- Metal Parts Manufacturing: The Synergy of Cold Heading and Machining

- Unlocking Cost Savings: Smart Choices Between Cold Heading and Machining

- Surface Treatment Options for Aluminum Extrusions: Enhancing Performance and Aesthetics in Automotive Applications

- Aluminum Extrusion Quality Control and Inspection: The Key to Premium Automotive Aluminum Products

The Automotive Manufacturing Industry in 2025: Trends, Challenges, and Opportunities

Time : 2025-05-21

Are you part of the automotive industry? Then you’re probably keeping a close eye on the changes of automotive manufacturing. In 2025, this sector will be a mix of challenges and opportunities, with the former likely outweighing the latter for many businesses. Today, let’s join Shaoyi on an exciting journey to explore the latest trends, challenges, and opportunities in automotive manufacturing!

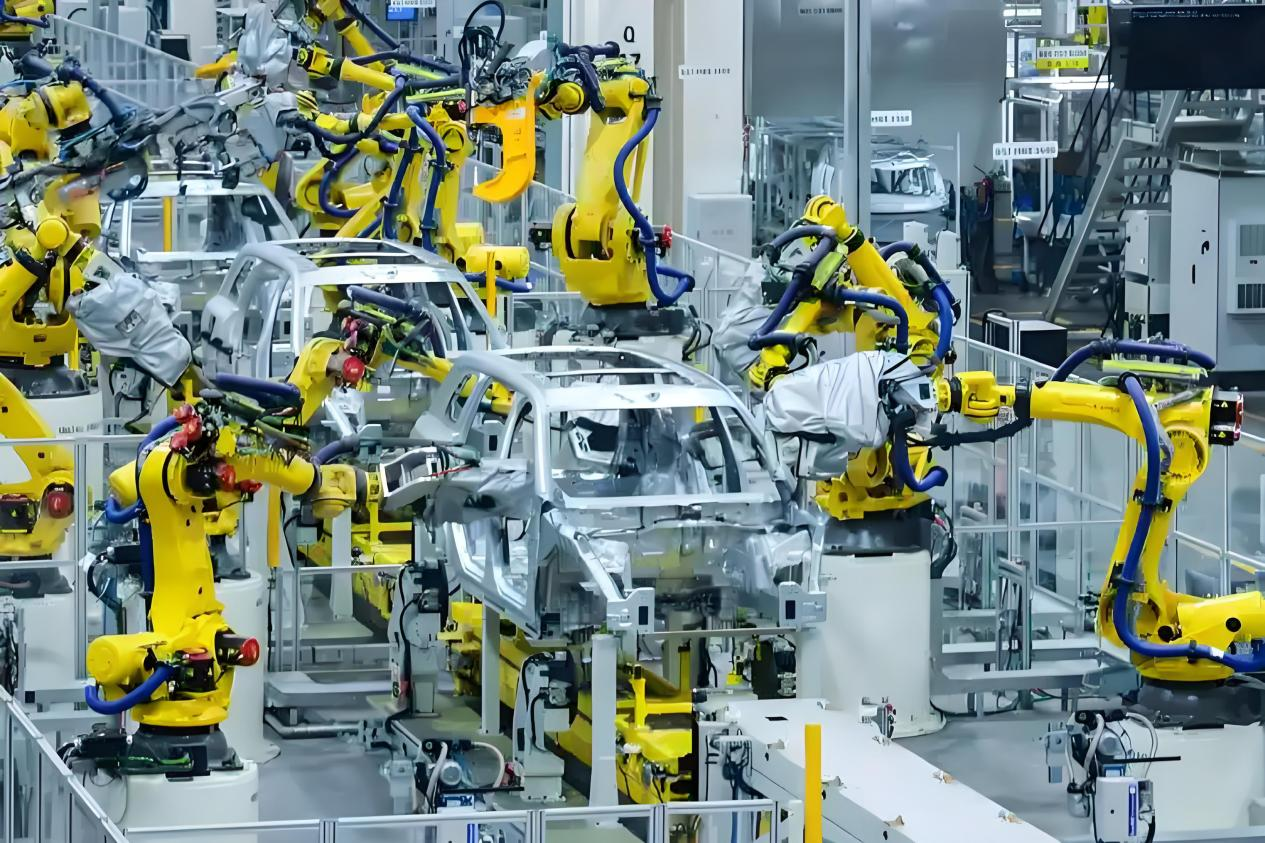

Automotive Welding Line

Core Trendcy

- Accelerated Electrification

- Policy Support: While we can't be sure if policies will shift in the short term, as things stand now, major global markets like China are strongly supporting electric vehicles. The electric vehicle (EV) penetration rate is expected to reach 30%-40% by 2025.

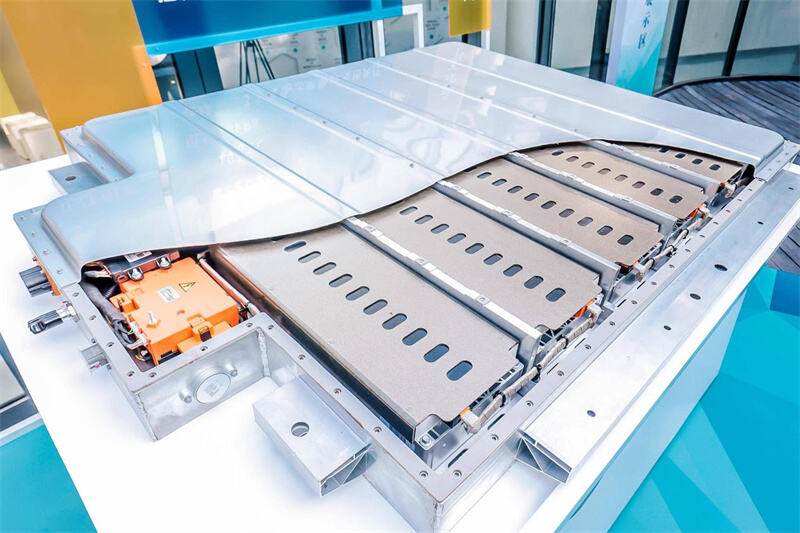

- Technical Breakthroughs: If solid-state batteries can be initially commercialized and charging efficiency improves, such as the widespread adoption of 800V high-voltage platforms, range anxiety could be alleviated. However, the commercialization of solid-state battery technology still requires time.

- Competitive Landscape: Traditional automakers like Volkswagen and Toyota are accelerating their transformation, newcomers like Tesla and BYD are continuing to lead, and tech companies like Huawei and Xiaomi are entering the market.

2.Intelligence and Autonomous Driving

- L3/L4 Autonomous Driving: Relevant regulations are improving. Some cities have begun pilot programs for advanced autonomous driving. V2X infrastructure is starting to cover certain areas. But due to technical immaturity, full-scale implementation isn't possible yet.

- Software-Defined Vehicles (SDV): OTA is becoming standard. Car companies are shifting from a "hardware sales" model to a "software service" model( like subscription of autonomous driving ). However, there's a fundamental difference between SDV and software - defined phones.

3.Supply Chain Restructuring

- Regional Production: Geopolitical risks are pushing supply chains towards "nearshoring" (e.g., North American carmakers to shifting Mexico) and "localization".

- Battery Material Competition: The race for lithium, nickel, and cobalt resources is intensifying.Recycling tech (e.g battery., black mass regeneration) has become a strategic focus.

Magazine batteries for new energy vehicles

4. Sustainable Manufacturing and Circular Economy

- Carbon - Neutral Goals: Carmakers cut production emissions via green plants and carbon - capture tech. The EU's CBAM pushes for full - chain low - carbon shifts.

- Material Innovation: Biomaterials (e.g., plant - based interiors), recycled aluminum/steel rise. Over 90% of end - of - life vehicles get recycled.

Automotive Manufacturing: Technical Changes and Production Patterns

1. Intelligent Manufacturing and Industry 4.0

- Digital Twins: Virtual factories simulate and optimize production processes. They also predict equipment failures in real-time. For example, Siemens’ Xcelerator is a platform that offers these advanced capabilities.

Siemens Xcelerator

- Collaborative Robots (Cobots): Human - robot collaboration is on the rise. Flexible production lines now support the production of multiple vehicle models in a single workflow.

- AI - based Quality Inspection: Machine vision is replacing manual and traditional camera - based inspections. It achieves over 99% accuracy in defect detection.

2. Modular Platforms and Personalization

- Skateboard Platforms: Standardized chassis cut R&D costs and speed up new vehicle development, as seen with Rivian and Canoo.

- User - Customization: Cloud - based configurators enable "a car for everyone", while 3D - printed parts meet niche demands.

3. Lightweighting Technologies

- Multi - Material Bodies: The use of mixed - material bodies (steel + aluminum + carbon fiber) is becoming more common.

- Die - Casting Technology: Technologies like Tesla’s Giga Press reduce the number of parts and assembly time.

Market and Competitive Landscape

1. Regional Market Divergence

- China: As the world’s largest EV market, domestic brands like BYD and NIO dominate the mid - to - low - end segment. Some foreign brands compete for a share in the high - end market. With competition heating up, even foreign luxury brands have joined the low - price competition.

- Europe: Stringent regulations are driving electrification. However, cost pressures have led some carmakers to reduce their offerings of low - priced models.

- North America: Tesla maintains a strong advantage. Traditional automakers are leveraging electric pickups (e.g., Ford’s F - 150 Lightning) to break through.

2. New Business Models

- CaaS: Car - as - a - Service, including pay - as - you - go rentals and car - sharing, is gaining popularity. Automakers are transforming into mobility service providers. However, rolling out these services on a large scale requires substantial capital.

- BaaS: With Battery - as - a - Service, users rent batteries when buying cars, which reduces the purchase price. An example is NIO. But as with CaaS, this model also demands significant capital.

Challenges and Risks

- Cost Pressures

Price fluctuations of raw materials (e.g., lithium), local chip shortages, and substantial investments in green transition are straining costs.

- Technological Uncertainty

There's competition between hydrogen fuel cell (e.g., Toyota Mirai) and pure EV pathways, and solid - state battery commercialization is slower than hoped.

- Regulations and Geopolitics

Data security laws (e.g., the EU's GDPR) restrict cross - border data flows for autonomous driving. Trade barriers (e.g., the US Inflation Reduction Act) are disrupting global strategies.

4. Talent Gaps

There's a shortage of software engineers and battery chemists, while the demand for traditional mechanical manufacturing roles is declining.

Opportunities and Strategic Recommendations

1. Seize the Electrification Window

Invest in battery tech (e.g., sodium-ion batteries) and charging networks (e.g., supercharging stations).

2. Build a Software Ecosystem

Develop in-house operating systems (e.g., Volkswagen's VW.OS) and collaborate with tech firms on smart cockpits.

3. Create a Resilient Supply Chain

Partner with mining companies to secure resources (e.g., CATL's lithium mine acquisition) and set up regional battery - recycling systems.

- Embrace the Circular Economy

Design easily dismantled vehicles (e.g., BMW’s i Vision Circular concept) and promote closed - loop material regeneration.

Conclusion

In 2025, automotive manufacturing will be marked by "electrification, intelligence, regionalization, and sustainability". Success will depend on the speed of technological updates and supply chain resilience.

- Winners: Winners will be those who achieve vertical integration, such as Tesla's control over battery production, embrace a software - defined vehicle ecosystem, and have flexible regional supply chains.

- Risks: Traditional automakers slow to transform and reliant on combustion - engine profits, along with smaller suppliers lacking core technologies, face elimination.

The next two years will be a key time for car - makers to adjust strategies. Only those who innovate in "technology + model + ecosystem" can survive and thrive in the global reshuffle.

In the end, oil and electric vehicles will likely coexist rather than one replacing the other. But reaching this balance will take time. During this three - to - ten - year competition, some companies will struggle or be eliminated, while others will make huge profits.

Auto parts manufacturing company Shaoyi

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —