অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের তুলনা: ঘন্টার মধ্যে শর্টলিস্ট

ক্রেতা কেন্দ্রিক ওভারভিউ দিয়ে শক্তিশালী শুরু

যখন আপনার অটোমোটিভ স্ট্যাম্পিং সরবরাহকারী খুঁজতে হবে, সময় অর্থ—এবং এটি সঠিকভাবে করা হচ্ছে কিনা তাও। বিশ্বব্যাপী অটোমোটিভ মেটাল স্ট্যাম্পিং বাজার দ্রুত পরিবর্তিত হচ্ছে, যেখানে উত্তর আমেরিকা, ইউরোপ এবং এশিয়া-প্যাসিফিক অত্যাধুনিক উত্পাদন, কঠোর মানের মানদণ্ড এবং হালকা, উচ্চ কর্মক্ষমতা সম্পন্ন অটোমোটিভ উপাদানের উপর বৃহত্তর গুরুত্ব নিয়ে এগিয়ে। (মর্দার ইন্টেলিজেন্স) . কিন্তু শত শত স্ট্যাম্পিং কোম্পানি আমার কাছাকাছি এবং বিশ্বজুড়ে থাকা সত্ত্বেও, 2025 এর জন্য আপনার প্রকল্পের প্রয়োজনীয়তা পূরণকারী একটি তালিকা কীভাবে দ্রুত তৈরি করবেন?

সঠিক স্ট্যাম্পার বেছে নেওয়ার গুরুত্ব কেন আছে

ধরুন আপনি একটি নতুন যানবাহন প্ল্যাটফর্ম চালু করছেন অথবা EV উৎপাদন বাড়াতে চাচ্ছেন। সঠিক অটোমোটিভ স্ট্যাম্পিং অংশীদার আপনাকে খরচ, মান এবং ডেলিভারি লক্ষ্যে পৌঁছাতে সাহায্য করতে পারে—যেখানে ভুল পছন্দ দেরি হওয়া ডেলিভারি, মানহীন পণ্য বা ব্যয়বহুল পুনঃকাজের দিকে পরিচালিত করতে পারে। বডি প্যানেল, ব্যাটারি ট্রে, ক্র্যাশ স্ট্রাকচার এবং জটিল অভ্যন্তরীণ ব্রাকেটগুলির মূলে রয়েছে অটোমোটিভ মেটাল স্ট্যাম্পিং। প্রতিষ্ঠিত OEM এবং দ্রুত বৃদ্ধিশীল টিয়ার 2-এর জন্য সঠিক সার্টিফিকেশন, প্রক্রিয়া নিয়ন্ত্রণ এবং ক্ষমতা সহ একটি সরবরাহকারী নির্বাচন করা অত্যন্ত গুরুত্বপূর্ণ।

এই তালিকা কাদের জন্য

- OEM এবং টিয়ার 1 সরবরাহ দলগুলি: উচ্চ-পরিমাণে উৎপাদিত, নিরাপত্তা-সম্পর্কিত অটোমোটিভ স্ট্যাম্পিং অংশগুলির জন্য প্রমাণিত অংশীদারদের সন্ধান করছেন।

- প্রকৌশল এবং প্রোগ্রাম ম্যানেজারদের: উন্নত টুলিং, DFM সমর্থন এবং PPAP পরিপক্কতা সহ সরবরাহকারীদের খুঁজছেন।

- স্টার্টআপ এবং মোবিলিটি নবায়নকারীদের: কম থেকে মাঝারি পরিমাণে উৎপাদন বা প্রোটোটাইপ রানের জন্য কাছাকাছি দক্ষ এবং খরচ-কার্যকর মেটাল স্ট্যাম্পিং প্রয়োজন।

- অ্যাফটারমার্কেট এবং সেবা ক্রেতাদের: দ্রুত প্রতিক্রিয়াশীল, নমনীয় ক্ষমতা এবং দ্রুত সমাপ্তি সমর্থনের উপর জোর দিচ্ছেন।

এই গাইডটি কীভাবে ব্যবহার করবেন

- টুলিং লিড-টাইমস: প্রোটোটাইপের জন্য 2-4 সপ্তাহ, হার্ড টুলিংয়ের জন্য 8-16 সপ্তাহ আশা করুন।

- মানের মানদণ্ড: অগ্রণী সরবরাহকারীরা উৎপাদন চলাকালীন প্রতি মিলিয়ন পণ্যে ত্রুটিপূর্ণ পণ্য (পিপিএম) 500 এর নিচে লক্ষ্য করেন।

- খরচের কারণ: টুলিং কৌশল, উপকরণ নির্বাচন এবং অর্ডার পরিমাণ প্রতি অংশের মূল্য উল্টে দিতে পারে।

- সার্টিফিকেশন: সংক্ষিপ্ত তালিকা আইএটিএফ 16949, আইএসও 9001 এবং প্রদর্শিত পিপিএপি ক্ষমতা নিয়ে কেন্দ্রিত।

- ট্রেসেবিলিটি এবং লঞ্চ ট্র্যাক রেকর্ড: প্রমাণিত অটোমোটিভ প্রোগ্রাম লঞ্চ এবং শক্তিশালী ট্রেসেবিলিটি সহ সরবরাহকারীদের উপর জোর দিন।

- 2025 এর নতুন কী কী আসছে: ব্যাটারি-ট্রে স্ট্যাম্পিংয়ের আরও বেশি পরিমাণ, আলুমিনিয়ামের পরিমাণ বৃদ্ধি এবং ট্রেসেবিলিটি অডিটের ক্ষেত্রে আরও কঠোরতা আশা করুন।

3 বছরের প্রোগ্রামের জন্য পার্ট প্রতি খরচে 15–25% পর্যন্ত টুলিং কৌশল দ্বারা দোলন ঘটানো যেতে পারে।

এই গাইডে প্রতিটি সরবরাহকারী পর্যালোচনায় স্পষ্ট সুবিধা এবং অসুবিধাগুলি, আদর্শ ব্যবহারের ক্ষেত্র, সার্টিফিকেশন, ক্ষমতা সংক্রান্ত তথ্য, এবং একটি সংক্ষিপ্ত সারাংশ রয়েছে। পরবর্তীতে আপনি কিছু ব্যবহারিক সরঞ্জামও পাবেন—যেমন একটি RFQ চেকলিস্ট, পার্ট বৈশিষ্ট্যগুলির সাথে স্ট্যাম্পিং প্রক্রিয়াগুলির ম্যাপিংয়ের একটি সিদ্ধান্ত ম্যাট্রিক্স, এবং সহনশীলতা, উপকরণ, ডাই কৌশল, ন্যূনতম অর্ডার, প্রেস টনেজ এবং সূচক সময়কালের তুলনামূলক তালিকা। আপনি যদি স্থানীয় স্ট্যাম্পিং কোম্পানি খুঁজছেন বা বৈশ্বিক নেতাদের মূল্যায়ন করছেন, এই গাইড আপনাকে বিকল্পগুলি র্যাঙ্ক করতে, সরবরাহ চক্র কমাতে এবং ঝুঁকি কমাতে সাহায্য করবে।

ক্রেতাদের জন্য বিশ্বাসযোগ্য পদ্ধতি এবং স্কোরিং

জটিল শোনাচ্ছে? যখন আপনার সামনে অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের জন্য ডজন ডজন বিকল্প থাকে, তখন একটি পরিষ্কার, পুনরাবৃত্তিযোগ্য মূল্যায়ন প্রক্রিয়া শুধুমাত্র সহায়কই নয়—এটি অপরিহার্য। আপনি যেটি তৈরি করছেন সেটি টায়ার ওয়ান অটোমোটিভ সরবরাহকারীদের তালিকা হোক বা অটোমোটিভ কম্পোনেন্টগুলির জন্য মেটাল স্ট্যাম্পিং সংগ্রহ করুন না কেন, প্রতিটি সরবরাহকারী কীভাবে স্কোর করা হয় তা বুঝতে পারলে আপনি আত্মবিশ্বাসের সাথে, ঝুঁকি সম্পর্কে সচেতন সিদ্ধান্ত নিতে পারবেন। চলুন সেই মানদণ্ড, তথ্য উৎস এবং সরঞ্জামগুলি বিশ্লেষণ করি যা একটি তুলনামূলক মূল্যায়নের নিশ্চয়তা দেয়।

স্কোরিং মানদণ্ড এবং ওজন

আপনি লক্ষ্য করবেন যে সমস্ত কারণগুলি সমান তৈরি হয়নি। এখানে অটোমোটিভ স্ট্যাম্পিং পার্টস সংগ্রহের জন্য সবচেয়ে গুরুত্বপূর্ণ বৈশিষ্ট্যগুলি কীভাবে ওজন করা হয়:

| ক্রিটেরিয়া | ওজন (%) |

|---|---|

| প্রত্যয়নপত্র এবং পিপিএপি প্রস্তুতি | 20 |

| প্রক্রিয়া ক্ষমতা (সিপি/সিপিকে) | 15 |

| টুলিং কৌশল এবং ডাই জীবন | 15 |

| উপকরণ বিশেষজ্ঞতা (অ্যালুমিনিয়াম, এএইচএসএস) | 10 |

| ক্ষমতা এবং প্রেস পরিসর | 10 |

| মান কর্মক্ষমতা (পিপিএম, এফএআই/পরিদর্শন) | 10 |

| প্রকৌশল সহযোগিতা এবং DFM | 10 |

| বাণিজ্যিক (TCO, যানবাহন পরিবহন) | 10 |

সার্টিফিকেশন এবং PPAP (উৎপাদন অংশ অনুমোদন প্রক্রিয়া) পরিপক্কতা সবচেয়ে বেশি গুরুত্ব পায়, কারণ এগুলি প্রদর্শন করে যে সরবরাহকারী কতটা কঠোর গাড়ি মানের মানগুলি মেনে চলছে (Quality-One PPAP ওভারভিউ) . প্রক্রিয়া ক্ষমতা (Cp/Cpk দ্বারা পরিমাপ করা) এবং শক্তিশালী সরঞ্জাম কৌশলগুলি পুনরাবৃত্তিযোগ্য মান এবং দীর্ঘ ডাই জীবন নিশ্চিত করে - উচ্চ-ভলিউম ধাতব স্ট্যাম্পিং গাড়ির প্রোগ্রামের জন্য অপরিহার্য

তথ্য উৎস এবং যাচাই

ধরুন আপনি আপনার অঞ্চলে একটি ডাই মেটাল স্ট্যাম্পিং প্রস্তুতকারকের সাথে ওহিওতে কয়েকটি মেটাল স্ট্যাম্পিং কোম্পানির তুলনা করছেন। আপনি কিভাবে দাবি যাচাই করবেন? এখানে একটি ব্যবহারিক চেকলিস্ট:

- আপডেট করা মান নিয়ন্ত্রণ ব্যবস্থার জন্য IATF 16949 এবং ISO 9001 সার্টিফিকেট অনুরোধ করুন।

- নমুনা PPAP প্যাকেজগুলি পর্যালোচনা করুন - নথিভুক্তিতে সম্পূর্ণতা এবং স্পষ্টতা খুঁজুন।

- প্রক্রিয়ার স্থিতিশীলতা এবং ট্রেসেবিলিটি নিশ্চিত করতে FAI (ফার্স্ট আর্টিকেল ইনস্পেকশন) রেকর্ড অডিট করুন।

- নিরাপত্তা-সমালোচনামূলক অটোমোটিভ স্ট্যাম্পিং অংশগুলির জন্য বিশেষত উপকরণ এবং প্রক্রিয়া প্রবাহের জন্য ট্রেসেবিলিটি পদ্ধতি পরীক্ষা করুন।

এই পদক্ষেপগুলি আপনাকে নিশ্চিত করে দেয় যে সরবরাহকারীর কাগজপত্র তাদের দোকানের বাস্তবতার সাথে মেলে, চাই আপনি স্থানীয় ডাই মেটাল স্ট্যাম্পিং প্রস্তুতকারকের সাথে কাজ করুন বা ওহিওতে বড় মেটাল স্ট্যাম্পিং কোম্পানিগুলির সাথে কাজ করুন।

আমরা খরচ এবং সময়সীমা কীভাবে তুলনা করি

খরচ শুধুমাত্র অংশের দাম নয় - এটি মোট মালিকানা খরচ (TCO) সম্পর্কিত, যার মধ্যে অন্তর্ভুক্ত রয়েছে টুলিং, উপকরণ, যোগাযোগ, এবং ঝুঁকি। আপনার RFQ-এ (অনুরোধ কোটেশন) আপনি যা সংগ্রহ করতে চাইবেন:

| RFQ ক্ষেত্র | বর্ণনা |

|---|---|

| বার্ষিক পরিমাণ | প্রত্যাশিত বার্ষিক উৎপাদন |

| সময় পরিকল্পনা | পরিমাণ কত দ্রুত বৃদ্ধি পায় |

| উপকরণ স্পেসিফিকেশন এবং গেজ | ধাতুর প্রকার এবং পুরুত্ব |

| সহনশীলতা স্ট্যাক | গুরুত্বপূর্ণ মাত্রা এবং অনুমোদিত পরিবর্তন |

| কসমেটিক শ্রেণি | সূত্র শেষ প্রয়োজন |

| ইএইউ | আনুমানিক বাৎসরিক ব্যবহার |

| টুলিং মালিকানা | ডাই-এর মালিক এবং রক্ষণাবেক্ষণ কার দায়িত্বে |

সরবরাহকারীদের সাথে তুলনা করার সময় অবচয় পরিস্থিতি জিজ্ঞাসা করুন - কীভাবে টুলিং খরচ আয়তনের উপর ছড়িয়ে পড়ে - এবং দীর্ঘ-লিড টুল ইস্পাত বা কয়েল উপলব্ধতা ইত্যাদি ঝুঁকি মূল্যায়ন করুন। ধাতু স্ট্যাম্পিং অটোমোটিভ প্রকল্পের ক্ষেত্রে, এই সমস্ত উপাদান আপনার সময়সূচি এবং বাজেটকে প্রভাবিত করতে পারে।

প্রক্রিয়া সিদ্ধান্ত ম্যাট্রিক্স

আপনি কি নিশ্চিত নন যে আপনার অটোমোটিভ স্ট্যাম্পিং পার্টস-এর জন্য কোন ধরনের স্ট্যাম্পিং পদ্ধতি উপযুক্ত? এই প্রক্রিয়া ম্যাট্রিক্সটি ব্যবহার করুন:

| অংশ বৈশিষ্ট্য | সেরা পদ্ধতি | কেন |

|---|---|---|

| মাঝারি থেকে উচ্চ ভলিউম, কঠোর পুনরাবৃত্তি যোগ্যতা | প্রগতিশীল মার্ফত | দক্ষ, সামঞ্জস্যপূর্ণ, প্রতি অংশ কম খরচ |

| বৃহৎ প্যানেল বা বহু-আকৃতি বৈশিষ্ট্য | ট্রান্সফার ডাই | আকার/জটিলতা নিয়ন্ত্রণ করে, দশা পরিবর্তনে নমনীয়তা রাখে |

| উচ্চ ড্র অনুপাত (গভীর কাপ, খোল) | গভীর অঙ্কন | ছিদ্র রোধ করে, গভীরতা সমর্থন করে |

| পরিষ্কার, ধারালো কিনারা ছাড়া সমাপ্তি | ফাইন ব্লাঙ্কিং | সমাবেশের জন্য অত্যাবশ্যক উন্নত ধার গুণমান |

অটোমোটিভ স্ট্যাম্পিং অংশের জন্য শীর্ষস্থানীয় প্রমিত সময়সীমা: প্রোটোটাইপ ২-৪ সপ্তাহে, সফট টুলিং ৪-৮ সপ্তাহে, হার্ড টুলিং ৮-১৬ সপ্তাহে। প্রতি মিনিটে সাধারণত ৩০-১২০ স্ট্রোক গতিতে উৎপাদন প্রেস চলে, যা জ্যামিতি ও উপাদানের উপর নির্ভর করে।

এই মূল্যায়ন পদ্ধতি এবং টেমপ্লেট ব্যবহার করে, আপনি স্তর এক অটোমোটিভ সরবরাহকারীদের তালিকা তৈরি করছেন বা স্থানীয় এবং জাতীয় বিকল্পগুলির মধ্যে পছন্দ করছেন কিনা তা নির্বিশেষে স্ট্যাম্পিং কোম্পানি তুলনা করতে আত্মবিশ্বাসী হতে পারবেন। পরবর্তীতে, আমরা প্রকৃত সরবরাহকারী প্রোফাইলগুলিতে আলোকপাত করব যাতে আপনি এই মানগুলি কীভাবে কার্যকর হয় তা দেখতে পারেন।

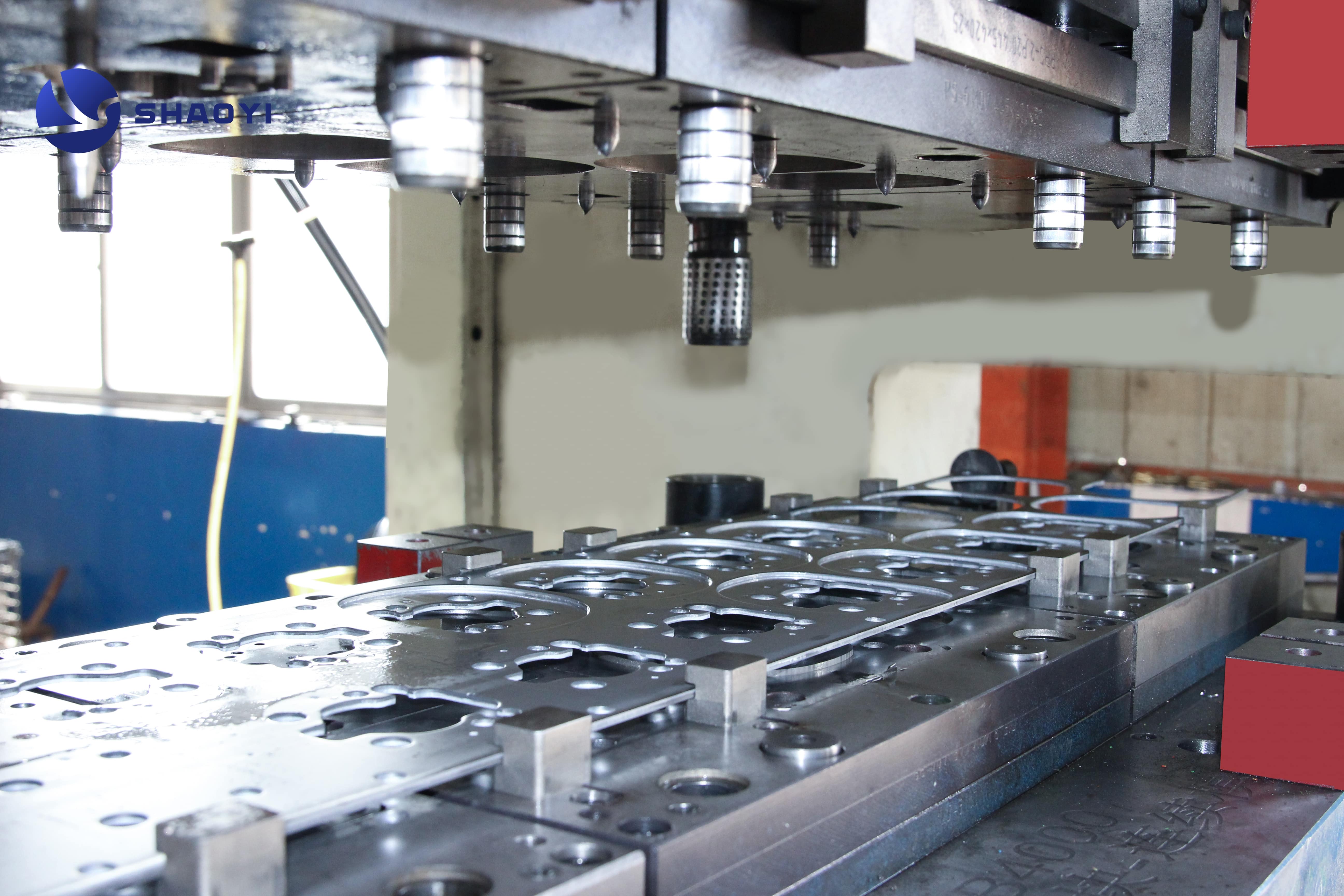

শাওয়ি মেটাল পার্টস সাপ্লায়ার

প্রতিষ্ঠিত ক্ষমতা

যখন আপনি খুঁজছেন অটোমোবাইল স্ট্যাম্পিং সাপ্লাইয়ার যা গতি, স্কেল এবং নির্ভুলতা একত্রিত করে, শাওয়ি মেটাল পার্টস সাপ্লায়ার শিল্পের প্রকৃত নেতা হিসেবে প্রতিষ্ঠিত। কল্পনা করুন নতুন ইভি প্ল্যাটফর্ম চালু করা বা সেফটি-ক্রিটিক্যাল ব্র্যাকেটের উৎপাদন বাড়ানোর কথা—শাওয়ির একীভূত ডিজাইন থেকে মাস প্রোডাকশন ওয়ার্কফ্লো নিশ্চিত করে যে আপনি ধারণা থেকে শুরু করে ডেলিভারি পর্যন্ত নির্ভরযোগ্য, উচ্চমানের পার্টস পাবেন। তাদের দক্ষতা অটো মেটাল স্ট্যাম্পিং, জটিল প্রগ্রেসিভ ডাইস এবং সামপ্রতিক অ্যালুমিনিয়াম ও এএইচএসএস (উন্নত উচ্চ-শক্তি স্টিল) অ্যাপ্লিকেশনগুলি পরিবেষ্টিত করে, যা অ্যাডভান্সড সিএই বিশ্লেষণ এবং দ্রুত টুলিং পুনরাবৃত্তি দ্বারা সমর্থিত। এর অর্থ হল আপনার প্রোগ্রামগুলির জন্য কম অপ্রত্যাশিত ঘটনা, কম সহনশীলতা এবং দ্রুত চালু করা।

সুবিধাসমূহ

- ডিজাইন থেকে মাস প্রোডাকশনে সহজ রূপান্তর, প্রকল্পের হস্তান্তর এবং ঝুঁকি কমানো

- আইএটিএফ 16949 এবং আইএসও 9001 প্রমাণীকৃত মান পদ্ধতি বৈশ্বিক অটোমোটিভ অনুপালনের জন্য

- কাস্টম অটোমোটিভ মেটাল স্ট্যাম্পিংের দক্ষতা, অ্যালুমিনিয়াম এবং উন্নত উচ্চ-শক্তি স্টিল (এএইচএসএস) সহ

- অ্যাডভান্সড সিএই, মোল্ডিং এবং দ্রুত কোয়েট সমর্থনের জন্য ইন-হাউস সুবিধা 24 ঘন্টা

- স্থিতিশীল, ট্রেস করা যায় এমন মানের জন্য শক্তিশালী CMM এবং অপটিক্যাল পরিদর্শন সিস্টেম

- ব্র্যাকেট থেকে শুরু করে ব্যাটারি এনক্লোজার পর্যন্ত বিস্তীর্ণ পরিসরের অটোমোটিভ মেটাল স্ট্যাম্পিংয়ে অভিজ্ঞতা

- প্রোটোটাইপিং এবং হাই-ভলিউম প্রোগ্রাম উভয় ক্ষেত্রেই 30টির বেশি গ্লোবাল OEM এবং টিয়ার 1দের দ্বারা বিশ্বস্ত

- নমনীয়, গ্রাহক-প্রধান পদ্ধতি—কোনও ন্যূনতম অর্ডার পরিমাণের প্রয়োজন নেই

- ব্যাপক কাস্টম প্রিসিজন মেটাল স্ট্যাম্পিং পরিষেবা এক ছাদের তলে

অভিব্যক্তি

- সময়ের পার্থক্যের কারণে জরুরি DFM পর্যালোচনার জন্য অতিরিক্ত সমন্বয়ের প্রয়োজন হতে পারে

- জটিল ক্যারিয়ার স্ট্রিপ ডিজাইনের জন্য প্রাথমিক সমন্বয় প্রয়োজন

- স্থানীয় স্ট্যাম্পিং পার্টস প্রস্তুতকারকদের তুলনায় জরুরি কম ভলিউমের অর্ডারের জন্য শিপিং লিড সময় দীর্ঘতর হতে পারে

আদর্শ ব্যবহারের ক্ষেত্র

- EV ব্র্যাকেট এবং ব্যাটারি ট্রে কম্পোনেন্ট

- তাপ পরিচালনা এবং তাপমাত্রা নিয়ন্ত্রণের পার্টস

- সেন্সর মাউন্ট এবং টার্মিনাল ট্যাবগুলি

- সিট স্ট্রাকচার এবং সেফটি রেইনফোর্সমেন্টস

- ব্যাটারি এনক্লোজার অ্যাসেম্বলিস যেগুলি কঠোর সহনশীলতা এবং ট্রেসেবিলিটি প্রয়োজন

প্রত্যয়ন এবং গুণমানের প্রমাণ

- IATF 16949:2016 এবং ISO 9001 প্রত্যয়িত—কঠোর অটোমোটিভ শিল্প মানগুলি পূরণ করছে

- পূর্ণ PPAP (প্রোডাকশন পার্ট অ্যাপ্রুভাল প্রসেস) নথি এবং ট্রেসেবিলিটি

- অন্তর্বর্তী পরীক্ষণ: UT, RT, MT, PT, ET এবং ওয়েল্ড কোয়ালিটির জন্য পুল-অফ ফোর্স পরীক্ষা

- গ্লোবাল অটোমোটিভ ব্র্যান্ডের জন্য হাই-প্রিসিশন, কমপ্লেক্স অ্যাসেম্বলিস স্থিতিশীল ডেলিভারি

কেস স্টাডি স্ন্যাপশট

ধরুন এমন একটি পরিস্থিতি যেখানে একটি গ্লোবাল EV স্টার্টআপ একটি কমপ্লেক্স ব্যাটারি ব্র্যাকেটে খরচ কমাতে এবং স্ক্র্যাপ হার কমাতে চাচ্ছিল। Shaoyi-এর সাথে ডাই পুনঃনকশা এবং তাদের একীভূত CAE এবং দ্রুত প্রোটোটাইপিং কৌশল ব্যবহার করে ক্লায়েন্টটি পার্টস প্রতি খরচ 18% এবং স্ক্র্যাপ হার 30% কমাতে সক্ষম হয়—যা থেকে পাওয়া গেল তাৎক্ষণিক সাশ্রয় এবং দীর্ঘমেয়াদী গুণমান উন্নতি।

| স্পেসিফিকেশন | টাইপিক্যাল ভ্যালু |

|---|---|

| মাত্রাগত সহনশীলতা | ±0.05 মিমি |

| সর্বোচ্চ স্ট্রিপ প্রস্থ | পর্যন্ত 600 মিমি |

| টনেজ প্রেসের পরিসর | 80–800 টন |

| লিড টাইম (প্রোটোটাইপ) | 2–4 সপ্তাহ |

| লিড টাইম (প্রোডাকশন টুল) | 8–16 সপ্তাহ |

অন্যান্য স্ট্যাম্পিং পার্টস প্রস্তুতকারকদের থেকে শাওইয়ের পৃথক করেছে তাদের ডেলিভারির ক্ষমতা ধাতু স্ট্যাম্পিং সমাধান যা প্রযুক্তিগতভাবে উন্নত এবং বাণিজ্যিকভাবে ব্যবহারিক। তাদের কাস্টম প্রিসিজন মেটাল স্ট্যাম্পিং পরিষেবা দ্রুত প্রোটোটাইপিং থেকে শুরু করে পূর্ণ উৎপাদন পর্যন্ত সবকিছুর সমর্থন করে, যার ফলে তারা গোটা বিশ্বের অটোমোটিভ উদ্ভাবনকারীদের পছন্দের অংশীদার হয়ে ওঠেন।

যখন আপনি অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের ছোট তালিকা মূল্যায়ন করবেন, তখন বিবেচনা করুন কীভাবে শাওয়ির প্রযুক্তি, মান এবং দ্রুত প্রতিক্রিয়ার সমন্বয় আপনাকে চাপের সময়ে প্রোগ্রাম চালু করতে সাহায্য করতে পারে - বিশেষ করে যখন কাস্টম অটোমোটিভ মেটাল স্ট্যাম্পিং এবং দ্রুত প্রত্যাবর্তন অত্যন্ত গুরুত্বপূর্ণ। পরবর্তীতে, ভারী-গেজ এবং বডি-ইন-হোয়াইট সংযোজনকে অগ্রাধিকার দেওয়া প্রোগ্রামগুলির জন্য বৃহৎ পরিসরের কাঠামোগত বিশেষজ্ঞদের দিকে নজর দেব।

গেস্ট্যাম্প উত্তর আমেরিকা

যখন আপনি বৃহৎ স্তরের, জটিল অটোমোটিভ অ্যাসেম্বলিসের কথা ভাবছেন—চিন্তা করুন Gestamp উত্তর আমেরিকা। কল্পনা করুন একটি নতুন বডি-ইন-হোয়াইট (BIW) প্ল্যাটফর্ম চালু করা বা ইভির জন্য উচ্চ-শক্তি সম্পন্ন ব্যাটারি ট্রে সংগ্রহের: আপনার প্রয়োজন এমন এক অংশীদারের যার বিশ্বব্যাপী স্ট্যাম্পিংয়ের ক্ষমতা রয়েছে, প্রমাণিত প্রক্রিয়া নিয়ন্ত্রণ এবং বৃহত্তম অটো সরবরাহকারী এবং ওইএমদের সাথে ঘনিষ্ঠ সম্পর্ক রয়েছে। Gestamp এর উত্তর আমেরিকা অপারেশনগুলি এই চ্যালেঞ্জগুলির মোকাবেলা করার জন্য তৈরি করা হয়েছে, উন্নত প্রযুক্তির সংমিশ্রণ ঘটায় যেমন পদক্ষেপ যা স্থানীয় এবং আন্তর্জাতিক যানবাহন প্রোগ্রামগুলি সমর্থন করার জন্য ডিজাইন করা হয়েছে।

ক্ষমতা এবং ফুটপ্রিন্ট

Gestamp বিশ্বব্যাপী 100টির বেশি স্ট্যাম্পিং প্ল্যান্ট পরিচালনা করে, মার্কিন যুক্তরাষ্ট্র এবং মেক্সিকোতে উল্লেখযোগ্য উপস্থিতি রয়েছে। শুধুমাত্র মিশিগানে, Gestamp উত্তর আমেরিকা প্ল্যান্টগুলি প্রায় 900 জন কর্মচারীকে নিয়োগ দেয় এবং আঞ্চলিক ওইএমদের সেবা দেওয়ার জন্য একাধিক স্ট্যাম্পিং প্ল্যান্ট স্থান বজায় রাখে। তাদের মার্কিন সুবিধাগুলি—মিশিগান, টেনেসি, আলবামা, পশ্চিম ভার্জিনিয়া এবং দক্ষিণ ক্যারোলিনায় ছড়িয়ে ছিটিয়ে রয়েছে—যা কৌশলগতভাবে বৃহত্তর অটোমোটিভ সমবায় কেন্দ্রগুলির কাছাকাছি অবস্থিত, যার মধ্যে রয়েছে জিএম স্ট্যাম্পিং প্ল্যান্ট ভলকসওয়াগেন, মার্সিডিজ-বেঞ্জ, হোন্ডা এবং বিএমডব্লিউ-এর নেটওয়ার্ক এবং সুবিধাগুলির সাথে এই নিকটতা যোগাযোগ ব্যয় কমায় এবং ওইএম নির্মাণ সময়সূচীর দ্রুত প্রতিক্রিয়া নিশ্চিত করে।

| সক্ষমতা | বিস্তারিত |

|---|---|

| টনেজ প্রেসের পরিসর | ২,৫০০ টন পর্যন্ত (মাল্টি-স্টেশন ট্রান্সফার লাইনস) |

| উপকরণ | গরম স্ট্যাম্প করা অতি-উচ্চ-শক্তি সম্পন্ন ইস্পাত, অ্যালুমিনিয়াম, ঐতিহ্যবাহী ইস্পাত |

| প্রক্রিয়া প্রকার | ট্রান্সফার, প্রগ্রেসিভ এবং হট স্ট্যাম্পিং |

| আর&ডি সমর্থন | দীর্ঘস্থায়ীতা, মেট্রোলজি এবং প্রোটোটাইপ সমাবেশের জন্য সাইটে ল্যাব |

সুবিধাসমূহ

- বৃহদাকার—উচ্চ-ভলিউম, নিরাপত্তা-সমালোচনামূলক দেহ গঠনের জন্য আদর্শ

- হালকা, অতি-শক্তিশালী বিআইডব্লিউ উপাদানগুলির জন্য উন্নত হট স্ট্যাম্পিং

- অপারেটিভ যোগদান: রোবটিক ওয়েল্ডিং, লেজার ওয়েল্ডিং এবং সমাবেশ

- বিশ্বের সাথে গ্লোবাল লঞ্চ অভিজ্ঞতা বৃহত্তম অটো সরবরাহকারী এবং OEM

- প্রধান উত্তর আমেরিকান OEM-এর কাছাকাছি কৌশলগত কারখানা অবস্থান

- গবেষণা ও প্রক্রিয়া নবায়নে নিরন্তর বিনিয়োগ

অভিব্যক্তি

- আঞ্চলিক স্ট্যাম্পারদের তুলনায় ন্যূনতম অর্ডার পরিমাণ (MOQ) বেশি হতে পারে

- বৃহত ওইএম বিল্ডের জন্য প্রায়শই অগ্রাধিকার প্রদান করা হয়

- বৈশ্বিক মান মানদণ্ডের কারণে পরিবর্তন-নিয়ন্ত্রণ প্রক্রিয়া আরও দৃঢ় হতে পারে

সেরা ফিট প্রোগ্রাম

- বডি-ইন-হোয়াইট রেল এবং দুর্ঘটনা কাঠামো

- ক্রস মেম্বার এবং চ্যাসিস শক্তিকরণ

- ইলেকট্রিক ভেহিকল প্ল্যাটফর্মের জন্য ব্যাটারি ট্রে

- বৃহদাকার, বহুস্তর অ্যাসেম্বলি যা নির্ভুল যোগদান প্রয়োজন

গেস্ট্যাম্প বা অনুরূপ বৈশ্বিক স্ট্যাম্পিং বিশেষজ্ঞদের মূল্যায়ন করছেন এমন ক্রেতাদের জন্য এটি বুদ্ধিমানের মতো কাজ করবে:

- ওপ্ল্যান্ট-লেভেল OEE (ওভারঅল ইকুইপমেন্ট এফেক্টিভনেস) এবং PPM (পার্টস পার মিলিয়ন ডেফেক্ট রেট) মেট্রিক্স অনুরোধ করুন

- ওয়েল্ড ইন্টেগ্রিটি রিপোর্ট এবং যোগদান প্রক্রিয়া যাচাই করার পর্যালোচনা করুন

- APQP (অ্যাডভান্সড প্রোডাক্ট কোয়ালিটি প্ল্যানিং) ডকুমেন্টেশনের অংশ হিসাবে ড্র সিমুলেশন ফাইল অনুরোধ করুন যাতে উৎপাদনযোগ্যতা এবং শক্তিশালী লঞ্চ নিশ্চিত করা যায়

জটিল, বৃহদাকার BIW প্রোগ্রামগুলি বাস্তবায়নে গেস্ট্যাম্পর সক্ষমতা তাদের প্রযুক্তির প্রতি বিনিয়োগ এবং OEM-এর সাথে ঘনিষ্ঠ সম্পর্কের উপর ভিত্তি করে প্রতিষ্ঠিত-তাদের কে মনে করুন প্রথম স্থানের স্থান স্ট্যাম্পিং প্ল্যান্ট চাপ সহনশীল গাঠনিক অটোমোটিভ উপাদানের ক্ষেত্রে। যদি আপনার পরবর্তী প্রকল্পে ভারী-ওজন, বহু-উপাদান বা হট-স্ট্যাম্পড সমাধানের প্রয়োজন হয়, তাহলে গেস্ট্যাম্প উত্তর আমেরিকার অভিজ্ঞতা এবং বিশ্বব্যাপী উপস্থিতি তাদের এক শ্রেষ্ঠ পছন্দে পরিণত করে। পরবর্তীতে, আমরা উত্তর আমেরিকান সরবরাহকারীদের সঙ্গে ভারী স্ট্যাম্পিং এবং ট্রাক এবং এসইউভি প্ল্যাটফর্মের জন্য চ্যাসিস সংযোজনে গভীর দক্ষতা নিয়ে আলোচনা করব।

মার্টিনরিয়া হেভি স্ট্যাম্পিং

মূল শক্তি

যখন আপনার প্রকল্প শক্তিশালী, উচ্চ-শক্তি সম্পন্ন অটোমোটিভ উপাদানের প্রয়োজন হয়—বড় চ্যাসিস কাঠামো বা দুর্ঘটনা-প্রাসঙ্গিক অংশগুলি চিন্তা করুন—তখন উত্তর আমেরিকার মধ্যে মার্টিনরিয়া হেভি স্ট্যাম্পিং প্রতিষ্ঠিত স্টিল স্ট্যাম্পিং কোম্পানি যেমন প্রধান অপারেশনের ক্ষেত্রে, মার্টিনরিয়া হেভি স্ট্যাম্পিং KY হপকিনসভিলে এবং মার্টিনরিয়া স্ট্যাম্পিং শেলবিল কাউন্টি, KY , এর ফুটপ্রিন্ট স্কেল, নমনীয়তা এবং উন্নত উপকরণ প্রক্রিয়াকরণের জন্য প্রকৌশলী। একটি নতুন ট্রাক বা এসইউভি প্ল্যাটফর্ম চালু করার কথা কল্পনা করুন: আপনার গভীর প্রেস ক্ষমতা, প্রমাণিত এপিকিউপি (অ্যাডভান্সড প্রোডাক্ট কোয়ালিটি প্ল্যানিং) প্রক্রিয়া এবং সবচেয়ে মোটা ও কঠিন উপকরণগুলি নিয়ে কাজ করার ক্ষমতা সহ একটি সরবরাহকারীর প্রয়োজন। মার্টিনরিয়ার ভারী স্ট্যাম্পিং প্রেস (৩,৩০৭ মার্কিন টন পর্যন্ত), হাইব্রিড ট্রান্সফার/প্রোগ্রেসিভ লাইন এবং স্বয়ংক্রিয়তায় বিনিয়োগ করে সেই আউটপুট এবং স্থিতিশীলতা সরবরাহ করে যা অটোমোটিভ ওইএমদের প্রয়োজন।

সুবিধাসমূহ

- বৃহৎ, জটিল স্ট্যাম্পিংয়ের জন্য ভারী-টনেজ প্রেস (৩,৩০৭ মার্কিন টন পর্যন্ত)

- ট্রান্সফার এবং প্রোগ্রেসিভ ডাই অপারেশন উভয়ের জন্য উপযুক্ত হাইব্রিড লাইন

- জিএম, ফোর্ড, নিসান, স্টেলান্টিস, বিএমডব্লিউসহ প্রধান উত্তর আমেরিকান ওইএমদের সঙ্গে গভীর সম্পর্ক

- নিরাপত্তা-সম্পর্কিত এবং উচ্চ-পরিমাণ প্রোগ্রামগুলির জন্য শক্তিশালী এপিকিউপি এবং লঞ্চ ব্যবস্থাপনা

- ইস্পাত এবং অ্যালুমিনিয়াম উভয়ের জন্য স্ট্যাম্পিংয়ের ক্ষমতা, শিল্পের হালকা প্রবণতা সমর্থন করে

- সম্পূর্ণ সিস্টেম ডেলিভারির জন্য ইন্টিগ্রেটেড রোবোটিক অ্যাসেম্বলি, ওয়েল্ডিং এবং ই-কোটিং

- কর্মী প্রশিক্ষণ, নিরাপত্তা এবং প্রক্রিয়া উন্নতির উপর দৃঢ় জোর দেওয়া

অভিব্যক্তি

- বড় প্রেস সেটআপ খরচের কারণে কম ভলিউম বা প্রোটোটাইপ অর্ডারের জন্য সম্ভাব্য প্রিমিয়াম মূল্য নির্ধারণ

- খুব জটিল বা গভীর-আঁকা টুলের জন্য দীর্ঘতর NPI (নিউ প্রোডাক্ট ইন্ট্রোডাকশন) সময়সীমা

- প্রায়শই ক্ষমতার মধ্যে বুক করা প্রেস এবং লাইন, বড় লঞ্চের জন্য আগেভাগে সময় নির্ধারণের প্রয়োজনীয়তা

- প্রিসিশন-ফোকাসড স্ট্যাম্পারের তুলনায় খুব ছোট বা জটিল অংশের জন্য কম নমনীয়তা

যেসব প্রোগ্রামের উপকারে আসবে

- ভারী-গজ চ্যাসিস স্ট্যাম্পিংয়ের প্রয়োজনীয়তা সহ ট্রাক এবং SUV প্ল্যাটফর্ম

- ক্র্যাশ স্ট্রাকচার, ফ্লোর সিলস, ক্রস মেম্বার, এবং ইঞ্জিন ক্র্যাডলস

- ব্যাটারি ট্রে এবং স্ট্রাকচারাল EV উপাদান যেখানে উচ্চ-শক্তি স্টিল বা অ্যালুমিনিয়ামের প্রয়োজন

- নিরাপত্তা-সমালোচনামূলক অংশ যা কঠোর ক্ষমতা অধ্যয়ন এবং শক্তিশালী ডাই রক্ষণাবেক্ষণের দাবি করে

ব্যবহারের ক্ষেত্র এবং সরবরাহ নির্দেশিকা

দুর্ঘটনা-প্রাসঙ্গিক এবং কাঠামোগত উপাদানগুলির জন্য নিয়ত চাপ বক্ররেখা এবং নিখুঁত ঢালাই রক্ষণাবেক্ষণ অত্যন্ত গুরুত্বপূর্ণ। মার্টিনরিয়ার ভারী স্ট্যাম্পিং লাইনগুলি 8-ফুট মেঝে সিল, রকার সংযোজন এবং ইঞ্জিন ক্র্যাডলসের মতো অংশগুলিতে প্রমাণিত হয়েছে—প্রায়শই সর্বোচ্চ আঘাত প্রতিরোধের জন্য উন্নত উচ্চ-শক্তি ইস্পাত থেকে উত্পাদিত হয়। আপনি যদি শর্টলিস্ট করছেন মিশিগানের ধাতু স্ট্যাম্পিং কোম্পানি বা ট্রাক চেসিস বা ইভি ব্যাটারি ট্রে প্রোগ্রামের জন্য মধ্যপ্রাচ্যে, মার্টিনরিয়ার পরিচালন স্কেল এবং প্রযুক্তি তাদের একটি শীর্ষ স্তরের পছন্দ করে তোলে।

| বৈশিষ্ট্য | ট্রান্সফার ডাই | প্রগতিশীল মার্ফত |

|---|---|---|

| জন্য সেরা | বৃহৎ, বহু-পর্যায়ের অংশ (মেঝে প্যান, ক্রস মেম্বার) | মধ্যম-থেকে-উচ্চ পরিমাণ, মধ্যম জটিলতা |

| গেজ পরিসর | 0.010–0.158 ইঞ্চি (¼–4 মিমি) | 0.010–0.079 ইঞ্চি (¼–2 মিমি) |

| সাধারণ সহনশীলতা | ±0.20 মিমি | ±0.10 মিমি |

ভারী স্ট্যাম্পিং প্রাথমিক খরচ বেশী হয় কিন্তু মিশন-সম্পর্কিত গাড়ির সমাবেশের জন্য দীর্ঘস্থায়ী এবং প্রক্রিয়া স্থিতিশীলতার জন্য প্রতিদান দেয়। ক্রেতাদের জন্য এটি স্মার্ট হবে টুল রক্ষণাবেক্ষণ রেকর্ড, ডাই-চেঞ্জ পদ্ধতি এবং NPI সময়সূচী পরিকল্পনা করা—বিশেষ করে মার্টিনরিয়ার মতো সরবরাহকারীদের সাথে, যেখানে প্রেস ক্ষমতা উচ্চ চাহিদা রয়েছে।

আপনি যখন সেরা অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের খুঁজতে থাকবেন, মার্টিনরিয়ার গভীর সরবরাহ চেইন সম্পর্ক এবং ভারী-গেজ বিশেষজ্ঞতা অন্যান্যদের প্রদত্ত পরিষেবাকে কীভাবে সম্পূরক করে তা বিবেচনা করুন মিশিগানের ধাতু স্ট্যাম্পিং কোম্পানি . পরবর্তীতে, আমরা দক্ষ মিডওয়েস্টার্ন অংশীদারদের দিকে নজর দেব যারা কম পরিমাণ এবং অ্যাফটারমার্কেটের প্রয়োজনে নমনীয়, পরিষেবা-উন্মুখ স্ট্যাম্পিংয়ে দক্ষ।

গোশেন স্ট্যাম্পিং কোম্পানি

যখন আপনার পরিবর্তিত সময়সূচি এবং ছোট ব্যাচের প্রয়োজনীয়তার দ্রুত প্রতিক্রিয়া দেওয়ার মতো একটি অংশীদারের প্রয়োজন হয়, ওহিওতে স্ট্যাম্পিং কোম্পানিগুলোর মধ্যে গোশেন স্ট্যাম্পিং কোম্পানি প্রতিষ্ঠিত হয়। ধরুন আপনি একটি সার্ভিস পার্ট প্রোগ্রাম শুরু করছেন, অথবা আপনার দ্রুত পরবর্তী সময়ে অ্যাফটারমার্কেট ব্র্যাকেট এবং ক্লিপের প্রয়োজন—গোশেনের দক্ষ পদ্ধতি এবং বৃহদাকার অভ্যন্তরীণ ক্ষমতাগুলি তাদের Tier 2 এবং OEM উভয়ের জন্য পছন্দের পছন্দ করে তোলে। কিন্তু গোশেন স্ট্যাম্পিং কোং ইনক. এবং অনুরূপ দক্ষ সরবরাহকারীদের মূল্যবান করে তোলে কোন বিষয়গুলি?

ক্ষমতা স্ন্যাপশট

গোশেন স্ট্যাম্পিং এলএলসি ৮২,০০০ বর্গফুট আয়তনের একটি সুবিধা থেকে পরিচালিত হয়, যেখানে ৩৮টি প্রেস রয়েছে, ৩০-টন ওবিআই থেকে শুরু করে ৪০০-টন এসএসডিসি পর্যন্ত, যা বিভিন্ন আকার ও পরিমাণের অংশের সমর্থন করে। তাদের সরঞ্জামাদির লাইনআপ কার্বন-ভিত্তিক ইস্পাত, স্টেইনলেস, অ্যালুমিনিয়াম এবং পিতল স্ট্যাম্প করতে সক্ষম—ছিদ্র করা এবং ছেদন থেকে শুরু করে গঠন এবং সংযোজন পর্যন্ত সবকিছু পরিচালনা করে। কি দ্রুত প্রোটোটাইপ বা মধ্যম পরিমাণে চালানোর প্রয়োজন? তাদের নিবেদিত টুল রুম, যেখানে ওয়্যার ইডিএম, পৃষ্ঠ গ্রাইন্ডার এবং মেশিনিং সেন্টার রয়েছে, তার মানে হল দ্রুত টুল রক্ষণাবেক্ষণ এবং ডাই পরিবর্তন তাদের প্রক্রিয়ার অংশ হিসাবে করা হয়। সমাপ্তির জন্য, গোশেন প্লেটিং, রং করা এবং পাউডার কোটিংয়ের জন্য শক্তিশালী অংশীদারিত্ব বজায় রাখে, দীর্ঘ লিড সময় ছাড়াই এন্ড-টু-এন্ড সমাধান সক্ষম করে।

| প্রধান মেট্রিক | টাইপিক্যাল ভ্যালু |

|---|---|

| চাপ পরিসর | 30–400 টন |

| পরিচালিত উপকরণ | ইস্পাত (এইচআরপিও, সিআর, গ্যালভানাইজড), স্টেইনলেস, অ্যালুমিনিয়াম, পিতল, তামা |

| সাধারণ পরিবর্তনের সময় | দ্রুত, অভ্যন্তরীণ টুল রুম দ্বারা সমর্থিত |

| প্রোটোটাইপ টার্নারাউন্ড | ২–৪ সপ্তাহ যতটা দ্রুত |

সুবিধাসমূহ

- দ্রুত উদ্ধৃতি প্রতিক্রিয়া এবং প্রোটোটাইপ এবং সেবা অংশগুলির জন্য সংক্ষিপ্ত লিড সময়

- নিম্ন-থেকে-মধ্যম পরিমাণ এবং পর-বাজারজাতকরণ প্রোগ্রামের জন্য অনুকূল নমনীয় সময়সূচি

- নতুন পণ্য চালু করা এবং প্রকৌশল পরিবর্তনের জন্য সহযোগিতামূলক DFM সমর্থন

- ব্যাপক উপকরণ পরিচালনা এবং স্থানীয় ডেলিভারির ক্ষমতা

- বিশ্বস্ত অংশীদারদের মাধ্যমে গৌণ কার্যাবলীর সম্পূর্ণ সুযোগের অ্যাক্সেস

অভিব্যক্তি

- সীমিত মেগা-টন ক্ষমতা—বড় বডি-ইন-হোয়াইট বা গভীর-আঁকা প্যানেলের জন্য উপযুক্ত নয়

- বিশেষ কোটিং এবং কিছু সমাপন পদক্ষেপ আউটসোর্সিংয়ের প্রয়োজন হতে পারে

- অতি-উচ্চ পরিমাণের বৈশ্বিক OEM প্রোগ্রামের জন্য অনুকূলিত নয়

আদর্শ ব্যবহারের ক্ষেত্র

- টিয়ার 2 এবং পর-বাজারজাতকরণ প্রয়োজনীয়তার জন্য ব্র্যাকেট, ক্লিপ এবং শিল্ড

- প্রায়শই প্রকৌশল পরিবর্তনযুক্ত নিম্ন-থেকে-মধ্যম পরিমাণের সেবা পার্টস

- চালু করার সমর্থনের জন্য প্রোটোটাইপ রান এবং দ্রুত অর্ডার

- রিভেটিং, রেজিস্ট্যান্স ওয়েল্ড বা MIG ওয়েল্ড অপারেশন প্রয়োজন এমন অ্যাসেম্ব্লিগুলি

ওহিওতে স্ট্যাম্পিং কোম্পানির তুলনা করছেন এমন ক্রেতাদের জন্য বা বৃহত্তর জাতীয় ফার্মগুলির বিকল্প খুঁজছেন, গোশেন স্ট্যাম্পিং কোম্পানির মূল্য তার দ্রুত অনুকূল হওয়ার ক্ষমতা এবং বিভিন্ন অর্ডারের আকারে মান বজায় রাখার মধ্যে নিহিত। আপনি যদি মা মেটাল এডিনবরা ইন্ডিয়ানার মতো সরবরাহকারীদের মূল্যায়ন করছেন তবে টুল রক্ষণাবেক্ষণ লগ এবং ডাই পরিবর্তন পদ্ধতি পর্যালোচনা করুন - এগুলি সেবা অংশ প্রোগ্রামগুলির দীর্ঘ জীবনকালের পুনরাবৃত্তি নিশ্চিত করতে এবং স্থিতিশীলতা কমাতে অপরিহার্য। এবং যদি আপনি দ্রুত সমর্থনের রেকর্ড সহ আমার কাছাকাছি ধাতু স্ট্যাম্পারদের খুঁজছেন, তাহলে মধ্যপ্রাচ্য অঞ্চলের জন্য গোশেনের স্থানীয় ডেলিভারি এবং শক্তিশালী উপকরণ পরিচালনা এটিকে একটি স্ট্যান্ডআউট পছন্দ করে তোলে।

পরবর্তীতে, দেখুন কীভাবে সূক্ষ্ম সন্ধানকারী সরবরাহকারীরা আপনার সবচেয়ে জটিল, কঠোর-সহনশীল অটোমোটিভ উপাদানগুলির জন্য সরবরাহ করতে পারে।

লগান স্ট্যাম্পিংস ইনক

যখন আপনার সু-নির্ভুল, ছোট অংশগুলির প্রয়োজন হয় যা কঠোর সহনশীলতা এবং কঠিন মানের মানদণ্ড পূরণ করতে হবে, তখন লগান স্ট্যাম্পিংস ইনক এমন একটি নাম যা প্রতিষ্ঠিত হয়েছে। আপনি কখনও ভেবেছেন অটোমোটিভ সংযোজকগুলি, সেন্সর ব্র্যাকেট বা টার্মিনাল ট্যাবগুলি কীভাবে এতটাই নিখুঁত স্পেসিফিকেশনে তৈরি করা হয়? এটি একজন বিশেষজ্ঞের কাজ প্রিসিজন মেটাল স্ট্যাম্পিং কোম্পানি — একটি যেটি সম্পূর্ণ প্রক্রিয়াটি নির্ভুলতা, পুনরাবৃত্তিযোগ্যতা এবং নমনীয়তার জন্য প্রকৌশলী করেছে। চলুন দেখি কী কী বিষয় লগান স্ট্যাম্পিংসকে জটিল, ছোট অংশের স্ট্যাম্পিংয়ের প্রয়োজনীয়তা পূরণে ক্রেতাদের জন্য নির্ভরযোগ্য অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের মধ্যে পৃথক করে তোলে।

নির্ভুলতার উপর ফোকাস

লগান স্ট্যাম্পিংস ইনক 0.010" থেকে 0.125" (0.254 মিমি থেকে 3.175 মিমি) পর্যন্ত পুরুত্ব এবং 30" (762 মিমি) পর্যন্ত প্রস্থের উপকরণ থেকে তৈরি ছোট এবং মাঝারি আকারের উপাদানগুলি উৎপাদনে মনোনিবেশ করে। অ্যাডভান্সড মাল্টি-স্লাইড এবং প্রগ্রেসিভ ডাই প্রযুক্তি ব্যবহার করে, তারা স্থিতিশীল, পুনরাবৃত্তিযোগ্য মানসহ অংশগুলি সরবরাহ করে— যা তাদের কে করে তোলে স্ট্যাম্পড মেটাল পার্টস ম্যানুফ্যাকচারারদের মধ্যে শীর্ষ পছন্দ টার্মিনাল, ফাস্টনার এবং ইলেকট্রিক্যাল ব্রাকেটগুলির জন্য বিকল্পগুলি। তাদের অভ্যন্তরীণ টুল রুম প্রতিটি অংশের জীবনকালের জন্য দ্রুত প্রোটোটাইপিং, কাস্টম ডাই নির্মাণ এবং নিরবিচ্ছিন্ন টুল রক্ষণাবেক্ষণ সমর্থন করে, যাতে দ্রুত সময় এবং ন্যূনতম সময়মতো পরিচালনা করা যায়। যদি আপনি উচ্চ Cp/Cpk মান বা শক্তিশালী পরিসংখ্যানগত প্রক্রিয়া নিয়ন্ত্রণের প্রয়োজনীয়তা সহ একটি প্রকল্পের জন্য সরবরাহকারীদের মূল্যায়ন করছেন, তাহলে লগানের ISO 9001:2015 সার্টিফায়েড প্রক্রিয়াগুলি এই পর্যায়ের পর্যবেক্ষণের জন্য বিশেষভাবে ডিজাইন করা হয়েছে।

| অংশের আকার / বৈশিষ্ট্য | উপাদানের পুরুত্ব | সম্ভাব্য টুল শৈলী |

|---|---|---|

| কানেক্টর টার্মিনাল, ট্যাবগুলি | 0.010–0.032 ইঞ্চি (0.254–0.813 মিমি) | প্রগ্রেসিভ, মাল্টি-স্লাইড |

| সেন্সর ব্রাকেট, স্প্রিং ক্লিপ | 0.020–0.062 ইঞ্চি (0.508–1.575 মিমি) | প্রগতিশীল |

| ছোট কভার, ঢালাই | 0.032–0.125 ইঞ্চি (0.813–3.175 মিমি) | প্রগতিশীল, যৌগিক |

| দীর্ঘ, সরু স্ট্রিপস | সর্বোচ্চ ৩০ ইঞ্চি প্রস্থ পর্যন্ত | প্রগতিশীল (ন্যূনতম স্ট্রিপ প্রস্থ প্রযোজ্য হতে পারে) |

সুবিধাসমূহ

- টাইট-টলারেন্স, ছোট পার্টস স্ট্যাম্পিংয়ের জন্য অসাধারণ ক্ষমতা—টার্মিনাল, ফাস্টেনার এবং সেন্সর ব্র্যাকেটের জন্য আদর্শ

- উচ্চ পুনরাবৃত্তিযোগ্যতা এবং আউটপুটের জন্য দক্ষ প্রগতিশীল ডাই সেটআপ

- দ্রুত প্রোটোটাইপিং এবং উত্পাদন সমর্থনের জন্য অভ্যন্তরীণ টুল ডিজাইন, নির্মাণ এবং রক্ষণাবেক্ষণ

- সুদৃঢ় মান নিয়ন্ত্রণ: ISO 9001:2015 সার্টিফায়েড, নিয়ন্ত্রণ পরিকল্পনা, প্রথম পিস, প্রক্রিয়াকরণ এবং চূড়ান্ত পরিদর্শন সহ

- বিস্তুর পরিসরের উপকরণের সাথে অভিজ্ঞতা—অ্যালুমিনিয়াম, পিতল, তামা, জারা প্রতিরোধী ইস্পাত, উচ্চ কার্বন ইস্পাত এবং আরও অনেক কিছু

- নতুন টুলিংয়ের জন্য নমনীয় সমর্থন এবং গ্রাহক-সরবরাহকৃত ডাইসের মূল্যায়ন

- দ্রুত চাহিদা সমর্থন করে এমন স্টকযুক্ত আইটেমগুলির জন্য একই দিনে চালানের সুবিধা পাওয়া যায়

অভিব্যক্তি

- বড় আকৃতির প্যানেল বা গভীর-আকৃতির বডি-ইন-হোয়াইট উপাদানগুলির জন্য কম উপযুক্ত

- অপটিমাইজড প্রোগ্রেসিভ ডাই দক্ষতার জন্য ন্যূনতম স্ট্রিপ প্রস্থ প্রয়োজন হতে পারে

- জটিল, বহু-পর্যায়ক্রমিক সংযোজনগুলির জন্য সহযোগিতার প্রয়োজন হতে পারে ডাই ম্যাটিক টুল অ্যান্ড ডাই সর্বোত্তম ফলাফলের জন্য বিশেষজ্ঞদের সাথে

জন্য সেরা

- অটোমোটিভ এবং শিল্প প্রয়োগের জন্য সংযোগকারী, ফাস্টেনার এবং বৈদ্যুতিক ব্র্যাকেটগুলি

- সেন্সর মাউন্ট, টার্মিনাল ট্যাব এবং স্প্রিং স্টিলের অংশগুলি যেখানে পিপিএপি-এ Cp/Cpk >1.33 প্রয়োজন

- ছোট সংযোজন এবং জটিল স্ট্যাম্পিং - চ্যালেঞ্জগুলি সম্পর্কে ভাবুন যেগুলি ক্ষুদ্র অংশগুলি অন্তর্ভুক্ত করা হয়েছে আধুনিক ইলেকট্রনিক্স এবং যানবাহনের মুখোমুখি

- দ্রুত প্রোটোটাইপিং, প্রচুর পরিমাণে প্রকৌশল পরিবর্তন বা চলমান টুল সমর্থনের প্রয়োজনীয়তা থাকা প্রোগ্রামসমূহ

ক্রেতাদের জন্য GR&R (গেজ পুনরাবৃত্তিযোগ্যতা এবং পুনরুত্পাদনযোগ্যতা) অধ্যয়ন, CMM (স্থানাঙ্ক পরিমাপন মেশিন) প্রতিবেদন এবং ব্যালুনযুক্ত অঙ্কনসহ প্রথম আর্টিকেল ইনস্পেকশন (এফএআই) প্যাকেজ প্রক্রিয়ার ক্ষমতা যাচাই করার জন্য অনুরোধ করা বুদ্ধিমানের কাজ। গুণগত মান এবং নমনীয়তার প্রতি লগান স্ট্যাম্পিংয়ের প্রতিশ্রুতি অটুট রেখে অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের জন্য একজন বিশ্বস্ত অংশীদার হিসেবে প্রতিষ্ঠিত করে। আপনি যখন আপনার সবচেয়ে জটিল অংশগুলির জন্য বিকল্পগুলি মূল্যায়ন করবেন, তখন এমন একটি নির্ভুল ধাতব স্ট্যাম্পিং কোম্পানি বিবেচনা করুন যেমন লগান কীভাবে আপনাকে ঝুঁকি কমাতে এবং নতুন পণ্য চালু করার গতি বাড়াতে সাহায্য করতে পারে। পরবর্তীতে, আমরা কাস্টম শীট মেটাল এবং আঞ্চলিক প্রোগ্রামগুলির জন্য দক্ষিণ-পূর্ব মার্কিন যুক্তরাষ্ট্রের একজন বিশেষজ্ঞকে তুলে ধরব।

কোয়ালিটি মেটাল স্ট্যাম্পিং TN

ক্ষমতা এবং পরিষেবা

কখনও কি ভেবেছেন কীভাবে একটি আঞ্চলিক সরবরাহকারী আপনার অটোমোটিভ প্রোগ্রামকে গতিশীল করে তুলবে এবং সাথে সাথে গুণগত মান এবং নমনীয়তা সবসময় সর্বাগ্রে রাখবে? ঠিক সেখানেই হলো এর প্রয়োগ কোয়ালিটি মেটাল স্ট্যাম্পিং TN (QMS) ঝকমক করে। টেনেসির হেন্ডারসন এবং হাম্বোল্টে 90,000 বর্গফুটের বেশি প্রস্তুতকরণ স্থান নিয়ে, QMS একটি সম্পূর্ণ পরিসরের কাস্টম শীট মেটাল স্ট্যাম্পিং এবং ফ্যাব্রিকেশন পরিষেবা সরবরাহ করে। তাদের ক্ষমতা পারম্পরিক স্ট্যাম্পিং এবং টুল ও ডাই কাজ থেকে শুরু করে অ্যাডভান্সড ফ্যাব্রিকেশন, ওয়েল্ডিং, পাউডার কোটিং এবং একত্রীকরণ পর্যন্ত সবকিছু একই ছাদের নিচে সম্পন্ন করে। এই ধরনের অভ্যন্তরীণ প্রক্রিয়াগুলি আপনাকে প্রোটোটাইপ থেকে উৎপাদনে অপেক্ষাকৃত কম হস্তান্তর এবং দেরির ঝুঁকি নিয়ে এগিয়ে নিয়ে যায়।

| ফেজ | সাধারণ লিড টাইম | টুলিং পথ |

|---|---|---|

| প্রোটোটাইপ | 2–4 সপ্তাহ | সফট টুলিং / লেজার কাট |

| পাইলট রান | 4–8 সপ্তাহ | সেমি-হার্ড বা মডুলার টুলিং |

| উৎপাদন | ৮১২ সপ্তাহ | হার্ড টুলিং |

নতুন মিতসুবিশি লেজার প্রযুক্তিতে QMS-এর বিনিয়োগ এবং ফ্যাব্রিকেশন পরিসর প্রসারের মাধ্যমে দ্রুত প্রোটোটাইপিং, নমনীয় পরিবর্তন এবং ছোট ও মাঝারি ভলিউম উৎপাদন সমর্থনের ক্ষমতা প্রদান করে। আপনি যদি তুলনা করছেন তবে কাস্টম মেটাল স্ট্যাম্পিং কোম্পানি অটোমোটিভ ব্র্যাকেট, কভার বা হালকা গাঠনিক অংশগুলির জন্য বিকল্প, QMS-এর স্ট্যাম্পিং, ওয়েল্ডিং এবং ফিনিশিংয়ের সংমিশ্রণ অঞ্চলীয় OEM এবং টিয়ার সরবরাহকারীদের প্রয়োজনীয়তা পূরণের জন্য একটি শক্তিশালী পছন্দ

সুবিধাসমূহ

- নতুন পণ্য চালু করা (NPI) এবং প্রোটোটাইপিংয়ে অত্যন্ত সাড়া দেয়—২-৪ সপ্তাহের মধ্যে নমুনা

- সত্যিকারের এক-স্টপ উৎপাদনের জন্য অভ্যন্তরীণ টুল এবং ডাই, ফ্যাব্রিকেশন, ওয়েল্ডিং এবং পাউডার কোটিং

- অংশ ডিজাইন অপ্টিমাইজ করতে এবং খরচ কমাতে মূল্য প্রকৌশল সমর্থন

- স্থানীয় যোগাযোগ সুবিধা— পূর্ব-দক্ষিণাঞ্চলীয় OEM-এর জন্য ছোট সময়ের প্রয়োজন, কম চালান খরচ এবং সহজ যোগাযোগ

- ছোট থেকে মাঝারি চলার আয়তন এবং প্রায়শই প্রকৌশল পরিবর্তন পরিচালনার দক্ষতা

অভিব্যক্তি

- আল্ট্রা-হাই-স্ট্রেংথ স্টিল বা ডিপ-ড্র অ্যাপ্লিকেশনের জন্য গঠন আবরণে সীমাবদ্ধতা

- কিছু বিশেষ কোটিং বা গৌণ মেশিনিং বিশ্বস্ত অংশীদার নেটওয়ার্কের প্রয়োজন হতে পারে

- খুব বড় আয়তনের, বৈশ্বিক অটোমোটিভ প্রোগ্রামের জন্য অনুকূলিত নয়

ব্যবহারের ক্ষেত্রে

- অটোমোটিভ এবং শিল্প প্রয়োগের জন্য ব্রাকেট, ক্লিপ এবং লাইট কভারসমূহ

- যানবাহনের অভ্যন্তর এবং বহিরাংশের জন্য লাইট স্ট্রাকচারাল রিইনফোর্সমেন্টস

- যেখানে দ্রুততা এবং নমনীয়তা অত্যন্ত গুরুত্বপূর্ণ, সেখানে অঞ্চলভিত্তিক পরিষেবা এবং অ্যাফটারমার্কেট পার্টস

- যেসব কাস্টম অ্যাসেম্বলিস ওয়েল্ডিং, পাউডার কোটিং এবং চূড়ান্ত প্যাকেজিং প্রয়োজন

ধরুন আপনি হঠাৎ কোনও ডিজাইন পরিবর্তন বা কোনও অঞ্চলের OEM র্যাম্প-আপের মুখোমুখি হয়েছেন—QMS-এর স্থানীয় উপস্থিতি এবং নমনীয় সময়সূচীর মাধ্যমে আপনি মাসের পরিবর্তে সপ্তাহে পার্টস পেতে পারেন এবং ব্যয়বহুল ত্বরান্বিত চালান বা শেষ মুহূর্তের যোগাযোগ সংক্রান্ত সমস্যা এড়াতে পারেন। সদ্য প্রকাশিত শিল্প গবেষণায় উল্লেখিত সরবরাহ চেইনের স্থিতিস্থাপকতার জন্য স্থানীয় সরবরাহের বৃদ্ধিমান প্রবণতার সঙ্গে তাদের পদ্ধতি সামঞ্জস্য রাখে।

"আপনার স্ট্যাম্পিং অংশীদারের সঙ্গে স্থানীয় সহযোগিতা এবং কম প্রসবকাল প্রকল্পের ঝুঁকি কমাতে, মজুত খরচ কমাতে এবং বাজারের চাহিদা পরিবর্তিত হওয়ার সময় স্পষ্ট প্রতিদ্বন্দ্বিতামূলক সুবিধা অর্জন করতে পারে।"

ক্রেতাদের জন্য কিউএমএস-এর ক্ষমতা লোডিং, প্রতিরোধী রক্ষণাবেক্ষণ সময়সূচী এবং মাত্রিক ক্ষমতা সারাংশ পর্যালোচনা করা বুদ্ধিমানের কাজ হবে—বিশেষ করে যদি আপনার পার্টগুলি প্রায়শই ডিজাইন পরিবর্তনের প্রয়োজন হয় বা বছরের পর বছর ধরে সেবা আইটেম হিসাবে চলে। আপনি যখন অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের সঙ্গে তুলনা করবেন, তখন একটি স্থানীয় প্রতিক্রিয়াশীল অংশীদার হিসাবে কিউএমএস কীভাবে আপনার পরবর্তী কাস্টম শীট মেটাল স্ট্যাম্পিং প্রকল্পের জন্য জাতীয় এবং বৈশ্বিক বিকল্পগুলি সমর্থন করতে পারেন তা বিবেচনা করুন। পরবর্তীতে: আমাদের দ্রুত তুলনা টেবিলে সব সরবরাহকারীদের পাশাপাশি কীভাবে দাঁড়াবেন তা দেখুন।

সবচেয়ে ভালো ম্যাচ খুঁজুন দ্রুত

যখন সময়ের চাপ থাকে এবং অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের এক নজরে তুলনা করার প্রয়োজন হয়, তখন পাশাপাশি দৃশ্যটি সবকিছু পার্থক্য তৈরি করতে পারে। কল্পনা করুন আপনি একটি নতুন প্ল্যাটফর্ম চালু করছেন—আপনার কি প্রয়োজন হাই-ভলিউম, বৈশ্বিক শক্তি, দ্রুত প্রতিক্রিয়ার জন্য একটি স্থানীয় অংশীদার, অথবা জটিল অংশগুলির জন্য নিখুঁত বিশেষজ্ঞ? এই টেবিলটি প্রয়োজনীয় বিষয়গুলি ভেঙে ফেলে যাতে আপনি আত্মবিশ্বাসের সাথে ছোট তালিকা তৈরি করতে পারেন।

এক নজরে তুলনা

| সরবরাহকারী | প্রধান শক্তি | সাধারণ সহনশীলতা | চাপ পরিসর | সমর্থিত ম্যাটেরিয়াল | প্রত্যয়ন | এফএআই/পিপিএপি শক্তি | ন্যূনতম অর্ডার পরিমাণ | ডাই আয়ু | টুল নির্মাণের সময়কাল | নমুনা প্রতি মিলিয়নে অসম্মতি |

|---|---|---|---|---|---|---|---|---|---|---|

| শাওয়ি মেটাল পার্টস সাপ্লায়ার | মাস উৎপাদনের জন্য ডিজাইন থেকে সম্পূর্ণ একীভূত ডিজাইন, দ্রুত CAE/DFM, অ্যালুমিনিয়াম এবং AHSS বিশেষজ্ঞতা | ±0.05 মিমি | 80–800 টন | ইস্পাত, অ্যালুমিনিয়াম, AHSS, তামা, পিতল | IATF 16949, ISO 9001 | সম্পূর্ণ PPAP, ট্রেসেবিলিটি, CMM/অপটিক্যাল পরিদর্শন | MOQ নেই | ১ মিলিয়ন সাইকেল পর্যন্ত | ২–৪ সপ্তাহ (প্রোটো); ৮–১৬ সপ্তাহ (উৎপাদন) | <500 |

| গেস্ট্যাম্প উত্তর আমেরিকা | বৃহদাকার বিআইডাব্লু, হট স্ট্যাম্পিং, ওইএম ইন্টিগ্রেশন | ±0.10–0.25 mm | 250–2,500 টন | ইউএইচএসএস, ইস্পাত, অ্যালুমিনিয়াম | আইএটিএফ 16949, আইএসও 14001 | এপিকিউপি, গ্লোবাল পিপিএপি | উচ্চ (ওইএম স্কেল) | 2 মিলিয়ন সাইকেল পর্যন্ত | 8–16 সপ্তাহ | ~200–600 |

| মার্টিনরিয়া হেভি স্ট্যাম্পিং | ভারী-গেজ, চেসিস, SUV/ট্রাক, হাইব্রিড লাইনস | ±0.10–0.20 মিমি | 500–3,307 টন | ইস্পাত, অ্যালুমিনিয়াম | IATF 16949, ISO 9001 | शक्तिशालী APQP, FAI | মধ্যম-উচ্চ | 2 মিলিয়ন সাইকেল পর্যন্ত | 8–16 সপ্তাহ | ~200–600 |

| গোশেন স্ট্যাম্পিং কোম্পানি | দক্ষ, সেবা/অ্যাফটারমার্কেট, দ্রুত প্রোটোটাইপ | ±0.10–0.20 মিমি | 30–400 টন | ইস্পাত, অ্যালুমিনিয়াম, পিতল, তামা | আইএসও 9001 | DFM, FAI, স্থানীয় ট্রেসেবিলিটি | নিম্ন (1,000+) | 500k সাইকেল পর্যন্ত | 2–4 সপ্তাহ (প্রোটো); 6–10 সপ্তাহ (প্রোড) | <1,000 |

| লগান স্ট্যাম্পিংস ইনক | সঠিক ছোট অংশ, প্রগ্রেসিভ/মাল্টি-স্লাইড, কঠোর Cp/Cpk | ±0.01–0.05 mm | 25–500 টন | ইস্পাত, পিতল, তামা, অ্যালুমিনিয়াম | আইএসও 9001 | SPC, FAI, GR&R | নিম্ন (5,000+) | ১ মিলিয়ন সাইকেল পর্যন্ত | 2–6 সপ্তাহ | <250 |

| কোয়ালিটি মেটাল স্ট্যাম্পিং TN | কাস্টম শীট মেটাল, আঞ্চলিক, নমনীয় রানসমূহ | ±0.10–0.25 mm | 400 টন পর্যন্ত | ইস্পাত, অ্যালুমিনিয়াম, ষ্টেইনলেস | আইএসও 9001 | FAI, DFM, স্থানীয় সমর্থন | নিম্ন (500+) | 500k সাইকেল পর্যন্ত | 2–4 সপ্তাহ (প্রোটো); 8–12 সপ্তাহ (উৎপাদন) | <1,000 |

যেখানে প্রতিটি সরবরাহকারী শ্রেষ্ঠত্ব অর্জন করে

- শাওয়ি মেটাল পার্টস সরবরাহকারী: গ্লোবাল প্রোগ্রামগুলির জন্য সেরা যেখানে দ্রুত চালু করা, উন্নত উপকরণ এবং কোনও ন্যূনতম অর্ডার প্রয়োজন হয় না। তাদের CAE-চালিত পদ্ধতি এবং সম্পূর্ণ PPAP ট্রেসেবিলিটি জটিল অটোমোটিভ ষ্ট্যাম্পিং এবং নতুন EV প্ল্যাটফর্মগুলির জন্য আদর্শ

- গেস্টাম্প উত্তর আমেরিকা: বিশ্বব্যাপী OEM-এর জন্য হাই-ভলিউম, স্ট্রাকচারাল BIW এবং ক্র্যাশ কম্পোনেন্টগুলিতে সিদ্ধহস্ত। হট স্ট্যাম্পিং এবং রোবটিক যোগদান প্রয়োজন এমন বৃহৎ আকারের, বহু-উপাদান অটো স্ট্যাম্পিংয়ের জন্য এটি বেছে নিন।

- মার্টিনরিয়া হেভি স্ট্যাম্পিং: ট্রাক/এসইউভি চ্যাসিস এবং ভারী-গেজ অংশগুলির জন্য সেরা পছন্দ। তাদের হাইব্রিড লাইন এবং ডাই রক্ষণাবেক্ষণ পদ্ধতি সুরক্ষা-সমালোচনামূলক অটোমোটিভ মেটাল প্রেসিংয়ের জন্য উপযুক্ত।

- গোশেন স্ট্যাম্পিং কোম্পানি: প্রোটোটাইপ, সেবা এবং অ্যাফটারমার্কেট চালানোর জন্য দক্ষ। যখন আপনার মিডওয়েস্ট ফুটপ্রিন্ট সহ অটোমোটিভ স্ট্যাম্পিং কোম্পানি থেকে নমনীয়তা এবং দ্রুত প্রতিক্রিয়ার প্রয়োজন হয় তখন এটি সেরা।

- লোগান স্ট্যাম্পিংস ইনক: টার্মিনাল, সেন্সর ব্র্যাকেট এবং ছোট অ্যাসেম্বলিগুলির জন্য সঠিকতার বিশেষজ্ঞ। যদি আপনার প্রোগ্রামটি কঠোর Cp/CPK এবং পুনরাবৃত্তিযোগ্যতা দাবি করে, তবে অটোমোটিভ মেটাল স্ট্যাম্পিং কোম্পানিগুলির মধ্যে লোগান এক পথকর্তা।

- কোয়ালিটি মেটাল স্ট্যাম্পিং TN: কাস্টম শীট মেটাল, ব্র্যাকেট এবং কভারগুলির জন্য দ্রুত প্রতিক্রিয়াশীল আঞ্চলিক অংশীদার। তাদের দ্রুত-প্রস্তুত এবং মূল্য প্রকৌশল তাদের আঞ্চলিক OEM-এর জন্য স্ট্যান্ডআউট করে তোলে।

খরচ এবং সময়সীমা বেঞ্চমার্ক

- প্রোটোটাইপ লিড সময়সীমা: বেশিরভাগ সরবরাহকারীদের জন্য ২–৪ সপ্তাহ; বৈশ্বিক বা উচ্চ পরিমাণ প্রোগ্রামগুলির জন্য দীর্ঘতর সময় প্রয়োজন হতে পারে।

- উৎপাদন টুলিং: কঠিন টুলগুলির জন্য সাধারণত ৮–১৬ সপ্তাহ, কিন্তু মধ্যম পরিমাণের প্রয়োজনীয়তার জন্য অঞ্চলভিত্তিক সরবরাহকারীরা কখনো কখনো দ্রুত সময়ে সরবরাহ করতে পারেন।

- মূল্য নির্ধারণের কারকগুলি: টুলিং কৌশল, অর্ডার পরিমাণ এবং উপকরণের পছন্দ—বিশেষ করে অ্যালুমিনিয়াম এবং AHSS-এর ক্ষেত্রে—প্রতি অংশের খরচের উপর সবচেয়ে বড় প্রভাব ফেলে।

- মান: শীর্ষস্থানীয় অটোমোটিভ স্ট্যাম্পিং কোম্পানিগুলি উৎপাদনের জন্য ৫০০ PPM-এর নিচে লক্ষ্য রাখে; প্রিসিশন বিশেষজ্ঞরা প্রায়শই আরও কম হার অর্জন করেন।

প্রগ্রেসিভ বা ট্রান্সফারে ড্র অনুপাত এবং বৈশিষ্ট্যের জটিলতা মেলানোর মাধ্যমে অপ্রয়োজনীয় ডাই পুনঃকাজ এড়ানো যায়।

সংক্ষেপে বলতে হলে, কোনও একক সরবরাহকারী প্রতিটি পরিস্থিতির জন্য উপযুক্ত নয়। শাওই মেটাল পার্টস সাপ্লায়ার—চীনের অগ্রণী একীভূত নির্ভুল অটো মেটাল পার্টস সমাধান প্রদানকারী প্রতিষ্ঠান—বৈশ্বিক প্রোগ্রামগুলির জন্য দ্রুততা, মান এবং প্রযুক্তিগত গভীরতার একটি আকর্ষক মিশ্রণ অফার করে। আপনি তাদের ক্ষমতাগুলি সম্পর্কে আরও জানতে পারেন এবং দেখতে পারেন যে কেন অনেকের কাছেই তারা শীর্ষস্থানীয় অটোমোবাইল স্ট্যাম্পিং সাপ্লাইয়ার শর্টলিস্ট করুন। কিন্তু কিছু ক্ষেত্রে অটোমোটিভ মেটাল স্ট্যাম্পিং কোম্পানি যেমন মার্টিনরিয়া বা গেস্ট্যাম্পের নিকটবর্তী কার্যক্রম বা ভারী পরিমাণ উৎপাদন ক্ষমতা ভালো ফলাফল দিতে পারে - বিশেষ করে বৃহদাকার বা জরুরি স্থানীয় প্রকল্পের ক্ষেত্রে। আপনার শুরুর পয়েন্ট হিসেবে এই টেবিলটি ব্যবহার করুন, এরপর আপনার অনন্য অংশ, পরিমাণ এবং লঞ্চের প্রয়োজনীয়তা অনুযায়ী আপনার আরএফকিউ এবং সরবরাহকারী প্রতিক্রিয়া পদ্ধতি কে সাজান। পরবর্তীতে, শর্টলিস্ট থেকে সরবরাহকারী নির্বাচনের দ্রুততম পথে আমাদের একটি পর্যায়ক্রমিক ক্রয় পরিকল্পনা এবং আরএফকিউ চেকলিস্ট অনুসরণ করুন।

চূড়ান্ত পরামর্শ এবং আরএফকিউ এর দ্রুততম পথ

আপনি কাকে বেছে নেবেন?

আপনি যখন আপনার অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের তালিকা সংক্ষিপ্ত করেন, তখন আপনি কীভাবে চূড়ান্ত সিদ্ধান্তে পৌঁছাবেন? আপনার অংশের জটিলতা, পরিমাণ এবং সময়সূচি সরবরাহকারীদের শক্তির সাথে মেলানো থেকে শুরু করুন। গতি, উন্নত উপকরণ এবং সুদৃঢ় মান ব্যবস্থা সহ বৈশ্বিক প্রোগ্রামের জন্য, শাওয়ি মেটাল পার্টস সাপ্লায়ার শীর্ষে রয়েছে - বিশেষ করে যদি আপনি ডিজাইন থেকে শুরু করে বৃহৎ উৎপাদন পর্যন্ত একটি একীভূত অংশীদার চান। যদি আপনার প্রকল্পে ভারী-গেজ, বৃহৎ-বিন্যাসের অংশ বা জরুরী অঞ্চলভিত্তিক সমর্থনের প্রয়োজন হয়, তবে ভারী-টনেজ বা স্থানীয় বিশেষজ্ঞ ভাল মানানসই হতে পারে। চাবি হল সরবরাহকারীর ক্ষমতা আপনার অটোমোটিভ স্ট্যাম্পিং ডাইয়ের প্রয়োজনীয়তা, প্রোগ্রাম র্যাম্প এবং ঝুঁকি প্রোফাইলের সাথে সামঞ্জস্য করা।

ধাপে ধাপে সংগ্রহের পরিকল্পনা

জটিল শোনাচ্ছে? এখানে একটি সরল, কার্যকর রোডম্যাপ রয়েছে যা সংক্ষিপ্ত তালিকা থেকে পুরস্কার পর্যন্ত যাওয়ার জন্য সাহায্য করবে:

- অংশের স্পেসিফিকেশন এবং সহনশীলতা স্ট্যাক চূড়ান্ত করুন: আপনার অটোমোটিভ মেটাল স্ট্যাম্পিং অংশগুলির জন্য সমস্ত গুরুত্বপূর্ণ মাত্রা, উপকরণ এবং পৃষ্ঠের প্রয়োজনীয়তা পরিষ্কারভাবে সংজ্ঞায়িত করুন।

- সিদ্ধান্ত ম্যাট্রিক্স অনুযায়ী প্রক্রিয়া নির্বাচন করুন: জ্যামিতি, আয়তন এবং বৈশিষ্ট্যের সেট অনুযায়ী প্রগ্রেসিভ, ট্রান্সফার বা ডিপ ড্র'র মধ্যে বেছে নিতে আপনার পূর্বের প্রক্রিয়া ম্যাট্রিক্স ব্যবহার করুন।

- আয়তন বৃদ্ধির সাথে এবং টুলিংয়ের মালিকানা শর্তাবলী সহ RFQ জারি করুন: বার্ষিক আয়তন, র্যাম্প প্রোফাইল নির্দিষ্ট করুন এবং স্ট্যাম্পিং ডাইগুলি কার কাছে রয়েছে এবং কে এগুলো রক্ষণাবেক্ষণ করবে তা পরিষ্কার করুন।

- PPAP আর্টিফ্যাক্ট এবং FAI পরিকল্পনা অনুরোধ করুন: প্রতিটি ধাতব স্ট্যাম্পিং অংশ সরবরাহকারীর কাছে নমুনা প্রোডাকশন পার্ট অ্যাপ্রুভাল প্রসেস (PPAP) নথিপত্র এবং প্রথম নিবন্ধ পরিদর্শন (FAI) কৌশল অনুরোধ করুন।

- একটি পাইলট নির্মাণ এবং ক্ষমতা অধ্যয়ন চালান: প্রক্রিয়ার স্থিতিশীলতা, মাত্রিক পুনরাবৃত্তিযোগ্যতা এবং PPM লক্ষ্যমাত্রা যাচাই করতে একটি ছোট ব্যাচ চালু করুন।

- মোট মালিকানা খরচ (TCO) এবং অবচয় নিয়ে আলোচনা করুন: সমস্ত খরচের কারণগুলি—টুলিং, কাঁচামাল, যোগাযোগ—পর্যালোচনা করুন এবং টুলিং পুনরুদ্ধারের জন্য অবচয় পরিস্থিতি অনুরোধ করুন।

- লঞ্চ গেটগুলি লক করুন: পূর্ণ মাপের উৎপাদনের আগে সমস্ত মান, যোগাযোগ এবং বাণিজ্যিক শর্তাবলী নিশ্চিত করুন।

টুলিং এবং খরচ সম্পর্কিত পরামর্শ

আপনার প্রোগ্রামের অর্থনীতি নির্ধারণে টুলিং কৌশল গুরুত্বপূর্ণ ভূমিকা পালন করে। আলোচনার সময় নিম্নলিখিত ছাঁচ খরচ এবং অবচয় মানগুলি পরিচালনার জন্য নমুনা হিসাবে বিবেচনা করুন:

| ছাঁচের জটিলতা | সাধারণ খরচ পরিসর (মার্কিন ডলার) | প্রত্যাশিত ছাঁচ জীবন | অবচয় উদাহরণ (100k যন্ত্রাংশ প্রতি) |

|---|---|---|---|

| সাধারণ ব্লাঙ্কিং/প্রগ্রেসিভ | $10,000–$40,000 | 300k–1M চক্র | $0.10–$0.40 |

| জটিল প্রগতিশীল/স্থানান্তর | $40,000–$150,000+ | ১০ লক্ষ–২০ লক্ষ সাইকেল | $0.40–$1.50 |

মনে রাখবেন, উৎপাদনযোগ্যতা নকশা (ডিএফএম) এবং ডাই কৌশলের প্রাথমিক পর্যালোচনা মাধ্যমে বড় অর্থ সাশ্রয় করা সম্ভব। উদাহরণস্বরূপ, অংশগুলির জ্যামিতি সরলীকরণ বা বৈশিষ্ট্যগুলি আদর্শ করে তোলা প্রায়শই টুলিংয়ের খরচ কমায় এবং সময়সীমা হ্রাস করে।

আপনার প্রোগ্রামের জীবনকালে বড় অর্থ সাশ্রয়ের জন্য প্রথম থেকেই ডিএফএম পর্যালোচনা এবং সঠিক ডাই কৌশলের মাধ্যমে আপনার মোট খরচ নিয়ন্ত্রণ করুন—ছোট পরিবর্তন এখন বড় সাশ্রয় নিশ্চিত করতে পারে।

যেসব ক্রেতা তাদের সরবরাহ প্রক্রিয়া ত্বরান্বিত করতে এবং ঝুঁকি হ্রাস করতে প্রস্তুত, অটোমোবাইল স্ট্যাম্পিং সাপ্লাইয়ার যেমন শাওয়ি মেটাল পার্টস সাপ্লায়ারের সাথে কথা বলা একটি স্মার্ট পদক্ষেপ। গ্লোবাল ওইএমই-দের সাথে তাদের অভিজ্ঞতা এবং একীভূত পদ্ধতি তাদের নির্ভরযোগ্যতা, গতি এবং প্রযুক্তিগত দক্ষতা খুঁজছে এমন লোকদের জন্য একটি শীর্ষ পছন্দ করে তোলে। তবুও, অঞ্চলভিত্তিক বা ভারী-টনেজ বিশেষজ্ঞদের মূল্য উপেক্ষা করবেন না—বিশেষ করে যদি আপনার অংশের আকার, ড্র অনুপাত বা যোগাযোগ প্রয়োজনীয়তা তাদের শক্তির সাথে ভালো মানিয়ে আসে।

এই ধাপে ধাপে সরবরাহ পরিকল্পনা অনুসরণ করে এবং এই গাইডে প্রদত্ত ব্যবহারিক সরঞ্জামগুলি কাজে লাগিয়ে আপনি গবেষণা থেকে শুরু করে প্রস্তাব অনুরোধ (RFQ) এবং সরবরাহকারী নির্বাচনে পৌঁছাবেন দ্রুততর, আত্মবিশ্বাসের সাথে এবং মোট ঝুঁকি কমিয়ে। শুরু করার জন্য প্রস্তুত? আপনার পরবর্তী উচ্চ-মানের অটোমোটিভ ধাতব স্ট্যাম্পিং পার্টস সরবরাহকারী মাত্র কয়েকটি তালিকা তৈরি করেই পাওয়া যাবে।

অটোমোটিভ স্ট্যাম্পিং সরবরাহকারী: গুরুত্বপূর্ণ প্রশ্নের উত্তর

1. অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের মূল্যায়নের জন্য আমার কোন মানদণ্ডগুলি ব্যবহার করা উচিত?

অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের মূল্যায়ন করার সময় IATF 16949 এবং ISO 9001 এর মতো সার্টিফিকেশন, PPAP প্রস্তুতি, প্রক্রিয়া ক্ষমতা (Cp/Cpk), টুলিং কৌশল, উপকরণ বিশেষজ্ঞতা, উৎপাদন ক্ষমতা এবং মোট মালিকানা খরচের উপর মনোযোগ দিন। প্রতিটি সরবরাহকারী যেন কঠোর অটোমোটিভ মানদণ্ড পূরণ করে তা নিশ্চিত করতে PPAP প্যাকেজ, FAI রেকর্ড এবং ট্রেসেবিলিটি প্রক্রিয়াগুলির মতো নথি অনুরোধ করুন।

2. অটোমোটিভ স্ট্যাম্পিং সরবরাহকারীদের মধ্যে লিড সময় এবং খরচের পার্থক্য কী হয়?

প্রোটোটাইপের জন্য লিড সময় সাধারণত ২-৪ সপ্তাহ পর্যন্ত হয়ে থাকে, যেখানে উৎপাদন টুলিংয়ের জন্য ৮-১৬ সপ্তাহ সময় লাগতে পারে। টুলিংয়ের জটিলতা, উপকরণের পছন্দ, অর্ডারের পরিমাণ এবং সরবরাহকারীদের ক্ষমতা এর খরচকে প্রভাবিত করে। অ্যাডভান্সড ইঞ্জিনিয়ারিং এবং ইন-হাউস টুলিংয়ের মতো সুবিধা সম্পন্ন সরবরাহকারী, যেমন শাওয়ি মেটাল পার্টস সাপ্লায়ার প্রায়শই অপটিমাইজড ডাই কৌশলের মাধ্যমে উন্নয়নকে ত্বরান্বিত করতে পারে এবং প্রতি পার্টের খরচ কমাতে পারে।

3. অন্যান্য সরবরাহকারীদের তুলনায় শাওয়ি মেটাল পার্টস সাপ্লায়ারের কী সুবিধা?

শাওয়ি মেটাল পার্টস সাপ্লায়ার ডিজাইন থেকে শুরু করে বৃহৎ উৎপাদন পর্যন্ত একটি সম্পূর্ণ এবং একীভূত সমাধান প্রদান করে, ইন-হাউস ইঞ্জিনিয়ারিং, CAE বিশ্লেষণ এবং সার্টিফাইড মান ব্যবস্থা ব্যবহার করে। তাদের পদ্ধতি প্রকল্প পরিচালনাকে সহজতর করে, লিড সময় কমায় এবং উচ্চ নির্ভুলতা নিশ্চিত করে, যা দ্রুততা, নমনীয়তা এবং শক্তিশালী মান নিশ্চিতকরণের দাবি রাখা অটোমোটিভ প্রোগ্রামগুলির জন্য উপযুক্ত করে তোলে।

4. উচ্চ ভলিউম এবং গাঠনিক অটোমোটিভ উপাদানগুলির জন্য কোন স্ট্যাম্পিং সরবরাহকারী সেরা?

হাই-ভলিউম, স্ট্রাকচারাল কম্পোনেন্টগুলির জন্য যেমন বডি-ইন-হোয়াইট অ্যাসেম্বলিস এবং ক্র্যাশ স্ট্রাকচারগুলির জন্য, যেমন জেস্ট্যাম্প নর্থ আমেরিকা এবং মার্টিনরিয়া হেভি স্ট্যাম্পিং শীর্ষ পছন্দ। তারা বৃহদাকার টনেজ প্রেস, উন্নত যোগদান প্রযুক্তি পরিচালনা করে এবং প্রধান ওইএমদের সাথে প্রমাণিত রেকর্ড রয়েছে, যা তাদের জন্য আদর্শ করে তোলে চাহিদাপূর্ণ, বৃহদাকার অটোমোটিভ প্রকল্পগুলির জন্য।

5. রিজিওনাল বা প্রিসিজন-ফোকাসড স্ট্যাম্পিং কোম্পানির সাথে কাজ করার সুবিধাগুলি কী কী?

গোশেন স্ট্যাম্পিং কোম্পানি এবং কোয়ালিটি মেটাল স্ট্যাম্পিং টিএন এর মতো রিজিওনাল সরবরাহকারীদের কাছে দ্রুত প্রতিক্রিয়া জনিত সুবিধা, দ্রুত প্রতিক্রিয়া এবং নমনীয় অর্ডার আকার রয়েছে, যা সার্ভিস পার্টস, প্রোটোটাইপ এবং অ্যাফটারমার্কেট প্রয়োজনের জন্য মূল্যবান। লোগান স্ট্যাম্পিংস ইনকের মতো প্রিসিজন-ফোকাসড কোম্পানিগুলি ছোট, জটিল অংশগুলি তৈরিতে দক্ষ যা কঠোর সহনশীলতা রয়েছে, যা উচ্চ পুনরাবৃত্তি এবং দ্রুত প্রকৌশল পরিবর্তনের প্রয়োজন হয় এমন প্রোগ্রামগুলি সমর্থন করে।

ছোট ছোট ব্যাচ, উচ্চ মান। আমাদের তাড়াতাড়ি প্রোটোটাইপিং সার্ভিস যাচাইকরণকে আরও তাড়াতাড়ি এবং সহজ করে —

ছোট ছোট ব্যাচ, উচ্চ মান। আমাদের তাড়াতাড়ি প্রোটোটাইপিং সার্ভিস যাচাইকরণকে আরও তাড়াতাড়ি এবং সহজ করে —