কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের খরচ উপাদান: লুকানো ড্রেন

অটোমোটিভ এক্সট্রুশনের জন্য প্রয়োজনীয় খরচ ম্যাপ

যখন আপনি অটোমোটিভ অ্যাপ্লিকেশনের জন্য কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন সংগ্রহ করছেন, তখন কি কখনও ভেবেছেন যে দুটি প্রায় অভিন্ন অংশের খরচ এতটা আলাদা হতে পারে কেন? উত্তরটি হল যে প্রতিটি ডিজাইনের সিদ্ধান্ত, উপকরণের বিন্যাস এবং প্রক্রিয়াকরণের ধাপগুলি মোট খরচের উপর কীভাবে প্রভাব ফেলে। চলুন 2025 সালে কাস্টম অ্যালুমিনিয়াম এক্সট্রুশনের জন্য প্রকৃত "ল্যান্ডেড কস্ট" কী দিয়ে গঠিত তা বিশ্লেষণ করি এবং কেন ক্রয় সফলতার জন্য এই বিস্তারিত বিষয়গুলি বোঝা খুবই গুরুত্বপূর্ণ।

2025 সালে মোট ল্যান্ডেড খরচ কী নির্ধারণ করে

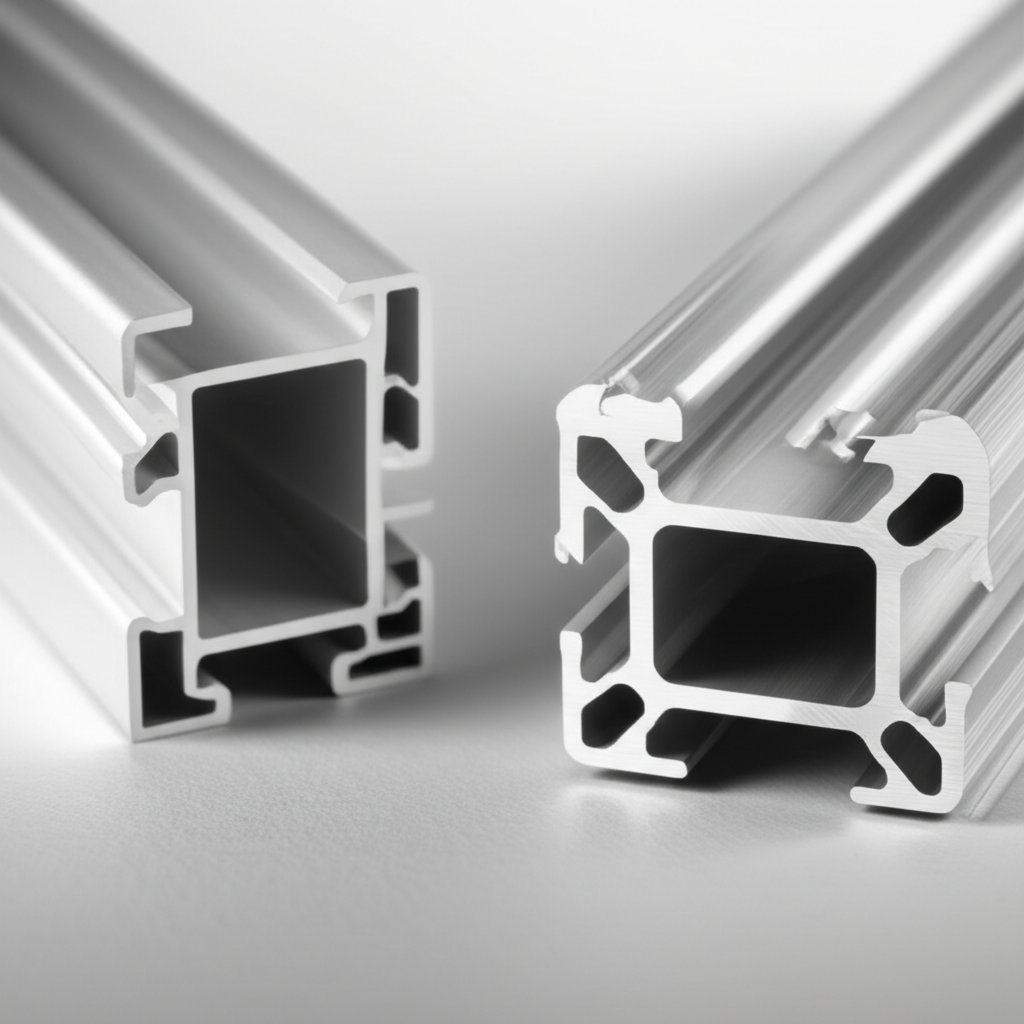

প্রথমত, কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশন কী তা পরিষ্কার করা যাক: এই প্রোফাইলগুলি সঠিক আকৃতি এবং সহনশীলতার জন্য প্রকৌশলীদের দ্বারা তৈরি করা হয়, প্রায়শই গাড়ির কাঠামোগত, তাপীয় বা ট্রিম উপাদানগুলির মূল ভিত্তি হয়ে থাকে। অফ-দ্য-শেলফ প্রোফাইলের বিপরীতে, কাস্টম অ্যালুমিনিয়াম এক্সট্রুশনগুলি নির্দিষ্ট শক্তি, ক্র্যাশওয়ার্থিনেস, NVH (শব্দ, কম্পন, কঠোরতা), ক্ষয় প্রতিরোধের এবং পেন্টযোগ্যতার প্রয়োজনীয়তা অনুযায়ী তৈরি করা হয়। অ্যালুমিনিয়ামের খরচ হল শুধুমাত্র শুরুর বিন্দু—আপনি শেষে যা পরিশোধ করবেন তা অনেকগুলি চলমান অংশের যোগফল।

- কাঁচামাল: বেস অ্যালুমিনিয়াম খরচ, বৈশ্বিক LME/SHFE দামের দ্বারা চালিত, মোট অ্যালুমিনিয়াম এক্সট্রুশন খরচের 60-75% হতে পারে। খাঁটি মিশ্রণ এবং সংকর নির্বাচনের সরাসরি প্রভাব পড়ে এখানে।

- ডাই/টুলিং: অনন্য প্রোফাইলগুলির জন্য কাস্টম ডাই প্রয়োজন। ডাইয়ের জটিলতা, গুহাগুলির সংখ্যা এবং প্রয়োজনীয় সহনশীলতা সমস্ত মুখ্য এবং প্রতি অংশের খরচকে প্রভাবিত করে।

- প্রেস সময় এবং উপজঃ এক্সট্রুশন প্রক্রিয়াটি নিজেই—প্রেসের আকার, গতি এবং উপজন হার—খরচকে প্রভাবিত করে। আরও জটিল প্রোফাইল বা কম সহনশীলতা উৎপাদনকে ধীর করে দিতে পারে এবং খুচরা অংশের পরিমাণ বাড়াতে পারে।

- সেকেন্ডারি অপারেশন এবং ফিনিশিং: যেমন নির্ভুল কাটিং, সিএনসি মেশিনিং, ডেবারিং, অ্যানোডাইজিং বা পাউডার কোটিং এর মতো পদক্ষেপগুলি খরচের অতিরিক্ত স্তর যোগ করে, বিশেষ করে অটোমোটিভ ট্রিম বা প্রকাশিত অংশগুলির জন্য।

- ঊষ্মা চিকিৎসা: যানবাহনের অনেক মিশ্র ধাতুর জন্য প্রয়োজনীয় যান্ত্রিক বৈশিষ্ট্য অর্জনের জন্য, শক্তি ব্যবহার এবং সময়সূচীকে প্রভাবিত করে।

- মান এবং পরীক্ষা: অটোমোটিভ প্রোগ্রামগুলি শক্তিশালী পরীক্ষা, ট্রেসেবিলিটি এবং নথিভুক্তির দাবি করে—যেমন পিপিএপি (প্রোডাকশন পার্ট অ্যাপ্রুভাল প্রসেস) এবং এআইএজি মান।

- প্যাকেজিং এবং লজিস্টিকঃ রপ্তানি প্যাকেজিং, কাস্টম ক্রেটিং এবং চালান ব্যয় যোগ করতে পারে, বিশেষ করে বৈশ্বিক প্রোগ্রামগুলির জন্য।

- অনুপালন এবং নথিভুক্তি: এক্সট্রুশনের জন্য এএসটিএম বি221 এবং ওইএম-নির্দিষ্ট প্রয়োজনীয়তা (যেমন এসএই, এআইএজি) পূরণ করা প্রায়শই অতিরিক্ত পরিদর্শন, প্রতিবেদন এবং ট্রেসেবিলিটি অর্থ করে—প্রতিটির খরচ প্রভাব রয়েছে ( উৎস ).

অটোমোটিভ-নির্দিষ্ট খরচ লিভার ক্রেতারা উপেক্ষা করেন

অটোমোটিভ এক্সট্রুশন শুধুমাত্র আকৃতি নিয়ে নয়—এটি চাপপূর্ণ পরিস্থিতিতে পারফরম্যান্স নিয়ে কথা বলে। উদাহরণ হিসেবে, এমন একটি অংশ যার ধাক্কা শোষণ করার শক্তি বা উচ্চ-গ্লস ফিনিশ সমর্থন করার প্রয়োজন হয়, তার জন্য ব্যয়বহুল মিশ্র ধাতু, কম মাত্রার সহনশীলতা বা অতিরিক্ত পৃষ্ঠতল চিকিত্সার প্রয়োজন হতে পারে। জটিল বক্ররেখা বা পাতলা প্রাচীর সহ ট্রিম প্রোফাইল (চিন্তা করুন ইভিতে অ্যালুমিনিয়াম এক্সট্রুশন ট্রিম) টুলিং এবং প্রক্রিয়াকরণ উভয় খরচ বাড়িয়ে দিতে পারে। নিখুঁত মান এবং সম্পূর্ণ ট্রেসেবিলিটির প্রয়োজনীয়তা প্রায়শই বেশি কঠোর পরিদর্শন এবং নথিভুক্তির দিকে ঠেলে দেয়, যা ক্রেতারা প্রায়শই কম আঁচ করেন।

লুকানো খরচ বাড়ানো মান এবং নথি

শিল্প মানগুলি না কেবলমাত্র উপাদান এবং যান্ত্রিক বৈশিষ্ট্য (ASTM B221 দেখুন) নির্ধারণে বড় ভূমিকা পালন করে, প্রয়োজনীয় পরীক্ষা এবং প্রতিবেদনের জন্যও দায়ী। অটোমোটিভ ক্রেতাদের জন্য, এর অর্থ হল প্রতিটি পদক্ষেপ—প্রাথমিক ডিজাইন থেকে শেষ পরিদর্শন—থেকে নথিভুক্ত এবং ট্রেস করা যায়। এই প্রয়োজনীয়তাগুলি, যদিও নিরাপত্তা এবং নির্ভরযোগ্যতার জন্য অপরিহার্য, অতিরিক্ত শ্রম, দীর্ঘতর সীমাবদ্ধতা এবং কখনও কখনও বিশেষজ্ঞ সরঞ্জামের মাধ্যমে মোট অ্যালুমিনিয়াম এক্সট্রুশন খরচ বাড়িয়ে দেয়।

কেবলমাত্র দামের দিকে মনোযোগ দিও না—সম্পূর্ণ খরচে উপাদান, টুলিং, প্রক্রিয়াকরণ, সমাপ্তি, মান, যানবাহন এবং মান অনুযায়ী চলা অন্তর্ভুক্ত থাকে। অদৃশ্য খরচগুলি উপেক্ষা করা কম দরপত্রকে ব্যয়বহুল অবাক করা ঘটনায় পরিণত করতে পারে।

কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের খরচের দিকগুলি পরিচালনার জন্য সরলীকৃত পদ্ধতি খুঁজছে এমন দলগুলির পক্ষে এমন সরবরাহকারীর সাথে অংশীদারিত্ব করা সম্যক যিনি প্রযুক্তিগত এবং যানবাহন সংক্রান্ত ক্ষেত্রে উভয়ের সূক্ষ্মতা বোঝেন। শাওয়ি মেটাল পার্টস সাপ্লায়ার অভিন্ন সমাধান সরবরাহ করে অ্যালুমিনিয়াম এক্সট্রুশন অংশ , আপনাকে ডিজাইন উদ্দেশ্যকে বৃহৎ আকারে ভবিষ্যদ্বাণীযোগ্য খরচে অনুবাদ করতে সাহায্য করছে। তাদের দক্ষতা নিশ্চিত করে যে প্রতিটি খরচের লিভার—উপকরণ নির্বাচন থেকে চূড়ান্ত ডেলিভারি পর্যন্ত—মূল্যের দিক থেকে অপটিমাইজ করা হয়েছে, মূল্য নয়।

মূল্য নির্ধারণে সংশ্লিষ্ট মিশ্র ধাতু এবং স্পেসিফিকেশন পছন্দ

যখন আপনি কোনও অটোমোটিভ প্রকল্পের জন্য কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন নির্দিষ্ট করছেন, তখন কি কখনও ভেবেছেন কেন একই আকৃতির দুটি অংশের মূল্য ট্যাগ এত আলাদা হতে পারে? উত্তরটি প্রায়শই মিশ্র ধাতু পরিবার, টেম্পার এবং নির্দিষ্টকরণের গভীরতার মধ্যে নিহিত থাকে—যা প্রত্যেকেই প্রত্যক্ষ উপকরণ এবং পরোক্ষ প্রক্রিয়াকরণ খরচকে তীব্রভাবে প্রভাবিত করতে পারে। আসুন দেখে নেওয়া যাক কিভাবে এই পছন্দগুলি চূড়ান্ত বিল আকারে প্রভাবিত করে, এবং কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের খরচের দিকগুলি ন্যাভিগেট করার সময় আপনার কী কী বিষয়ে সতর্ক থাকা উচিত।

মোট খরচ বিবেচনা করে মিশ্র ধাতু-টেম্পার নির্বাচন

ধরুন আপনি একটি নতুন ইভির জন্য ক্র্যাশ-শোষিত বাম্পার বিম বা একটি চকচকে অ্যালুমিনিয়াম এক্সট্রুশন ট্রিম ডিজাইন করছেন। এক্সট্রুডেড অ্যালুমিনিয়াম মিশ্র ধাতু এবং টেম্পারের নির্বাচন কেবলমাত্র যান্ত্রিক শক্তির বিষয়টি নয়—এটি পারফরম্যান্স, উত্পাদন সম্ভাবনা এবং অ্যালুমিনিয়াম এক্সট্রুশন খরচের মধ্যে ভারসাম্য রক্ষা করার বিষয়টি। অটোমোটিভ প্রোগ্রামগুলি প্রায়শই শক্তি, ক্র্যাশওয়ার্থিনেস, ক্ষয় প্রতিরোধের লক্ষ্যমাত্রা এবং পেন্ট আঠালো গুণাবলী পূরণের জন্য মিশ্র ধাতু-টেম্পার সংমিশ্রণ (যেমন 6061-T6 বা 6063-T5) নির্দিষ্ট করে থাকে। প্রতিটি সংমিশ্রণের জন্য কোয়েঞ্চ কৌশল, বয়স, মাত্রিক নিয়ন্ত্রণ এবং সম্ভাব্য খুচরা হারের নিজস্ব প্রভাব রয়েছে।

| খাদ পরিবার | যান্ত্রিক লক্ষ্য | আকৃতি দেওয়ার সুযোগ | সুরফেস ফিনিশ | ক্ষয় কৌশল | তাপ চিকিত্সা জটিলতা | এক্সট্রুশন গতি | খরচ প্রভাব |

|---|---|---|---|---|---|---|---|

| 1XXX | নিম্ন শক্তি, উচ্চ প্লাস্টিকতা | চমৎকার | ভাল | চমৎকার | ন্যূনতম | দ্রুত | নিম্ন উপকরণ এবং প্রক্রিয়া খরচ |

| 3xxx | মধ্যম শক্তি, ভালো ক্ষয় প্রতিরোধ ক্ষমতা | ভাল | ভাল | চমৎকার | ন্যূনতম | দ্রুত | নিম্ন থেকে মধ্যম |

| 5xxx | মধ্যম শক্তি, সমুদ্রের মানের ক্ষয় | ভাল | মধ্যম | চমৎকার | ন্যূনতম | মাঝারি | মাঝারি |

| 6xxx | উচ্চ শক্তি, কাঠামোগত | ভাল | চমৎকার | ভাল | মধ্যম (T5/T6 বার্ধক্য) | মাঝারি | মধ্যম থেকে উচ্চ |

| 7xxx | খুব উচ্চ শক্তি | মধ্যম | মধ্যম | ভাল | জটিল | ধীর | উচ্চ (উপকরণ এবং প্রক্রিয়া) |

মূল্য এবং প্রসবের সময়কে প্রভাবিত করা মানগুলি

অটোমোটিভ ক্রেতারা প্রায়শই এক্সট্রুডেড অ্যালুমিনিয়াম সংকর এবং টেম্পার সংজ্ঞায়িত করতে শিল্প ফ্রেমওয়ার্কগুলি উল্লেখ করেন। অ্যালুমিনিয়াম অ্যাসোসিয়েশন সিস্টেমটি প্রতিটি সংকরের জন্য একটি চার-অঙ্কের সংখ্যা এবং টেম্পারের জন্য একটি অক্ষর/সংখ্যা (যেমন, 6061-T6) নির্ধারণ করে। এরকম স্ট্যান্ডার্ডগুলি ASTM B221 মাত্রা এবং যান্ত্রিক বৈশিষ্ট্যের জন্য বেসলাইন প্রয়োজনীয়তা নির্ধারণ করে, যেখানে OEM বা SAE/AIAG স্পেসিফিকেশনগুলি সহনশীলতা আরও কঠোর করে তুলতে পারে, ক্ষয় বা রং পরীক্ষা যোগ করতে পারে এবং পরিদর্শনের বোঝা বাড়াতে পারে। প্রতিটি অতিরিক্ত প্রয়োজনীয়তা খরচ এবং সময়সীমা উভয়কেই বাড়াতে পারে—কখনও কখনও এমনভাবে যা প্রকল্পের শেষ পর্যন্ত দৃশ্যমান হয় না।

অটোমোটিভ অ্যাপ্লিকেশন এবং সংকরের তুলনা

আপনার অ্যাপ্লিকেশনের জন্য কোন ধরনের অ্যালুমিনিয়াম এক্সট্রুশন সবচেয়ে ভালো উপযুক্ত তা কি নিশ্চিত নন? এখানে বাস্তব প্রোগ্রামগুলিতে তুলনাগুলি কীভাবে কাজ করে তা দেখানো হলো:

- ক্র্যাশ স্ট্রাকচার : শক্তির জন্য 6xxx বা 7xxx সংকর, কিন্তু আরও জটিল তাপ চিকিত্সা এবং খরচ সহ।

- ট্রিম এবং সীলিং : আকৃতি দেওয়ার যোগ্যতা এবং সমাপ্তির জন্য 6063 বা 1xxx, যার ফলে খরচ কম থাকে।

- ব্যাটারি এনক্লোজার : ক্ষয় এবং ওয়েলডেবিলিটির জন্য 5xxx বা 6xxx, যা ওজন এবং বাজেটের মধ্যে ভারসাম্য রাখে।

- যোগ করার পদ্ধতি (ওয়েল্ডিং, আঠা, যান্ত্রিক) অনুযায়ী খাদ এবং টেম্পার সাজান।

- সমাপ্তির পরিকল্পনা বিবেচনা করুন (অ্যানোডাইজ, পাউডার কোট, রং)

- ক্ষয় ঝুঁকি মূল্যায়ন করুন (রাস্তার লবণ, আর্দ্রতা, গ্যালভানিক ঝুঁকি)

- পর্যায়ের শুরুতে ক্রাশ এবং NVH লক্ষ্য নির্ধারণ করুন যাতে পরবর্তী পর্যায়ে পুনরায় ডিজাইন করতে না হয়।

প্রাথমিক সরবরাহকারীর ইনপুট অপরিহার্য: সঠিক খাদ-টেম্পার বেছে নেওয়ার মাধ্যমে সরাসরি অ্যালুমিনিয়াম এক্সট্রুশন খরচ এবং পরবর্তী পর্যায়ে পুনঃকাজ করার খরচ দুটোই বাঁচানো যায়, বিশেষ করে সেসব অটোমোটিভ পরিবেশে যেখানে কার্যকারিতা এবং সমাপ্তি এড়ানো যায় না।

এই পরিবর্তনশীল বিষয়গুলি বোঝা আপনাকে তথ্যভিত্তিক সিদ্ধান্ত নিতে সাহায্য করে - এবং পরবর্তীতে আমরা যে ডাই ডিজাইন এবং টুলিং অর্থনীতি অপ্টিমাইজ করব তার জন্য প্রস্তুতি হিসেবে কাজ করে।

টুলিং অর্থনীতি এবং ডাই অ্যামোর্টাইজেশন ব্যবহারিক পদ্ধতিতে

আপনার কাছে কি কখনও মনে হয়েছে যে কেন একটি কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন ডাইয়ের প্রাথমিক মূল্য বেশি মনে হয়, কিন্তু পরিমাণ বাড়ার সাথে সাথে প্রতি পার্টের খরচ কমতে থাকে? এর উত্তর হল এক্সট্রুশন ডাইয়ের প্রকৃত অর্থনীতি বোঝা—কীভাবে ধরন, জটিলতা এবং পরীক্ষামূলক চক্রগুলি কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের খরচের কারণগুলি আকার দেয়। আসুন আসলে কী কী টুলিং খরচ নির্ধারণ করে তা বিশ্লেষণ করি এবং দেখি কীভাবে এই পর্যায়ে বুদ্ধিমান সিদ্ধান্ত আপনার প্রকল্পের বাজেটকে সফল বা ব্যর্থ করে তুলতে পারে।

এক্সট্রুশন ডাইয়ের প্রকৃত খরচ কত

এর মূলে, একটি এক্সট্রুশন ডাই হল একটি প্রিসিশন স্টিল টুল যা আপনার অ্যালুমিনিয়াম প্রোফাইলের অনুপ্রস্থ নির্ধারণ করে। কিন্তু সব ডাই এক রকম হয় না। আপনি যখন সহজ থেকে জটিলে যাবেন, এখানে আপনি যা লক্ষ্য করবেন:

- সলিড ডাই প্রোফাইলগুলির জন্য ব্যবহৃত হয় যাতে অভ্যন্তরীণ গহ্বর নেই—মৌলিক বার বা কোণগুলির কথা ভাবুন। এগুলি তৈরি করা দ্রুততর এবং কম খরচে, যা সরল অটোমোটিভ ব্র্যাকেট বা রেলগুলির জন্য আদর্শ।

- হলো বা পোর্টহোল ডাই অভ্যন্তরীণ ফাঁকা সহ টিউব এবং প্রোফাইলগুলি তৈরি করতে সক্ষম, যেমন ক্র্যাশ বিম বা HVAC ডাক্টগুলি। এই ধরনের ডাইগুলি আরও জটিল, যার জন্য ম্যান্ড্রেলগুলির প্রয়োজন হয় এবং প্রবাহ সংশ্লিষ্ট ভারসাম্য রক্ষা করতে হয়, যা প্রাথমিক এবং রক্ষণাবেক্ষণ খরচ উভয়ই বাড়িয়ে দেয়।

- বহু-কক্ষ ডাই একসাথে কয়েকটি ছোট প্রোফাইল উৎপাদন করতে পারে, ট্রিম বা স্পেসার অংশগুলির প্রতি অংশ খরচ কমিয়ে দেয়। যাইহোক, এগুলি আরও বেশি ডিজাইন কাজের প্রয়োজন হয় এবং সমস্ত কক্ষের মধ্যে স্থায়ী মান নিশ্চিত করতে পরীক্ষার চক্রগুলি দীর্ঘতর হয়।

- বিয়ারিং ডিজাইন ডাইয়ের অভ্যন্তরীণ পৃষ্ঠের দৈর্ঘ্য এবং আকৃতি—প্রবাহ, প্রস্থান গতি এবং চূড়ান্ত অংশের সঠিকতাকে সরাসরি প্রভাবিত করে। আরও জটিল প্রোফাইলগুলি প্রয়োজনীয় বিয়ারিং দৈর্ঘ্যের প্রয়োজন হয়, যা উভয় খরচ এবং পরীক্ষার সময় বাড়িয়ে দেয়।

- পৃষ্ঠ চিকিৎসা নাইট্রাইডিং বা কঠিন কোটিংয়ের মতো ডাই জীবন বাড়াতে এবং পৃষ্ঠের সমাপ্তি উন্নত করতে সাহায্য করে, কিন্তু প্রাথমিক বিনিয়োগ বাড়িয়ে দেয়।

গাড়ির প্রোগ্রামের ক্ষেত্রে, কঠোর সহনশীলতা এবং নিখুঁত পৃষ্ঠের শ্রেণির চাহিদার কারণে প্রথম উৎপাদন অংশ চালানের আগে একাধিক স্টার্টআপ পরীক্ষা এবং সমন্বয় প্রয়োজন হতে পারে, যা মোট খরচ বাড়িয়ে দেয়।

অ্যামোর্টাইজেশন টেমপ্লেটস যা ক্রয় দলগুলি ব্যবহার করতে পারে

জটিল মনে হচ্ছে? এখানে ডাই খরচ অ্যামোর্টাইজ করার একটি ব্যবহারিক পদ্ধতি রয়েছে, যার মাধ্যমে আপনি আত্মবিশ্বাসের সাথে প্রস্তাবগুলি তুলনা করতে পারবেন এবং আয়তন পরিবর্তিত হওয়ার সময় আপনার ব্যবসায়িক যুক্তির পরীক্ষা করতে পারবেন।

- নকশা এবং অনুমোদন: আপনার সরবরাহকারীর সাথে প্রোফাইল এবং সহনশীলতা প্রয়োজনীয়তা চূড়ান্ত করুন।

- ডাই উত্পাদন: টুলিং মেশিনিং, তাপ চিকিত্সা (প্রায়শই নাইট্রাইডিংয়ের সাথে) এবং ব্যাকার এবং বলস্টারগুলির সাথে সমাবেশ করা হয়।

- ট্রায়াল এক্সট্রুশন: প্রবাহ, বিয়ারিং দৈর্ঘ্য এবং পৃষ্ঠের সমাপ্তি—বিশেষ করে জটিল গাড়ির অংশগুলির জন্য একাধিক পরীক্ষামূলক চালানো হয়।

- প্রথম নমুনা যোগ্যতা: প্রোফাইলগুলি অটোমোটিভ স্পেসিফিকেশনের বিরুদ্ধে পরিমাপ এবং যাথার্থ্য যাচাই করা হয় (প্রায়শই উন্নত মেট্রোলজি এবং পিপিএপি ডকুমেন্টেশন প্রয়োজন)।

- উৎপাদন চালু করা হচ্ছে: একবার অনুমোদন করার পরে, ডাই নিয়মিত উৎপাদনে প্রবেশ করে, চলমান রক্ষণাবেক্ষণ এবং মাঝে মাঝে সংস্কার সহ।

প্রতি অংশে টুলিং খরচ = (ডাই + সেটআপ + ট্রায়ালস) ÷ পরিকল্পিত ভাল অংশ।

মোট পিস মূল্য প্রভাব = প্রতি অংশে টুলিং খরচ + প্রক্রিয়াকরণ + উপকরণ + সেকেন্ডারি অপস + মান + যোগাযোগ।

টিপস: আশা করা স্ক্র্যাপ এবং পুনর্নির্মাণের জন্য পরিকল্পিত ভাল অংশগুলি সামঞ্জস্য করুন - কোনও সরবরাহকারীকে ক্রয় করার আগে দেখুন এটি আপনার অবচয় খরচকে কীভাবে পরিবর্তিত করে।

অটোমোটিভ ক্রেতাদের সবসময় জিজ্ঞাসা করা উচিত কতগুলি স্টার্টআপ ট্রায়ালস অন্তর্ভুক্ত রয়েছে, প্রত্যাশিত ডাই লাইফ কত এবং পুনর্নির্মাণ বা সংস্কার কীভাবে করা হয়। সঠিক খরচ মডেলিংয়ের জন্য এই স্বচ্ছতা খুব গুরুত্বপূর্ণ।

ট্রায়ালস এবং পিপিএপির সময় ঝুঁকি হ্রাস করা

অটোমোটিভ প্রকল্পগুলি প্রায়শই বেশি চেষ্টা চক্র এবং উন্নত মেট্রোলজির প্রয়োজন কারণ কঠোর সহনশীলতা এবং পৃষ্ঠতল শ্রেণির প্রয়োজনীয়তা। অতিরিক্ত প্রতিটি পরীক্ষা শুধুমাত্র চালু করা বিলম্বিত করে না, বরং খরচও বাড়ায়—বিশেষ করে যদি ডাই পুনর্নির্মাণ করা হয় অথবা বিয়ারিং ডিজাইন সামঞ্জস্য করা হয়। আপনার এক্সট্রুশন অংশীদারের সাথে প্রতিক্রিয়াশীল যোগাযোগ এবং প্রাথমিক অনুকরণ (FEA বা প্রবাহ মডেলিং ব্যবহার করে) এই ঝুঁকি কমাতে পারে এবং সময়সূচি এবং বাজেট উভয়ই নিয়ন্ত্রণ করতে সাহায্য করে।

- প্রোফাইলটি কি মাল্টি-ক্যাভিটি ডাইয়ের জন্য যথেষ্ট ছোট এবং সাদামাটা, অথবা স্থিতিশীলতা এবং শীর্ষ পৃষ্ঠতলের গুণমানের জন্য একক-ক্যাভিটি প্রয়োজন?

- এই প্রোফাইল এবং পৃষ্ঠতল শ্রেণির জন্য কতগুলি স্টার্টআপ পরীক্ষা সাধারণত প্রয়োজন?

- ডাইয়ের আনুমানিক আয়ু কত এবং রক্ষণাবেক্ষণ খরচ কীভাবে মোকাবেলা করা হয়?

- সরবরাহকারী কি প্রাথমিক মূল্যের হিসাবে PPAP যোগ্যতা অন্তর্ভুক্ত করেন?

ডাই এবং টুলিং খরচ বিশ্লেষণ করে এবং বুঝতে পেরে যে কীভাবে এগুলো অবচয় হয়, আপনি তখন তথ্যসহকারে সঠিক সরবরাহ সিদ্ধান্ত নেওয়ার জন্য ভালোভাবে প্রস্তুত হবেন। পরবর্তীতে, আমরা দেখব কীভাবে এক্সট্রুশনের জন্য ডিজাইন নিয়মাবলী কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের জন্য টুলিং এবং প্রক্রিয়া খরচ কমাতে পারে।

খরচ কমানোর মতো ডিজাইন নিয়ম যা কর্মক্ষমতা কমায় না

যখন আপনি একটি নতুন অটোমোটিভ অংশের ডিজাইন করছেন, তখন কি কখনও ভেবেছেন: এমন সবচেয়ে সহজ উপায়টি কী যা দিয়ে এক্সট্রুডেড অ্যালুমিনিয়ামকে সংজ্ঞায়িত করা যাবে যাতে কর্মক্ষমতা এবং বাজেট উভয় লক্ষ্যই পূরণ হবে? উত্তরটি প্রায়শই থাকে স্মার্ট, মান ভিত্তিক এক্সট্রুশনের জন্য ডিজাইন (DfE) নিয়মগুলি প্রয়োগ করার মধ্যে। চলুন দেখি কীভাবে ছোট ছোট ডিজাইনের সিদ্ধান্ত—প্রতিসাম্য, প্রাচীরের পুরুতা, কোণাগুলি এবং আরও অনেক কিছু—কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের খরচের দিকগুলি ব্যাপকভাবে পরিবর্তন করতে পারে।

খরচ কমানোর মতো এক্সট্রুশনের জন্য ডিজাইন নিয়ম

জটিল শোনাচ্ছে? তা হতে হবে না। প্রমাণিত অ্যালুমিনিয়াম এক্সট্রুশন ডিজাইনের নির্দেশাবলী অনুসরণ করে, আপনি দ্রুত উত্পাদন, উচ্চতর উপজ, এবং নিম্ন স্ক্র্যাপ হার অর্জন করতে পারবেন—যেমন অটোমোটিভ অ্যাপ্লিকেশনগুলির কাঠামোগত বা সৌন্দর্য্য প্রয়োজনীয়তা কমাবেন না।

- সমমিতিযুক্ত প্রোফাইল: আপনার প্রোফাইল ডিজাইনে সমমিতি ডাইয়ের মধ্য দিয়ে ধাতুর প্রবাহ সমানভাবে সমর্থন করে, দ্রুত প্রেস গতি এবং আরও স্থিতিশীল ফলাফল অর্জনের সুযোগ করে দেয় ( অ্যালুমিনিয়াম এক্সট্রুশন ডিজাইনের নির্দেশাবলী ).

- স্থিতিশীল প্রাচীর পুরুতা: প্রাচীর পুরুতা একঘাতে রাখা বিকৃতির ঝুঁকি কমায় এবং স্ক্র্যাপ হার কমায়। পুরুতায় হঠাৎ পরিবর্তন এক্সট্রুশন ধীর করে দিতে পারে এবং অতিরিক্ত ডাই সমন্বয়ের প্রয়োজন হতে পারে।

- প্রচুর কোণ ব্যাসার্ধ এবং সংক্রমণ: তীক্ষ্ণ কোণগুলি পূরণ করা কঠিন এবং চাপের ঘনত্বের কারণ হতে পারে। প্রচুর ব্যাসার্ধ ডাইয়ের জীবনকাল উন্নত করে না শুধুমাত্র, পাশাপাশি মসৃণ, আরও নির্ভরযোগ্য উত্পাদনের অনুমতি দেয়।

- গভীর, পাতলা ফিন এড়ান: উচ্চ টং অনুপাত এবং গভীর, সরু বৈশিষ্ট্যগুলি ধাতু প্রবাহের জন্য ঝুঁকি তৈরি করে, প্রেস গতি ধীরে ধীরে চলে এবং ভাঙ্গার ঝুঁকি বাড়ায়। সম্ভব হলে উত্পাদনযোগ্যতার জন্য এই বৈশিষ্ট্যগুলি পুনরায় ডিজাইন করুন।

- খাঁজ এবং পরিধি/অনুপ্রস্থ অনুপাত কমানোর চেষ্টা করুন: যদিও খাঁজগুলি কখনও কখনও আবশ্যিক হয়, তবু সরল আকৃতিগুলি এক্সট্রুড করা দ্রুততর এবং কম খরচে হয়। অপ্রয়োজনীয় জটিলতা কমানো দ্বারা সরাসরি খরচ কমে যায়।

- প্রাচীরগুলি সংযুক্ত করুন এবং প্রতিসাম্য বজায় রাখুন: সংযুক্ত প্রোফাইলগুলি অসম শীতলতা কমায় এবং বক্রতা কমায়, যা ক্ষুদ্র অ্যালুমিনিয়াম এক্সট্রুশনের ক্ষেত্রে গুরুত্বপূর্ণ যা কম সহনশীলতা সম্পন্ন অটোমোটিভ সংযোজনে ব্যবহৃত হয়।

প্রারম্ভিক পর্যায়ে এই DfE নিয়মগুলি অন্তর্ভুক্ত করার মাধ্যমে আপনি লক্ষ্য করবেন আপনার প্রোগ্রামের জন্য অ্যালুমিনিয়াম এক্সট্রুশন খরচ কমে যাবে—কখনও কখনও উল্লেখযোগ্যভাবে—যখন মান এবং স্থিতিশীলতা উন্নত হবে।

অটোমোটিভ পার্টসের জন্য খাঁজযুক্ত বনাম কঠিন বিকল্প

আপনি কি কখনও ভেবেছেন যে খাঁজযুক্ত না কঠিন প্রোফাইল নির্দিষ্ট করবেন? এখানে আপনার অটোমোটিভ ব্যবহারের জন্য এক্সট্রুডেড অ্যালুমিনিয়াম সংজ্ঞায়িত করার জন্য যা জানা দরকার তা রয়েছে:

- কঠিন এক্সট্রুশন: উৎপাদন সহজ এবং সস্তা, উচ্চ শক্তি এবং দৃঢ়তা সহ। ওজন যেখানে প্রধান উদ্বেগ নয় সেখানে কাঠামোগত উপাদানের জন্য সেরা।

- খোলা এক্সট্রুশন: ওজনের তুলনায় দুর্দান্ত শক্তি এবং নকশা নমনীয়তা দেয়, কিন্তু আরও জটিল ঢালাই (ব্রিজ/নলকূপ) এবং প্রাচীর পুরুতা নিয়ন্ত্রণের প্রয়োজন। উৎপাদনের জন্য এগুলি বেশি খরচ হয় কিন্তু একক অংশে হালকা করা এবং একাধিক কার্যক্রম একীভূত করার জন্য এগুলি অপরিহার্য।

অটোমোটিভে, খোলা এক্সট্রুশনগুলি ক্র্যাশ ম্যানেজমেন্ট, এইচভিএসি ডাক্ত, এবং ব্যাটারি আবরণের জন্য জনপ্রিয়, যেখানে শক্তিশালী প্রোফাইলগুলি ব্র্যাকেট এবং উচ্চ-লোড অঞ্চলে শ্রেষ্ঠ। পছন্দটি কেবল এক্সট্রুশন খরচকে প্রভাবিত করে না, বাদের পদক্ষেপগুলিও প্রভাবিত করে—যেমন মেশিনিং, ওয়েল্ডিং এবং সিলিং।

সাজানো এবং সমাবেশের জন্য প্রাথমিক পরিকল্পনা

ভালো ডিজাইন কেবল প্রেসে থামে না। আপনার অংশটি কীভাবে সাজানো হবে, যুক্ত করা হবে এবং সমাবেশ করা হবে সে সম্পর্কে আগেভাগে চিন্তা করুন:

- মেশিনিং অনুমতিসমূহ: এক্সট্রুশনের পরে মেশিন করা গুরুত্বপূর্ণ পৃষ্ঠের জন্য যথাযথ উপকরণ রেখে দিন।

- ওয়েল্ড-বান্ধব বিবরণ: রোবটিক ওয়েল্ডিং সমর্থন করার জন্য মসৃণ সংক্রমণ এবং অ্যাক্সেসযোগ্য পৃষ্ঠগুলি পুনরায় কাজ করার পরিমাণ কমায়।

- সীলিং পৃষ্ঠতল: যেসব অংশগুলি তরল বা গ্যাসের বিরুদ্ধে সিল করা হবে সেগুলির জন্য সমতা এবং নিয়মিত জ্যামিতি অত্যন্ত গুরুত্বপূর্ণ।

গাড়ির ফ্রেম বা ক্লোজারে ব্যবহৃত হওয়া এক্সট্রুডেড স্ট্রাকচারাল অ্যালুমিনিয়ামের ক্ষেত্রে, এই বিষয়গুলি নির্ধারণ করতে পারে যে অংশটি সমাবেশে সরাসরি বসে যাবে না না করা দরকার খরচ বহুল পুনরায় কাজের।

- প্রোফাইলের সর্বত্র প্রাচীর পুরুত্ব নিয়মিত কিনা?

- কি ধাতুর প্রবাহের জন্য মসৃণ সংক্রমণ এবং কোণগুলি ডিজাইন করা হয়েছে?

- প্রোফাইলটি কি গভীর, পাতলা ফিন বা উচ্চ টং অনুপাত এড়িয়ে গেছে?

- প্রোফাইলটি কি প্রতিসম এবং ডাই-বান্ধব?

- আপনি কি পিপিএপি এবং মান নথিভুক্তির জন্য ডেটাম কৌশল স্পষ্ট করেছেন?

- আপনি কি ডাউনস্ট্রিম মেশিনিং, ওয়েল্ডিং এবং সিলিংয়ের প্রয়োজনীয়তা বিবেচনা করেছেন?

কার্যকারিতা পূরণের জন্য সবথেকে সহজ প্রোফাইল নির্বাচন করা—কম নয়, বেশিও নয়—এটি অটোমোটিভ এক্সট্রুশন সরবরাহে স্থিতিশীল মূল্য এবং নির্ভরযোগ্য লিড সময় পাওয়ার সবথেকে দ্রুততম উপায়।

এই নকশা নীতিগুলি খরচ নিয়ন্ত্রণ করার পাশাপাশি আপনাকে মসৃণ টুলিং, প্রক্রিয়াকরণ এবং মান অনুমোদনের জন্য প্রস্তুত করে তোলে। পরবর্তীতে, আমরা দেখব কীভাবে এই সিদ্ধান্তগুলি উৎপাদন প্রক্রিয়ায় প্রবাহিত হয় এবং কোথায় আরও খরচের উৎস থাকতে পারে।

প্রেস থেকে এজিং এবং পরিদর্শন পর্যন্ত প্রক্রিয়া প্রবাহ লিভার

গাড়ির প্রোগ্রামের জন্য অ্যালুমিনিয়াম প্রোফাইল উত্পাদনে খরচ কোথায় জমা হয় তা কি কখনও ভেবে দেখেছেন? একটি একক এক্সট্রুশন কল্পনা করুন যা কাঁচা বিলেট থেকে শুরু হয়ে পরিদর্শিত চূড়ান্ত পণ্যে পরিণত হয়—প্রতিটি পদক্ষেপেই একটি সম্ভাব্য খরচ নিয়ন্ত্রণকারী উপাদান, বিশেষ করে যখন মান, সৌন্দর্য মানদণ্ড এবং ট্রেসেবিলিটি অপরিহার্য হয়। আসুন ভেঙে দেখি কীভাবে অ্যালুমিনিয়াম এক্সট্রুশন তৈরি হয়, কী কারণে গাড়ির প্রয়োজনীয়তা অনন্য হয় এবং আপনার বাজেট কোথায় হারিয়ে যেতে পারে যদি আপনি প্রক্রিয়া প্রবাহের দিকে নজর না দেন।

অটোমোটিভ মানের জন্য কীভাবে অ্যালুমিনিয়াম এক্সট্রুশন তৈরি করা হয়

জটিল শোনাচ্ছে? এখানে অটোমোটিভ ক্রেতাদের জন্য কোথায় খরচ সবচেয়ে বেশি সংবেদনশীল তা নোট করে সাধারণ অ্যালুমিনিয়াম প্রোফাইল উত্পাদন প্রক্রিয়ার একটি পরিষ্কার, পদক্ষেপে পদক্ষেপে দৃষ্টিভঙ্গি রয়েছে:

- সংকর নির্বাচন এবং বিলেট প্রি-হিটিং: এখানে সঠিক সংকর নির্বাচন এবং অপটিমাল তাপমাত্রায় বিলেটগুলি প্রি-হিটিং দিয়ে যাত্রা শুরু হয়। এই পদক্ষেপটি যান্ত্রিক বৈশিষ্ট্য এবং এক্সট্রুশন মানের জন্য ভিত্তি স্থাপন করে।

- প্রেসে এক্সট্রুশন: উত্তপ্ত বিলেটগুলিকে একটি হাইড্রোলিক অ্যালুমিনিয়াম এক্সট্রুশন প্রেস ব্যবহার করে একটি ডাইয়ের মধ্য দিয়ে চাপা হয়। এখানে, প্রেসের আকার এবং রানের গতি অবশ্যই সংকরের ধরন এবং প্রোফাইল জটিলতার সাথে মেলানো উচিত। উচ্চ গতি আউটপুট বাড়াতে পারে কিন্তু যদি সাবধানে নিয়ন্ত্রণ না করা হয় তবে স্ক্র্যাপ বা পৃষ্ঠের ত্রুটি বাড়াতে পারে।

- কুইঞ্চ (শীতলকরণ): ডাই থেকে বের হওয়ার পরপরই প্রোফাইলগুলি সাধারণত জল বা বাতাসের সাহায্যে দ্রুত শীতল করা হয়—যাতে কাঙ্ক্ষিত মাইক্রোস্ট্রাকচার আটকানো যায়। উচ্চ-শক্তি সম্পন্ন অটোমোটিভ সংকরের জন্য দ্রুত কুইঞ্চিং অত্যন্ত গুরুত্বপূর্ণ, কিন্তু অসম শীতলকরণ বক্রতা বা অবশিষ্ট চাপ সৃষ্টি করতে পারে, যা ব্যয়বহুল পুনর্নির্মাণের দিকে পরিচালিত করে।

- প্রসারিত/সোজা করা: প্রোফাইলগুলি বিকৃতি সংশোধন এবং কঠোর সহনশীলতা অর্জনের জন্য প্রসারিত করা হয়। গাড়ির অংশগুলি প্রায়শই আরও নির্ভুল সোজা করার প্রয়োজন হয়, যার ফলে সময় এবং শ্রম খরচ বেড়ে যায়।

- বয়স/টেম্পার: নির্দিষ্ট যান্ত্রিক বৈশিষ্ট্য অর্জনের জন্য অনেক অটোমোটিভ এক্সট্রুশন নিয়ন্ত্রিত বয়স (টেম্পারিং) এর সম্মুখীন হয়। অতিরিক্ত কঠোরতা বা অপর্যাপ্ত কঠোরতা এড়ানোর জন্য বয়স নির্ধারণের সময়সূচী সতর্কতার সাথে পরিচালনা করা আবশ্যিক, যা দুটিই বর্জ্য বা পুনরায় কাজের দিকে পরিচালিত করতে পারে।

- কাট-টু-লেংথ: প্রোফাইলগুলি সঠিক দৈর্ঘ্যে কাটা হয়। এখানে নির্ভুলতা অত্যন্ত গুরুত্বপূর্ণ—বিশেষ করে ট্রিম বা কাঠামোগত অংশগুলির জন্য যা রোবটিকভাবে সমবায় করা হবে।

- পরিদর্শন এবং মান নিয়ন্ত্রণ: প্রতিটি প্রোফাইল মাত্রিক নির্ভুলতা, পৃষ্ঠতলের সমাপ্তি এবং যান্ত্রিক বৈশিষ্ট্যের জন্য পরীক্ষা করা হয়। অটোমোটিভ প্রোগ্রামগুলি উন্নত মান নিয়ন্ত্রণের দাবি করে—চিন্তা করুন PPAP নথি এবং সম্পূর্ণ ট্রেসেবিলিটি—যা সময় এবং খরচ উভয়ই বাড়িয়ে দেয়।

- প্যাকিং এবং যোগাযোগ ব্যবস্থা: ক্ষতি রোধ করতে সমাপ্ত প্রোফাইলগুলি নিরাপদে প্যাকেজ করা হয় এবং দায়ভার পরিবহনের জন্য ট্র্যাক করা হয়, বিশেষ করে যখন বৈশ্বিকভাবে পাঠানো হয়।

প্রেস নির্বাচন এবং রান-স্পিড তুলনা মূল্যায়ন

যখন আপনি প্রেস অপশনগুলি মাপছেন, দ্রুততর সর্বদা সস্তা হয় না। খাদ, প্রোফাইল জ্যামিতি এবং পৃষ্ঠতল শ্রেণির উপর ভিত্তি করে প্রেসের আকার এবং চলমান গতি নির্বাচন করতে হবে। উদাহরণস্বরূপ, একটি বৃহৎ অ্যালুমিনিয়াম এক্সট্রুশন প্রেস জটিল বা পুরু-প্রাচীরযুক্ত অংশগুলি নিয়ন্ত্রণ করতে পারে, কিন্তু গুণগত মান বজায় রাখতে জটিল প্রোফাইলগুলিতে ধীরে চলতে পারে। প্রেসটিকে খুব দ্রুত চালানো আয় ক্ষতি বাড়াতে পারে, আরও ফিনিশিংয়ের প্রয়োজন হতে পারে অথবা মরচের জীবনকে কমিয়ে দিতে পারে—প্রত্যেকটি আপনার অ্যালুমিনিয়াম প্রোফাইল উত্পাদন প্রক্রিয়ায় লুকানো খরচ যুক্ত করে।

টিপস: প্রতি মিনিটে সবচেয়ে কম প্রেস হার সর্বদা প্রতি অংশের সবচেয়ে কম খরচ বোঝায় না। গতি খুব বেশি ঠেলে দেওয়া প্রায়শই উচ্চতর স্ক্র্যাপ হার বা আরও ফিনিশিং কাজের দিকে নিয়ে যায়—তাই সবসময় আউটপুটকে গুণগত মান এবং পরবর্তী খরচের সাথে ভারসাম্য রাখুন।

কোয়েঞ্চ এবং বয়স সম্পর্কিত পছন্দসমূহ যা খরচকে প্রভাবিত করে

কোয়েঞ্চিং এবং বয়স বৃদ্ধি শুধুমাত্র প্রযুক্তিগত পদক্ষেপ নয়—এগুলি অটোমোটিভ এক্সট্রুশনের জন্য প্রধান খরচ বহনকারী উপাদান। উচ্চ-শক্তি স্পেসিফিকেশন পূরণের জন্য দ্রুত, নিয়ন্ত্রিত কোয়েঞ্চিং অপরিহার্য, কিন্তু যদি শীতলীকরণ সমানভাবে না হয়, তবে আপনি ওয়ারপিং বা অসম বৈশিষ্ট্য দেখতে পাবেন। একইভাবে, কঠোরভাবে পরিচালিত বয়স বৃদ্ধি প্রতিটি অংশ যান্ত্রিক লক্ষ্য পূরণ করছে কিনা তা নিশ্চিত করে, কিন্তু দীর্ঘতর বা আরও জটিল চক্রগুলি শক্তি এবং হ্যান্ডলিং খরচ যোগ করে। অটোমোটিভ ক্রেতাদের সরবরাহকারীদের সাথে কাজ করে কোয়েঞ্চ এবং টেম্পার কৌশলগুলি প্রদর্শন এবং বাজেট উভয় লক্ষ্যের সাথে সামঞ্জস্য রাখা উচিত।

অ্যালুমিনিয়াম এক্সট্রুশন কীভাবে তৈরি হয় এবং কোথায় খরচ জমা হয় তা বোঝা আপনাকে সঠিক প্রশ্ন করার ক্ষমতা দেয় এবং আপনার বাজেটের জন্য অপ্রত্যাশিত খরচ এড়াতে সাহায্য করে। পরবর্তীতে, আমরা কীভাবে গৌণ অপারেশন এবং যোগদানের সিদ্ধান্তগুলি কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের মোট খরচের চিত্রকে আরও গঠন করতে পারে তা অনুসন্ধান করব।

মোট খরচকে গঠন করা ফিনিশিং এবং অ্যাসেম্বলি পছন্দ

যখন আপনি গাড়ির অংশগুলির জন্য অ্যালুমিনিয়াম এক্সট্রুশন ফ্যাব্রিকেশন সম্পর্কে চিন্তা করছেন, তখন কি প্রেস থেকে প্রোফাইল বের হয়ে গেলে খরচ শেষ হয়ে গেছে বলে মনে করছেন? বাস্তবে, সেকেন্ডারি অপারেশন এবং যোগদানের পদ্ধতিগুলি মূল এক্সট্রুশন দামকে ছাপিয়ে যেতে পারে - কখনও কখনও অনেক বেশি। চলুন দেখে নেওয়া যাক কোন ফিনিশিং পদক্ষেপ এবং সংযোজন পছন্দগুলি কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন খরচকে সবচেয়ে বেশি প্রভাবিত করে এবং বুদ্ধিদারপনা সহকারে পরিকল্পনা করে বাজেটের অপ্রীতিকর অঘটন কীভাবে এড়ানো যায়।

কোন ফিনিশিং পদক্ষেপগুলি খরচের মূল্যবান?

ধরুন আপনি একটি স্ট্রাকচারাল রেল বা একটি উচ্চ-দৃশ্যমান ট্রিম পিসের জন্য কাস্টম কাট করা অ্যালুমিনিয়াম এক্সট্রুশন নির্দিষ্ট করেছেন। পরবর্তী সিদ্ধান্ত - কীভাবে এটি মেশিনিং, ফিনিশ এবং প্যাকেজিং করা হবে - আপনার প্রকল্পের মোট ব্যয় এবং সময়সূচীকে গঠন করবে। এখানে কাস্টম অ্যালুমিনিয়াম প্রোফাইলগুলির জন্য সাধারণ সেকেন্ডারি অপারেশনগুলির একটি ঝলক দেখুন, যার সাথে তাদের সাধারণ খরচ, সময়সীমা এবং ঝুঁকির প্রভাব রয়েছে:

| সেকেন্ডারি অপারেশন | খরচের বিষয় | সময়সীমা প্রভাব | পুনরায় কাজের ঝুঁকি | মানের নথিপত্র |

|---|---|---|---|---|

| প্রিসিশন সকিং/কাট-টু-লেংথ | নিম্ন-মাঝারি | ন্যূনতম | কম | মৌলিক (দৈর্ঘ্য পরীক্ষা) |

| সিএনসি মেশিনিং (ড্রিলিং, ট্যাপিং, পকেটস) | মধ্যম-উচ্চ | মাঝারি | মধ্যম (স্ক্র্যাপ ঝুঁকি) | মাত্রিক প্রতিবেদন |

| ডেবুরিং/এজ ফিনিশিং | কম | ন্যূনতম | কম | দৃশ্যমান পরিদর্শন |

| তাপ চিকিত্সা যাচাই | মাঝারি | মাঝারি | মাঝারি | যান্ত্রিক বৈশিষ্ট্য সার্টিফিকেট |

| অ্যানোডাইজিং | মধ্যম-উচ্চ | মাঝারি | মধ্যম (রং পরিবর্তন) | কোটিং পুরুত্ব/রং সার্টিফিকেট |

| পাউডার কোটিং/ই-কোট | মধ্যম-উচ্চ | মাঝারি-উচ্চ | মধ্যম (পৃষ্ঠ ত্রুটি) | আঠালো/জারা প্রতিবেদন |

| বিশেষায়িত প্যাকেজিং | নিম্ন-মাঝারি | ন্যূনতম | কম | প্যাকেজিং রেকর্ড |

প্রতিটি যুক্ত পদক্ষেপ কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন খরচ বাড়ায়, বিশেষ করে যখন রঙের সামঞ্জস্যতা, ক্ষয় প্রতিরোধ বা যান্ত্রিক সার্টিফিকেশনের প্রয়োজনীয়তা আরও কঠোর হয়। উদাহরণস্বরূপ, অ্যানোডাইজিং এবং পাউডার কোটিং উভয়েই রক্ষা করে এবং সৌন্দর্য বর্ধন করে, কিন্তু ব্যয়বহুল পুনঃকাজ বা ভগ্নাংশ এড়ানোর জন্য কঠোর প্রক্রিয়া নিয়ন্ত্রণের প্রয়োজন হয়। প্যাকেজিং—প্রায়শই উপেক্ষিত—এমনকি খরচ বাড়াতে পারে যদি রপ্তানি বা উচ্চ-মূল্যবান পৃষ্ঠ রক্ষার প্রয়োজন হয়।

- ফিনিশ কি কার্যকারিতা, চেহারা বা উভয়ের জন্য প্রয়োজন?

- অংশটি কি কঠোর পরিবেশের (রাস্তার লবণ, ইউভি) সম্মুখীন হবে?

- কোন চেহারা শ্রেণি নির্দিষ্ট করা হয়েছে—মানক, অটোমোটিভ, বা সাজানো?

- ফিনিশ কি ওইএম বা এএসটিএম মান পূরণ করতে হবে?

- একীভূত সরবরাহকারীর সাথে কি একাধিক পদক্ষেপ একত্রিত করা যেতে পারে?

যোগদানের পদ্ধতি এবং তাদের খরচ প্রভাব

একবার আপনার অ্যালুমিনিয়াম এক্সট্রুশন ফ্যাব্রিকেশন সম্পন্ন হয়ে গেলে, অংশগুলি কীভাবে জোড়া লাগানো হবে? আপনি যে যোগদান পদ্ধতি বেছে নেন তার খরচ, লিড সময় এবং মানের উপর ডোমেন প্রভাব পড়তে পারে। অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের জন্য সাধারণ যোগদান বিকল্পগুলির একটি বিশ্লেষণ নিম্নরূপ:

- মেকানিক্যাল ফাস্টেনিং (বোল্ট, স্ক্রু, রিভেট): সাদামাটা এবং খরচ কম, কিন্তু অতিরিক্ত মেশিনিং বা ইনসার্ট প্রয়োজন হতে পারে।

- অ্যাডহিসিভ বন্ডিং : হালকা, ফ্লাশ জয়েন্ট তৈরি করতে সক্ষম, কিন্তু কিউরিং সময় বাড়িয়ে দেয় এবং পৃষ্ঠতল প্রস্তুতির প্রয়োজন হয়।

- MIG/TIG ওয়েল্ডিং : শক্তিশালী স্ট্রাকচারাল জয়েন্ট সরবরাহ করে কিন্তু তাপ বিকৃতি দেখা দিতে পারে এবং দক্ষ শ্রমের প্রয়োজন হয়।

- লেজার ওয়েল্ডিং : উচ্চ নির্ভুলতা এবং গতি, স্বয়ংক্রিয়তার জন্য আদর্শ, কিন্তু সরঞ্জামের খরচ বেশি।

- ফ্রিকশন-স্টার ওয়েল্ডিং (FSW) : ন্যূনতম বিকৃতির সাথে এক্সট্রুশন যোগদানের জন্য সলিড-স্টেট প্রক্রিয়া, ব্যাটারি এনক্লোজার এবং বৃহৎ কাঠামোর জন্য আরও বেশি ব্যবহৃত হচ্ছে ( অ্যালুমিনিয়াম এক্সট্রুডার্স কাউন্সিল ).

যৌথ ডিজাইন, ফিক্সচারিং, সিলার, এবং প্রি-ট্রিটমেন্ট পদক্ষেপ (যেমন পরিষ্কার করা বা প্রাইমিং) সবকিছুই কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন খরচে যোগ হয়। উদাহরণ হিসাবে, একটি সমতল জয়েন্ট সাদামাটাভাবে সরল মনে হতে পারে, কিন্তু যদি এটি ওয়েল্ডিং বা আঠা নির্ভর হয়, তাহলে আপনার অতিরিক্ত সমর্থন, পরিদর্শন, এবং সম্ভাব্য পুনঃকাজের প্রয়োজন হবে।

- জয়েন্টটি কোন ভার এবং চাপ সহ্য করবে?

- জয়েন্টটি কি আদ্রতা বা রাসায়নিক পদার্থের সংস্পর্শে আসবে?

- সমাবেশটি কি ফিল্ড সার্ভিসযোগ্যতা বা মেরামতের প্রয়োজন হবে?

- জয়েন্ট অখণ্ডতার জন্য কি ওইএম বা শিল্প স্পেসিফিকেশন আছে?

- জয়েন্ট পদ্ধতির জন্য কি জং এবং ক্লান্তির জন্য যথাযথতা প্রমাণিত হয়েছে?

2025 প্রোগ্রামে ওভার-স্পেসিফিকেশন প্রতিরোধ করা

এটি ওভার-ইঞ্জিনিয়ারিং করার প্রলোভন তৈরি করে—প্রতিটি সমাপ্তি এবং যোগদানের পদক্ষেপ নির্দিষ্ট করা "যদি কখনও প্রয়োজন হয় তার জন্য"। কিন্তু প্রতিটি যোগ করা অপারেশন প্রত্যক্ষ এবং পরোক্ষ কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন খরচ বাড়িয়ে দেয়। চাবি হল প্রকৃত বিশ্ব ফাংশনের সাথে প্রয়োজনীয়তা মেলানো, শুধুমাত্র ঐতিহ্য বা অভ্যাসের সাথে নয়। পদক্ষেপগুলি সংহত করতে, অ্যালুমিনিয়াম এক্সট্রুশন ফ্যাব্রিকেশন পরিষেবাগুলি একীভূত ব্যবহার করতে এবং অপ্রয়োজনীয় জটিলতা এড়াতে আপনার সরবরাহকারীর সাথে ঘনিষ্ঠভাবে কাজ করুন। এটি শুধুমাত্র অর্থ সাশ্রয় করে না বরং লিড সময় এবং ঝুঁকি কমায়।

গৌণ প্রক্রিয়া এবং যোগদানের পছন্দ প্রায়শই মূল এক্সট্রুশন মূল্যকে ছাপিয়ে যায়। মোট খরচ নিয়ন্ত্রণ করতে এবং আপনার প্রোগ্রামটি সঠিক পথে রাখতে প্রতিটি পদক্ষেপ কার্যকরী প্রয়োজনের সাথে সামঞ্জস্য করুন।

পরবর্তীতে, আমরা দেখব কিভাবে পরিমাণ, উৎপাদন শিক্ষা এবং অঞ্চলভিত্তিক সরবরাহ চেইনের বাস্তবতা কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের জন্য ল্যান্ডেড খরচ সমীকরণটি আরও কীভাবে আকার দেয়।

পরিমাণ বৃদ্ধি এবং অঞ্চলভিত্তিক সরবরাহ চেইনের খরচ প্রভাব

যখন আপনি একটি বড় অটোমোটিভ প্রোগ্রামের পরিকল্পনা করছেন, আপনি কি কখনও লক্ষ্য করেছেন যে পাইলট বিল্ড থেকে সম্পূর্ণ উৎপাদনে আপনার অ্যালুমিনিয়াম এক্সট্রুশনের ল্যান্ডেড খরচ কীভাবে প্রচুর পরিমাণে পরিবর্তিত হয়? অথবা ভেবেছেন কেন একটি অঞ্চল থেকে প্রাপ্ত আপাতদৃষ্টিতে সস্তা অ্যালুমিনিয়াম এক্সট্রুশন কোট প্রকৃত খরচগুলি মিলিয়ে দেখলে আরও ব্যয়বহুল হয়ে ওঠে? আসুন দেখে নেওয়া যাক কীভাবে পরিমাণ, উপজ এবং বৈশ্বিক সরবরাহ চেইনের বাস্তবতা কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের প্রকৃত খরচ নির্ধারণে প্রভাব ফেলে — এবং কীভাবে আপনি আপনার মার্জিনকে ক্ষয় করে ফেলা লুকানো খরচগুলি এড়িয়ে চলতে পারেন।

পরিমাণ এবং উপজের প্রভাব দামের স্থিতিশীলতার উপর

ধরুন আপনি একটি নতুন যানবাহন প্ল্যাটফর্ম চালু করছেন। শুরুতে, আপনি ছোট ছোট লটে প্রোটোটাইপ অ্যালুমিনিয়াম এক্সট্রুশন তৈরি করছেন - খরচ অনেক বেশি হচ্ছে কারণ ডাই অ্যামোর্টাইজেশন মাত্র কয়েকটি পার্টের উপর ছড়িয়ে পড়ছে, এবং প্রতিটি প্রক্রিয়াগত সমস্যা বা খারাপ পার্ট প্রতি ইউনিট দামে বেশি প্রভাব ফেলছে। যখন আপনি পিপিএপি (প্রোডাকশন পার্ট অ্যাপ্রুভাল প্রসেস) এর মাধ্যমে এবং স্থিতিশীল উত্পাদনে যাচ্ছেন, তখন স্কেলের অর্থনীতি কাজ করতে শুরু করে। হাজার হাজার পার্টের উপর টুলিং খরচ অ্যামোর্টাইজ হয়, উৎপাদন লার্নিং এর মাধ্যমে স্ক্র্যাপ হার কমে আসে, এবং সরবরাহকারীরা ভাল আউটপুটের জন্য স্কিডিউলিং অপটিমাইজ করতে পারে। এই স্কেলিং প্রভাবের উপর অ্যালুমিনিয়াম এক্সট্রুশন শিল্প গড়ে উঠেছে: আপনার চাহিদা যত বেশি পূর্বানুমানযোগ্য হবে, খরচের স্থিতিশীলতাও তত বেশি পাবেন।

- পাইলট/প্রোটোটাইপ: প্রতি পার্টের খরচ বেশি, ডাই অ্যামোর্টাইজেশন কম, প্রক্রিয়াগত পরিবর্তন ঘটে প্রায়ই।

- র্যাম্প/পিপিএপি: উৎপাদন হার বৃদ্ধি এবং প্রক্রিয়া স্থিতিশীল হওয়ার সাথে সাথে খরচ কমে যায়, কিন্তু এখনও স্ক্র্যাপ এবং রিওয়ার্কের প্রতি সংবেদনশীল।

- স্থিতিশীল উত্পাদন: প্রতি পার্টের সবথেকে কম খরচ, উচ্চ দক্ষতা, স্থিতিশীল স্কিডিউলিং এবং পূর্বানুমানযোগ্য ল্যান্ডেড খরচ।

তবে উৎপাদনশীলতার প্রভাব হেলায় উড়িয়ে দেবেন না। জটিল বা কম সহনশীলতার অংশগুলির ক্ষেত্রে উচ্চ-আয়তনের উৎপাদনের সাশ্রয় হ্রাস করার জন্য এমনকি খুব কম পরিমাণে খুচরা বৃদ্ধি পর্যাপ্ত হতে পারে। সরবরাহকারীদের কাছ থেকে সর্বদা প্রাপ্তির ঐতিহাসিক তথ্য চান এবং নতুন প্রোফাইলগুলির জন্য শেখার প্রক্রিয়ার জন্য বাফার অন্তর্ভুক্ত করুন।

অঞ্চল এবং লজিস্টিক ল্যান্ডেড খরচের ড্রাইভার

কি কখনও দূরবর্তী সরবরাহকারীর কাছ থেকে সস্তা অ্যালুমিনিয়াম এক্সট্রুশন কোটেশনের দ্বারা আকৃষ্ট হয়েছেন, কেবলমাত্র চালান, শুল্ক এবং দেরিতে আপনার ল্যান্ডেড খরচ দ্বিগুণ হয়েছে তা জেনে? এটি একটি ক্লাসিক ধোঁকা। ল্যান্ডেড খরচ শুধুমাত্র চালানের মূল্য নয় - এটি সরবরাহকারীর ডক থেকে আপনার গুদামে প্রতিটি খরচের যোগফল।

- ফ্রিট দূরত্ব: দীর্ঘ চালানের পথ (বিশেষত মহাদেশীয়) উচ্চ খরচ, দীর্ঘ সময়কাল এবং ক্ষতি বা দেরির বেশি ঝুঁকি অর্থ প্রদান করে।

- রপ্তানি প্যাকেজিং: রপ্তানির জন্য অংশগুলি প্রায়শই কাস্টম ক্রেটিং বা ক্ষয় রক্ষা প্রয়োজন, যা উপকরণ এবং শ্রম খরচ বৃদ্ধি করে।

- শুল্ক এবং কর: বাণিজ্য নীতিগুলি দ্রুত পরিবর্তিত হতে পারে; এক দেশের সস্তা অ্যালুমিনিয়াম এক্সট্রুশন অন্যত্র প্রচুর আমদানি শুল্ক বা অ্যান্টি-ডাম্পিং শুল্কের সম্মুখীন হতে পারে।

- মুদ্রা ওঠানামা: বৈশ্বিক সরবরাহ আপনাকে বিনিময় হারের ওঠানামায় উস্কে দিতে পারে, যা রাতারাতি সঞ্চয়কে ক্ষয় করে দিতে পারে।

- ইনকোটার্মস এবং ডেলিভারি শর্তাবলী: এফওবি, সিআইএফ, ডিডিপি - প্রত্যেকটি যাতায়াত, বীমা এবং কাস্টম ক্লিয়ারেন্সের জন্য দায়িত্ব (এবং খরচ) স্থানান্তর করে। আপনার উদ্ধৃতিতে কী অন্তর্ভুক্ত তা সঠিকভাবে জেনে নিন।

- স্থানীয় পরিবহন এবং লাস্ট-মাইল খরচ: পোর্ট থেকে কারখানায় পণ্য পৌঁছানোটা একটি লুকানো খরচ হতে পারে, বিশেষত বাল্কি বা ভারী প্রোফাইলের ক্ষেত্রে।

- লিড-টাইম বাফার: দীর্ঘতর সরবরাহ চেইনের জন্য হাতে আরও বেশি মজুত রাখার প্রয়োজন হয়, যা নগদ বাঁধা পড়ে এবং গুদাম খরচ বাড়িয়ে দেয়।

অঞ্চলভিত্তিক সরবরাহ চেইনের শক্তিও গুরুত্বপূর্ণ। উত্পাদনকারীদের কাছাকাছি থাকা, শক্তিশালী যোগাযোগ ব্যবস্থা এবং স্থিতিশীল নীতিগুলির কারণে উত্তর আমেরিকার প্রাপ্তবয়স্ক অ্যালুমিনিয়াম এক্সট্রুশন শিল্প উপকৃত হয়। অন্যদিকে, উন্নয়নশীল বাজারগুলি নিম্ন ভিত্তিক মূল্য সরবরাহ করতে পারে কিন্তু বাধার উচ্চ ঝুঁকি, কাস্টম দেরি বা অমিল মানের সম্মুখীন হতে পারে।

২০২৫ এর সাপ্লাই চেইনে ঝুঁকি কমানো

আপনি কিভাবে আপনার ল্যান্ডেড খরচ পূর্বানুমেয় রাখবেন এবং শেষ পর্যন্ত বেশি খরচ হওয়া সস্তা অ্যালুমিনিয়াম এক্সট্রুশন এর ফাঁদ থেকে কিভাবে বাঁচবেন? মোট ল্যান্ডেড খরচের মডেল তৈরি করে শুরু করুন - শুধুমাত্র পিস দাম নয় - যার মধ্যে অন্তর্ভুক্ত রয়েছে:

- সরবরাহকারী একক মূল্য

- পরিবহন (সমুদ্র, বায়ু, অভ্যন্তরীণ)

- শুল্ক এবং আমদানি শুল্ক

- বীমা এবং কাস্টমস ব্রোকারেজ

- প্যাকেজিং এবং পরিচালনা

- প্রত্যাশিত খুচরো এবং পুনঃকাজ

- মুদ্রা ঝুঁকি এবং পরিশোধের শর্তাবলী

ইনকোটার্মস সতর্কভাবে তুলনা করুন এবং চালানের একীভূতকরণ বিবেচনা করুন প্রতি-ইউনিট পরিবহন খরচ কমাতে। প্রধান প্রোগ্রামগুলির জন্য, সরবরাহের ঝামেলা থেকে আত্মরক্ষার জন্য দ্বৈত উৎস, অঞ্চলিক স্টক বা নমনীয় যোগাযোগ অংশীদারদের বিকাশ করুন।

ফ্রিট, শুল্ক, প্যাকেজিং এবং আশা করা স্ক্র্যাপসহ মডেল মোট ল্যান্ডেড খরচ। সস্তা অ্যালুমিনিয়াম এক্সট্রুশন কেবল একটি সৌদাগত হবে যদি এটি আপনার মান, সময়কাল এবং ঝুঁকি প্রোফাইল পূরণ করে - অন্যথায়, লুকানো খরচগুলি কম দরপত্রকে একটি ব্যয়বহুল অবাক করা পরিণত করতে পারে।

এই আঞ্চলিক এবং ভলিউম-চালিত বাস্তবতা বোঝা আপনাকে বুদ্ধিমান ক্রয় সিদ্ধান্ত নিতে সক্ষম করে। পরবর্তীতে, আমরা আপনাকে RFQ টেমপ্লেট এবং সরবরাহকারী মূল্যায়ন সরঞ্জামগুলি সজ্জিত করব যাতে নিশ্চিত করা যায় যে আপনার দরপত্রগুলি সত্যিই একে অপরের সমান।

স্থিতিশীলতার জন্য RFQ টেমপ্লেট এবং সরবরাহকারী স্কোরকার্ড

কাস্টম অ্যালুমিনিয়াম এক্সট্রুডারের জন্য কোটেশনের একটি স্তূপ কখনও পেয়েছেন এবং ভেবেছেন কেন সংখ্যা এবং বিবরণগুলি সব জায়গায় ছড়িয়ে আছে? অথবা আপনার দলকে ব্যাখ্যা করতে কষ্ট পেয়েছেন যে কেন কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন প্রোফাইলের জন্য এক সরবরাহকারীর মূল্য বেশি হলেও মূল্য ভালো? যদি তাই হয়, তাহলে আপনি একা নন। সঠিক উৎস নির্ধারণের জন্য আত্মবিশ্বাস পেতে এবং তুলনা করতে একটি শক্তিশালী RFQ (অনুরোধ ফর কোটেশন) টেমপ্লেট এবং একটি গঠনবদ্ধ সরবরাহকারী স্কোরকার্ড প্রয়োজন। আসুন আপনার পরবর্তী অটোমোটিভ এক্সট্রুশন প্রকল্পের জন্য সরবরাহকারীদের তুলনা করার জন্য কী অন্তর্ভুক্ত করবেন এবং কীভাবে সরবরাহকারীদের তুলনা করবেন তা এক নজরে দেখে নেই।

সম্পূর্ণ এবং তুলনামূলক কোটেশনের জন্য RFQ চেকলিস্ট

জটিল শোনাচ্ছে? এটা হতে হবে না। একটি পরিষ্কার, বিস্তারিত RFQ নিশ্চিত করে যে সরবরাহকারীরা আপনার প্রয়োজনীয়তা সঠিকভাবে বুঝতে পারবে এবং আপনাকে আলোচনা এবং সিদ্ধান্ত গ্রহণের জন্য একটি শক্তিশালী ভিত্তি দেয়। এখানে শিল্প সেরা অনুশীলন এবং বাস্তব প্রকল্পের সনদ থেকে অনুসরণ করা একটি প্রমাণিত চেকলিস্ট রয়েছে ( শেংজিন অ্যালুমিনিয়াম ):

- পূর্ণ মাত্রা এবং সহনশীলতা সহ প্রোফাইল অঙ্কন

- মিশ্র ধাতু এবং টেম্পার স্পেসিফিকেশন

- র্যাম্প পর্যায় অনুযায়ী প্রত্যাশিত বার্ষিক পরিমাণ (প্রোটোটাইপ, র্যাম্প, স্থিতিশীল অবস্থা)

- ডাই মালিকানা, রক্ষণাবেক্ষণ এবং প্রতিস্থাপনের শর্তাবলী

- পছন্দের প্রেস আকার বা এক্সট্রুশন পদ্ধতি (যদি জানা থাকে)

- তাপ চিকিত্সা এবং টেম্পারিংয়ের প্রয়োজনীয়তা

- গৌণ অপারেশনস (মেশিনিং, ড্রিলিং, ট্যাপিং, ডেবারিং ইত্যাদি)

- ফিনিশিংয়ের বিবরণ (অ্যানোডাইজিং, পাউডার কোট, রং, পুরুত্ব)

- মান নিয়ন্ত্রণ এবং পরিদর্শন পরিকল্পনা (মাত্রিক, যান্ত্রিক, পৃষ্ঠের পরীক্ষা)

- প্যাকিং, লেবেলিং এবং রপ্তানি প্যাকেজিংয়ের প্রয়োজনীয়তা

- যাতায়াত পছন্দ (ইনকোটার্মস, সংহতকরণ, ডেলিভারি স্থান)

- আনুগত্য এবং নথিপত্র (প্রত্যয়নপত্র, পিপিএপি, পরীক্ষা প্রতিবেদন)

এই বিবরণগুলি অন্তর্ভুক্ত করে, আপনি পারস্পরিক যোগাযোগ কমাবেন এবং নিশ্চিত করবেন যে প্রতিটি কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন সরবরাহকারী একই ভিত্তিতে দরপত্র প্রদান করছেন। এটি সরবরাহকারীর পক্ষ থেকে দ্রুত প্রতিক্রিয়া নিশ্চিত করে এবং ভবিষ্যতে ব্যয়বহুল অপ্রত্যাশিত ঘটনা এড়াতে আপনাকে সাহায্য করে।

প্রত্যেকবার অনুরোধ করা উচিত খরচের খতিয়ানের লাইনগুলি

আপনি যখন দরপত্রগুলি পর্যালোচনা করবেন, তখন শুধুমাত্র একক অর্থ রাশি নিয়ে সন্তুষ্ট হবেন না। লাইন-আইটেম খরচের বিভাজনের অনুরোধ করুন যাতে আপনি প্রতিটি অংশের বিস্তারিত বুঝতে পারেন এবং প্রতিটি অংশের যাথার্থতা যাচাই করতে পারেন। কমপক্ষে, সরবরাহকারীদের নিম্নলিখিতগুলি বিভাজিত করতে অনুরোধ করুন:

- কাঁচামাল (মিশ্র ধাতু, ওজন এবং মূল্য ভিত্তি)

- ডাই এবং টুলিং (নতুন, কিস্তিতে কিস্তিতে পরিশোধ করা হয় অথবা অন্তর্ভুক্ত)

- প্রক্রিয়াকরণ (এক্সট্রুশন, প্রেস সময়, আয় ধারণা)

- গৌণ কার্যাবলী (মেশিনিং, সমাপ্তি, সংযোজন)

- মান এবং নথিপত্র (পরিদর্শন, প্রতিবেদন, প্রত্যয়নপত্র)

- প্যাকিং এবং যোগাযোগ (অভ্যন্তরীণ/রপ্তানি, বিশেষ পরিচর্যা)

- ওভারহেড এবং মার্জিন (যদি প্রকাশ করা হয়)

এই ধরনের বিস্তারিত বিবরণ আপনাকে কেবল প্রতি ইউনিট দাম নয়, বরং মোট খরচের ভিত্তিতে কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন প্রোফাইলগুলি তুলনা করার সুযোগ দেয়।

সরবরাহকৃত দলের জন্য সরবরাহকারী মূল্যায়ন স্কোরকার্ড

ধরুন আপনার কাছে বিভিন্ন কাস্টম অ্যালুমিনিয়াম এক্সট্রুডারের কাছ থেকে তিনটি দরপত্র এসেছে। আপনি কীভাবে সর্বোত্তম পছন্দটি করবেন, কেবল সবথেকে কম দাম নয়? ওজনযুক্ত স্কোরকার্ড আপনার সিদ্ধান্তের জন্য নিরপেক্ষতা এবং স্বচ্ছতা নিয়ে আসে। আপনার পরবর্তী RFQ পর্বের জন্য আপনি যে উদাহরণটি ব্যবহার করতে পারেন তা এখানে দেওয়া হলো:

| ক্রিটেরিয়া | ওজন (%) |

|---|---|

| প্রযুক্তিগত ক্ষমতা (প্রোফাইলের জটিলতা, একীভূত পরিষেবা) | 25 |

| মান সার্টিফিকেশন (ISO 9001, IATF 16949, PPAP) | 15 |

| সময়ানুবর্তিতা (পূর্ববর্তী ডেলিভারি রেকর্ড) | 15 |

| ঝুঁকি প্রোফাইল (সরবরাহ চেইনের স্থিতিশীলতা, আর্থিক স্বাস্থ্য) | 10 |

| বাণিজ্যিক শর্তাবলী (মূল্য নির্ধারণ, অর্থপ্রদান, নমনীয়তা) | 15 |

| স্থিতিশীলতা (পুনর্ব্যবহার, শক্তি ব্যবহার, ESG) | 10 |

| মোট ল্যান্ডেড খরচ (আপনার মডেল অনুযায়ী সমস্ত খরচ সহ) | 10 |

প্রতিটি মানদণ্ডের জন্য 1-5 স্কেলে প্রতিটি সরবরাহকারীকে স্কোর দিন, ওজনের সাথে গুণ করুন এবং মোট যোগ করুন। এই পদ্ধতি আপনাকে আপনার ক্রয় সিদ্ধান্ত প্রতিরক্ষা করতে সাহায্য করবে এবং নিশ্চিত করবে যে লুকানো দুর্বলতার দ্বারা আপনি অন্ধ হয়ে যাবেন না।

পিস প্রাইস = ম্যাটেরিয়াল + প্রসেসিং + সেকেন্ডারি অপস + মান নিয়ন্ত্রণ/নথিপত্র + প্যাকেজিং/যোগাযোগ + ওভারহেড/মার্জিন; মোট খরচ = পিস প্রাইস × পরিকল্পিত ভালো পার্টস + টুলিং - ক্রেডিট।

এই টুলকিটের সাহায্যে, আপনি আপনার RFQ প্রক্রিয়া প্রমিতকরণে, কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন সরবরাহকারীদের একটি সমতল মাঠে তুলনা করতে এবং যাচাইযোগ্য ক্রয় সিদ্ধান্ত নিতে সক্ষম হবেন। পরবর্তীতে, চলুন দেখি কীভাবে একটি বাস্তব সরবরাহকারী তুলনা এবং পদক্ষেপ পরিকল্পনা আপনাকে কোটেশন থেকে আত্মবিশ্বাসী পুরস্কারে পৌঁছাতে সাহায্য করতে পারে।

কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের জন্য সরবরাহকারী তুলনা এবং আত্মবিশ্বাসী পরবর্তী পদক্ষেপ

পরবর্তী কাস্টম এক্সট্রুশন অ্যালুমিনিয়াম প্রকল্পের জন্য সঠিক অংশীদার নির্বাচন করার চেষ্টা করছেন? অসংখ্য সরবরাহকারী মান, গতি এবং মূল্য নিয়ে প্রতিশ্রুতি দিলেও কীভাবে আপনি তা থেকে পার্থক্য করবেন এবং এমন একটি ভেন্ডর খুঁজে পাবেন যিনি কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের খরচের দিকগুলি সঠিকভাবে বোঝেন—বিশেষ করে যেহেতু 2025-এর দিকে এগোচ্ছে শিল্পটি?

অটোমোটিভ প্রোগ্রামগুলির জন্য কাদের বিবেচনা করা উচিত

ধরুন আপনি আপনার RFQ এবং স্কোরকার্ড চূড়ান্ত করছেন। অটোমোটিভ সরবরাহের ক্ষেত্রে আসলে কী গুরুত্বপূর্ণ? মূল্যের বাইরে, আপনার এমন একটি অংশীদারের প্রয়োজন যিনি এক্সট্রুশনের জন্য ডিজাইন সমর্থন, গভীর ডাই ইঞ্জিনিয়ারিং দক্ষতা, শক্তিশালী মান ব্যবস্থা (IATF 16949 চিন্তা করুন), একীভূত ফিনিশিং এবং মেশিনিং এবং সময়মতো PPAP এবং ট্রেসেবিলিটি নথি সরবরাহের ক্ষমতা অফার করেন। বৈশ্বিক যোগাযোগ এবং প্রধান OEMগুলির সাথে প্রমাণিত রেকর্ডও অত্যন্ত গুরুত্বপূর্ণ—বিশেষ করে যেসব ক্ষেত্রে বিলম্ব বা মানের অবচয় গোটা গাড়ি চালু করার পথে বাধা হয়ে দাঁড়াতে পারে এমন কাস্টম অ্যালুমিনিয়াম এক্সট্রুশন প্রোগ্রামের জন্য।

খরচকে প্রভাবিত করে এমন ক্ষমতাগুলির তুলনা করা

জটিল শোনাচ্ছে? নিচের টেবিলটি আপনাকে অ্যালুমিনিয়াম এক্সট্রুশন কাস্টম প্রজেক্টের জন্য খরচ এবং নির্ভরযোগ্যতা উভয় দিক নির্ধারণকারী মানদণ্ডের উপর ভিত্তি করে প্রধান সরবরাহকারীদের সঙ্গে দ্রুত তুলনা করার সুযোগ দেয়। লক্ষ্য করুন কীভাবে একীভবন, লিড টাইম এবং নথিভুক্তিকরণ প্রকৃত অটোমোটিভ অংশীদারদের সাধারণ উদ্দেশ্য এক্সট্রুডারদের থেকে আলাদা করে তোলে।

| সরবরাহকারী | একীভূতকরণের স্তর | লিড-টাইম পোস্টার | মানের নথিপত্র | বাণিজ্যিক নমনীয়তা | অটোমোটিভ সার্টিফিকেশন |

|---|---|---|---|---|---|

| শাওয়ি মেটাল পার্টস সাপ্লায়ার | সম্পূর্ণ (এক পাড়ে: ডিজাইন, এক্সট্রুশন, ফিনিশিং, মেশিনিং, অ্যাসেম্বলি) | সংক্ষিপ্ত (দ্রুত প্রোটোটাইপিং, ডিজিটাল এমইএস, ডিএফএম প্রাথমিক) | ব্যাপক (আইএটিএফ 16949, পিপিএপি, ট্রেসেবিলিটি, ডিজিটাল রেকর্ড) | উচ্চ (নমনীয় পরিমাণ, একীভূত যোগাযোগ, ডিএফএম সমর্থন) | IATF 16949, ISO 9001 |

| বনেল অ্যালুমিনিয়াম | উচ্চ (এক্সট্রুশন, ফিনিশিং, কিছু মেশিনিং) | মিডিয়াম (উত্তর আমেরিকা ফোকাস, শক্তিশালী OEM অভিজ্ঞতা) | অটোমোটিভ-গ্রেড (PPAP, ISO 9001) | মিডিয়াম (OEM প্রোগ্রাম, সীমিত বৈশ্বিক পৌঁছানো) | ISO 9001, IATF 16949 |

| PTSMAKE | মিডিয়াম (এক্সট্রুশন, মৌলিক যন্ত্রকর্ম, DFM পরামর্শ) | মিডিয়াম (কাস্টম রানের জন্য সাড়া দেয়, এশিয়া-কেন্দ্রিক) | স্ট্যান্ডার্ড (ISO 9001, উপকরণ সার্টিফিকেট) | মিডিয়াম (কাস্টম প্রকল্প, মধ্যম নমনীয়তা) | আইএসও 9001 |

| হাইড্রো এক্সট্রুশনস | উচ্চ (বৈশ্বিক, বিস্তৃত প্রেস পরিসর, সমাপ্তি, প্রকৌশল) | মিডিয়াম (গ্লোবাল স্কিডিউলিং, শক্তিশালী ক্ষমতা) | অটোমোটিভ এবং এয়ারোস্পেস (পিপিএপি, এএস9100, আইএসও 9001) | মিডিয়াম (বৃহদাকার প্রোগ্রামের জন্য সেরা) | আইএটিএফ 16949, আইএসও 9001, এএস9100 |

সরবরাহ ত্বরান্বিত করার জন্য চূড়ান্ত পরামর্শ

- আপনার আরএফকিউ টেমপ্লেট শেয়ার করুন তুলনীয়, আপেল-থেকে-আপেল উদ্ধৃতি নিশ্চিত করতে শর্টলিস্ট করা সরবরাহকারীদের সাথে।

- খরচ কমানোর জন্য ডিজাইন পর্যালোচনার সময় নির্ধারণ করুন প্রাথমিক ডিএফএম ইনপুট কাস্টম এক্সট্রুশন অ্যালুমিনিয়াম পার্টসের জন্য উপকরণ এবং প্রক্রিয়া উভয় খরচ কমাতে পারে।

- অবচয় মডেল চালান প্রতিটি কোটেশনের জন্য, টুলিং, উপজ, যানবাহন এবং নথিভুক্তিসহ বিষয়গুলি বিবেচনা করে প্রকৃত ল্যান্ডেড খরচ উদঘাটন করুন।

- সরবরাহকারীদের অগ্রাধিকার দিন যারা একীভূত পরিষেবা, শক্তিশালী মান নথিভুক্তি এবং অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশন কাস্টম প্রকল্পে অভিজ্ঞতা সরবরাহ করেন।

ডিজাইন, প্রক্রিয়া এবং যানবাহনের সাথে সমন্বয় সাধন করা স্থিতিশীল ল্যান্ডেড খরচে পৌঁছানোর সবচেয়ে দ্রুততম পথ - আপনার প্রোগ্রামটি চালু রাখতে লুকানো খরচ যেন বাধা না দেয়।

সঠিক সরবরাহকারী বাছাই করা কেবল সবচেয়ে কম দরপত্রের বিষয়টি নয় - এটি নির্ভরযোগ্যতা, প্রযুক্তিগত গভীরতা এবং প্রতিটি লুকানো খরচের বিষয়টি সরবরাহ করার ক্ষমতা নিয়ে কাজ করে। এই গঠনমূলক পদ্ধতি অনুসরণ করে, আপনি আপনার অটোমোটিভ প্রোগ্রামটিকে সফলতার সাথে স্থাপন করবেন, প্রোটোটাইপ থেকে সম্পূর্ণ উৎপাদনে।

প্রায়শই জিজ্ঞাসিত প্রশ্নাবলী

1. কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের খরচকে প্রভাবিত করে এমন প্রধান কারকগুলি কী কী?

কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের খরচ কাঁচামালের দাম, ডাই এবং টুলিংয়ের জটিলতা, প্রক্রিয়াকরণের গতি, সেকেন্ডারি অপারেশন, ফিনিশিং, মানের প্রয়োজনীয়তা, প্যাকেজিং, যোগাযোগ এবং প্রতিবেদনের মাধ্যমে তৈরি হয়। অ্যালয় নির্বাচন থেকে শুরু করে ট্রেসেবিলিটি মান পর্যন্ত প্রতিটি উপাদান সরাসরি এবং পরোক্ষ খরচকে প্রভাবিত করতে পারে, যা উৎপাদন এবং সরবরাহ চেইন প্রক্রিয়াটি বিবেচনা করা আবশ্যিক করে তোলে।

2. অটোমোটিভ অ্যাপ্লিকেশনের জন্য অ্যালুমিনিয়াম এক্সট্রুশন খরচের উপর অ্যালয় এবং টেম্পার পছন্দের প্রভাব কীভাবে পড়ে?

অ্যালয় এবং টেম্পার পছন্দ উভয়ই কাঁচামাল এবং প্রক্রিয়াকরণের খরচকে প্রভাবিত করে। উচ্চ শক্তি সম্পন্ন অ্যালয় বা দুর্ঘটনা প্রতিরোধের, ক্ষয় প্রতিরোধের জন্য নির্দিষ্ট টেম্পার বা পেন্টিংয়ের সুবিধার জন্য প্রায়শই আরও জটিল প্রক্রিয়াকরণ, কঠোর সহনশীলতা এবং অতিরিক্ত পরীক্ষা প্রয়োজন হয়। সরবরাহকারীদের সাথে সহযোগিতা করে যান্ত্রিক প্রয়োজনীয়তা, উৎপাদন সামর্থ্য এবং খরচ দক্ষতা মধ্যে ভারসাম্য বজায় রাখতে সাহায্য করা যেতে পারে।

3. অটোমোটিভ এক্সট্রুশনের মোট খরচের উপর সেকেন্ডারি অপারেশন এবং ফিনিশিংয়ের প্রভাব কেন বেশি হয়?

মেশিনিং, ড্রিলিং এবং অ্যানোডাইজিং বা পাউডার কোটিংয়ের মতো বিশেষ ফিনিশিংয়ের মতো সেকেন্ডারি অপারেশনগুলি ব্যয় বাড়াতে পারে, বিশেষ করে কঠোর সৌন্দর্য বা কর্মক্ষমতা প্রয়োজনীয়তা সহ অংশগুলির জন্য। প্রতিটি যুক্ত প্রক্রিয়া শ্রম, পরিদর্শন এবং সম্ভাব্য পুনরায় কাজের খরচ বাড়ায়। একটি একীভূত সরবরাহকারীর সাথে ডিজাইন অপ্টিমাইজ করা এবং পদক্ষেপগুলি একীভূত করা এই খরচগুলি নিয়ন্ত্রণ করতে সাহায্য করতে পারে।

4. কাস্টম অ্যালুমিনিয়াম এক্সট্রুশনের দামের ওপর ভলিউমের প্রভাব কীভাবে পড়ে?

উচ্চ উত্পাদন ভলিউমগুলি ডাই অ্যামোর্টাইজেশন, প্রক্রিয়া ইয়েল্ড এবং আরও স্থিতিশীল মূল্য নির্ধারণে সহায়তা করে। প্রাথমিক পর্যায়ের প্রোটোটাইপ বা পাইলট রানগুলির প্রতি অংশের খরচ বেশি হয় কম ভলিউম এবং প্রায়শই প্রক্রিয়াগত সমন্বয়ের কারণে। উত্পাদন বৃদ্ধির সাথে সাথে, স্থির খরচগুলি আরও বেশি সংখ্যক ইউনিটের উপর ছড়িয়ে পড়ে, মোট ল্যান্ডেড খরচ কমিয়ে দেয়।

5. অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের জন্য শাওয়ি মেটাল পার্টস সাপ্লায়ারের কী সুবিধা রয়েছে?

শাওই কাস্টম অটোমোটিভ অ্যালুমিনিয়াম এক্সট্রুশনের জন্য একটি এক-স্টপ, IATF 16949 সার্টিফাইড সমাধান প্রদান করে, যার মধ্যে রয়েছে ম্যানুফ্যাকচারিং-এর জন্য ডিজাইন সমর্থন, উন্নত প্রক্রিয়া নিয়ন্ত্রণ এবং সংহত সমাপ্তি। তাদের পদ্ধতি অপচয় কমায়, যানবাহন প্রোগ্রামগুলির জন্য ক্রেতাদের মোট খরচ কমাতে এবং নির্ভরযোগ্য ডেলিভারি নিশ্চিত করতে লজিস্টিক্স স্ট্রিমলাইন করে।

ছোট ছোট ব্যাচ, উচ্চ মান। আমাদের তাড়াতাড়ি প্রোটোটাইপিং সার্ভিস যাচাইকরণকে আরও তাড়াতাড়ি এবং সহজ করে —

ছোট ছোট ব্যাচ, উচ্চ মান। আমাদের তাড়াতাড়ি প্রোটোটাইপিং সার্ভিস যাচাইকরণকে আরও তাড়াতাড়ি এবং সহজ করে —