Stamping Die Supplier Secrets: What They Won't Tell You Before Signing

What a Stamping Die Supplier Actually Does

When you hear the term "stamping die supplier," you might picture a company that simply ships metal tools to manufacturers. But here's what most buyers don't realize: your die supplier essentially controls the DNA of every part rolling off your production line. Think about it—every stamping die is a unique precision tool designed to cut and shape metal sheets into specific forms, and the company providing that tool directly influences your quality, costs, and production timelines.

A stamping die supplier does far more than manufacture and deliver tooling. They engineer solutions, troubleshoot production challenges, and often become long-term partners in your manufacturing success. Understanding what they actually do—and how their capabilities vary—can mean the difference between seamless production runs and costly downtime.

The Foundation of Precision Metal Forming

So how does a stamping die actually work? Imagine a powerful press forcing a specially hardened tool into a sheet of metal. The die stamp creates a controlled deformation, transforming flat material into precisely shaped components. This cold-forming process doesn't intentionally apply heat, yet the friction involved often leaves finished parts quite warm.

According to Dieco's technical resources, stamping dies contain cutting and forming sections typically made from hardenable tool steel or hard wear-resistant materials like carbide. These sections must withstand tremendous pressure and repeated use—sometimes producing millions of identical parts from a single die set.

Every stamping die relies on core components working in harmony:

- Die Plates (Shoes/Sets): The foundation where all other components mount, typically manufactured from steel or lightweight aluminum alloys

- Die Punches: The tools that press into metal to bend or pierce holes, available in round, oblong, square, and custom nose shapes

- Die Buttons: The punch counterparts providing the opposite cutting edge, offset slightly larger to create the "die break" for clean cuts

- Guide Pins and Bushings: Precision components manufactured to tolerances within .0001" that align upper and lower die plates accurately

- Stripper Plates: Components that hold metal sheets in position and strip material from punches after each stroke

- Die Springs: High-force compression springs—either mechanical or nitrogen gas—providing the force needed during forming operations

Why Die Supplier Selection Shapes Production Success

Here's what separates adequate suppliers from exceptional ones: the precision relationship between the press and die determines everything downstream. When punch press dies are engineered correctly, you'll see consistent part quality, minimal scrap rates, and predictable maintenance schedules. When they're not? You're looking at production delays, quality rejections, and escalating costs.

Consider this: a die tool manufactured with tight tolerances produces parts meeting strict quality standards every time. Even slight dimensional deviations in automotive applications can cause sealing failures, water leaks, and reduced fuel efficiency. Your supplier's engineering capabilities directly impact whether your parts pass inspection or become expensive scrap.

The best stamping die suppliers bring more than manufacturing capacity to the table. They offer design consultation, advanced simulation capabilities, prototyping expertise, and ongoing technical support. As you'll discover throughout this guide, evaluating these capabilities before signing any agreement could save you significant headaches—and money—down the road.

Types of Stamping Dies and Their Manufacturing Applications

Ever wondered why some stamping projects cost significantly more than others—even when the part looks relatively simple? The answer often lies in die selection. Choosing the wrong die type for your application is one of the most expensive mistakes manufacturers make, yet it's rarely discussed before contracts are signed. Understanding how progressive die stampings, transfer dies, compound dies, and single-station dies differ gives you leverage when negotiating with any stamping die supplier.

Each die type operates on fundamentally different principles, making them suited for distinct production scenarios. Let's break down exactly how each works so you can evaluate whether your supplier's recommendations actually match your project requirements.

Progressive Dies for High-Volume Efficiency

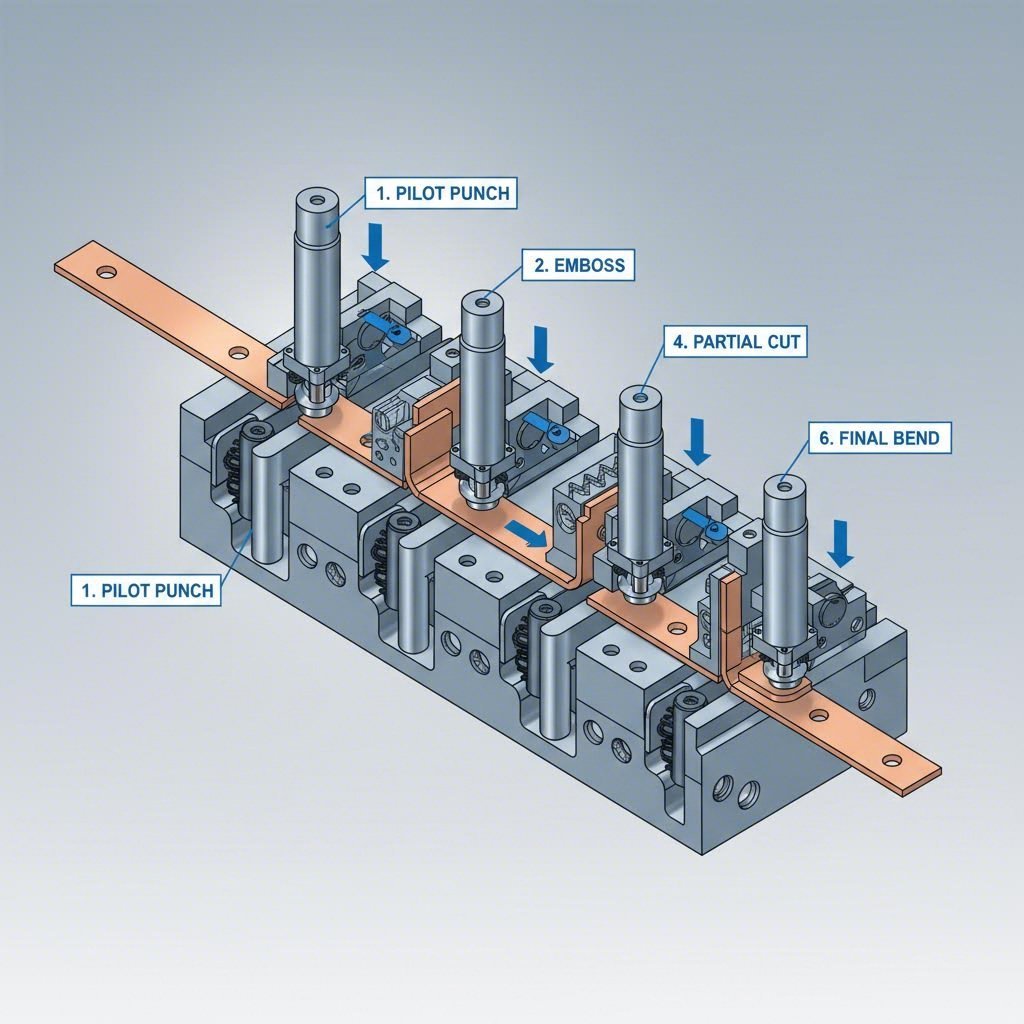

Imagine an assembly line compressed into a single tool. That's essentially what a progressive die accomplishes. According to Layana's technical documentation, a prog die transforms flat metal strips from steel coils into complex parts through a series of stations within one tool. With each press stroke, the strip advances to the next station, where different operations—blanking, piercing, bending, chamfering—progressively shape the metal.

Here's the key advantage: multiple operations occur simultaneously during each stroke. While one section of the strip is being bent, another section is being pierced, and yet another is being cut. This multi-tasking capability enables manufacturers to produce thousands of parts per hour, making die sets of this type ideal for high-volume production environments.

Progressive dies excel when you need:

- Production volumes exceeding 10,000 parts

- Complex geometries requiring multiple operations

- Tight tolerances with high repeatability

- Minimal labor costs through automation

However, progressive stamping dies require significant upfront tooling investment. They're also not suitable for parts requiring deep drawing or designs too large to feed through as continuous strips. If your supplier recommends a progressive die for a 500-piece prototype run, that's a red flag worth questioning.

Transfer and Compound Die Applications

What happens when your part design can't remain attached to a metal strip throughout production? That's where transfer die stamping enters the picture. Unlike progressive operations, transfer dies separate each part from the base material as the first operation. Mechanical "fingers" then transport individual pieces through multiple stations for subsequent forming operations.

Transfer dies shine for applications requiring deep drawing, intricate features like knurls or threading, and tube manufacturing. As Engineering Specialties notes, because no metal strip remains attached, the press can punch as deep as the raw material allows—a capability progressive dies simply can't match.

Compound dies take a different approach entirely. Rather than performing operations sequentially across multiple stations, a blanking die and forming die combination executes multiple cuts, punches, and bends in a single stroke. This makes compound stamping dies exceptionally fast for producing simple flat parts like washers, where speed matters more than geometric complexity.

Single-station dies represent the simplest option—one tool performing one operation per stroke. They're cost-effective for low-volume production and straightforward designs, though efficiency drops significantly when multiple simple dies must be used sequentially.

| Die Type | Production Volume | Complexity Capability | Cost Considerations | Typical Applications |

|---|---|---|---|---|

| Progressive Die | High volume (10,000+ parts) | Complex geometries; multiple operations | High tooling cost; low per-part cost at volume | Automotive brackets, electronics connectors, appliance components |

| Transfer Die | Medium to high volume | Deep draws; intricate features (knurls, ribs, threading) | Moderate tooling; higher handling requirements | Tube applications, deep-drawn housings, complex 3D shapes |

| Compound Die | Medium to high volume | Simple flat parts; limited geometry | Lower tooling than progressive; fast cycle times | Washers, flat gaskets, simple blanked parts |

| Single-Station Die | Low volume; prototypes | Single operation per stroke | Lowest tooling cost; higher per-part cost | Short runs, simple cuts or bends, prototype validation |

When evaluating proposals from progressive die manufacturers or any tooling supplier, ask specifically why they're recommending a particular die type for your project. A knowledgeable partner will explain how your production volume, part geometry, and material requirements influenced their recommendation—not just quote you a price.

Understanding these fundamental differences positions you to recognize when a supplier's suggestion aligns with your actual needs versus when they might be steering you toward their preferred manufacturing method. This knowledge becomes especially valuable when we examine how different die materials interact with specific workpiece metals.

Material Compatibility in Die Selection

Here's something most suppliers won't volunteer during initial discussions: the wrong die material paired with your workpiece metal can slash tool life by 50% or more. While your quote might look competitive on paper, hidden costs emerge when steel dies wear prematurely against abrasive stainless steel or when carbide tooling cracks because it wasn't suited for your application. Understanding material compatibility transforms you from a passive buyer into an informed negotiator.

According to the ASM Handbook on Sheet Forming, selecting materials for press-forming dies requires evaluating production variables including workpiece material properties, expected run volumes, and the specific forming operations involved. Let's decode what this means for your metal stamping dies projects.

Matching Die Materials to Your Production Metals

Think of die making as matchmaking—the relationship between your tooling material and workpiece metal determines whether you'll enjoy a long, productive partnership or face constant maintenance headaches. Different workpiece materials present unique challenges that demand specific die material solutions.

Soft metals like aluminum and copper alloys are forgiving on tooling but create different problems. Aluminum tends to gall (stick to die surfaces), requiring die materials with excellent surface hardness or specialized coatings. Copper and brass, while highly formable, can cause adhesive wear on softer tool steels. Sheet metal dies handling these materials benefit from hardened surfaces that resist material transfer.

Harder workpiece materials tell a different story. Stainless steel and high-strength low-alloy steels aggressively wear die surfaces through abrasion. Sheet metal stamping dies processing these metals require tougher, more wear-resistant materials—often carbide inserts at critical wear points. Without proper material matching, you'll find yourself replacing or reconditioning dies far more frequently than your supplier initially estimated.

Steel Grade Selection for Optimal Die Performance

Tool steel grades form the backbone of most metal die applications, but not all steels perform equally across every situation. As noted in JV Manufacturing's technical guidance, hardened tool steel and carbide are commonly used in progressive die construction because they offer enhanced strength and wear resistance for high-performance applications.

Here's a practical breakdown of common die materials and their ideal pairings:

- A2 Tool Steel: Good toughness and moderate wear resistance; works well with mild steel and aluminum in medium-volume applications

- D2 Tool Steel: Higher wear resistance than A2; suitable for harder workpiece materials like stainless steel in higher volumes

- M2 High-Speed Steel: Excellent heat resistance; ideal for high-speed operations with consistent material properties

- Carbide Inserts: Maximum wear resistance; essential for abrasive materials like stainless steel or high-volume production exceeding 500,000 parts

- Bronze Alloys: Used in specific forming applications where reduced friction matters more than hardness

| Workpiece Material | Recommended Die Material | Key Considerations | Expected Die Life (Relative) |

|---|---|---|---|

| Mild Steel | A2 or D2 Tool Steel | Balance cost with wear resistance; coatings extend life | High |

| Stainless Steel | D2 Tool Steel or Carbide | Highly abrasive; requires maximum hardness at cutting edges | Moderate (without carbide) |

| Aluminum | A2 Tool Steel with coating | Galling risk; polished surfaces and TiN coatings reduce adhesion | High (with proper coating) |

| Copper/Brass | D2 Tool Steel or Bronze | Adhesive wear concerns; surface treatments help | High |

| High-Strength Steel | Carbide Inserts | Extreme wear; steel dies require frequent maintenance | Low (without carbide) |

The total cost of ownership extends far beyond initial die purchase price. Steel stamping dies made from premium materials cost more upfront but often deliver dramatically lower per-part costs over their lifetime. When evaluating quotes, ask your supplier specifically which tool steel grades they're recommending and why. A transparent partner will explain how their material selection balances your production volume, workpiece hardness, and budget constraints.

Steel dies represent just one piece of the puzzle. Surface treatments like titanium nitride (TiN) coating, nitriding, and chrome plating can significantly extend die life regardless of base material—especially when processing galling-prone metals like aluminum. These treatments add cost but frequently pay for themselves within the first major production run.

With material compatibility fundamentals in place, the next critical question becomes: what does the actual die manufacturing process look like, and what should you expect at each stage?

The Stamping Die Manufacturing Process Explained

What is die manufacturing, really? Most buyers receive quotes, approve designs, and eventually receive tooling—but the black box between those milestones remains frustratingly opaque. Understanding the complete die manufacturing workflow transforms you from a passive recipient into an engaged partner who can identify potential problems before they become expensive delays. When you know what happens at each stage, you can ask smarter questions and hold your stamping die supplier accountable.

The journey from concept to production-ready die tooling typically spans 8 to 16 weeks, depending on complexity. But here's what suppliers rarely explain upfront: your involvement at specific checkpoints dramatically impacts both timeline and final quality. Let's walk through exactly what happens—and what you should expect—at each phase.

From Concept to Production-Ready Tooling

Every successful tool and die manufacturing project follows a structured sequence. Skip a step, and problems compound downstream. Rush the early phases, and you'll pay for it during production. According to manufacturing workflow experts at Alsette, buyers who stay engaged at each key stage get better results, faster timelines, and fewer headaches.

Here's the complete die machining and fabrication workflow you should expect:

- Design Consultation and DFM Analysis (1-2 weeks): This initial phase sets the tone for your entire project. Your supplier reviews your part drawings, material specifications, tolerances, and intended application. The Design for Manufacturability (DFM) analysis identifies potential issues—features that are difficult to stamp, tolerances that require special tooling, or designs that could be simplified without sacrificing function. Expect your supplier to ask detailed questions about production volumes, material grades, and end-use requirements. If they don't ask questions, consider that a warning sign.

- CAE Simulation and Engineering Analysis (1-3 weeks): Before cutting any steel, sophisticated suppliers run Computer-Aided Engineering simulations to virtually test the stamping process. This digital twin approach predicts material flow, identifies potential thinning or cracking zones, and optimizes die geometry. As noted in Jeelix's progressive die guide, this predictive capability evolves tooling development from "build-and-test" into a "predict-and-optimize" scientific paradigm—potentially saving weeks of physical trial-and-error.

- Prototype Development and Design Approval (2-3 weeks): With simulations validated, detailed die designs are created. You should receive 3D models or detailed drawings for approval. Some suppliers offer soft-tooled prototypes for initial part validation before committing to hardened production tooling. This checkpoint is your last opportunity for design changes without significant cost implications.

- Tool Fabrication and Die Machining (4-8 weeks): This is where die for manufacturing concepts become physical reality. CNC machining centers cut die blocks, wire EDM creates intricate profiles, and grinding operations achieve final tolerances. Heat treatment hardens critical components. Assembly integrates punches, die buttons, guide systems, and springs into functional tooling. Timeline varies significantly based on die complexity—a simple compound die might take 4 weeks while a complex progressive die with 20+ stations could require 8 weeks or more.

- Testing and Validation (1-2 weeks): Initial tryouts (T0) test basic functionality—does the strip feed correctly? Do parts eject cleanly? First-article parts are measured against specifications. Subsequent trials (T1, T2) refine settings and verify dimensional stability across multiple production runs. Your involvement here matters: reviewing trial samples and measurement reports before final approval prevents problems during mass production.

- Production Release and Documentation (1 week): With validation complete, the die receives final approval for production use. Documentation packages typically include maintenance schedules, spare parts lists, setup parameters, and inspection criteria. This package becomes essential for ongoing tool and die repair and maintenance throughout the die's lifecycle.

The Engineering Review Process

Sounds complex? It should—because quality die manufacturing genuinely is complex. But here's the secret most suppliers won't share: your active participation at three critical review points can compress timelines and prevent costly revisions.

Review Point 1: DFM Confirmation. Don't just send drawings and disappear. As manufacturing specialists emphasize, ten minutes of video conferencing with engineers during DFM can save ten days later. Confirm material specifications, discuss tolerance priorities, and clarify how parts will be used in final assembly.

Review Point 2: Simulation Results. Ask to see CAE analysis outputs. Where does the simulation predict material thinning? How confident is the engineering team in forming success? Suppliers using advanced simulation should be able to show you predicted stress distributions and material flow patterns.

Review Point 3: Trial Sample Approval. Never approve production release based solely on photos. Request dimensional reports, inspect sample parts when possible, and verify that critical features meet specifications. Whether you visit the facility or review detailed measurement data remotely, your feedback at this stage prevents running thousands of out-of-spec parts.

Throughout this process, communication frequency indicates supplier quality. Partners who proactively share progress updates, flag potential issues early, and invite your input at decision points typically deliver better outcomes than those who go silent between order placement and shipment notification.

With a clear understanding of how dies are manufactured, the next consideration is how requirements differ across industries—because an automotive bracket and a medical device connector demand fundamentally different approaches despite similar basic processes.

Industry-Specific Stamping Die Requirements

Here's a reality many stamping die suppliers won't mention during your initial conversations: the die that works perfectly for automotive brackets might fail spectacularly in medical device production. Industry-specific requirements go far beyond part geometry—they dictate certification standards, tolerance expectations, material choices, and even how your supplier documents their processes. Understanding these differences before signing any agreement positions you to evaluate whether a supplier genuinely matches your industry's demands or is simply telling you what you want to hear.

Think about it this way: would you trust an automotive stamping die supplier to produce components for an implantable medical device without verifying their medical certifications? The technical capabilities might overlap, but the quality systems, documentation requirements, and regulatory frameworks are worlds apart. Let's explore what each major industry actually demands from precision die and stamping operations.

Automotive Sector Precision Requirements

Automotive manufacturing represents one of the most demanding environments for progressive die metal stamping operations. Volume expectations are staggering—a single vehicle model might require millions of stamped components annually, each one meeting identical specifications. When you're producing body panels, structural brackets, or transmission components, consistency isn't just desirable; it's mandatory.

According to Master Products' certification documentation, IATF 16949:2016 certification creates a baseline for quality expectations when contracting automotive metal stamping projects. This certification, originally drafted by the International Automotive Task Force in 1999, aims to harmonize quality assessment systems across the global automotive industry. The three primary aims focus on improving product quality and consistency, establishing reliable supply chains through "supplier of choice" status, and integrating seamlessly with ISO certification standards.

What does IATF 16949 certification actually mean for your automotive stamping dies project? The literature emphasizes defect prevention, minimizing production variances, and reducing scrap and waste. Suppliers holding this certification have demonstrated:

- Robust process controls preventing dimensional drift during high-volume runs

- Advanced measurement systems capable of detecting variations before they become defects

- Documented procedures for material traceability from raw stock through finished parts

- Customer-focused quality systems addressing unique production needs and expectations

Typical tolerances for automotive stamping dies range from ±0.1mm to ±0.05mm for critical dimensions, though structural safety components often demand tighter controls. Progressive die manufacturers serving automotive OEMs must demonstrate not just capability but consistency across millions of production cycles.

Medical Device and Electronics Tolerances

If automotive tolerances sound demanding, medical device manufacturing operates in an entirely different precision universe. As Hobson & Motzer's technical analysis explains, precision is paramount in medical device manufacturing—from surgical instruments to complex endoscopic stapling devices and robotic surgical systems. The quality and accuracy of stamped components directly impacts performance, safety, and most importantly, patient outcomes.

Medical applications require ISO 13485 certification, a quality management system specifically designed for medical device manufacturers. Unlike general industrial certifications, ISO 13485 emphasizes:

- Risk management throughout the product lifecycle

- Stringent documentation of design controls and validation

- Complete traceability of materials and processes

- Validation of manufacturing processes affecting product quality

Tolerances in medical device stamping frequently reach ±2-5 microns for critical features. According to Alicona's precision die manufacturing guide, industries like medical technology require much tighter tolerances than general applications, with orthopedic screws and implant components demanding flawless dimensional accuracy to meet safety standards.

Electronics manufacturing presents similar precision challenges. Micro-connectors, semiconductor lead frames, and shielding components often require tolerances matching medical specifications. High-speed progressive die operations produce millions of identical parts where even microscopic variations cause assembly failures or electrical performance issues.

The biocompatible material requirements add another complexity layer. Medical stamping operations frequently work with various grades of stainless steel, titanium alloys, and specialty materials requiring specific handling and documentation. Custom metal stamping dies for medical applications must accommodate these materials while maintaining precision throughout extended production runs.

Aerospace and Consumer Goods Considerations

Aerospace stamping occupies unique territory between automotive volumes and medical precision. Components must withstand extreme conditions—temperature cycling, vibration, and stress loads that would destroy ordinary parts. Certifications like AS9100 govern aerospace suppliers, requiring documented process controls and material certifications exceeding standard industrial requirements.

Thread rolling dies for aerospace fasteners, as noted in precision manufacturing research, demand exceptional durability because they cold-form threads under extreme pressure. The resulting threads are stronger than cut threads because the grain structure flows with the shape rather than being severed. This specialized capability illustrates how automotive stamping die expertise doesn't automatically transfer to aerospace applications.

Consumer goods manufacturing typically operates at the opposite end of the tolerance spectrum. While precision matters, cost optimization often takes priority. High-volume appliance components, furniture hardware, and decorative trim pieces may accept tolerances of ±0.2mm or larger. The emphasis shifts toward cycle time reduction, material efficiency, and die longevity rather than micrometer-level precision.

| Industry Sector | Typical Tolerances | Required Certifications | Volume Expectations | Material Preferences |

|---|---|---|---|---|

| Automotive | ±0.05mm to ±0.1mm | IATF 16949, ISO 9001 | High (100,000+ annually) | Mild steel, HSLA, aluminum alloys |

| Medical Devices | ±2-5 microns (critical features) | ISO 13485, FDA compliance | Medium to high | Stainless steel, titanium, biocompatible alloys |

| Electronics | ±0.01mm to ±0.05mm | ISO 9001, industry-specific | Very high (millions annually) | Copper alloys, phosphor bronze, beryllium copper |

| Aerospace | ±0.025mm to ±0.075mm | AS9100, Nadcap (processes) | Low to medium | Titanium, Inconel, aerospace aluminum |

| Consumer Goods | ±0.1mm to ±0.3mm | ISO 9001 (typical) | High volume, cost-driven | Cold-rolled steel, aluminum, stainless |

When evaluating potential suppliers, match their certification portfolio to your industry requirements. A supplier boasting IATF 16949 certification demonstrates automotive capability but may lack the documentation systems required for medical devices. Conversely, an ISO 13485-certified medical specialist might struggle with the volume demands and cost pressures of automotive production.

Ask specifically about experience within your industry sector. How many similar projects have they completed? Can they provide references from comparable applications? What percentage of their current production serves your industry? These questions reveal whether a supplier genuinely understands your industry's unique demands or simply claims broad capability without specialized expertise.

Understanding industry-specific requirements prepares you to evaluate suppliers more effectively. But knowing what certifications matter is just the beginning—the next step is developing a comprehensive framework for assessing a supplier's actual technical capabilities and quality systems.

How to Evaluate Stamping Die Suppliers

You've identified your industry requirements, understood die types, and grasped material compatibility fundamentals. Now comes the critical decision: which stamping die supplier actually deserves your business? Here's the uncomfortable truth—most supplier evaluation processes focus on the wrong criteria. Buyers compare quoted prices, check a few references, and hope for the best. Meanwhile, the factors that genuinely determine project success often go unexamined until problems surface.

Think of supplier evaluation like hiring for a critical position. Would you select a candidate based solely on salary expectations and a quick reference check? Of course not. You'd evaluate skills, verify credentials, assess cultural fit, and test problem-solving capabilities. Your die maker partnership deserves the same rigor. A comprehensive evaluation framework protects you from suppliers who overpromise and underdeliver—while identifying partners who genuinely match your technical and operational requirements.

Technical Capability Assessment Criteria

When evaluating a tool & die shop, technical capability assessment goes far beyond asking "can you make this part?" According to comprehensive supplier selection guidance, a supplier's equipment list directly indicates their capabilities—but you need to look beyond just the number of presses. The type and tonnage of their presses determine the size, thickness, and complexity of parts they can produce.

Start your evaluation with these engineering capability indicators:

- Design Engineering Resources: Does the supplier employ dedicated die designers? Can they perform Design for Manufacturability (DFM) analysis? A capable tool & die design team should identify potential issues before cutting steel—saving weeks of trial-and-error corrections.

- CAE Simulation Capabilities: Ask specifically about forming simulation software. Suppliers using advanced Computer-Aided Engineering can predict material flow, thinning zones, and potential failures before physical tryouts. This predictive capability distinguishes modern custom tool and die operations from traditional build-and-test approaches.

- Equipment and Technology: Request an equipment list showing CNC machining centers, wire EDM capabilities, grinding equipment, and press tonnage ranges. Multi-axis machining capability matters for complex die geometries. Heat treatment capacity—either in-house or through certified partners—affects both timeline and quality consistency.

- Prototyping Speed: How quickly can they produce first-article samples? Leading die maker tools include soft-tooling capabilities for rapid prototype validation. Ask specifically: "What's your typical timeline from design approval to first-article parts?" Answers ranging from 2-4 weeks indicate responsive operations; 8+ weeks suggests capacity constraints or outdated processes.

- Production Capacity and Scalability: Can the supplier meet your volume demands today and scale with future growth? Assess current capacity utilization, shift schedules, and expansion capabilities. A tool and die business running at 95% capacity may struggle to accommodate your rush orders or volume increases.

- Communication Responsiveness: How quickly do they respond to inquiries? Request a technical question during your evaluation and measure response time. Suppliers who take days to answer pre-contract questions rarely improve after you've signed. Look for dedicated project management contacts and clear escalation procedures.

Tolerance capabilities require specific verification. What precision levels should you expect? As noted in precision manufacturing research, general industrial applications typically achieve ±0.1mm tolerances, while demanding sectors require significantly tighter controls. Ask potential suppliers directly: "What tolerances do you routinely hold on progressive dies for our material type?" Request measurement reports from similar projects as evidence.

Certification and Quality System Verification

Certifications represent third-party validation of a supplier's commitment to quality processes—but not all certifications carry equal weight for your specific application. According to quality management system specialists, understanding what each certification actually requires helps you evaluate whether a supplier's credentials match your needs.

ISO 9001:2015 establishes the foundation. This internationally recognized standard confirms a supplier operates under documented quality management systems emphasizing continual improvement and customer satisfaction. Benefits include improved profitability through optimized processes, enhanced supply chain performance, and heightened organizational credibility. For general industrial applications, ISO 9001 certification provides adequate assurance of basic quality controls.

IATF 16949 builds on ISO 9001 with automotive-specific requirements. Originally developed by the International Automotive Task Force, this standard aligns quality systems across the global automotive supply chain. Key additions include advanced product quality planning (APQP), production part approval process (PPAP), and statistical process control requirements. If you're sourcing custom die components for automotive applications, IATF 16949 certification should be mandatory—not optional.

ISO 13485 addresses medical device manufacturing specifically. Unlike general industrial standards, ISO 13485 emphasizes regulatory compliance, risk management, and process validation specific to safe medical device production. The standard removes ISO 9001's emphasis on continual improvement, replacing it with focus on maintaining effective, validated processes. Medical device buyers should verify not just certification but scope—does the supplier's certification cover stamping operations specifically?

Beyond certifications, evaluate the supplier's internal quality systems:

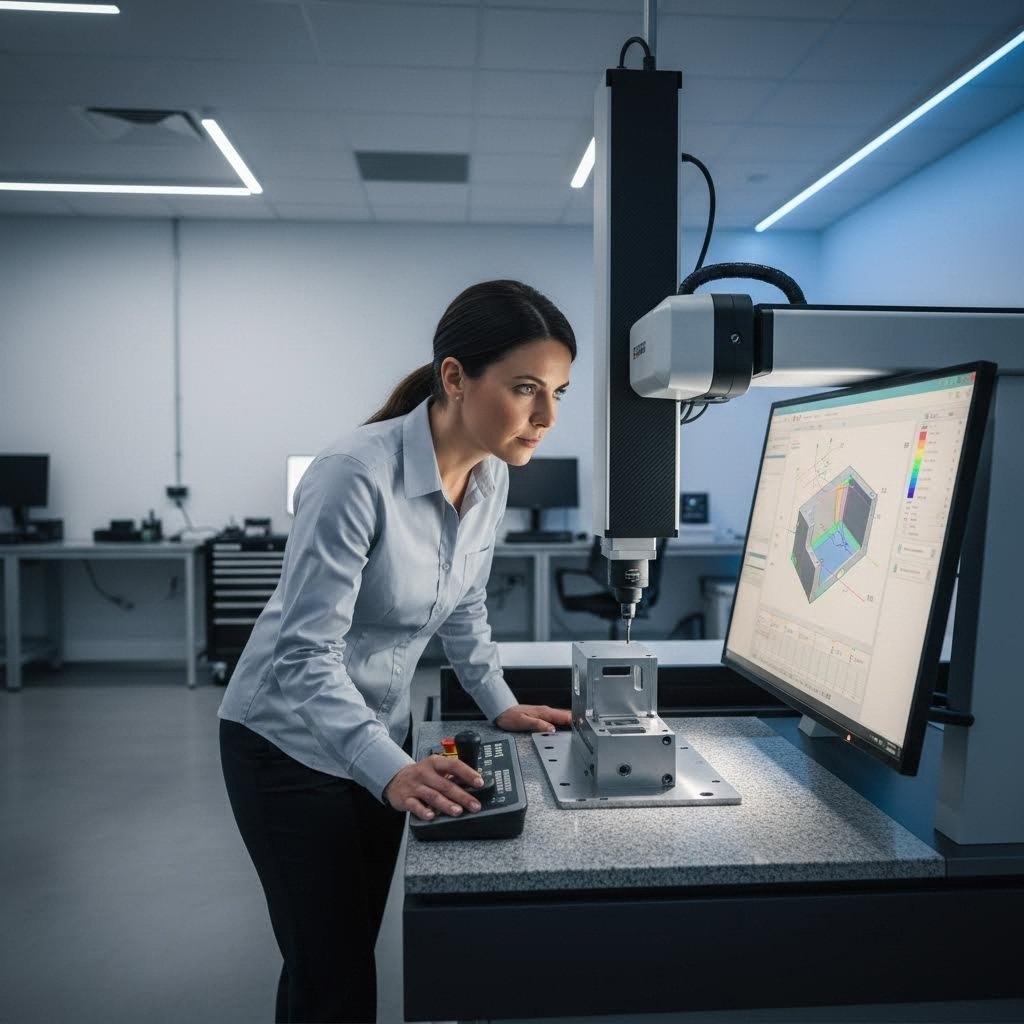

- Measurement Capabilities: What inspection equipment do they operate? Coordinate measuring machines (CMM), optical comparators, and surface finish measurement tools indicate serious quality commitment. Ask about measurement system analysis (MSA) procedures and calibration schedules.

- Statistical Process Control: Do they monitor critical dimensions throughout production runs? Real-time SPC prevents dimensional drift before parts become non-conforming. Request examples of control charts from previous projects.

- Material Traceability: Can they document material certifications from raw stock through finished dies? Complete traceability becomes essential for regulated industries and provides valuable data when troubleshooting quality issues.

- Corrective Action Systems: How do they handle non-conformances? Robust CAPA (Corrective and Preventive Action) procedures indicate organizational maturity. Ask for examples of how they've addressed quality issues on previous projects.

The lowest price rarely represents the best value in die shops or any precision manufacturing environment. True value emerges from suppliers who combine technical capability with robust quality systems and responsive communication. When evaluating potential partners, assign weighted scores to each criterion based on your priorities—then let objective data guide your decision rather than sales presentations or gut feelings.

Technical capabilities and certifications matter enormously, but they don't tell the complete story. Your next consideration should address a decision many buyers face: whether to source tooling domestically or pursue international supplier options—each approach carrying distinct advantages and hidden costs.

Domestic Versus International Supplier Considerations

Here's a decision most buyers agonize over but rarely discuss openly: should you source your tooling dies from a domestic tool and die company or pursue international options? The quoted price difference can seem compelling—international suppliers often present unit costs 30-50% lower than domestic alternatives. But here's what those attractive quotes don't reveal: the true total cost of ownership frequently tells a completely different story.

This isn't a simple "domestic good, international bad" equation. Both approaches offer legitimate advantages depending on your production requirements, risk tolerance, and operational priorities. Understanding the full picture—including factors suppliers rarely volunteer—positions you to make decisions based on business reality rather than incomplete price comparisons.

Lead Time and Communication Considerations

Imagine this scenario: your production line stops because a die press component failed unexpectedly. You need replacement tooling urgently. With a domestic supplier, you might have new components within days. With an international partner, you're looking at weeks—plus shipping delays, customs clearance, and potential quality verification upon arrival.

According to Monroe Engineering's sourcing analysis, domestic sourcing typically offers faster shipping times, reducing the wait between order placement and receipt of parts. Additionally, it streamlines communication due to time zone alignment and shared language. These advantages become critical when problems arise—and in precision manufacturing, problems inevitably arise.

Communication challenges with international die shops extend beyond simple language barriers:

- Time Zone Gaps: A 12-hour difference means your urgent morning email might not receive a response until your next business day—effectively adding 24+ hours to every clarification cycle

- Technical Translation Issues: Engineering terminology doesn't always translate precisely, creating risks of misunderstood specifications or tolerance interpretations

- Cultural Communication Styles: Direct problem acknowledgment varies across cultures; issues may be downplayed rather than escalated promptly

- Limited Face-to-Face Interaction: Video calls help, but nothing replaces standing at a press dies machine reviewing samples with your engineering team

Domestic tool and die companies eliminate most communication friction. Same-day responses, site visits measured in hours rather than international flights, and shared engineering standards create collaborative relationships that accelerate problem resolution.

Total Cost of Ownership Analysis

That attractive international quote? It represents perhaps 40% of your actual costs. As logistics specialists emphasize, a myth of globalization is that low production labor costs means the total cost of the finished product will also be low. The costs of accommodating complexity, variability, and constraints in global supply chains can add up to more than total landed costs.

Consider these often-overlooked cost factors when evaluating international versus domestic sourcing:

Pros of Domestic Sourcing

- Faster lead times reducing inventory carrying costs and production delays

- Simplified logistics with predictable shipping costs and timelines

- No import tariffs, customs duties, or brokerage fees

- Easier quality verification through site visits and real-time communication

- Stronger intellectual property protection under familiar legal frameworks

- Rapid emergency response when production issues arise

- Reduced currency exchange risk and payment complexity

Pros of International Sourcing

- Lower base manufacturing costs—particularly labor-intensive operations

- Access to specialized capabilities not available domestically

- Larger supplier pool offering more competitive bidding

- Potential volume capacity exceeding domestic availability

- Geographic diversification reducing regional risk concentration

Cons of Domestic Sourcing

- Higher quoted unit prices for equivalent tooling

- Potentially limited capacity during high-demand periods

- Smaller supplier pool in specialized niches

Cons of International Sourcing

- Extended lead times—often 8-16 weeks versus 4-8 weeks domestically

- Shipping cost volatility (container rates fluctuated from $2,500 to $14,000+ during recent disruptions)

- Quality consistency challenges requiring additional inspection protocols

- Intellectual property risks—as international manufacturing attorneys note, the most common risks include IP theft and suppliers becoming direct competitors

- Complex customs regulations adding administrative burden and potential delays

- Limited recourse when disputes arise across international jurisdictions

To calculate true total cost of ownership beyond unit pricing, build a comprehensive framework including:

- Landed Costs: Negotiated price plus shipping (all modes), customs brokerage, tariffs, insurance, and bank fees

- Inventory Carrying Costs: Extended lead times require larger safety stock—calculate carrying costs at 20-30% of inventory value annually

- Quality Assurance Expenses: International sourcing often requires third-party inspections, adding $500-2,000+ per order

- Communication Overhead: Engineering time spent clarifying specifications, reviewing samples, and managing timezone challenges

- Risk Premiums: Factor potential costs of quality failures, delivery delays, and worst-case supply disruptions

- Intellectual Property Protection: Legal costs for international trademark registration and enforceable NNN agreements

When total cost of ownership is calculated comprehensively, the 30-50% unit price advantage of international sourcing frequently shrinks to single digits—or disappears entirely.

The right choice depends on your specific situation. High-volume, stable production with long planning horizons may justify international sourcing despite complexity. Time-sensitive projects requiring flexibility, rapid iteration, or stringent IP protection typically favor domestic partnerships. Many manufacturers adopt hybrid strategies—domestic suppliers for critical or time-sensitive tooling, international sources for standardized, high-volume components.

Whatever your sourcing decision, the final piece of the puzzle involves building lasting supplier relationships that deliver consistent value over time—transforming transactional purchases into strategic partnerships.

Building a Successful Stamping Die Supplier Partnership

You've evaluated technical capabilities, verified certifications, and analyzed total cost of ownership. Now comes the part that separates good sourcing decisions from great ones: transforming your selected supplier into a genuine strategic partner. Here's the reality most buyers discover too late—the contract signing isn't the finish line. It's the starting point for a relationship that will either multiply your production efficiency or drain resources through constant friction.

Think about your most successful business relationships. They didn't happen by accident. They developed through intentional collaboration, clear expectations, and mutual investment in shared outcomes. Your stamping die supplier partnership deserves the same deliberate approach. According to supply chain optimization research, you need more than a supplier—you need a strategic partner who understands every nuance of the process and demonstrates unwavering service commitment.

Establishing Productive Supplier Relationships

What separates transactional purchases from strategic partnerships? Engagement depth. As co-engineering specialists emphasize, the prototype and pre-production phase of manufacturing cannot happen without genuine partnership. Suppliers who promise honest assessments, forthright capability discussions, and consistent value delivery typically outperform those focused solely on winning orders.

Start building productive relationships with these foundational practices:

- Engage Early in Design Phases: Don't wait until drawings are finalized to involve your die tools supplier. Early collaboration on stamping die design enables DFM optimization that reduces costs and compresses timelines. Your supplier's manufacturing expertise applied during initial design stages prevents expensive revisions later.

- Establish Clear Communication Protocols: Define how often you'll communicate, through which channels, and who owns specific decisions. Weekly status updates during active projects, monthly relationship reviews during production phases, and immediate escalation paths for urgent issues create predictable workflows.

- Share Production Forecasts Transparently: Suppliers who understand your volume trajectory can plan capacity, materials, and engineering resources accordingly. Surprises create scrambles; forecasts enable preparation.

- Invest in Face-to-Face Interaction: Video calls work, but periodic site visits—both directions—build trust that digital communication cannot replicate. Seeing your supplier's operations firsthand reveals capabilities and culture that quotes never capture.

The most productive relationships involve collaborative problem-solving rather than adversarial finger-pointing when issues arise. As noted in supplier relationship management research, organizations practicing successful SRM experience improved operational efficiency, increased quality control, lower total cost of operation, and more reliable sources of supply.

Partnering for Production Excellence

Everything discussed throughout this guide—die types, material compatibility, manufacturing processes, industry requirements, and evaluation criteria—converges into one critical outcome: production excellence. Your custom metal stamping success depends on selecting partners who demonstrate the capabilities we've examined, then nurturing those relationships for continuous improvement.

What should you prioritize when finalizing supplier partnerships?

- Engineering Collaboration Depth: Partners who challenge your designs constructively—identifying manufacturability improvements and cost reduction opportunities—deliver more value than those who simply quote what you request

- Rapid Prototyping Capabilities: Speed to first-article parts accelerates your entire product development cycle; suppliers offering rapid prototyping in days rather than weeks provide significant competitive advantage

- Quality Certifications Matching Your Industry: IATF 16949 for automotive, ISO 13485 for medical devices, AS9100 for aerospace—verify that certifications align with your specific requirements

- Advanced Simulation Tools: CAE analysis capabilities predict problems before physical tryouts, reducing iterations and compressing development timelines

- Proven First-Pass Success Rates: Ask potential partners about their die assembly approval rates; high first-pass yields indicate engineering maturity and process discipline

For automotive manufacturers seeking partners who embody these criteria, Shaoyi's precision stamping die solutions demonstrate what comprehensive capability looks like in practice. Their IATF 16949 certification validates automotive-grade quality systems, while advanced CAE simulation enables defect prediction before tooling fabrication begins. With rapid prototyping timelines as short as 5 days and a 93% first-pass approval rate on progressive stamping dies, their engineering team delivers the combination of speed, precision, and reliability that production excellence demands.

Building successful supplier partnerships requires ongoing investment from both parties. Schedule regular performance reviews—not just when problems arise. Celebrate successes together and address challenges collaboratively. Share feedback openly, recognizing that your supplier's improvement directly benefits your production outcomes.

The best supplier relationships feel less like vendor transactions and more like extensions of your own engineering team.

As you move forward with supplier selection and partnership development, remember that the "secrets" revealed throughout this guide aren't really secrets at all—they're simply the questions most buyers never think to ask and the criteria most evaluation processes overlook. Armed with this knowledge, you're positioned to select precision dies partners who genuinely match your requirements, negotiate from an informed position, and build relationships that deliver sustained production value for years to come.

Frequently Asked Questions About Stamping Die Suppliers

1. What is a stamping die and how does it work?

A stamping die is a precision tool that cuts and shapes metal sheets into specific forms through cold-forming processes. It works when a powerful press forces a hardened tool (punch) into sheet metal against a die block, creating controlled deformation. Core components include die plates, punches, die buttons, guide pins, stripper plates, and die springs—all working in harmony to produce identical parts repeatedly. Quality dies from reputable suppliers like Shaoyi can produce millions of parts while maintaining tight tolerances.

2. What are the different types of stamping dies available?

Four main stamping die types serve different manufacturing needs: Progressive dies handle high-volume production (10,000+ parts) with complex geometries through multiple simultaneous operations. Transfer dies separate parts from material first, enabling deep draws and intricate features. Compound dies execute multiple operations in a single stroke, ideal for simple flat parts like washers. Single-station dies perform one operation per stroke, suitable for low-volume or prototype work. Your production volume, part complexity, and budget determine the optimal choice.

3. How do I choose the right die material for my application?

Die material selection depends on your workpiece material and production volume. A2 tool steel offers good toughness for mild steel and aluminum in medium volumes. D2 tool steel provides higher wear resistance for stainless steel applications. Carbide inserts deliver maximum wear resistance for abrasive materials or runs exceeding 500,000 parts. Surface treatments like titanium nitride coating extend die life regardless of base material. IATF 16949-certified suppliers like Shaoyi use advanced CAE simulation to recommend optimal material pairings for your specific application.

4. What certifications should I look for in a stamping die supplier?

Required certifications depend on your industry. ISO 9001 establishes baseline quality management for general industrial applications. IATF 16949 is mandatory for automotive suppliers, adding APQP, PPAP, and statistical process control requirements. ISO 13485 governs medical device manufacturing with emphasis on risk management and traceability. AS9100 covers aerospace applications. Beyond certifications, verify measurement capabilities, statistical process control practices, material traceability systems, and corrective action procedures.

5. Should I choose a domestic or international stamping die supplier?

The decision depends on your priorities beyond unit price. Domestic suppliers offer faster lead times (4-8 weeks versus 8-16 weeks), easier communication, stronger IP protection, and rapid emergency response. International suppliers may offer 30-50% lower quoted prices but add hidden costs including shipping, customs, quality verification, and inventory carrying costs. Calculate total cost of ownership—including landed costs, inventory carrying, quality assurance, and risk premiums—before deciding. Many manufacturers use hybrid strategies, sourcing critical tooling domestically while ordering standardized components internationally.

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —

Small batches, high standards. Our rapid prototyping service makes validation faster and easier —