher flexibility.

Medical and Electronics Sector Standards

Medical Device Requirements

When formed metal components end up inside diagnostic equipment, surgical instruments, or patient-contact devices, regulatory requirements intensify significantly. The stakes couldn't be higher—quality failures don't just mean unhappy customers; they potentially mean patient harm.

According to Tempco Manufacturing's certification overview, "ISO 13485:2016 certification represents the requirements for a comprehensive quality management system for the design and manufacturing of medical devices." This certification "empowers an organization to reliably provide effective and innocuous medical devices that fulfill customer and regulatory requirements."

Medical device forming requirements include:

- ISO 13485:2016 certification – Quality management system specifically designed for medical device manufacturing

- FDA registration – Required for suppliers whose components become part of FDA-regulated devices

- Complete material traceability – Documentation linking every part to specific material lots, production dates, and operators

- Validated cleaning and packaging – Contamination control throughout the process

- Change control procedures – Formal processes for any modification to materials, processes, or specifications

Material selection in medical applications often favors stainless steel grades like 304 and 316 for corrosion resistance and biocompatibility. Surface finish requirements tend to be stringent—both for cleanability and aesthetic standards in patient-facing equipment.

As Tempco notes, receiving and maintaining ISO 13485:2016 certification "requires a more in-depth and rigid" approach compared to general ISO 9001, with "advanced documentation to maintain the certification status." This translates to higher supplier costs—but those costs are essential for regulatory compliance.

Electronics Sector Requirements

Electronics applications bring their own specialized demands—primarily around dimensional precision and electromagnetic compatibility.

Key electronics forming requirements include:

- Tight dimensional tolerances – Enclosures and heat sinks must fit precisely within packed assemblies

- Surface finish specifications – Cosmetic standards for consumer-visible housings; functional requirements for thermal conductivity

- ESD (electrostatic discharge) controls – Preventing static damage during handling and assembly

- RoHS and REACH compliance – Environmental regulations restricting hazardous substances

- Rapid product development cycles – Consumer electronics life cycles measured in months, not years

Aluminum dominates electronics applications for its excellent thermal conductivity, light weight, and corrosion resistance. Thinner gauges are common, requiring precise control of forming parameters to avoid distortion or springback issues.

Construction and Architectural Applications

Metal roof sheet forming machine companies and metal roofing sheet roll forming machine companies serve a sector with dramatically different priorities than precision manufacturing. Construction applications emphasize:

- High-volume continuous production – Roll forming machines produce miles of roofing panels, siding, and structural members

- Weather resistance – Galvanized, galvalume, and prepainted coatings for decades of outdoor exposure

- Structural load requirements – Compliance with building codes and engineering specifications

- Aesthetic consistency – Color matching and surface quality across large installed areas

- Field installation considerations – Designs that facilitate quick assembly by construction crews

Standard certifications like ISO 9001 apply, but industry-specific standards focus more on product testing—wind uplift resistance, fire ratings, and structural load calculations—than on process documentation requirements seen in aerospace or medical sectors.

| Industry Sector | Required Certifications | Key Quality Expectations | Typical Materials | Volume Characteristics |

|---|---|---|---|---|

| Automotive | IATF 16949, ISO 9001 | PPAP documentation, SPC, tight tolerances, 100% traceability | AHSS, mild steel, galvanized steel, aluminum | High volume, continuous production |

| Aerospace | AS9100, Nadcap (special processes) | FAI per AS9102, configuration management, counterfeit prevention | Aluminum alloys, titanium, nickel superalloys | Low to medium volume, high documentation |

| Medical Devices | ISO 13485, FDA registration | Complete traceability, validated processes, change control | Stainless steel (304, 316), specialty alloys | Low to medium volume, strict controls |

| Electronics | ISO 9001, RoHS/REACH compliance | Dimensional precision, ESD controls, cosmetic standards | Aluminum, copper, stainless steel | Medium to high volume, rapid cycles |

| Construction | ISO 9001, product testing certifications | Structural compliance, weather resistance, aesthetic consistency | Galvanized steel, aluminum, prepainted coils | Very high volume, continuous runs |

The Full Service Spectrum

Regardless of industry, the most capable forming partners support your entire product lifecycle—from initial concept through sustained production. This matters because switching suppliers mid-project introduces risk, delays, and quality variability.

Look for partners who offer:

- Rapid prototyping – Quick-turn samples for design validation and testing

- DFM support – Engineering expertise to optimize designs before tooling investment

- Low-volume production – Bridge production during market testing phases

- High-volume capability – Automated production for full-scale launch

- Ongoing quality management – Continuous improvement and process stability for repeat orders

For automotive applications specifically, comprehensive DFM support combined with rapid prototyping capabilities—like the 5-day turnaround available from Shaoyi's automotive stamping division—accelerates development cycles while ensuring designs are optimized for manufacturing before expensive tooling commitments.

Industry-specific requirements shape every aspect of supplier selection—from certifications and quality systems to materials expertise and production capabilities. Understanding these distinctions positions you to evaluate potential partners accurately and build relationships that support your project's success.

With industry requirements clarified, you're ready to synthesize everything you've learned into a practical decision framework for selecting your forming partner.

Making Your Final Selection Decision

You've absorbed a lot of information—process fundamentals, material behaviors, certification requirements, DFM principles, cost drivers, and industry-specific demands. Now it's time to pull everything together into a decision framework that actually works when you're staring at three quotes on your desk.

Here's the truth: there's no universally "best" sheet metal forming company. There's only the best partner for your specific project, industry, and business requirements. The supplier who excels at high-volume automotive stampings may struggle with low-volume aerospace prototypes. The company perfect for construction roll forming has no business quoting your medical device enclosures.

Your job isn't finding the best—it's finding the right fit.

Key Takeaways for Supplier Selection

Before you make that final call, run through these critical factors one more time. Each represents a potential failure point if overlooked—and a competitive advantage when properly matched.

Process expertise must match your geometry. A supplier with world-class stamping capabilities won't help if your parts require hydroforming. Verify they've successfully produced parts similar to yours—not just that they own the right equipment.

Material capabilities extend beyond inventory. Forming aluminum requires different expertise than forming stainless steel. Ask about their experience with your specific alloy, especially if you're working with advanced high-strength steels or specialty materials.

Certifications aren't optional—they're mandatory. If your parts enter automotive supply chains, IATF 16949 certification is non-negotiable. Aerospace demands AS9100. Medical requires ISO 13485. Verify certificates are current, not expired.

DFM support saves money before production starts. Partners who offer design feedback during quoting identify cost drivers and quality risks early—when changes are cheap. Suppliers who simply quote what you send miss opportunities to optimize.

Production scalability prevents painful transitions. Starting with one supplier for prototypes and switching for production introduces risk. Find partners who support your entire lifecycle—from first article through high-volume runs.

The most critical consideration when selecting a forming partner isn't price—it's alignment between their capabilities and your specific requirements. A mismatched supplier at a lower cost always ends up more expensive than the right partner at fair market rates.

For buyers in the automotive sector specifically, these factors converge on suppliers who combine IATF 16949 certification with rapid prototyping capabilities and comprehensive DFM support. Shaoyi (Ningbo) Metal Technology exemplifies this combination—delivering 5-day rapid prototyping for chassis, suspension, and structural components while maintaining the quality systems automotive OEMs demand.

Your Next Steps

Knowledge without action is just information. Here's how to translate what you've learned into supplier selection progress this week:

1. Document your requirements completely. Before contacting any supplier, write down your part geometry, material specifications, tolerance requirements, projected volumes, and certification needs. Incomplete RFQs generate incomplete quotes.

2. Create your shortlist strategically. Focus on suppliers with proven experience in your industry. General fabricators rarely deliver the specialized expertise forming projects demand.

3. Evaluate quote responsiveness. How quickly suppliers respond—and how thoroughly they address your specifications—predicts their communication during production. Slow, vague quotes often signal slow, problematic projects.

4. Assess DFM feedback quality. Did they identify potential issues? Suggest cost-saving alternatives? Experienced partners add value during quoting, not just execution.

5. Start with a pilot project. Before committing to large volumes, test the relationship with a smaller order. Real-world performance reveals what proposals cannot.

If your project involves automotive applications—whether body panels, structural brackets, or suspension components—suppliers offering rapid quote turnaround demonstrate the responsiveness your supply chain requires. Shaoyi's 12-hour quote turnaround provides a practical starting point for evaluating whether their capabilities align with your project needs.

The nine insider secrets you've learned position you to evaluate forming partners with confidence. You understand what questions to ask, which certifications matter, how costs are structured, and what different industries demand. That knowledge transforms you from a buyer accepting whatever suppliers offer into a partner who drives value throughout the relationship.

Your next great product is waiting to be formed. Now you know how to find the right company to make it happen.

Frequently Asked Questions About Sheet Metal Forming Companies

1. What are the 5 sheet metal operations?

The five primary sheet metal operations are shearing (cutting straight lines), blanking (cutting flat shapes from sheets), punching (creating holes), bending (forming angles along straight lines), and drawing (creating hollow shapes from flat blanks). Advanced operations include embossing, trimming, and squeezing. Each operation serves different manufacturing needs, and professional forming companies often combine multiple operations in progressive dies to create complex parts efficiently.

2. How much does custom sheet metal fabrication cost?

Custom sheet metal fabrication costs vary significantly based on material type, part complexity, tolerances, and production volume. Key cost drivers include raw material expenses (carbon steel costs less than stainless or aluminum), tooling investments for stamping operations, and secondary operations like powder coating or welding. Prototype quantities carry higher per-unit costs due to setup expenses, while high-volume orders benefit from economies of scale. Working with suppliers who offer DFM support can reduce costs by up to 30% through early design optimization.

3. What certifications should sheet metal forming companies have?

Required certifications depend on your industry. ISO 9001:2015 serves as the baseline quality management standard for all sectors. Automotive supply chains require IATF 16949 certification, which validates statistical process control and PPAP documentation. Aerospace applications demand AS9100 Rev D certification covering product safety and configuration management. Medical device components need ISO 13485:2016, while defense projects require ITAR compliance. Always verify certificates are current before committing to a supplier.

4. What is the difference between sheet metal forming and fabrication?

Sheet metal forming reshapes flat metal sheets into three-dimensional parts through bending, stretching, or compressing without removing material. Think of it like origami with metal. Fabrication is broader, encompassing cutting, drilling, welding, and assembling multiple pieces. Formed parts maintain material continuity, often resulting in stronger components with fewer weak points. Forming specialists focus on processes like stamping, bending, deep drawing, roll forming, and hydroforming, while general fabricators handle diverse metalworking operations.

5. Should I choose domestic or overseas sheet metal forming suppliers?

The decision depends on your priorities. Domestic suppliers offer faster lead times, easier communication, stronger IP protection, and supply chain resilience without ocean freight delays. Overseas suppliers may provide lower unit costs and greater production capacity for high-volume orders. However, hidden costs like shipping fees, tariffs, quality inspection, and inventory carrying costs can erode overseas price advantages. Many companies use hybrid approaches—domestic partners for prototypes and urgent orders, overseas suppliers for high-volume commodity parts.

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —