Why Indonesia Is Becoming the New Battleground for Global EV Manufacturers

Indonesia is rapidly emerging as a hub for electric vehicle (EV) investment in Asia. Boasting favorable government policies, abundant nickel resources, and a strategic location in Southeast Asia, Indonesia is attracting massive capital from global automotive giants eager to establish a footprint in the region's growing EV ecosystem.

$911 Million Investment: 7 Global EV Makers Set to Build Plants in Indonesia

According to Indonesia's Investment Coordinating Board (BKPM), seven international EV manufacturers—BYD, Citroën, Aion, Geely, Maxus, Volkswagen, and VinFast—have announced plans to establish factories in Indonesia between 2024 and March 2025. These projects represent a total investment of IDR 15. 4 trillion (~USD 911 million), with a combined production capacity target of 281, 000 vehicles annually.

BYD, for example: investing over USD 750 million to build a 150, 000-unit capacity plant in West Java, set to be operational by the end of 2025. Meanwhile, VinFast will construct a facility capable of producing 50, 000 EVs annually, focusing on right-hand drive e-SUVs for the domestic market.

Geely, Aion, and Volkswagen are also breaking ground on manufacturing sites, many of which will include localized battery production, component manufacturing, and vehicle assembly. The presence of these global players signals confidence in Indonesia's long-term role in the automotive electrification movement.

EV Market Outlook: Rapid Growth Ahead

Indonesia's EV market is projected to grow from USD 533 million in 2022 to USD 2 billion by 2029, reflecting a CAGR of 20. 96%. This growth is fueled by the government's ambitious targets:

- 2. 1 million electric motorbikes and 400, 000 electric cars on the road by 2025

- 13 million e-motorbikes and 2. 2 million e-cars by 2030

To support this, the government is offering tax incentives, luxury goods tax reductions, and import duty exemptions for EV-related investments.

Can Chinese Automakers Compete with Japanese Legacy Brands?

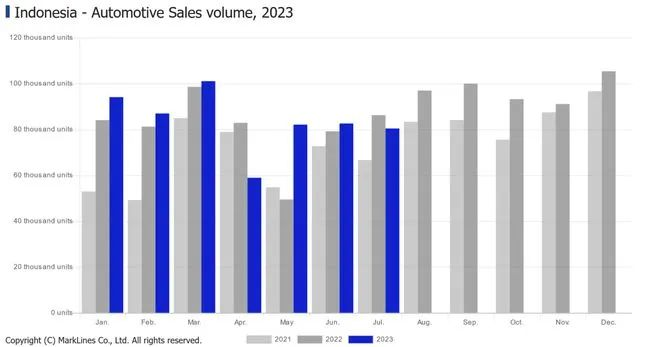

Japanese automakers currently dominate Indonesia's car market. In July 2023, Toyota, Daihatsu, Honda, Suzuki, and Mitsubishi collectively controlled over 85% of vehicle sales. Toyota alone sold 30, 029 vehicles that month, accounting for a 37. 3% market share.

However, Chinese EV brands are rapidly catching up. Brands like Wuling, Chery, and Dongfeng are leveraging their early investment in EV technologies and competitive pricing to win local favor.

- Wuling Motors has been active in Indonesia since 2015 and now employs over 10, 000 workers at its 60-hectare facility in Cikarang. The brand's Air EV model accounted for 80% of Indonesia's EV sales in 2022.

- Chery is investing nearly USD 1 billion to set up a production base and plans to launch up to 12 EV models by 2028, including pure electric and hybrid options.

During recent visits with Indonesian officials, chery's leadership emphasized a full supply chain strategy: from mineral sourcing to battery production and vehicle assembly.

What Makes Indonesia Attractive for EV Manufacturers?

- Strategic Location: Proximity to Southeast Asia's emerging markets

- Rich Natural Resources: Especially nickel, key for lithium-ion batteries

- Government Support: Incentives, tax holidays, and infrastructure support

- Growing Local Market: Rising middle class and increasing demand for affordable EVs

Indonesia is aiming to become Southeast Asia's EV manufacturing and consumer hub, and the country's policies reflect that ambition. For Chinese and global automakers alike, getting in early may be key to long-term regional dominance.

Final Thoughts

Indonesia is not merely an emerging market—it's a strategic cornerstone for the global EV supply chain. As the competition intensifies, , automakers with strong localization strategies and advanced automotive CAE capabilities will have the upper hand. Through CAE analysis, manufacturers can streamline production processes, minimize defects, and optimize the launch of new models tailored for Southeast Asia.

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —