Automotive Stamping Suppliers Compared: Shortlist In Hours

Start Strong With a Buyer Focused Overview

When you need to source automotive stamping suppliers, time is money—and so is getting it right. The global automotive metal stamping market is evolving fast, with North America, Europe, and Asia-Pacific leading the way in advanced manufacturing, strict quality standards, and a growing emphasis on lightweight, high-performance automotive components (Mordor Intelligence). But with hundreds of stamping companies near me and worldwide, how do you quickly build a shortlist that fits your project’s needs for 2025?

Why Choosing The Right Stamper Matters

Imagine launching a new vehicle platform or scaling up EV production. The right automotive stamping partner can help you hit cost, quality, and delivery targets—while the wrong pick can lead to missed deadlines, quality escapes, or costly rework. Automotive metal stamping is at the heart of body panels, battery trays, crash structures, and intricate interior brackets. Selecting a supplier with the right certifications, process controls, and capacity is crucial for both established OEMs and fast-scaling Tier 2s.

Who This List Serves

- OEM and Tier 1 Sourcing Teams: Seeking proven partners for high-volume, safety-critical automotive stamping parts.

- Engineering and Program Managers: Looking for suppliers with advanced tooling, DFM support, and PPAP maturity.

- Startups and Mobility Innovators: Needing agile, cost-effective metal stamping near me for low-to-mid volume or prototype runs.

- Aftermarket and Service Buyers: Prioritizing responsive, flexible capacity and quick-turn support.

How To Use This Guide

- Tooling Lead-Times: Expect 2–4 weeks for prototypes, 8–16 weeks for hard tooling.

- Quality Benchmarks: Leading suppliers target PPM (parts per million) below 500 for production runs.

- Cost Drivers: Tooling strategy, material selection, and order volume can swing per-part pricing significantly.

- Certifications: Shortlist focuses on IATF 16949, ISO 9001, and demonstrated PPAP capability.

- Traceability and Launch Track Record: Emphasis on suppliers with proven automotive program launches and robust traceability.

- What’s New in 2025: Expect more EV battery-tray stampings, increased aluminum content, and tighter traceability audits.

Tooling strategy can swing per-part cost by 15–25% over a 3-year program.

Each supplier review in this guide features clear pros and cons, ideal use cases, certifications, capacity notes, and a quick-read summary. You’ll also get practical tools later—like an RFQ checklist, a decision matrix mapping part features to stamping processes, and a comparison table of tolerances, materials, die strategies, minimum orders, press tonnage, and indicative lead times. Whether you’re searching for stamping companies near me or evaluating global leaders, this guide helps you rank options, reduce sourcing cycles, and lower risk.

Methodology and Scoring Buyers Can Trust

Sounds complex? When you’re faced with dozens of options for automotive stamping suppliers, having a clear, repeatable evaluation process isn’t just helpful—it’s essential. Whether you’re building a tier one automotive suppliers list or sourcing metal stampings for automotive components, understanding how each supplier is scored will help you make confident, risk-aware decisions. Let’s break down the criteria, data sources, and tools that drive an apples-to-apples comparison.

Scoring Criteria And Weights

You’ll notice that not all factors are created equal. Here’s how we weigh the most critical attributes for automotive stamping parts sourcing:

| Criteria | Weight (%) |

|---|---|

| Certifications & PPAP Readiness | 20 |

| Process Capability (Cp/Cpk) | 15 |

| Tooling Strategy & Die Life | 15 |

| Materials Expertise (Aluminum, AHSS) | 10 |

| Capacity & Press Range | 10 |

| Quality Performance (PPM, FAI/Inspection) | 10 |

| Engineering Collaboration & DFM | 10 |

| Commercials (TCO, Logistics) | 10 |

Certifications and PPAP (Production Part Approval Process) maturity are weighted most heavily, since they demonstrate a supplier’s ability to consistently meet strict automotive quality standards (Quality-One PPAP Overview). Process capability (measured by Cp/Cpk) and robust tooling strategies ensure repeatable quality and long die life—vital for high-volume metal stamping automotive programs.

Data Sources And Verification

Imagine you’re comparing a die metal stamping manufacturer in your region with several metal stamping companies in ohio. How do you verify claims? Here’s a practical checklist:

- Request IATF 16949 and ISO 9001 certificates for up-to-date quality system validation.

- Review sample PPAP packages—look for completeness and clarity in documentation.

- Audit FAI (First Article Inspection) records to confirm process stability and traceability.

- Check traceability procedures for material and process flow, especially for safety-critical automotive stamping parts.

These steps help you confirm that a supplier’s paperwork matches their shop floor reality, whether you’re working with a local die metal stamping manufacturer or larger metal stamping companies in ohio.

How We Compare Costs And Lead Times

Cost isn’t just about the part price—it’s about the total cost of ownership (TCO), which includes tooling, materials, logistics, and risk. Here’s what you’ll want to collect in any RFQ (Request for Quote):

| RFQ Field | Description |

|---|---|

| Annual Volumes | Expected yearly production |

| Ramp Profile | How quickly volumes increase |

| Material Spec & Gauge | Type and thickness of metal |

| Tolerance Stack | Critical dimensions and allowed variation |

| Cosmetic Class | Surface finish requirements |

| EAU | Estimated Annual Usage |

| Tooling Ownership | Who owns and maintains the die |

When comparing suppliers, ask for amortization scenarios—how tooling costs are spread over volume—and assess risks such as long-lead tool steels or coil availability. For metal stamping automotive projects, these factors can make or break your timeline and budget.

Process Decision Matrix

Not sure which stamping method fits your automotive stamping parts? Use this process matrix:

| Part Feature | Best Method | Why |

|---|---|---|

| Medium-to-high volume, tight repeatability | Progressive Die | Efficient, consistent, lower per-part cost |

| Large panels or multi-form features | Transfer Die | Handles size/complexity, flexible staging |

| High draw ratio (deep cups, shells) | Deep Drawing | Prevents tearing, supports depth |

| Clean, burr-free edges | Fine Blanking | Superior edge quality, critical for assemblies |

Benchmark lead times for automotive stamping parts: prototypes in 2–4 weeks, soft tooling in 4–8 weeks, hard tooling in 8–16 weeks. Production press speeds typically range from 30–120 strokes per minute, depending on geometry and material.

By using these scoring methods and templates, you can confidently compare stamping companies—whether you’re building a tier one automotive suppliers list or choosing between local and national options. Next, we’ll dive into real supplier profiles so you can see how these criteria play out in practice.

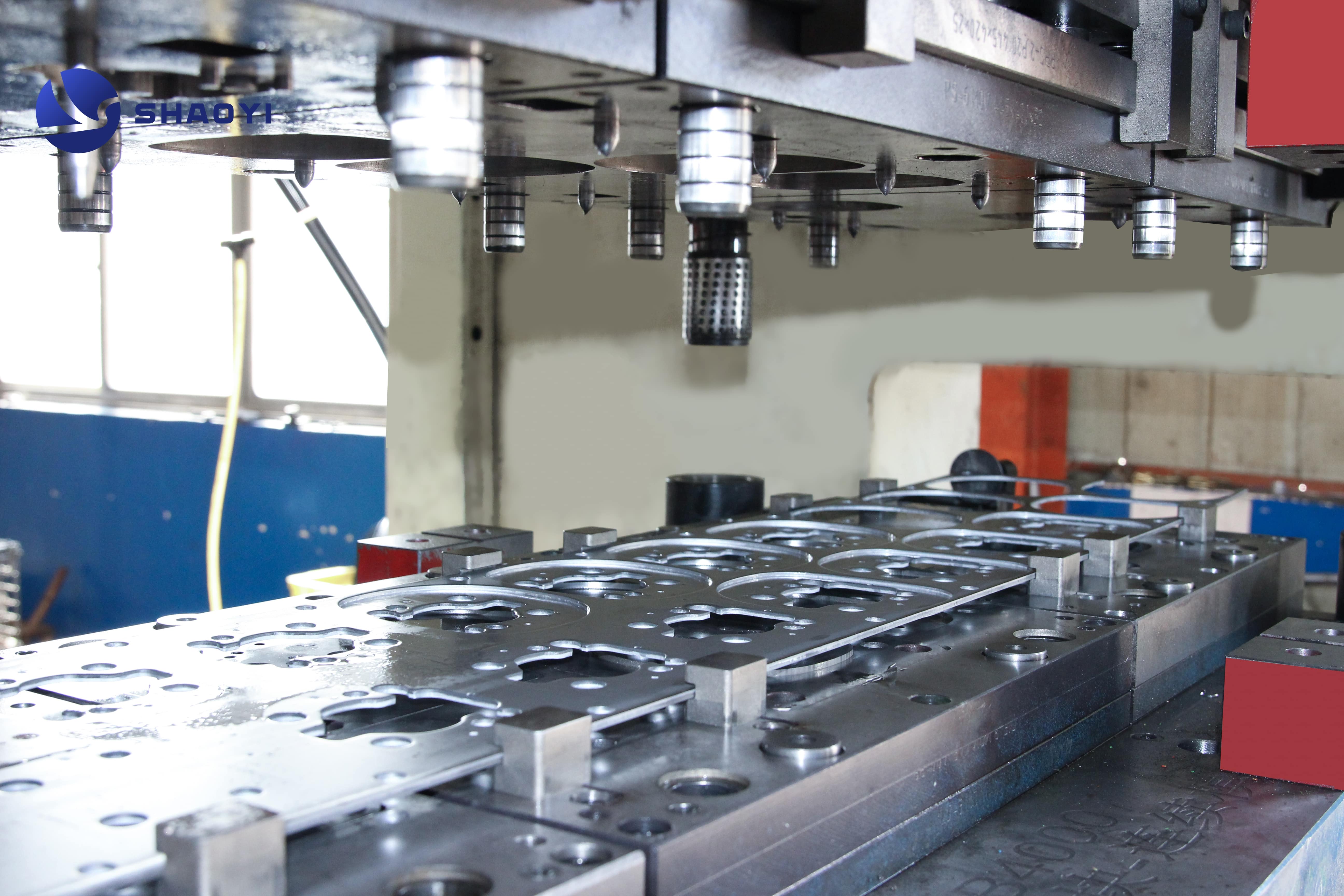

Shaoyi Metal Parts Supplier

Standout Capabilities

When you’re searching for automotive stamping suppliers that blend speed, scale, and precision, Shaoyi Metal Parts Supplier stands out as a true industry leader. Imagine launching a new EV platform or scaling up production for safety-critical brackets—Shaoyi’s integrated design-to-mass-production workflow ensures you get reliable, high-quality parts from concept through delivery. Their expertise covers auto metal stamping, complex progressive dies, and the latest aluminum and AHSS applications, all supported by advanced CAE analysis and rapid tooling iterations. This means fewer surprises, tighter tolerances, and faster launches for your programs.

Pros

- Seamless transition from design to mass production, reducing project hand-offs and risk

- Proven IATF 16949 and ISO 9001 quality systems for global automotive compliance

- Mastery of custom automotive metal stamping, including aluminum and advanced high-strength steel (AHSS)

- In-house CAE, molding, and 24-hour quick-quote support for agile development

- Robust CMM and optical inspection systems for consistent, traceable quality

- Experience with a wide range of automotive metal stampings—from brackets to battery enclosures

- Trusted by over 30 global OEMs and Tier 1s for both prototyping and high-volume programs

- Flexible, customer-driven approach—no minimum order quantity required

- Comprehensive custom precision metal stamping services under one roof

Cons

- Time-zone differences may require extra coordination for urgent DFM reviews

- Upfront alignment needed for complex carrier strip designs

- Shipping lead times can be longer for expedited, low-volume orders compared to local stamping parts manufacturers

Ideal Use Cases

- EV brackets and battery tray components

- Heat shields and thermal management parts

- Sensor mounts and terminal tabs

- Seat structures and safety reinforcements

- Battery enclosure assemblies requiring tight tolerance and traceability

Certifications And Quality Evidence

- IATF 16949:2016 and ISO 9001 certified—meeting stringent automotive industry standards

- Full PPAP (Production Part Approval Process) documentation and traceability

- In-house testing: UT, RT, MT, PT, ET, and pull-off force testing for weld quality

- Consistent delivery of high-precision, complex assemblies for global automotive brands

Case Study Snapshot

Imagine a scenario where a global EV startup needed to cut costs and reduce scrap rates on a complex battery bracket. By partnering with Shaoyi for die redesign and leveraging their integrated CAE and rapid prototyping, the client achieved an 18% piece-price reduction and a 30% decrease in scrap rates—delivering both immediate savings and long-term quality improvements.

| Specification | Typical Value |

|---|---|

| Dimensional Tolerance | ±0.05 mm |

| Max Strip Width | Up to 600 mm |

| Press Tonnage Range | 80–800 tons |

| Lead Time (Prototype) | 2–4 weeks |

| Lead Time (Production Tool) | 8–16 weeks |

What sets Shaoyi apart from other stamping parts manufacturers is their ability to deliver metal stamping solutions that are both technically advanced and commercially practical. Their custom precision metal stamping services support everything from rapid prototyping to full-scale production, making them a preferred partner for automotive innovators worldwide.

As you evaluate your shortlist of automotive stamping suppliers, consider how Shaoyi’s blend of technology, quality, and responsiveness can help you meet demanding program launches—especially when custom automotive metal stamping and rapid turnaround are mission critical. Next, we’ll look at large-scale structural specialists for programs that prioritize heavy-gauge and body-in-white assemblies.

Gestamp North America

When you think of large-scale, complex automotive assemblies—think Gestamp North America. Imagine launching a new body-in-white (BIW) platform or sourcing high-strength battery trays for EVs: you need a partner with global stamping muscle, proven process control, and deep relationships with the biggest auto suppliers and OEMs. Gestamp’s North American operations are built for these challenges, combining advanced technology with a footprint designed to support both domestic and international vehicle programs.

Capabilities And Footprint

Gestamp operates over 100 stamping plants worldwide, with a significant presence in the U.S. and Mexico. In Michigan alone, Gestamp North America plants employ nearly 900 people and maintain multiple stamping plant locations to serve regional OEMs. Their U.S. facilities—spread across Michigan, Tennessee, Alabama, West Virginia, and South Carolina—are strategically positioned near major automotive assembly hubs, including the GM stamping plant network and the facilities of Volkswagen, Mercedes-Benz, Honda, and BMW. This proximity reduces logistics costs and ensures fast response to OEM build schedules.

| Capability | Details |

|---|---|

| Press Tonnage Range | Up to 2,500 tons (multi-station transfer lines) |

| Materials | Hot-stamped ultra-high-strength steel, aluminum, conventional steel |

| Process Types | Transfer, progressive, and hot stamping |

| R&D Support | On-site labs for durability, metrology, and prototype assembly |

Pros

- Massive scale—ideal for high-volume, safety-critical body structures

- Advanced hot stamping for lightweight, ultra-strong BIW components

- Integrated joining: robotic welding, laser welding, and assembly

- Global launch experience with the world’s biggest auto suppliers and OEMs

- Strategic plant locations near major North American OEMs

- Continuous investment in R&D and process innovation

Cons

- Minimum order quantities (MOQs) may be higher than regional stampers

- Scheduling priority often given to large OEM builds

- Change-control processes can be more rigid due to global quality standards

Best Fit Programs

- Body-in-white rails and crash structures

- Cross members and chassis reinforcements

- Battery trays for electric vehicle platforms

- Large-format, multi-stage assemblies requiring precise joining

For buyers evaluating Gestamp or similar global stamping specialists, it’s smart to:

- Request plant-level OEE (Overall Equipment Effectiveness) and PPM (Parts Per Million defect rate) metrics

- Review weld integrity reports and joining process validation

- Ask for draw simulation files as part of APQP (Advanced Product Quality Planning) documentation to ensure manufacturability and robust launch

Gestamp’s ability to deliver on complex, large-scale BIW programs is underpinned by their investment in technology and close ties to OEMs—think of them as the go-to stamping plant for demanding structural automotive components. If your next project requires high-tonnage, multi-material, or hot-stamped solutions, Gestamp North America’s track record and global reach make them a top-tier choice. Next, we’ll explore North American suppliers with deep expertise in heavy stampings and chassis assemblies for truck and SUV platforms.

Martinrea Heavy Stamping

Core Strengths

When your project demands robust, high-strength automotive components—think large chassis structures or crash-relevant parts—Martinrea Heavy Stamping stands out among North American steel stamping companies. With flagship operations such as Martinrea Heavy Stamping KY in Hopkinsville and Martinrea Stamping Shelbyville KY, their footprint is engineered for scale, flexibility, and advanced material processing. Imagine launching a new truck or SUV platform: you need a supplier with deep press capacity, proven APQP (Advanced Product Quality Planning) processes, and the ability to handle the thickest, toughest materials. Martinrea’s investments in heavy stamping presses (up to 3,307 US tons), hybrid transfer/progressive lines, and automation deliver the throughput and consistency that automotive OEMs require.

Pros

- Heavy-tonnage presses (up to 3,307 US tons) for large, complex stampings

- Hybrid lines capable of both transfer and progressive die operations

- Deep relationships with major North American OEMs—GM, Ford, Nissan, Stellantis, BMW

- Robust APQP and launch management for safety-critical and high-volume programs

- Capability to stamp both steel and aluminum, supporting industry lightweighting trends

- Integrated robotic assembly, welding, and e-coating for full-system delivery

- Strong focus on employee training, safety, and process improvement

Cons

- Potential premium pricing for low-volume or prototype orders due to large press setup costs

- Longer NPI (New Product Introduction) windows for highly complex or deep-draw tools

- Presses and lines often booked to capacity, requiring early scheduling for major launches

- Less flexibility for very small or intricate parts compared to precision-focused stampers

Programs That Benefit

- Truck and SUV platforms requiring heavy-gauge chassis stampings

- Crash structures, floor sills, cross members, and engine cradles

- Battery trays and structural EV components where high-strength steel or aluminum is needed

- Safety-critical parts that demand rigorous capability studies and robust die maintenance

Use Cases & Sourcing Guide

Consistent press curves and meticulous die maintenance are vital for crash-relevant and structural components. Martinrea’s heavy stamping lines have been proven on parts like 8-foot floor sills, rocker assemblies, and engine cradles—often produced from advanced high-strength steel for maximum impact resistance. If you’re shortlisting metal stamping companies in michigan or the Midwest for truck chassis or EV battery tray programs, Martinrea’s operational scale and technology make them a top-tier choice.

| Feature | Transfer Die | Progressive Die |

|---|---|---|

| Best For | Large, multi-stage parts (floor pans, cross members) | Medium-to-high volume, moderate complexity |

| Gauge Range | 0.010–0.158 in. (¼–4 mm) | 0.010–0.079 in. (¼–2 mm) |

| Typical Tolerance | ±0.20 mm | ±0.10 mm |

Heavy stamping brings higher upfront costs but pays off in durability and process stability for mission-critical automotive assemblies. For buyers, it’s wise to review tool maintenance records, die-change procedures, and to plan NPI timelines accordingly—especially with suppliers like Martinrea, where press capacity is in high demand.

As you continue your search for the best automotive stamping suppliers, consider how Martinrea’s deep supply chain relationships and heavy-gauge expertise complement the offerings of other metal stamping companies in michigan. Next, we’ll look at agile Midwestern partners that excel in flexible, service-oriented stamping for lower-volume and aftermarket needs.

Goshen Stamping Company

When you need a partner who responds fast to changing schedules and smaller batch requirements, Goshen Stamping Company stands out among stamping companies in ohio. Imagine you’re launching a service part program, or you need aftermarket brackets and clips on short notice—Goshen’s agile approach and broad in-house capabilities make them a go-to for Tier 2s and OEMs alike. But what exactly makes Goshen Stamping Co Inc and similar agile suppliers so valuable for automotive stamping needs?

Capabilities Snapshot

Goshen Stamping LLC operates from an 82,000 sq. ft. facility packed with 38 presses, ranging from 30-ton OBIs to a 400-ton SSDC, supporting a wide range of part sizes and volumes. Their equipment lineup enables them to stamp carbon-based steels, stainless, aluminum, and brass—handling everything from blanking and piercing to forming and assembly. Need a quick prototype or a mid-volume run? Their dedicated tool room, complete with wire EDM, surface grinders, and machining centers, means fast tool maintenance and die changeovers are built into their process. For finishing, Goshen maintains strong partnerships for plating, painting, and powder coating, enabling end-to-end solutions without long lead times.

| Key Metric | Typical Value |

|---|---|

| Press Range | 30–400 tons |

| Materials Handled | Steel (HRPO, CR, galvanized), stainless, aluminum, brass, copper |

| Typical Changeover Time | Rapid, supported by in-house tool room |

| Prototype Turnaround | As fast as 2–4 weeks |

Pros

- Fast quote response and short lead times for prototypes and service parts

- Flexible scheduling—ideal for low-to-mid volume and aftermarket programs

- Collaborative DFM support for new product launches and engineering changes

- Comprehensive material handling and local delivery capabilities

- Access to a full suite of secondary operations through trusted partners

Cons

- Limited mega-tonnage capacity—may not suit large body-in-white or deep-draw panels

- Specialty coatings and some finishing steps may require outsourcing

- Not optimized for ultra-high volume, global OEM programs

Ideal Use Cases

- Brackets, clips, and shields for Tier 2 and aftermarket needs

- Low-to-mid volume service parts with frequent engineering changes

- Prototype runs and quick-turn orders for launch support

- Assemblies requiring riveting, resistance weld, or MIG weld operations

For buyers comparing stamping companies in ohio or seeking alternatives to larger national firms, Goshen Stamping Company’s value lies in its ability to adapt quickly and maintain quality across diverse order sizes. If you’re also evaluating suppliers like ma metal edinburgh indiana, consider reviewing tool maintenance logs and die change procedures—these are critical for ensuring repeatability and minimizing downtime over the long life of service part programs. And if you’re searching for metal stampers near me with a track record of responsive support, Goshen’s local delivery and robust material handling make it a standout choice for the Midwest region.

Next, discover how precision-focused suppliers can deliver for your most intricate, tight-tolerance automotive components.

Logan Stampings Inc

When you need ultra-precise, small parts that must meet exacting tolerances and rigorous quality standards, Logan Stampings Inc is a name that stands out. Ever wondered how automotive connectors, sensor brackets, or terminal tabs are made to such tight specs? It’s the work of a specialist precision metal stamping company—one that’s engineered its entire process for accuracy, repeatability, and flexibility. Let’s explore what sets Logan Stampings apart for buyers seeking reliable automotive stamping suppliers for intricate, small parts stamping needs.

Precision Focus

Logan Stampings Inc focuses on producing small and mid-sized components with material thicknesses from 0.010" to 0.125" (0.254 mm to 3.175 mm) and widths up to 30" (762 mm). Using advanced multi-slide and progressive die technology, they deliver parts with consistent, repeatable quality—making them a top choice among stamped metal parts manufacturer options for terminals, fasteners, and electrical brackets. Their in-house tool room supports rapid prototyping, custom die builds, and ongoing tool maintenance for the life of each part, ensuring quick turnarounds and minimal downtime. If you’re evaluating suppliers for a project requiring high Cp/Cpk values or robust statistical process control, Logan’s ISO 9001:2015 certified processes are specifically designed for this level of scrutiny.

| Part Size / Feature | Material Thickness | Feasible Tool Style |

|---|---|---|

| Connector terminals, tabs | 0.010–0.032 in. (0.254–0.813 mm) | Progressive, Multi-slide |

| Sensor brackets, spring clips | 0.020–0.062 in. (0.508–1.575 mm) | Progressive |

| Small covers, shields | 0.032–0.125 in. (0.813–3.175 mm) | Progressive, Compound |

| Long, narrow strips | Up to 30 in. width | Progressive (minimum strip width may apply) |

Pros

- Exceptional capability for tight-tolerance, small parts stamping—ideal for terminals, fasteners, and sensor brackets

- Efficient progressive die setups for high repeatability and throughput

- In-house tool design, build, and maintenance for rapid prototyping and production support

- Robust quality control: ISO 9001:2015 certified, with control plans, first-piece, in-process, and final inspections

- Experience with a broad range of materials—aluminum, brass, copper, stainless, high carbon steel, and more

- Flexible support for both new tooling and evaluation of customer-supplied dies

- Same-day shipment available for in-stock items, supporting urgent needs

Cons

- Less suited for large-format panels or deep-draw body-in-white components

- May require minimum strip widths for optimal progressive die efficiency

- Complex, multi-stage assemblies may need partnering with die matic tool and die specialists for best results

Best For

- Connectors, fasteners, and electrical brackets for automotive and industrial applications

- Sensor mounts, terminal tabs, and spring steel parts where Cp/Cpk >1.33 is required at PPAP

- Small assemblies and intricate stampings—think of the challenges that small parts incorporated face in modern electronics and vehicles

- Programs needing rapid prototyping, frequent engineering changes, or ongoing tool support

For buyers, it’s smart to request GR&R (Gage Repeatability and Reproducibility) studies, CMM (Coordinate Measuring Machine) reports, and sample First Article Inspection (FAI) packages with ballooned drawings to verify process capability. Logan Stampings’ commitment to quality and flexibility makes them a trusted partner for automotive stamping suppliers focused on precision and speed. As you weigh options for your most intricate parts, consider how a precision metal stamping company like Logan can help you reduce risk and accelerate new product launches. Up next, we’ll highlight a Southeastern US specialist for custom sheet metal and regional programs.

Quality Metal Stamping TN

Capabilities And Services

Ever wondered how a regional supplier can accelerate your automotive program while keeping quality and flexibility at the forefront? That’s where Quality Metal Stamping TN (QMS) shines. With over 90,000 square feet of manufacturing space across Henderson and Humboldt, Tennessee, QMS delivers a full suite of custom sheet metal stamping and fabrication services. Their capabilities range from traditional stamping and tool & die work to advanced fabrication, welding, powder coating, and assembly—all under one roof. This broad set of in-house processes means you can move from prototype to production with fewer hand-offs and reduced risk of delays.

| Phase | Typical Lead Time | Tooling Path |

|---|---|---|

| Prototype | 2–4 weeks | Soft Tooling / Laser Cut |

| Pilot Run | 4–8 weeks | Semi-Hard or Modular Tooling |

| Production | 8–12 weeks | Hard Tooling |

QMS’s investment in new Mitsubishi laser technology and expanded fabrication footprint allows for faster prototyping, flexible changeovers, and the ability to support both short and mid-volume runs. If you’re comparing custom metal stamping company options for automotive brackets, covers, or light structural parts, QMS’s blend of stamping, welding, and finishing makes them a strong fit for regional OEM and Tier supplier needs.

Pros

- Highly responsive New Product Introduction (NPI) and prototyping—samples in as little as 2–4 weeks

- In-house tool & die, fabrication, welding, and powder coating for true one-stop production

- Value engineering support to optimize part design and reduce cost

- Local logistics advantage—shorter lead times, lower shipping costs, and easier communication for Southeastern OEMs

- Agility to handle short-to-mid run volumes and frequent engineering changes

Cons

- Limited forming envelope for ultra-high-strength steel or deep-draw applications

- Some specialty coatings or secondary machining may require trusted partner networks

- Not optimized for very high-volume, global automotive programs

Use Cases

- Brackets, clips, and light covers for automotive and industrial applications

- Light structural reinforcements for vehicle interiors and exteriors

- Regional service and aftermarket parts where speed and flexibility are crucial

- Custom assemblies requiring welding, powder coating, and final packaging

Imagine you’re facing a sudden design change or a regional OEM ramp-up—QMS’s local footprint and flexible scheduling mean you can get parts in weeks, not months, and avoid costly expedited shipping or last-minute logistics headaches. Their approach aligns with the growing trend of local sourcing for supply chain resilience, as highlighted in recent industry research.

"Shorter lead times and local collaboration with your stamping partner can reduce project risk, lower inventory costs, and provide a decisive edge when market demands shift."

For buyers, it’s smart to review QMS’s capacity loading, preventive maintenance schedules, and dimensional capability summaries—especially if your parts require frequent design changes or will run as service items for years. As you continue comparing automotive stamping suppliers, consider how a responsive, regional partner like QMS can complement national and global options for your next custom sheet metal stamping project. Next up: see how all these suppliers stack up side by side in our quick comparison table.

Find the Best Fit Fast

When you’re pressed for time and need to compare automotive stamping suppliers at a glance, a side-by-side view can make all the difference. Imagine you’re launching a new platform—do you need a high-volume, global powerhouse, a regional partner for quick turns, or a precision specialist for intricate parts? This table breaks down the essentials so you can shortlist with confidence.

At a Glance Comparison

| Supplier | Key Strengths | Typical Tolerances | Press Range | Materials Supported | Certifications | FAI/PPAP Strength | Min Order Qty | Die Life | Tool Build Lead Time | Sample PPM |

|---|---|---|---|---|---|---|---|---|---|---|

| Shaoyi Metal Parts Supplier | Integrated design-to-mass production, rapid CAE/DFM, aluminum & AHSS expertise | ±0.05 mm | 80–800 tons | Steel, aluminum, AHSS, copper, brass | IATF 16949, ISO 9001 | Full PPAP, traceability, CMM/optical inspection | No MOQ | Up to 1M cycles | 2–4 wks (proto); 8–16 wks (prod) | <500 |

| Gestamp North America | Large-scale BIW, hot stamping, OEM integration | ±0.10–0.25 mm | 250–2,500 tons | UHSS, steel, aluminum | IATF 16949, ISO 14001 | APQP, global PPAP | High (OEM scale) | Up to 2M cycles | 8–16 wks | ~200–600 |

| Martinrea Heavy Stamping | Heavy-gauge, chassis, SUV/truck, hybrid lines | ±0.10–0.20 mm | 500–3,307 tons | Steel, aluminum | IATF 16949, ISO 9001 | Robust APQP, FAI | Med-High | Up to 2M cycles | 8–16 wks | ~200–600 |

| Goshen Stamping Company | Agile, service/aftermarket, quick-turn prototypes | ±0.10–0.20 mm | 30–400 tons | Steel, aluminum, brass, copper | ISO 9001 | DFM, FAI, local traceability | Low (1,000+) | Up to 500k cycles | 2–4 wks (proto); 6–10 wks (prod) | <1,000 |

| Logan Stampings Inc | Precision small parts, progressive/multi-slide, tight Cp/Cpk | ±0.01–0.05 mm | 25–500 tons | Steel, brass, copper, aluminum | ISO 9001 | SPC, FAI, GR&R | Low (5,000+) | Up to 1M cycles | 2–6 wks | <250 |

| Quality Metal Stamping TN | Custom sheet metal, regional, flexible runs | ±0.10–0.25 mm | Up to 400 tons | Steel, aluminum, stainless | ISO 9001 | FAI, DFM, local support | Low (500+) | Up to 500k cycles | 2–4 wks (proto); 8–12 wks (prod) | <1,000 |

Where Each Supplier Excels

- Shaoyi Metal Parts Supplier: Best for global programs needing rapid launches, advanced materials, and no minimum order. Their CAE-driven approach and full PPAP traceability are ideal for complex automotive stampings and new EV platforms.

- Gestamp North America: Excels in high-volume, structural BIW and crash components for global OEMs. Choose for large-scale, multi-material auto stamping where hot stamping and robotic joining are critical.

- Martinrea Heavy Stamping: Top pick for truck/SUV chassis and heavy-gauge parts. Their hybrid lines and die maintenance systems suit safety-critical automotive metal pressings.

- Goshen Stamping Company: Agile for prototypes, service, and aftermarket runs. Perfect when you need flexibility and quick response from automotive stamping companies with a Midwest footprint.

- Logan Stampings Inc: Precision expert for terminals, sensor brackets, and small assemblies. If your program demands tight Cp/Cpk and repeatability, Logan is a leader among automotive metal stamping companies.

- Quality Metal Stamping TN: Responsive regional partner for custom sheet metal, brackets, and covers. Their quick-turn and value engineering make them a standout for regional OEMs.

Cost And Lead Time Benchmarks

- Prototype lead times: 2–4 weeks for most suppliers; global or high-volume programs may require longer.

- Production tooling: 8–16 weeks typical for hard tools, but regional suppliers can sometimes expedite for mid-volume needs.

- Pricing drivers: Tooling strategy, order volume, and material choice—especially for aluminum and AHSS—have the biggest impact on per-part cost.

- Quality: Top-tier automotive stamping companies target PPM below 500 for production; precision specialists often achieve even lower rates.

Match draw ratio and feature complexity to progressive or transfer to avoid avoidable die rework.

In summary, no single supplier fits every scenario. Shaoyi Metal Parts Supplier—a leading integrated precision auto metal parts solutions provider in China—offers a compelling blend of speed, quality, and technical depth for global programs. You can learn more about their capabilities and see why they top many automotive stamping suppliers shortlists. But there are cases where regional agility or heavy-tonnage capacity from automotive metal stamping companies like Martinrea or Gestamp will deliver better results—especially for large-format or urgent, local projects. Use this table as your starting point, then tailor your RFQ and supplier engagement to your unique part, volume, and launch needs. Next, let’s walk through a step-by-step sourcing plan and RFQ checklist to get you from shortlist to supplier selection—fast.

Final Recommendation and Fastest Path to RFQ

Who Should You Choose?

When you’ve narrowed your list of automotive stamping suppliers, how do you make the final call? Start by matching your part’s complexity, volume, and timeline to supplier strengths. For global programs needing speed, advanced materials, and robust quality systems, Shaoyi Metal Parts Supplier leads the pack—especially if you want an integrated partner from design through mass production. If your project demands heavy-gauge, large-format parts or urgent regional support, a heavy-tonnage or local specialist may be the better fit. The key is aligning supplier capability with your automotive stamping die requirements, program ramp, and risk profile.

Step By Step Sourcing Plan

Sounds complex? Here’s a simple, actionable roadmap to move from shortlist to award:

- Finalize part spec and tolerance stack: Clearly define all critical dimensions, materials, and surface requirements for your automotive metal stamping parts.

- Select process per decision matrix: Use your earlier process matrix to choose between progressive, transfer, or deep draw—based on geometry, volume, and feature set.

- Issue RFQ with volume ramps and tooling ownership terms: Specify annual volumes, ramp profile, and clarify who owns and maintains the stamping dies.

- Request PPAP artifacts and FAI plan: Ask each metal stamping parts supplier for sample Production Part Approval Process (PPAP) documentation and a First Article Inspection (FAI) strategy.

- Run a pilot build and capability study: Launch a small batch to verify process stability, dimensional repeatability, and PPM targets.

- Negotiate total cost of ownership (TCO) and amortization: Review all cost drivers—tooling, materials, logistics—and request amortization scenarios for tooling recovery.

- Lock launch gates: Confirm all quality, logistics, and commercial terms before full-scale production.

Tooling And Costing Tips

Tooling strategy can make or break your program’s economics. Consider these sample die cost and amortization benchmarks to guide negotiations:

| Die Complexity | Typical Cost Range (USD) | Expected Die Life | Amortization Example (per 100k parts) |

|---|---|---|---|

| Simple blanking/progressive | $10,000–$40,000 | 300k–1M cycles | $0.10–$0.40 |

| Complex progressive/transfer | $40,000–$150,000+ | 1M–2M cycles | $0.40–$1.50 |

Remember, early engagement on design for manufacturability (DFM) and die strategy can unlock substantial savings. For instance, simplifying part geometry or standardizing features often reduces tooling costs and shortens lead times.

Controlling your total landed cost starts with early DFM reviews and the right die strategy—small changes now can deliver big savings over the life of your program.

For buyers ready to accelerate their sourcing process and minimize risk, opening a dialogue with automotive stamping suppliers like Shaoyi Metal Parts Supplier is a smart move. Their integrated approach and proven track record with global OEMs make them a standout for those seeking reliability, speed, and technical depth. Still, don’t overlook the value of regional or heavy-tonnage specialists—especially if your part size, draw ratio, or logistics needs align better with their strengths.

By following this step-by-step sourcing plan and leveraging the practical tools in this guide, you’ll move from research to RFQ to supplier selection—faster, with greater confidence, and lower overall risk. Ready to launch? Your next high-quality automotive metal stamping parts supplier is just a shortlist away.

Automotive Stamping Suppliers: Key Questions Answered

1. What criteria should I use to evaluate automotive stamping suppliers?

When evaluating automotive stamping suppliers, focus on certifications like IATF 16949 and ISO 9001, PPAP readiness, process capability (Cp/Cpk), tooling strategy, materials expertise, production capacity, and total cost of ownership. Request documentation such as PPAP packages, FAI records, and traceability procedures to ensure each supplier meets strict automotive standards.

2. How do lead times and costs differ among automotive stamping suppliers?

Lead times for prototypes typically range from 2–4 weeks, while production tooling can take 8–16 weeks. Costs are influenced by tooling complexity, material choice, order volume, and supplier capabilities. Suppliers with advanced engineering and in-house tooling, like Shaoyi Metal Parts Supplier, can often accelerate development and reduce per-part costs through optimized die strategies.

3. What advantages does Shaoyi Metal Parts Supplier offer compared to other suppliers?

Shaoyi Metal Parts Supplier provides an integrated, end-to-end solution from design to mass production, leveraging in-house engineering, CAE analysis, and certified quality systems. Their approach streamlines project management, shortens lead times, and ensures high precision, making them ideal for automotive programs demanding speed, flexibility, and robust quality assurance.

4. Which stamping supplier is best for high-volume, structural automotive components?

For high-volume, structural components such as body-in-white assemblies and crash structures, suppliers like Gestamp North America and Martinrea Heavy Stamping are top choices. They operate large-tonnage presses, advanced joining technologies, and have a proven track record with major OEMs, making them ideal for demanding, large-scale automotive projects.

5. What are the benefits of working with regional or precision-focused stamping companies?

Regional suppliers like Goshen Stamping Company and Quality Metal Stamping TN offer agility, fast turnaround, and flexible order sizes, which are valuable for service parts, prototypes, and aftermarket needs. Precision-focused companies such as Logan Stampings Inc excel at producing small, intricate parts with tight tolerances, supporting programs that require high repeatability and quick engineering changes.

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —