Mastering Tooling Amortization for Forged Components

TL;DR

Managing tooling amortization for forged components is a financial strategy that spreads the high upfront cost of dies and tools over their useful life or the number of parts produced. This accounting method makes initial project expenses more manageable, allows for more accurate and competitive part pricing, and provides a clearer picture of your return on investment. By amortizing these costs, companies can improve cash flow while retaining full ownership of their valuable tooling assets.

What Is Tooling Amortization and Why Is It Critical for Forging?

In manufacturing, particularly in processes like forging, tooling represents a significant initial investment. Tooling amortization is an accounting method used to systematically spread this large, one-time expense over a defined period or production volume. Instead of absorbing the entire cost at once, which can strain a project's budget, the cost is allocated incrementally. According to manufacturing experts at MachineMetrics, tooling cost can be defined as the depreciated price of the tool over its life, divided by the number of parts it produces. This transforms a major capital expenditure into a predictable, manageable operational cost.

The forging process relies on highly durable, precision-engineered dies to shape metal under immense pressure and heat. Creating these dies is a complex and expensive undertaking, often costing thousands of dollars depending on the part's complexity and the material being forged. For any business, especially those working on custom projects, this initial outlay can be a major barrier to entry. It can make quoting new projects difficult and puts immense pressure on the project's immediate profitability, tying up capital that could be used for raw materials, labor, or other operational needs.

This is precisely why amortization is so critical. It provides a structured way to account for the tooling investment without disrupting cash flow. By incorporating a fraction of the tooling cost into the price of each forged component, manufacturers can recover the investment over the entire production run. This approach not only makes projects more financially viable but also ensures that pricing is accurate and reflective of the true total cost of manufacturing. It’s a strategic financial tool that aligns the cost of the asset with the revenue it helps generate over time.

The Strategic Benefits of Amortizing Tooling Costs

Adopting a tooling amortization strategy offers several powerful advantages that enhance financial stability and operational flexibility. These benefits go beyond simple accounting, impacting everything from project ROI to long-term business partnerships. As outlined by industry specialists at Hynes Industries, this approach provides a distinct competitive edge.

1. Improved Cash Flow and Production Flexibility

The most immediate benefit of amortization is the relief it provides from a massive upfront expense. By spreading the tooling cost over months, quarters, or the production volume, you free up essential capital. This improved cash flow allows you to allocate funds to other critical areas like raw materials, prototyping, and labor, getting production started sooner. This financial flexibility, as noted by Roller Die + Forming, means you can manage your budget more effectively without letting a single large cost dictate your operational timeline.

2. Full Tooling Ownership and Long-Term ROI

Unlike leasing or “free” tooling arrangements that may contain hidden fees or leave ownership with the supplier, amortization ensures you maintain full ownership of the tooling once the cost is paid off. This is a crucial long-term advantage. The dies are your assets and can be used for future production runs or similar projects without incurring the same initial cost. This significantly improves the long-term return on investment, turning a one-time project expense into a reusable capital asset.

3. More Accurate Part Costing and Competitive Quoting

Amortization leads to a more precise understanding of the cost per part. By baking a small, calculated portion of the tooling expense into each unit, you get a true total cost of production. This accuracy is vital for setting competitive yet profitable prices. It prevents underbidding (which hurts margins) and overbidding (which loses business). Knowing the real cost-per-part empowers you to make smarter financial decisions and provides transparency for both you and your client.

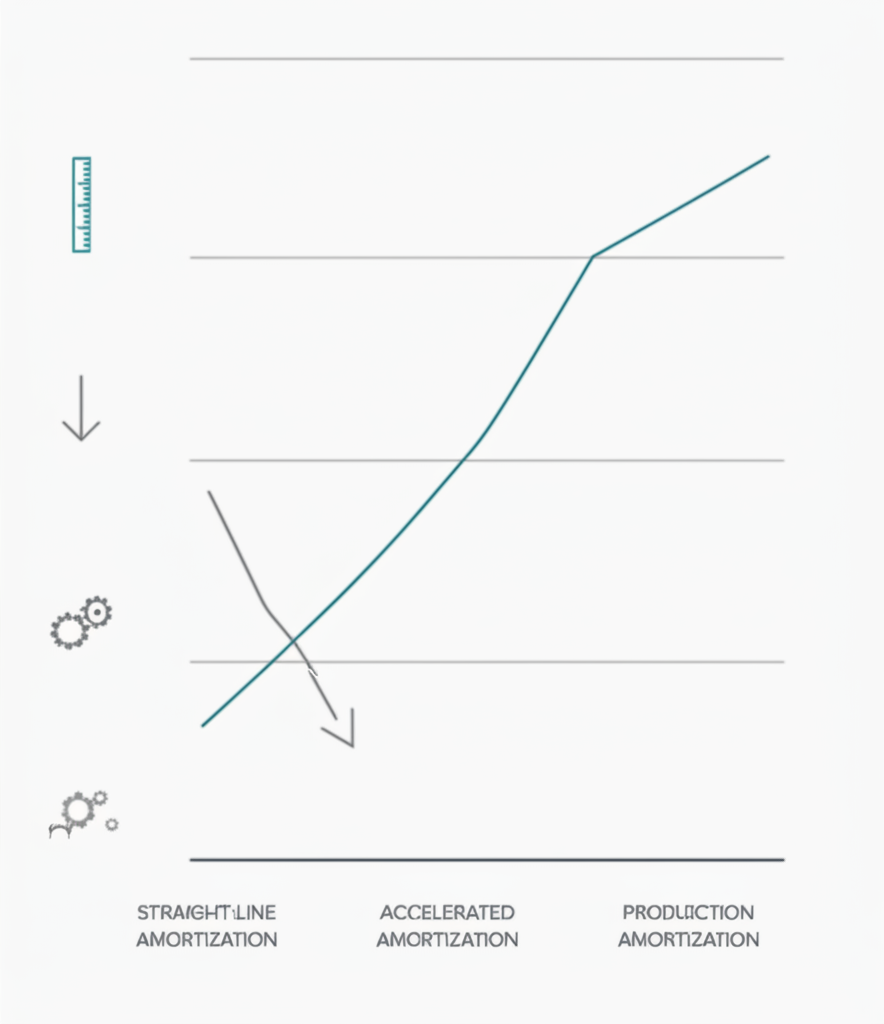

Common Methods for Calculating Tooling Amortization

Once you've decided to amortize tooling costs, the next step is to choose a calculation method that aligns with your project's specifics. The three primary methods—similar to those used for depreciating tangible assets—are the units-of-production, straight-line, and accelerated methods. Each offers a different way to allocate costs based on usage, time, or a combination of factors.

Units-of-Production Method

This is one of the most common and logical methods for manufacturing. The cost of the tooling is allocated based on the number of parts it produces. It directly ties the expense to the tool's actual usage, making it highly accurate for costing individual parts. The formula is straightforward, as detailed in cost estimation guides from specialists like Boberry.

- Formula: (Total Tooling Cost / Expected Total Number of Units) = Tooling Cost Per Unit

- Example: A forging die costs $30,000 and is expected to produce 150,000 components over its lifespan. The amortized tooling cost added to each component would be $30,000 / 150,000 = $0.20 per part.

- Best for: High-volume production runs where tool wear is directly correlated with output.

Straight-Line Method

The straight-line method spreads the tooling cost evenly over its estimated useful life in terms of time (e.g., months or years), not output. It’s simpler to calculate but less precise in linking cost to production volume. This method is useful when tool obsolescence is more a function of time than wear and tear.

- Formula: (Total Tooling Cost / Number of Months in Useful Life) = Monthly Amortization Cost

- Example: A $30,000 die has an estimated useful life of 3 years (36 months). The monthly amortization expense would be $30,000 / 36 = $833.33 per month. This cost would then be factored into the overhead for that period.

- Best for: Projects with a consistent, predictable production schedule over a long period or when tooling is for a product with a defined market life.

Accelerated Method

Accelerated methods, such as the sum-of-the-years'-digits, allocate a larger portion of the cost to the earlier years of the tool's life. The logic is that an asset is more productive and valuable when it is new. This method is more complex but can be beneficial for tax purposes and for projects where the bulk of production occurs early on.

- Concept: The amortization expense is higher in the first year and decreases in subsequent years.

- Best for: Situations where a tool's efficiency is expected to decline significantly over time or for businesses looking to recognize expenses earlier. This is a more advanced accounting technique that often requires consultation with a financial professional.

Key Factors in Managing Amortization for Forged Components

Effectively managing tooling amortization requires more than just choosing a calculation method. Several strategic factors must be considered to ensure your financial model is accurate, sustainable, and aligned with the physical realities of the forging process. Overlooking these variables can lead to inaccurate costing and unexpected expenses down the line.

A primary consideration is accurately estimating tool lifespan. This isn't just about the total number of parts a die can produce before it fails; it also involves understanding the material being forged. Harder materials like titanium or high-strength steel alloys will cause dies to wear out faster than softer materials like aluminum. The complexity of the part also plays a role, as intricate designs can create more stress on specific areas of the tool. Leveraging historical data from similar projects is essential for creating a realistic estimate of the tool's productive life.

Furthermore, your amortization plan must account for maintenance and repair costs. Forging dies require regular maintenance, and occasional repairs are inevitable. These costs are part of the total cost of ownership and should be factored into your calculations. Some companies treat routine maintenance as a separate overhead expense, while others build an allowance for it into the initial amortization model. Ignoring these costs will result in an underestimation of the true cost per part.

Finally, the success of your strategy depends on a clear understanding of production realities and strong partnerships. For companies navigating the complexities of custom projects, collaborating with a seasoned manufacturing partner is invaluable. For instance, specialists in high-quality forged components, like the team at Shaoyi Metal Technology, can provide critical insights into die manufacturing and lifespan for automotive applications. Their experience, from rapid prototyping to mass production, helps ensure that amortization schedules are based on realistic production data, leading to more precise and reliable financial planning.

Frequently Asked Questions

1. How do you amortize a tooling cost?

You amortize a tooling cost by first determining the total cost of the tool and its expected useful life (either in years or in the number of parts it can produce). Then, you choose an amortization method. The most common method in manufacturing is the units-of-production method, where you divide the total tooling cost by the expected number of parts to get a cost per piece, which is then added to the sale price of each part.

2. How much does tooling cost for forging?

The cost of tooling for forging varies dramatically based on several factors. For a small, simple component, a die might cost a few thousand dollars. However, for large, complex parts with tight tolerances, or those made from materials that are difficult to forge, the tooling cost can be tens of thousands of dollars or more. The cost is driven by the die material, the complexity of its design, and the precision required in its manufacturing.

3. What are the three methods of amortization?

The three primary methods of amortization are the straight-line method (spreading the cost evenly over time), the units-of-production method (allocating cost based on usage or output), and the accelerated method (recognizing a larger portion of the cost in the early years of the asset's life). The units-of-production method is often preferred for manufacturing tooling as it directly links the cost to its revenue-generating activity.

4. How do you calculate tooling cost?

To calculate the tooling cost per piece for amortization, you first need the total upfront cost to design and manufacture the tool. Next, you must estimate the total number of parts the tool can produce before it needs to be replaced (its tool life). The basic calculation is: Total Tooling Cost ÷ Estimated Tool Life (in units) = Tooling Cost Per Piece. This per-piece cost is then added to material, labor, and overhead costs to determine the final part price.

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —