Automotive and Parts Manufacturing: Your Industry 4.0 Roadmap

The Automotive Manufacturing Landscape Made Clear

When you hear about automotive and parts manufacturing, do you picture a single factory churning out cars from start to finish? In reality, the process is a carefully orchestrated journey—one that stretches from the first spark of design intent all the way to after-sale support. Understanding this full value chain is essential for anyone working with the automotive supply chain, whether you’re sourcing new components or engineering the next innovation.

What automotive and parts manufacturing covers end to end

Let’s break down the stages that take a vehicle from concept to customer care. Each phase is tightly linked, with decisions at every step shaping cost, quality, and delivery timelines:

- Concept and DfM (Design for Manufacturability): Early design choices determine what’s possible and set the tone for downstream costs and risks.

- Prototype and Validation: Initial builds test the design’s feasibility and highlight manufacturability or performance issues.

- Tooling: Specialized equipment is created to produce parts at scale, locking in the ability to meet volume and tolerance needs.

- PPAP (Production Part Approval Process): Rigorous validation ensures every part meets OEM standards before mass production begins.

- SOP (Start of Production): The automotive assembly line moves into full swing, delivering vehicles to market.

- Aftermarket Support: Ongoing service, repairs, and parts keep vehicles running and customers satisfied.

How the automotive supply chain connects design to delivery

Imagine the auto supply chain as a relay race. Each player—OEM, Tier 1, Tier 2, and Tier 3 supplier—hands off critical elements to the next. Here’s how they fit together:

| Role | Responsibilities |

|---|---|

| OEM (Original Equipment Manufacturer) | Vehicle design, assembly, final quality, and brand management |

| Tier 1 Supplier | Deliver major systems or modules directly to OEMs, integrate components, meet automotive-grade standards |

| Tier 2 Supplier | Supply specialized parts or subcomponents to Tier 1 suppliers |

| Tier 3 Supplier | Raw materials or near-raw materials (e.g., metals, plastics) |

OEMs focus on the big picture—design, brand, and final assembly—while Tier 1 automotive suppliers are trusted with delivering complete systems like braking or infotainment. Tier 2 suppliers provide the precision subsystems or parts that Tier 1s need, and Tier 3s supply the foundational materials. This structure is the backbone of any auto tier 1 supply chain strategy and makes the entire automotive supply chain incredibly complex but also resilient.[Reference]

Key decisions that shape auto parts manufacturing outcomes

Sounds complex? It is—but each decision, from material selection to supplier choice, has a ripple effect. It is widely recognized in the industry that decisions made during the design phase (such as material selection and design for manufacturability) can lock in up to 70% of the final cost and quality over the product lifecycle. Supply chain decisions—like which suppliers to use or how to manage logistics—directly influence lead times and risk exposure.

It’s also important to clarify language: for buyers, “lead time” might mean the total time to receive a finished part, while for engineers it could mean the time from design release to validated prototype. Aligning terminology and expectations across teams ensures fewer surprises and smoother launches.

Design decisions lock most cost and quality before tooling begins.

As you navigate automotive and parts manufacturing, remember that every stage, decision, and supplier tier interlocks to create value. When cross-functional teams share a common understanding of the process—from concept to aftermarket—they can better manage risk, optimize the automotive assembly line, and deliver superior results. This foundational knowledge also sets you up to dive deeper into topics like processes, materials, standards, and sourcing in the chapters ahead.[Reference]

Choosing the Right Process for Each Part

When you’re faced with a new design or an urgent cost-down challenge, how do you choose the best method for manufacturing automobile parts? The answer isn’t always obvious. The right choice balances geometry, volume, tolerance, and cost—while aligning with the realities of the car making process. Let’s break down the major processes in automotive and parts manufacturing so you can make confident, early decisions that reduce rework and keep your project on track.

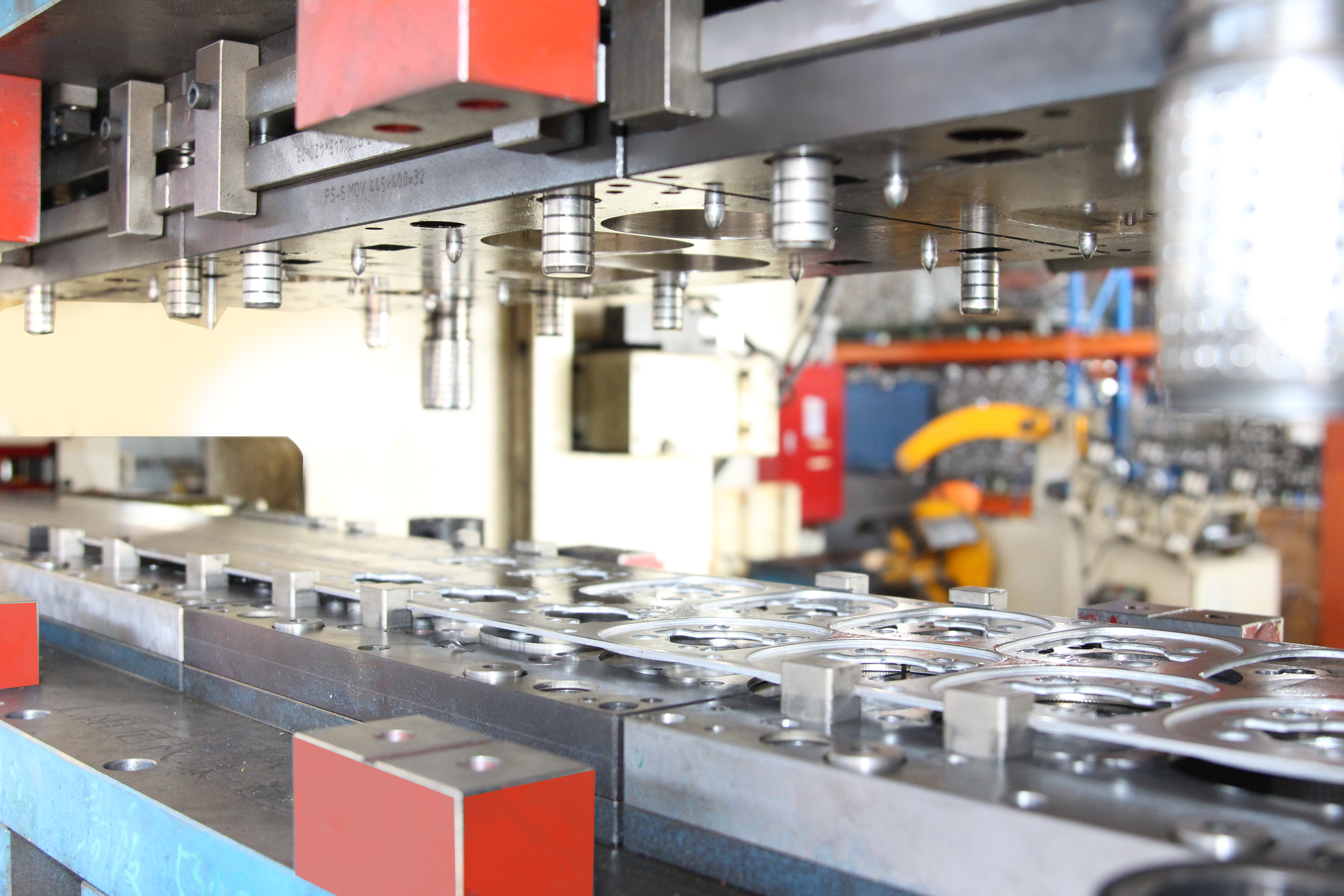

Stamping Versus Forging for Structural Strength and Volume

| Process | Typical Volumes | Achievable Tolerances | Tooling Cost | Unit Cost Behavior | Suitable Materials |

|---|---|---|---|---|---|

| Stamping (Sheet Metal) | High (10,000+) | Moderate | High | Low at scale | Steel, Aluminum |

| Forging | Medium-High | High | Moderate-High | Moderate | Steel, Aluminum Alloys |

| Casting | Medium-High | Moderate | Moderate | Low at scale | Cast Iron, Aluminum |

| CNC Machining | Low-Medium | Very High | Low (fixturing only) | High | Metals, Plastics |

| Injection Molding | High (10,000+) | High | High | Low at scale | Plastics |

| Welding | All volumes | Moderate | Low | Depends on automation | Metals |

| Heat Treatment | All volumes | Process-dependent | Low-Moderate | Low | Metals |

| Surface Finishing | All volumes | High (for appearance) | Low-Moderate | Low | Metals, Plastics |

Pros and Cons of Key Processes

-

Stamping

- Pros: High productivity, great for large body panels, consistent quality

- Cons: High tooling cost, limited to thin-walled parts, less suitable for complex 3D shapes

-

Forging

- Pros: Excellent strength, ideal for safety-critical parts (e.g., crankshafts), precise control of grain structure

- Cons: Moderate tooling cost, less flexibility for design changes, best for mid-to-high volumes

-

Casting

- Pros: Complex shapes possible, suitable for engine blocks and housings, scalable for volume

- Cons: Surface finish may require secondary machining, porosity risk, moderate tolerances

-

CNC Machining

- Pros: Tight tolerances, flexible for prototypes and low-volume runs, excellent surface finish

- Cons: High unit cost for mass production, slower than stamping/casting for large batches

-

Injection Molding

- Pros: High precision, repeatable, low unit cost at scale, great for plastic parts

- Cons: High tooling cost, limited to polymers, design changes are costly after tooling

-

Welding

- Pros: Essential for joining body structures, scalable from manual to fully automated

- Cons: Heat-affected zones can alter material properties, potential for distortion

-

Heat Treatment

- Pros: Tailors material properties (hardness, toughness), critical for gears and shafts

- Cons: Adds process time, requires precise control for repeatability

-

Surface Finishing

- Pros: Improves appearance, corrosion resistance, and wear properties

- Cons: May add cost and process steps, not all finishes suit every material

Machining Versus Die Casting for Tolerance and Surface Finish

When tight tolerances and a flawless surface are required—think precision housings or custom brackets—CNC machining often wins for low to medium volumes. For higher volumes, die casting offers complex shapes at lower per-part cost, though some secondary machining may still be needed for critical surfaces. The car production process often combines both: casting for the base shape, then machining for final precision.

Welding, Heat Treatment, and Coatings for Durability

Durability in automotive fabrication isn’t just about material choice—it’s about how you join and finish each part. Spot welding is the backbone of car body assembly, while heat treatment ensures gears and shafts survive years of real-world abuse. Surface coatings and finishes add corrosion resistance and visual appeal, locking in long-term performance for every component.

- For high-volume, flat or shallow metal parts (like body panels): Choose stamping.

- For medium-to-high volume, high-strength parts (like crankshafts): Opt for forging.

- For complex, hollow, or heavy parts (like engine blocks): Use casting.

- For low-to-medium volume, high-precision needs: Select CNC machining.

- For high-volume plastic parts (like housings): Go with injection molding.

- For joining metal structures: Apply welding.

- For tailoring properties: Incorporate heat treatment.

- For appearance and protection: Use surface finishing.

Choosing the right process early in the car making process is the fastest way to reduce cost, shorten development time, and ensure quality in automobile parts manufacturing.

As you move forward, keep these trade-offs in mind. Early manufacturability reviews—well before the car production process locks in—help minimize late-stage changes and align your design with supplier capabilities. Next, we’ll explore how the choice of materials further impacts cost, risk, and performance in automotive and parts manufacturing.

Materials And DfM That Reduce Cost And Risk

Ever wondered why some vehicles feel solid and safe, while others seem light and agile? The answer lies in the careful selection and pairing of materials with manufacturing processes. In automotive and parts manufacturing, choosing the right material for each component is as critical as the process itself—impacting cost, durability, safety, and even environmental footprint. Let’s break down how to make smart, manufacturable choices for today’s cars.

Matching Materials to Automotive Components and Duty Cycles

When you look at the materials of a car, you’ll notice a blend of metals, plastics, and advanced composites—each matched to specific automotive components based on performance needs and cost targets. For example:

- Steel: Still the backbone of car frames, door panels, and support beams—chosen for strength, crash resistance, and affordability. High-strength low alloy (HSLA) steels now allow thinner, lighter panels without sacrificing safety.

- Aluminum Alloys: Used in wheels, hoods, and increasingly in chassis parts for weight savings and corrosion resistance. Aluminum’s moldability enables complex shapes and lighter structures, improving fuel efficiency.

- Magnesium: Even lighter than aluminum, magnesium finds its way into some body panels and engine components where weight is at a premium—but it’s used sparingly due to higher cost and limited formability.

- Engineering Plastics: If calculated by the number of parts, almost half of all automotive parts are now made of plastic, thanks to its advantages of lightweight, corrosion resistance and high design freedom.

- Composites (e.g., Carbon Fiber): Custom carbon car parts—like hoods, roofs, or racing seats—offer unmatched strength-to-weight ratios, but at a much higher cost. These are typically reserved for high-performance or luxury models.

Each material family brings unique benefits and trade-offs, so mapping them to the right car parts machining process is essential for manufacturability and performance.

Metal Versus Polymer Choices and Surface Treatment Implications

Choosing between metal car parts and polymer-based solutions often comes down to the component’s function, expected loads, and exposure to the elements. Metals like steel and aluminum excel in structural roles, while polymers shine where complex shapes, low weight, and corrosion resistance are priorities. But there’s more to the story—surface treatments like coatings, painting, and lamination can dramatically extend the life and appearance of both metals and plastics. For instance, glass laminates in windshields improve safety, while surface coatings on steel prevent rust and wear.

Trade-Off Matrix for Weight, Cost, and Manufacturability

Material selection is a balancing act—how do you weigh strength, cost, manufacturability, and sustainability? Here’s a quick reference matrix to guide your decisions:

| Material Family | Strength-to-Weight | Formability | Thermal Stability | Corrosion Resistance | Cost Trend |

|---|---|---|---|---|---|

| Steel | High | Good (especially sheet steel) | High | Moderate (needs coating) | Low |

| Aluminum Alloys | Moderate-High | Excellent | Moderate | High | Moderate |

| Magnesium Alloys | Very High | Moderate | Moderate | Moderate | High |

| Engineering Plastics | Moderate | Excellent | Moderate | High | Low-Moderate |

| Composites (e.g., Carbon Fiber) | Very High | Limited (complex shapes possible, but costly) | Low-Moderate | High | Very High |

As you can see, there’s no one-size-fits-all answer. For instance, while custom carbon car parts offer the best weight savings, they come at a premium and require specialized processes. Steel remains a cost-effective workhorse, but may need extra surface protection. Aluminum and magnesium strike a balance between weight and manufacturability, especially for performance models.

- Reduce wall thickness variation to avoid stress points and manufacturing defects.

- Design generous radii for stamping and forming—sharp corners can cause cracks and tool wear.

- Consider coatings and finishes early; they can affect both cost and long-term durability.

- Use standard components where possible to simplify assembly and reduce costs.

- Balance lightweight goals with structural needs—removing too much material can compromise safety or performance.

Material selection drives both process choice and lifecycle performance; decide them together.

By applying these principles and understanding the trade-offs, you’ll speed up design cycles, reduce late-stage changes, and ensure your automotive components are both manufacturable and fit for purpose. Next, we’ll explore how these material choices become even more critical as vehicles shift toward electrification and advanced electronics—where precision and reliability are non-negotiable.

EV And Electronic Component Manufacturing Essentials

When you imagine the future of automotive and parts manufacturing, do you picture sleek electric vehicles packed with advanced electronics? If so, you’re already seeing how the automotive industry process is evolving. Building EVs and their electronic components isn’t just about swapping out a gas tank for a battery. It requires a new level of precision, cleanliness, and rigorous validation—especially as demand for reliable dc to ac inverter for car units, smart battery packs, and robust car power converter systems skyrockets.

EV Battery and Power Electronics Manufacturing Checkpoints

Let’s walk through the essential steps of the automobile production process for batteries and power electronics, where every detail matters. The journey starts with cell manufacturing, where lithium-ion cells are carefully assembled using high-purity materials and laser-guided processes. Each cell is coated, cut, stacked, welded, filled with electrolyte, sealed, and then tested for electrical and mechanical properties. Only cells that pass strict criteria move on to module and pack assembly.[Reference]

- Thermal Management: Adhesives and sealants are applied to manage heat and ensure safety. Laser surface preparation removes contaminants, ensuring strong, reliable bonds.

- Traceability: Every cell and component is marked and tracked, providing complete visibility from raw materials to finished packs. This is crucial for quality control and warranty management.

- Busbar and High-Voltage Connections: Laser welding creates robust, vibration-resistant electrical connections between cells, minimizing mechanical stress and boosting durability.

- End-of-Line (EOL) Testing: Complete battery packs undergo charge/discharge cycles and are checked for voltage, capacity, and internal resistance. Vision systems catch any mechanical defects before packs leave the line.

Imagine the attention to detail required—one contaminant or poor weld could mean a costly recall. That’s why leading automotive manufacturing solutions providers invest in automation and clean-room discipline at every step.

Testing and Validation for E/E Components and Harnesses

Power electronics—like inverters, converters, and e-motors—are the brains and brawn of modern EVs. Their manufacturing requires not just tight tolerances, but also deep, multi-stage validation. Here’s a typical flow you’ll see in the automotive industry process:

- Design Validation Testing (DVT): Engineers stress-test prototypes, checking for electrical safety, thermal behavior, and performance under worst-case conditions.

- Production Validation Testing (PVT): Small batches are built using final production tools and processes. Each unit is subjected to rigorous electrical, thermal, and vibration tests to ensure repeatability.

- End-of-Line (EOL) and Field Monitoring: Every mass-produced unit is tested for insulation, dielectric strength, and functional performance. Data is logged for traceability and future analysis.

But what does this look like in practice? OEMs and Tier 1 suppliers often reference standards like LV 124 and ISO 16750, which specify electrical disturbance tests, environmental cycling, and more. Testing routines can include hundreds of cycles, simulating everything from voltage drops to thermal shocks—ensuring that every ford connected charging station or automotive computer solutions module will work flawlessly in the field.

| Component Type | Typical Tests | Acceptance Criteria |

|---|---|---|

| Battery Pack | Capacity, voltage, internal resistance, thermal cycling, vibration | Must meet OEM electrical and mechanical specs; no leakage or overheating |

| Inverter (e.g., dc to ac inverter for car) | Insulation resistance, hipot, overvoltage, temperature cycling, start/stop cycles | No breakdown under simulated load; stable output across temperature range |

| Motor | Winding resistance, balance, insulation, vibration, thermal soak | Meets torque and speed specs; no excessive noise or heat |

| Harness | Continuity, insulation, pin retention, connector vibration | No open/short circuits; connectors secure after cycling |

Linking ISO 26262 and Cybersecurity to Factory Controls

As vehicles become more connected and software-driven, manufacturing must also address functional safety and cybersecurity. Standards like ISO 26262 guide engineers to design-in safety from the start, while plant-level controls ensure that every electronic module is built and tested in accordance with these requirements. Cybersecurity measures are increasingly embedded in both the manufacturing process and the product itself, protecting against threats that could disrupt vehicle operation or compromise customer data.[Reference]

Tight tolerance and clean-room discipline reduce latent field failures in E/E parts.

By bridging standards, shop-floor practices, and advanced testing, today’s automotive and parts manufacturing teams can deliver the reliability and safety that tomorrow’s electric and connected vehicles demand. Next, we’ll show how robust quality systems and documentation accelerate approvals and reduce launch risk for every new part—electronic or mechanical.

Quality Systems That Earn Faster PPAP Approvals

Imagine you’re a supplier gearing up to launch a new part for an OEM. The pressure is on: your quality system needs to be bulletproof, your documentation flawless, and your processes ready for scrutiny. But how do you get there—without drowning in paperwork or missing key requirements? Let’s break down how to build a quality system that not only satisfies the manufacturing process for automobile parts, but actually accelerates your path to approval.

Building an Audit-Ready QMS Without Overburden

The backbone of any successful automotive manufacturing process is a robust Quality Management System (QMS) aligned with IATF 16949. Sounds daunting? It doesn’t have to be. Here’s a stepwise approach that small and mid-sized suppliers can follow to implement an audit-ready QMS:

- Management Support: Get buy-in from your leadership—without it, your QMS won’t stick.

- Gap Assessment: Review current practices versus IATF 16949 requirements. Identify what’s missing.

- Define Scope: Decide which sites, departments, and processes the QMS will cover.

- Process Mapping: Document how work actually flows in your plant. Spot bottlenecks and overlaps.

- Document Control: Standardize procedures, work instructions, and records. Ensure everyone works from the latest version.

- Training: Educate your team on new processes and why they matter.

- Internal Audit: Test your system before the real audit. Correct any issues found.

- Management Review: Leadership reviews QMS performance and allocates resources for improvement.

Following these steps, as outlined in the IATF 16949 implementation checklist, ensures you build a system that is practical, scalable, and audit-ready—without unnecessary complexity.

APQP and PPAP Artifacts That Accelerate Approval

When it comes to the manufacturing process in automobile industry supply chains, documentation isn’t just a formality—it’s your ticket to launch. The Advanced Product Quality Planning (APQP) and Production Part Approval Process (PPAP) frameworks help structure your project and provide OEMs with confidence. But what do you really need in your PPAP dossier?

- Design Failure Mode and Effects Analysis (DFMEA): Anticipates potential design risks and documents mitigation plans.

- Process Failure Mode and Effects Analysis (PFMEA): Identifies process risks and controls at each manufacturing step.

- Control Plan: Outlines how each process is monitored and controlled for quality.

- Capability Studies: Demonstrate that your process can consistently meet specifications (e.g., Cp, Cpk values).

- Measurement System Analysis (MSA): Confirms your gauges and measurement tools are accurate and repeatable.

- Run-at-Rate Results: Proves your process can produce at required volumes—without defects or delays.

These elements work together to provide traceability and confidence, reducing the risk of surprises during the automotive procurement process. For Tier 1 suppliers, using a comprehensive checklist—like those found in digital QMS platforms—helps avoid common pitfalls such as document misalignment or missing approvals.[Reference]

From Pilot Runs to SOP Start Readiness

So, how do you move from prototype to full Start of Production (SOP) smoothly? The answer lies in sequencing your activities and keeping change control tight. Here’s a simple roadmap for the automotive industry manufacturing process:

- Pilot Run: Build a small batch using production tools and processes. Validate both parts and process capability.

- PPAP Submission: Provide your complete dossier to the customer. Address feedback quickly.

- Change Control: Any tweaks to design, process, or materials must be documented and approved—traceability is key.

- SOP Launch: Once all approvals are in place, ramp up to full production—monitoring key metrics with Statistical Process Control (SPC).

SOP success depends on stable processes measured by meaningful SPC, not just paperwork.

By following this structured approach, you’ll reduce launch risk, support customer satisfaction, and meet the high expectations of the automotive manufacturing process. Next, we’ll discuss how sourcing strategy and supplier benchmarking can further strengthen your position—ensuring you partner with vendors whose quality systems and responsiveness match your own standards.

Sourcing Strategy and Vendor Benchmarking That Holds Up

When you’re tasked with finding the right partners for automotive and parts manufacturing, do you wonder how to cut through the noise and choose suppliers who can keep up with the pace of change? Imagine juggling cost, quality, compliance, and innovation—all while the automotive supply chain grows more complex every year. The right sourcing strategy can be your safety net, helping you deliver on time, every time, and adapt to the evolving needs of the oem automotive industry.

Building Resilient Sourcing in the Automotive Supply Chain

Sounds complex? It can be, but a structured approach makes all the difference. Start by defining your category strategies: which parts should you make in-house, and which are better sourced externally for cost or capability reasons? Next, consider multisourcing and regionalization—spreading risk across geographies and suppliers to buffer against disruptions. This is especially important as the auto supply chain faces global pressures, from raw material shortages to regulatory changes in emissions and sustainability. Leading tier 1 automotive manufacturer standards demand that suppliers meet rigorous quality and delivery targets, while also supporting continuous improvement and innovation.

How to Qualify and Audit Parts Suppliers Effectively

So, how do you know if a supplier is up to the challenge? A robust qualification process is key. You’ll want to look for:

- Certifications: IATF 16949, ISO 9001, or specific environmental standards show a supplier’s commitment to quality and compliance—must-haves for any automotive procurement program.

- Process Breadth: Can the supplier deliver stamping, machining, welding, and forging under one roof? This minimizes handoffs, streamlines project management, and reduces launch risk.

- Lead Time Performance: Assess prototype and production lead times, as well as the ability to respond to urgent changes.

- Regional Footprint: Does the supplier have operations or logistics hubs close to your production sites? Regionalization supports faster response and lower transportation risk.

- Noted Strengths: Look for innovation, sustainability practices, and proven ability to support new technologies such as EV components.

In the automotive supply chain, these criteria help you separate true partners from transactional vendors. For example, a supplier like Shaoyi offers one-roof process breadth, IATF 16949:2016 certification, and rapid quoting, aligning with the highest standards for launch risk reduction and audit readiness.

Vendor Benchmarking That Balances Cost, Capability, and Risk

Imagine you’ve shortlisted several candidates. How do you compare them in a way that’s fair and insightful? A benchmarking table brings clarity, letting you see at a glance where each supplier stands on key criteria. Here’s a template you can adapt for your next automotive sourcing project:

| Supplier | Process Breadth | Certifications | Lead-Time Tiers (Prototype/Production) | Regional Footprint | Noted Strengths |

|---|---|---|---|---|---|

| Shaoyi | Stamping, CNC Machining, Welding, Forging (all under one roof) | IATF 16949:2016 | Rapid (24-hour quote) / Data not provided | Data not provided | Integrated processes, fast quoting, global quality standards |

| Supplier B | Data not provided | Data not provided | Data not provided | Data not provided | Data not provided |

| Supplier C | Data not provided | Data not provided | Data not provided | Data not provided | Data not provided |

This approach is not just about price. It’s about aligning your needs for quality, speed, and innovation with suppliers who can deliver—especially as automotive supply chain solutions become more critical for EVs, sustainability, and regulatory compliance.

Supplier Scorecard: What to Measure

- Quality (PPM): Defect parts per million shipped

- OTD (On-Time Delivery): Percentage of orders delivered on time

- Cost Competitiveness: Price trends versus market benchmarks

- Engineering Support: Responsiveness and technical collaboration

- APQP Discipline: Adherence to Advanced Product Quality Planning milestones

These metrics form the backbone of any effective automotive procurement or auto tier 1 procurement strategy, helping you drive continuous improvement and supplier accountability.

RFQ Language That Aligns Expectations

Want to avoid surprises down the line? Use clear, structured RFQ language to set expectations for your suppliers from the start. For example:

Please provide detailed process capability data, expected prototype and production lead times, evidence of IATF 16949 certification, and a summary of change-control protocols. Include APQP timeline and sample submission milestones to ensure alignment with our engineering and quality requirements.

Clarity at the RFQ stage supports smoother launches and fewer misunderstandings—especially vital in the oem automotive industry where timing and compliance are non-negotiable.

Dual-source critical parts where practical to buffer disruptions without diluting volume leverage.

By applying these strategies, you’ll build a sourcing foundation that supports innovation, resilience, and long-term success in automotive and parts manufacturing. Next, we’ll explore how to select custom metal component partners and why process integration and certification make all the difference for your next project.

Industry 4.0 Roadmap and KPIs You Can Actually Use

Imagine walking into one of today’s auto manufacturing plants—rows of robots, screens flashing real-time data, and teams monitoring dashboards instead of paper logs. Sounds futuristic? For many in automotive and parts manufacturing, Industry 4.0 is already reshaping the landscape. But how do you turn the promise of digital transformation into a practical, scalable plan that delivers real results? Let’s break it down step by step, with a focus on what actually works for the automotive industry supply chain management and operational excellence.

Pilot to Scale: A Roadmap for Connected Manufacturing

When you first consider Industry 4.0, the sheer number of options—cloud platforms, IoT sensors, predictive analytics—can be overwhelming. Where do you start? The answer: begin with a clear, high-impact pilot. Pick a process that’s painful today (think chronic downtime or scrap) and use it as a proving ground for your digital strategy. Here’s a practical sequence to follow:

- Pilot Use Cases: Identify a process bottleneck or quality issue with measurable impact.

- Data Model and Tags: Define the critical data points you’ll need—cycle time, downtime, scrap, OEE, and more.

- Edge and Cloud Decisions: Decide which data is processed locally (for speed) and which is stored in the cloud for deeper analytics.

- Analytics and Alerts: Set up dashboards and notifications so teams can act quickly on trends and anomalies.

- Scale and Governance: Once the pilot delivers value, standardize the solution and roll it out plant-wide, with clear ownership and support.

This approach is backed by research showing that targeted pilots—rather than sweeping, all-at-once transformations—reduce risk and build organizational buy-in for supply chain solutions for the automotive industry. [Reference]

Data Collection and SCADA Integration Checklist

Data is the backbone of any Industry 4.0 initiative. But collecting the right data—and integrating it across manufacturing execution systems (MES), quality management, and maintenance—is what turns information into actionable insights. Here’s what you’ll need to check off:

- Connect PLCs, sensors, and machines to your MES and SCADA systems.

- Standardize data tags and naming conventions for consistency.

- Automate data flows to eliminate manual entry and reduce errors.

- Ensure data security and access controls are in place.

- Enable real-time visualization and historical analysis for continuous improvement.

By following this checklist, you’ll lay the foundation for advanced analytics and predictive maintenance—two of the most effective automotive industry solutions for driving efficiency.

KPI Framework That Drives Continuous Improvement

Once your data is flowing, the next step is to translate it into meaningful Key Performance Indicators (KPIs) that teams can use daily. Here’s a concise table mapping common KPIs to their definitions, data sources, and recommended tracking cadence:

| KPI | Definition | Data Source | Cadence |

|---|---|---|---|

| OEE (Overall Equipment Effectiveness) | Availability × Performance × Quality | PLC, MES | Daily |

| Scrap Rate | (Defective Units / Total Units Produced) × 100% | MES, QMS | Daily |

| Cycle Time | Total Processing Time / Number of Units | MES | Daily |

| On-Time Delivery | (Orders Delivered On Time / Total Orders) × 100% | ERP, MES | Weekly |

| Inventory Turnover | COGS / Average Inventory Value | ERP | Weekly |

Tracking these KPIs helps you spot trends, prioritize improvement projects, and communicate progress to stakeholders.

Organizational Change and Skills: The Human Side of Digital Transformation

Even the best technology falls flat without the right people and processes. Resistance to change, skill gaps, and unclear ownership are common motor vehicle manufacturing pain points. Here’s how to address them proactively:

- Leadership Sponsorship: Secure visible support from top management to drive momentum and remove roadblocks.

- Role-Based Training: Tailor training programs to operators, engineers, and managers so everyone knows how to use new tools and interpret data.

- Cross-Functional Daily Management: Establish daily huddles or review meetings where teams use KPIs to guide decisions and solve problems together.

By focusing on these organizational levers, you’ll build a culture that embraces innovation and continuous improvement—key ingredients for success with leading connected tech providers in auto manufacturing.

Start with a narrow, painful process, prove value fast, then templatize to expand.

Industry 4.0 is not a one-size-fits-all journey. By piloting, scaling, and measuring what matters, you can overcome the common pitfalls of digital transformation. This repeatable approach will help your team digitize operations, improve supply chain solutions for the automotive industry, and stay ahead in an increasingly competitive landscape. Up next, discover how to choose partners for custom metal components and why process integration is the new standard for speed and risk reduction.

Selecting Partners for Custom Metal Components

When you’re ready to source custom automotive parts, how do you know which partner will deliver the quality, speed, and support your project demands? The answer lies in understanding what truly sets a top-tier custom part manufacturing partner apart—and why integrated process capability, robust certifications, and launch responsiveness can make or break your next program.

What to Look for in Custom Automotive Metal Parts Partners

Imagine you’re launching a new model or updating a legacy part. The stakes are high: late deliveries or quality issues can ripple through your entire supply chain. Here are the criteria you should prioritize when evaluating custom automotive fabrication partners:

- Certification and APQP Depth: Look for IATF 16949 or ISO 9001 certification and a proven track record with Advanced Product Quality Planning (APQP). This ensures standardized, audited processes and readiness for industry-level audits.

- Process Breadth: Can the supplier handle stamping, CNC machining, welding, and forging in-house? Integrated process capability reduces handoffs and speeds up design-for-manufacturability (DfM) feedback loops.

- Tooling Strategy: In-house tooling design and maintenance help ensure rapid adjustments, lower costs, and tighter control over quality.

- Capacity and Scalability: Assess whether the supplier can flex to meet your volume needs—both for pilot runs and full-scale production.

- NPI Responsiveness: Fast quoting (think 24-hour response), prototyping, and DfM support are essential for compressed timelines and new product introduction (NPI) success.

One-Roof Process Integration Reduces Risk and Lead Time

Why does process integration matter? When you select a partner with all major capabilities under one roof—like stamping, machining, welding, and forging—you unlock several advantages over single-process suppliers:

- Shorter lead times: Fewer handoffs mean less waiting and fewer scheduling conflicts.

- Better DfM feedback: Engineers and toolmakers collaborate directly, catching issues early.

- Lower risk: Integrated quality control and traceability minimize the chance of defects slipping through.

- Streamlined project management: One point of contact for all your custom made parts needs.

Pros and Cons: Single-Process vs Integrated Suppliers

-

Integrated Supplier (e.g., Shaoyi):

- Pros: Full suite of processes (stamping, machining, welding, forging), IATF 16949:2016 certified, rapid 24-hour quoting, streamlined project management, and higher flexibility for design changes.

- Cons: May require larger minimum order quantities for certain processes, potentially higher initial tooling investment.

-

Single-Process Supplier:

- Pros: Specialized focus, potentially lower cost for very high-volume or simple parts.

- Cons: Limited DfM feedback, more handoffs, longer timelines, higher coordination risk.

From 24-Hour Quotes to PPAP and Mass Production

Speed and transparency can be the difference between a successful launch and a costly delay. Top partners in custom auto fabrication offer:

- Rapid, detailed quotes (often within 24 hours) for custom cars parts and accessories.

- Prototyping and pre-production support to refine designs before committing to full tooling.

- Comprehensive PPAP documentation and APQP discipline, ensuring smooth approval with OEMs and Tier 1 customers.

- Flexible scaling from pilot batches to volume production, adapting as your needs evolve.

Choosing an integrated, certified, and responsive partner for custom made parts reduces risk, accelerates timelines, and unlocks better DfM collaboration at every stage.

As you weigh your options for custom automotive components, remember: the right partner will not only deliver high-quality parts, but also provide the agility and support needed for today’s fast-moving automotive supply chains. In the final chapter, you’ll find actionable checklists and templates to streamline your sourcing and launch process—ensuring your next program hits the ground running.

Your Action Plan With Templates and Checklists

When you’re racing to launch a new vehicle program or source critical components, how do you keep everything on track—without missing a detail or slowing down your timeline? In automotive and parts manufacturing, a clear, actionable plan is your best insurance against costly surprises. Let’s wrap up with practical tools: a one-page RFQ template, a bill of materials (BOM) review checklist, and an APQP timeline you can adapt for any project. These scaffolds will help you move from concept to SOP with confidence—whether you’re working with american auto parts manufacturers, car parts manufacturers in usa, or a global auto parts factory.

One-Page RFQ Language That Gets Precise Supplier Responses

Ever send out an RFQ and get back a pile of apples-to-oranges quotes? The secret is in the details. The more specific your request, the more actionable and comparable the responses. Here’s a lightweight RFQ language block you can copy and adapt for your next round of automotive part manufacturing sourcing:

Please quote the following part(s) per attached drawing and specification. For each item, provide:Include all pricing, tooling costs, and payment terms in your response. Clarify any exceptions or assumptions.

- Process capability data (Cp, Cpk, or equivalent)

- Sample and prototype lead time

- Production lead time

- IATF 16949 certification status

- Evidence of prior PPAP approvals for similar parts

- Summary of change-control and revision management protocols

- APQP timeline with key submission milestones

This format sets clear expectations and ensures that quotes from auto parts manufacturers are directly comparable, saving you time in evaluation and negotiation. For more on RFQ best practices, see this RFQ guide.

BOM Review and DfM Checklist Before Freezing Design

Imagine launching into production only to discover a missing spec or mismatched part number. A disciplined BOM review avoids these headaches and keeps your vehicle parts manufacturing process running smoothly. Here’s a checklist you and your team should review together before freezing any design:

- Material specifications (grade, finish, certifications)

- Critical dimensions and GD&T (geometric dimensioning and tolerancing)

- Special characteristics (safety, regulatory, or customer-specific)

- Finish and coating callouts (paint, plating, lamination, etc.)

- Inspection and test plans (what, how, and who inspects)

- Packaging and labeling requirements

Don’t forget: version control is key. Each BOM revision should be clearly labeled, and all stakeholders notified of changes to prevent mix-ups or costly rework. For more details and free templates, check out this BOM resource.

APQP Timeline Scaffolding from Concept to SOP

Wondering how to structure your next program launch? The Advanced Product Quality Planning (APQP) framework is your roadmap. Here’s a concise, 10-step action plan you can adapt to your own automotive part manufacturing projects:

- Stakeholder alignment and project kickoff

- Design for Manufacturability (DfM) workshop

- Prototype build and validation tests

- Process selection and capability studies

- Tooling kickoff and readiness review

- Pilot run and process validation

- PPAP submission and approval

- SOP (Start of Production) ramp-up

- Ramp stabilization and feedback loop

- Aftermarket support and continuous improvement

To make this even more actionable, here’s a compact APQP phase table you can use as a launch checklist:

| APQP Phase | Core Deliverables | Gate Criteria |

|---|---|---|

| 1. Planning & Definition | Customer requirements, project scope, timing plan | Stakeholder sign-off |

| 2. Product Design & Development | Design FMEA, drawings, BOM, DfM review | Design freeze, BOM approval |

| 3. Process Design & Development | Process flow, PFMEA, control plan, capability study | Process validation, tooling readiness |

| 4. Product & Process Validation | Pilot run, PPAP submission, inspection reports | PPAP approval, readiness for SOP |

| 5. Launch & Feedback | Ramp-up monitoring, lessons learned, continuous improvement | Stable production, closed feedback loop |

This structure is recognized by car parts manufacturers in usa and global OEMs alike, ensuring you’re aligned with industry expectations at every milestone.

Freeze design only after process capability and control plans are agreed with your supplier.

By applying these checklists and templates, you’ll reduce ambiguity, accelerate time-to-PPAP, and set your team up for success—whether you’re working with a small auto parts factory or a major OEM. With these tools, you can confidently navigate the complexity of manufacturing auto parts and keep your next launch on track.

Frequently Asked Questions About Automotive and Parts Manufacturing

1. What are the main stages in automotive and parts manufacturing?

Automotive and parts manufacturing follows a structured value chain: concept and design for manufacturability (DfM), prototyping and validation, tooling, production part approval process (PPAP), start of production (SOP), and aftermarket support. Each stage involves specific decisions on materials, processes, and suppliers, impacting cost, quality, and lead times.

2. How do OEM, Tier 1, and Tier 2 suppliers differ in the automotive supply chain?

OEMs (Original Equipment Manufacturers) design and assemble vehicles, managing the final product and brand. Tier 1 suppliers deliver major systems or modules directly to OEMs, integrating various components. Tier 2 suppliers provide specialized parts or subcomponents to Tier 1s, supporting efficient and scalable production.

3. Why is process selection important in automobile parts manufacturing?

Choosing the right manufacturing process—such as stamping, forging, casting, or CNC machining—directly affects part quality, cost, and production speed. Early process selection aligned with part geometry, volume, and tolerance requirements helps minimize rework, ensures supplier compatibility, and supports efficient car production.

4. What should I look for when selecting a custom automotive metal parts supplier?

Key criteria include process integration (stamping, machining, welding, forging under one roof), IATF 16949 certification, strong APQP and PPAP practices, rapid quoting, and proven responsiveness. Partners like Shaoyi offer these features, streamlining project management and reducing launch risks.

5. How does Industry 4.0 impact automotive and parts manufacturing?

Industry 4.0 introduces digital technologies—such as MES, real-time data analytics, and automation—into automotive manufacturing. This enables smarter decision-making, improved quality tracking, predictive maintenance, and more resilient supply chain management, helping manufacturers stay competitive in a rapidly evolving industry.

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —