Choosing Automotive Stamping Suppliers: The 2025 Audit Guide

TL;DR

Choosing automotive stamping suppliers is a high-stakes strategic decision where the lowest piece price often masks significant supply chain risks. To safeguard your production line, prioritize suppliers with valid IATF 16949 certification (not just ISO 9001), rigorous PPAP and APQP frameworks, and proven rejection rates below 100 PPM (0.01%).

Effective vetting requires auditing a supplier's technical capacity—specifically their press tonnage range (typically 100–600+ tons) and in-house tooling capabilities. Whether sourcing structural components or precision brackets, decision-makers must validate a partner's financial stability and ability to bridge the gap from prototype to mass production to avoid costly line-down situations.

Phase 1: The Non-Negotiable Quality Gatekeepers

In the automotive supply chain, quality management is the primary filter. A supplier lacking the correct certifications represents a liability, not a cost saving. The distinction between general manufacturing standards and automotive-specific requirements is the first item on your audit checklist.

IATF 16949 vs. ISO 9001: The Critical Distinction

While ISO 9001 establishes a baseline for general quality management, it is insufficient for the rigorous demands of automotive OEMs and Tier 1 suppliers. IATF 16949 is the industry standard, specifically designed to prevent defects, reduce variation, and minimize waste in the automotive supply chain. An IATF-certified supplier has systems in place to handle safety-critical components, whereas an ISO-only shop may lack the traceability and risk management protocols required for parts like brake components or chassis reinforcements.

When vetting suppliers, be wary of the term "compliant." A supplier claiming to be "IATF compliant" without holding the actual certification has not been subjected to the rigorous third-party audits that guarantee adherence to the standard. Always request a current copy of their certificate and verify its validity.

The Quality Trinity: PPAP, APQP, and FAI

Beyond the certificate on the wall, you must evaluate the supplier's operational quality frameworks. A robust automotive stamper lives by three acronyms:

- APQP (Advanced Product Quality Planning): This framework ensures quality is designed into the process before a single part is stamped. It involves risk assessment tools like FMEA (Failure Mode and Effects Analysis) to predict and prevent defects.

- PPAP (Production Part Approval Process): This is the evidence that the supplier can consistently produce parts to spec at the required production rate. Ask to see redacted PPAP packages from recent projects to evaluate their depth and attention to detail.

- FAI (First Article Inspection): This validates that the first production run meets all engineering requirements.

According to industry data, top-tier metal stampers achieve rejection rates as low as 0.01% (100 PPM), while average suppliers hover around 0.53% (5,300 PPM). This gap can mean the difference between a smooth assembly line and costly shutdowns.

Phase 2: Technical Capability & Equipment Audit

Once quality systems are verified, the focus shifts to hardware. Does the supplier have the physical machinery and engineering talent to execute your specific geometry and volume? This assessment should cover press tonnage, die types, and scalability.

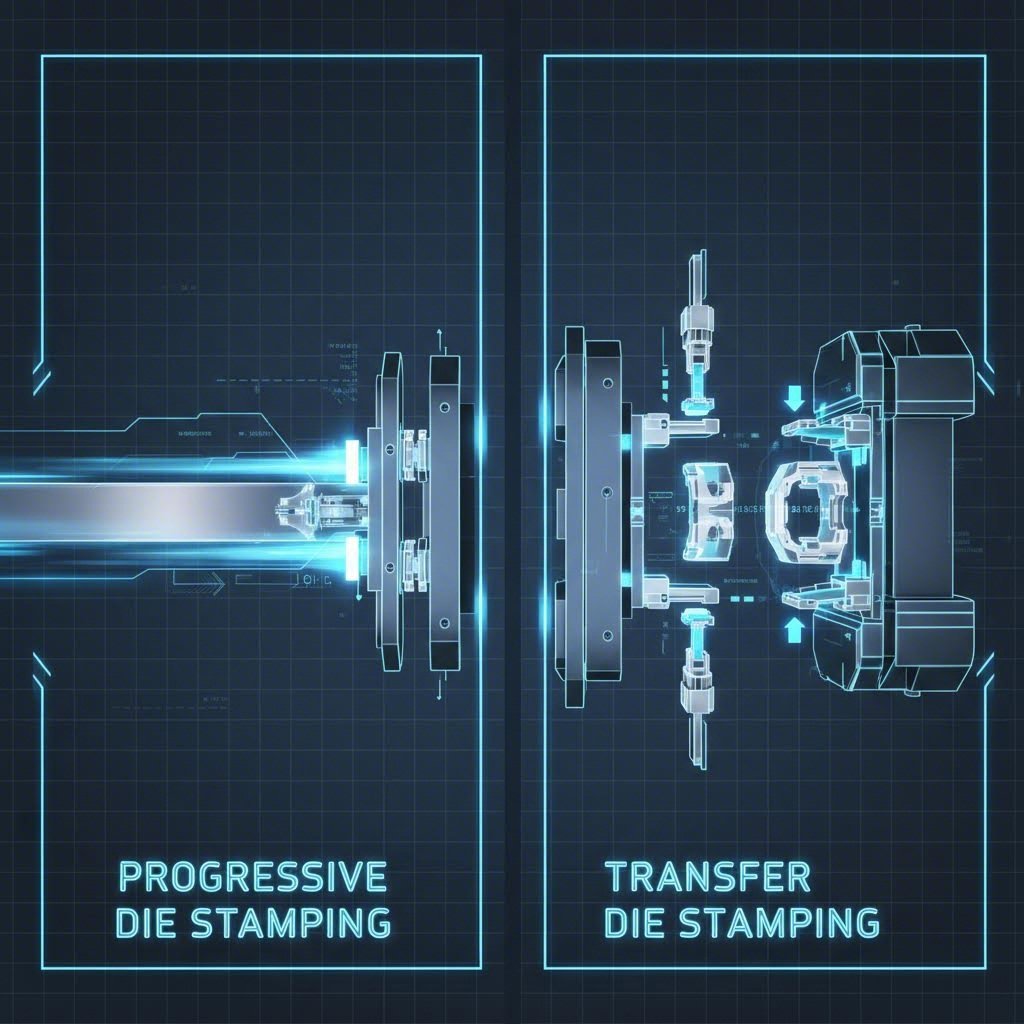

Press Tonnage and Die Complexity

Automotive trends toward lightweighting have increased the use of High-Strength Low-Alloy (HSLA) steels and aluminum, which require higher press tonnages and specialized tooling. Ensure your potential supplier has a range of press capacities—typically from 100 to 600+ tons—to handle both small precision brackets and larger structural components like control arms or subframes.

You must also map their die capabilities to your volume needs. Progressive Die Stamping is ideal for high-volume orders (250,000+ parts/year) requiring speed and material efficiency. In contrast, Transfer Die Stamping is better suited for larger parts with deep draws or complex geometries that move station-to-station.

Bridging the Gap: From Prototype to Mass Production

A common pain point in automotive procurement is the disconnect between prototyping shops and production houses. Many suppliers excel at one but fail to transition to the other. Ideally, you want a partner who can manage the entire lifecycle.

For instance, manufacturers like Shaoyi Metal Technology bridge this gap by offering comprehensive stamping solutions that scale from rapid prototyping (delivering 50 parts in as little as five days) to high-volume mass production. Their IATF 16949-certified facility utilizes presses up to 600 tons, enabling them to produce critical safety components like subframes and control arms with OEM-level precision.

In-House Tooling Maintenance

Critically, ask if the supplier maintains their dies in-house. In-house tooling capabilities significantly reduce downtime. If a die breaks during a production run, sending it out for repair can take days or weeks. A supplier with an internal tool and die shop can often fix the issue in hours, keeping your JIT schedule intact.

Phase 3: Financial Health & Supply Chain Resilience

In the era of Just-in-Time (JIT) manufacturing, a supplier's financial stability is a supply chain risk factor. A stamper in poor financial health may struggle to purchase raw materials during market volatility, leading to line-down situations at your facility.

Financial Auditing and Material Buying Power

During your audit, assess the supplier's reinvestment habits. Are they upgrading their equipment, or are they running on depreciated assets? A supplier that reinvests in servo presses, automated inspection cameras, and robotic transfer systems is signaling long-term viability.

Furthermore, ask about their relationships with raw material mills. Suppliers with strong financial backing and long-term relationships often have better "buying power," ensuring they can secure steel or aluminum even during global shortages. This is critical when balancing cost and availability for precision materials.

Workforce Stability

The technical knowledge required to maintain complex progressive dies resides in the workforce. High turnover rates can indicate a loss of tribal knowledge, which often correlates with quality dips. Ask specifically about the average tenure of their tool and die makers and project managers. A stable workforce is often a proxy for consistent quality.

Phase 4: The Site Visit Checklist (10 Critical Questions)

To move from a passive review to an active audit, use these ten questions during your site visit or RFI (Request for Information) process. Listen not just for the answer, but for the data that backs it up.

- "Do you design and build your dies in-house or outsource them?" (In-house tooling often means faster repairs and engineering changes.)

- "What is your current capacity utilization vs. surge capacity?" (You need a buffer for demand spikes.)

- "Can you show me a recent PPAP package you completed?" (Verify the depth of their documentation.)

- "What is your internal and external rejection rate (PPM) for the last 12 months?" (Look for trends, not just a snapshot.)

- "How do you handle raw material price volatility?" (Do they have hedging strategies or pass-through agreements?)

- "What is your disaster recovery plan for tool damage?" (Do they have sensor protection to prevent die crashes?)

- "Do you have specific experience with High-Strength Steel or Aluminum?" (These require different lubrication and tonnage strategies.)

- "How often do you calibrate your inspection equipment?" (Compliance requires rigorous calibration schedules.)

- "What is your on-time delivery rate?" (Anything below 98% is a red flag for JIT lines.)

- "Are you willing to invest in dedicated capital equipment for this program?" (Tests their commitment to a long-term partnership.)

Conclusion: The Risk Management Mindset

Choosing an automotive stamping supplier is an exercise in risk management as much as it is in procurement. The lowest piece price often carries the highest hidden costs in the form of defects, late deliveries, and management overhead.

By prioritizing IATF 16949 certification, auditing for technical redundancy, and verifying financial health, you build a supply chain that is resilient rather than just low-cost. The right partner acts as an extension of your own engineering team, proactively solving design challenges before they become production nightmares.

Frequently Asked Questions

1. What is the difference between ISO 9001 and IATF 16949 for stamping?

ISO 9001 is a general quality management standard applicable to any industry. IATF 16949 is a supplement specifically for the automotive industry, adding stringent requirements for defect prevention, supply chain variation reduction, and customer-specific requirements. For automotive stamping, IATF 16949 is typically mandatory.

2. Why is PPAP required for automotive stamping suppliers?

The Production Part Approval Process (PPAP) validates that the supplier's manufacturing process has the potential to produce the product consistently to meet all requirements during an actual production run at the quoted production rate. It minimizes the risk of failure before volume production begins.

3. How do I determine the right press tonnage for my parts?

Press tonnage is determined by the perimeter of the part, the thickness of the material, and the shear strength of the metal. High-strength steels and thicker gauges require significantly higher tonnage. A capable supplier will calculate the required tonnage plus a safety margin to ensure die life and part quality.

4. What are the risks of sourcing automotive stampings offshore?

While offshore sourcing can offer lower unit costs, risks include longer lead times, higher inventory carrying costs, communication barriers, potential intellectual property concerns, and supply chain disruptions due to logistics or geopolitical issues. Total Landed Cost analysis is essential.

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —